Starfish Markets

Resumo:Starfish Markets Limited, a financial service provider based in New Zealand, has had its regulatory license revoked, operating outside the regulatory framework. Customers should exercise caution due to the associated risks. Starfish offers trading options in forex, CFDs, ETFs, and spread betting. They provide ECN accounts for experienced traders and a demo account for practice. Live accounts are available with different types to suit traders' preferences. Starfish FX implements specific fees and offers multiple trading platforms, including MT4 Terminal and mobile options. Educational tools are provided, and various payment methods are accepted. Reviews on WikiFX are mixed, with both negative and positive experiences shared by traders.

| Aspect | Information |

| Registered Country/Area | New Zealand |

| Founded Year | 5-10 years |

| Company Name | Starfish Markets Limited |

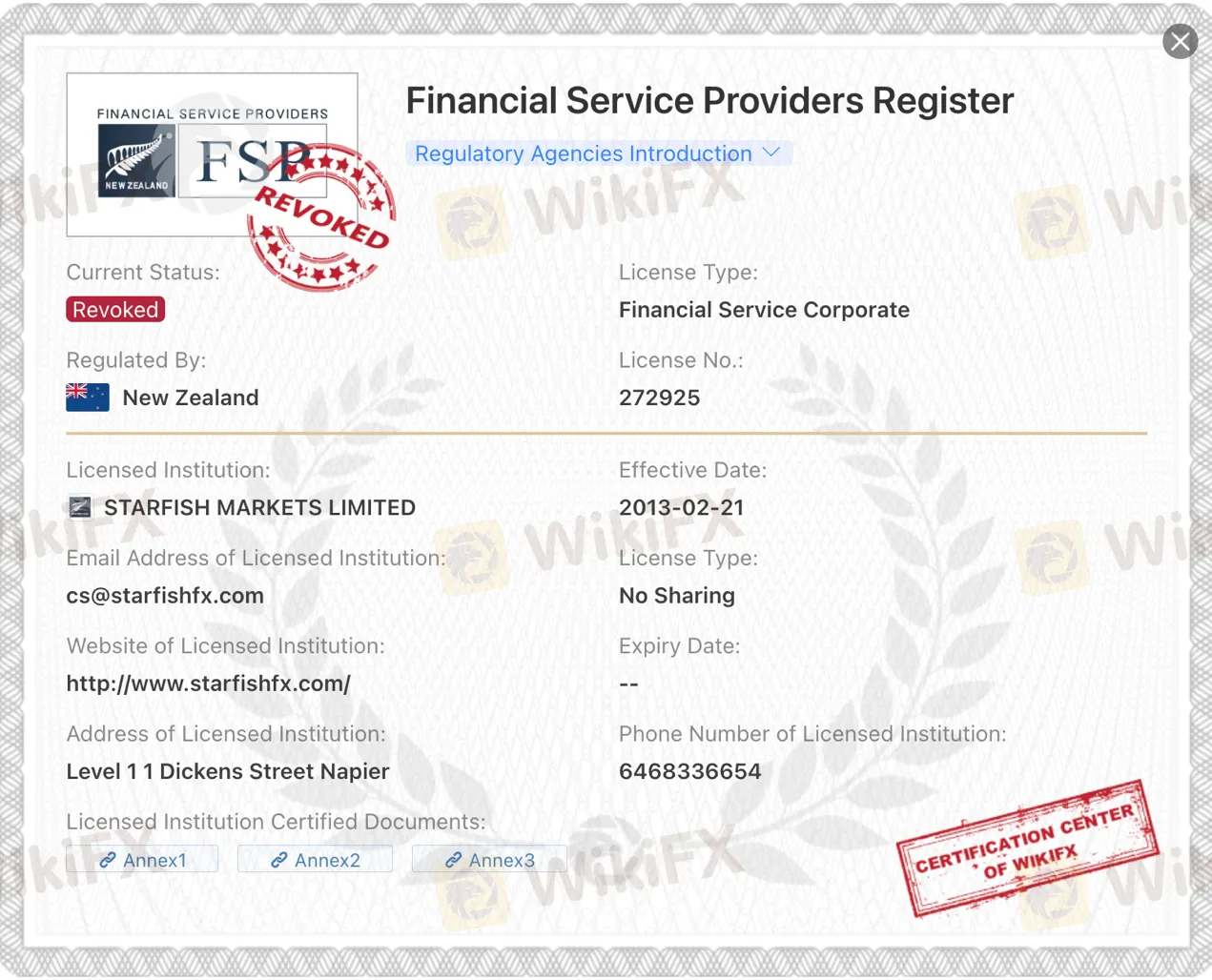

| Regulation | Regulatory license revoked, not currently regulated |

| Minimum Deposit | N/A |

| Maximum Leverage | N/A |

| Spreads | N/A |

| Trading Platforms | Starfish FX MT4 Terminal, Starfish FX iPhone/Android Trader, MT4 forex derivatives trading platform |

| Tradable Assets | Forex, CFDs on stocks, indices, commodities, and cryptocurrencies |

| Account Types | ECN Accounts, Demo Account, Live Account |

| Demo Account | Available |

| Islamic Account | N/A |

| Customer Support | Phone: +852 8191 7339 (English), +64 6 824 3665 (Chinese), Email: cs@starfishfx.com |

| Payment Methods | Mastercard, VISA, UnionPay |

| Educational Tools | 14 free lessons on forex trading |

Overview of Starfish

Starfish Markets Limited, a financial service provider based in New Zealand, has had its regulatory license revoked, indicating that it is operating outside the regulatory framework. This poses potential risks for customers, and caution should be exercised when dealing with the company. Despite the availability of market instruments such as trading in over 50 currency pairs in the foreign exchange market and Contracts for Difference (CFDs) on various assets, the selection of Exchange-Traded Funds (ETFs) offered by Starfish may be limited compared to other brokers. Spread betting on different assets is also an option for customers.

Account types provided by Starfish include ECN accounts for experienced traders seeking direct market access, demo accounts for practicing strategies, and live accounts for real-money trading. The company implements specific fees for their services, but they offer fee-free deposits and the opportunity to earn interest on unused funds in accounts.

Multiple trading platforms are available, including the Starfish FX MT4 Terminal for comprehensive trading tools, the Starfish FX iPhone/Android Trader for mobile trading, and the MT4 forex derivatives trading platform. Educational tools, such as free lessons on forex trading, are provided to enhance traders' knowledge. Customer support can be accessed through phone and email. Reviews of Starfish on WikiFX are mixed, with some reviewers cautioning against the company while others expressing positive experiences. It is important to consider these mixed reviews and exercise caution when considering Starfish Markets Limited as a financial service provider.

Pros and Cons

Starfish offers a range of trading opportunities, including over 50 currency pairs, CFDs on stocks, indices, commodities, and cryptocurrencies, as well as spread betting on various assets. They provide ECN accounts for experienced traders and demo accounts for practice trading. The broker also offers the popular MT4 trading platform. However, it is important to note that Starfish has had its regulatory license revoked, operating outside the regulatory framework. Additionally, there is limited information available regarding deposit and withdrawal processes, trading fees, and specific educational resources beyond basic forex trading lessons. Reviews of Starfish are polarized, with both positive and negative experiences shared by traders.

| Pros | Cons |

| Offers trading in over 50 currency pairs | Regulatory license revoked, operating outside the regulatory framework |

| Provides CFDs on stocks, indices, commodities, and cryptocurrencies | Limited information on deposit and withdraw |

| Allows spread betting on various assets | Vague trading fees and conditions |

| Offers ECN accounts for experienced traders | Limited educational resources beyond basic forex trading lessons |

| Provides demo accounts for practice trading | Polarized reviews, with both positive and negative experiences shared |

| Provides popular MT4 | Limited information on specific fees beyond fee-free deposit option |

Is Starfish Legit?

Starfish Markets Limited, a financial service provider based in New Zealand, has had its regulatory license revoked. The company is no longer regulated by the appropriate authorities and does not hold a valid license. This means that Starfish Markets Limited is operating outside the regulatory framework, which poses a potential risk for customers. It is important to exercise caution when dealing with this company and be aware of the associated risks.

Market Instruments

Forex: Starfish provides a range of trading options in the foreign exchange market, allowing customers to trade in over 50 currency pairs. This includes major currency pairs such as EUR/USD and GBP/USD, as well as minor and exotic currency pairs.

CFDs: Starfish offers Contracts for Difference (CFDs) on various assets, providing customers with the opportunity to speculate on the price movements of stocks, indices, commodities, and cryptocurrencies. Customers can trade CFDs on popular stocks like Apple, Google, and Amazon, as well as global indices such as the S&P 500 and the FTSE 100.

ETFs: While Starfish offers trading in a limited number of Exchange-Traded Funds (ETFs), the specific options and variety of ETFs available may be relatively limited compared to other brokers. Customers interested in ETF trading should consider the available options before making investment decisions.

Spread Betting: Starfish allows customers to engage in spread betting, a form of speculative trading where customers can take positions on the price movements of various assets. This includes stocks, indices, commodities, and cryptocurrencies. Spread betting enables customers to potentially profit from both rising and falling markets.

Pros and Cons

| Pros | Cons |

| Provides a wide range of trading options in the forex market, including 50+ currency pairs | Limited options and variety of ETFs compared to other brokers |

| Offers Contracts for Difference (CFDs) on various assets, including stocks and indices | Limited information on specific market instruments on official website |

| Allows spread betting on multiple assets, enabling potential profits in rising and falling markets | Limited information on specific fees and conditions beyond deposit options |

Account Types

ECN Accounts: Starfish offers ECN accounts to its clients. These accounts are designed for experienced traders who prefer direct market access and require fast execution speeds. ECN accounts provide access to the interbank market, allowing traders to trade with other market participants. They typically offer tight spreads and charge commissions on trades. ECN accounts are suitable for those who value transparency and direct market access.

Demo Account: Starfish provides a demo account option for traders who wish to practice their trading strategies or familiarize themselves with the platform before committing real funds. The demo account simulates real market conditions, allowing users to trade with virtual money without any risk. It serves as a valuable tool for beginners or traders looking to test new strategies without incurring any financial losses.

Live Account: Starfish offers live trading accounts for clients who are ready to trade with real money. These accounts provide access to a wide range of financial instruments and trading opportunities. Live accounts require an initial deposit, and traders can choose from different types such as Standard, Mini, or VIP accounts, depending on their trading preferences and investment size. Live accounts allow traders to participate actively in the financial markets and execute trades based on their strategies and analysis.

Pros and Cons

| Pros | Cons |

| Offers ECN accounts for experienced traders | Limited information on specific spreads and commissions |

| Provides demo accounts for practice trading | Regulatory license revoked, operating outside the regulatory framework |

| Offers live trading accounts with access to various financial instruments | Limited information on account types and their specific features |

Fees

Starfish FX implements specific fees for their services. They offer a fee-free deposit option for all e-deposits, meaning there are no charges for depositing funds into the trading account electronically. Additionally, they provide an interest rate of 2.5% per annum on the free margin, with daily compounding. This allows traders to earn interest on the unused funds in their accounts, providing a potential source of additional income.

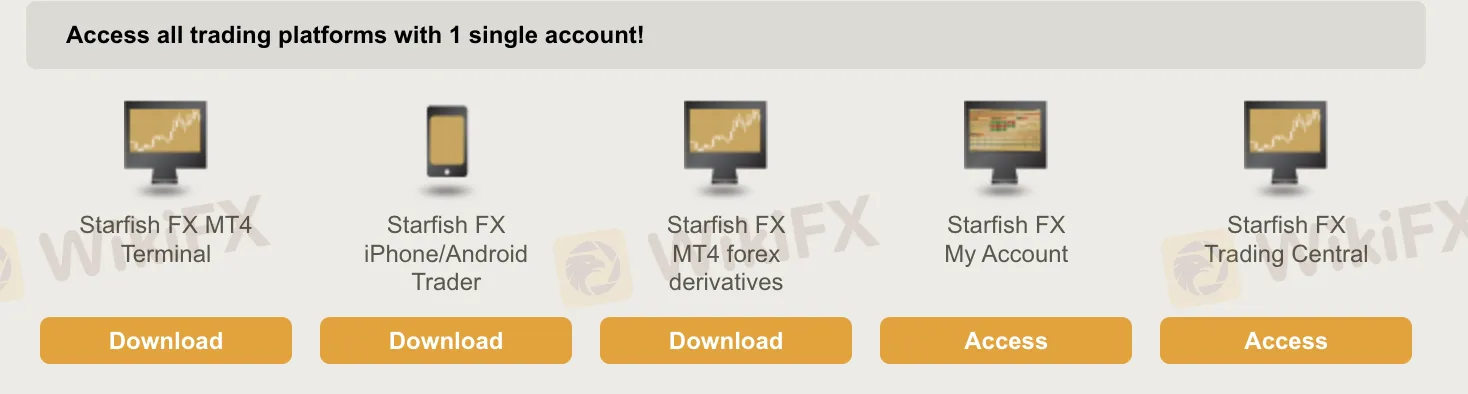

Trading Platforms

Starfish FX offers multiple trading platforms to cater to the diverse needs of traders. One of their trading platforms is the Starfish FX MT4 Terminal, which is available for download. This platform provides traders with a comprehensive set of tools and features to execute their trades.

Another trading platform offered by Starfish FX is the Starfish FX iPhone/Android Trader, which is also available for download. This platform is specifically designed for mobile devices, allowing traders to access their accounts and execute trades while on the go.

Starfish FX also offers the MT4 forex derivatives trading platform. Traders can download this platform to access a wide range of forex derivative products, enabling them to engage in various trading strategies and capitalize on market opportunities.

In addition to the trading platforms, Starfish FX provides access to the My Account feature. Through this feature, traders can manage their accounts, monitor their trading activity, and access important account information.

Furthermore, Starfish FX offers access to Trading Central, a platform that provides traders with valuable market analysis and research tools. Traders can utilize this platform to make informed trading decisions based on the latest market trends and insights.

Pros and Cons

| Pros | Cons |

| Offers multiple trading platforms catering to diverse needs | Limited information on specific fees beyond fee-free deposit option |

| Comprehensive set of tools and features | Lack of information on additional features such as research tools |

| Mobile trading platform for access on the go |

Educational Tools

Starfish FX provides a range of educational tools to assist traders in expanding their knowledge. These tools include 14 free lessons on forex trading, covering various topics such as the basics of forex, foreign exchange rates, players in the forex market, major forex markets worldwide, key factors affecting exchange rates, different types of trading, fundamental analysis, and technical analysis. These lessons aim to provide traders with a solid foundation and understanding of the forex market and its intricacies, enabling them to make informed trading decisions.

Payment Methods

Starfish FX offers multiple payment methods for its clients. These payment methods include widely accepted options such as Mastercard, VISA, and UnionPay. These payment options provide clients with ways to fund their accounts and engage in trading activities.

Customer Support

Starfish FX provides customer support through various channels. Traders can contact their English customer support team at +852 8191 7339 and their Chinese (Simplified) customer support team at +64 6 824 3665. Additionally, traders can reach out to Starfish FX via email at cs@starfishfx.com for any inquiries or assistance they may require.

Reviews

The reviews of Starfish on WikiFX are mixed. Some reviewers have labeled it as a scam and a fraud broker, warning others to stay away due to severe slippage. However, there are also positive reviews from traders who had a pleasant experience with Starfish. They appreciated the lower spreads, smoother platform, and decent profits they were able to make. One reviewer expressed gratitude for the excellent customer support and convenience provided by Starfish. Overall, the reviews on WikiFX are polarized, with both negative and positive experiences shared by traders.

Conclusion

In conclusion, Starfish Markets Limited, a financial service provider based in New Zealand, operates without a valid regulatory license, which raises concerns about its legitimacy and customer protection. While Starfish offers a range of market instruments such as forex, CFDs, ETFs, and spread betting, it is important to note that the variety of ETFs available may be limited compared to other brokers. The company provides different account types, including ECN accounts for experienced traders, a demo account for practice, and live accounts for real trading. Starfish FX implements specific fees for their services, including fee-free e-deposits and an interest rate on unused funds. The company offers multiple trading platforms, including the Starfish FX MT4 Terminal and the Starfish FX iPhone/Android Trader. Educational tools are available, including free lessons on forex trading. Payment methods such as Mastercard, VISA, and UnionPay are accepted. However, it is crucial to exercise caution when dealing with Starfish due to the mixed reviews on WikiFX, with some reviewers labeling it as a scam and warning about severe slippage.

FAQs

Q: Is Starfish Markets Limited a legitimate company?

A: Starfish Markets Limited is no longer regulated and does not hold a valid license, posing potential risks for customers. Exercise caution when dealing with this company.

Q: What market instruments does Starfish offer?

A: Starfish offers forex trading, CFDs on various assets, limited ETF trading options, and spread betting.

Q: What types of accounts does Starfish offer?

A: Starfish offers ECN accounts for experienced traders, demo accounts for practice, and live accounts for real trading with different options.

Q: What are the fees associated with Starfish?

A: Starfish offers fee-free e-deposits and the opportunity to earn interest on unused funds.

Q: What trading platforms does Starfish provide?

A: Starfish offers the Starfish FX MT4 Terminal, Starfish FX iPhone/Android Trader, and MT4 forex derivatives trading platform.

Q: What educational resources does Starfish offer?

A: Starfish provides 14 free lessons on forex trading to help traders expand their knowledge.

Q: What payment methods are accepted by Starfish?

A: Starfish accepts payment methods such as Mastercard, VISA, and UnionPay.

Q: How can I contact Starfish customer support?

A: You can contact Starfish customer support via phone or email, depending on the language you prefer.

Q: What do the reviews say about Starfish?

A: Reviews on Starfish are mixed, with some labeling it as a scam and others praising its lower spreads and customer support. Exercise caution and consider both positive and negative experiences shared by traders.

Corretora WikiFX

Últimas notícias

Axi Select Alcança Marco Histórico: Trader Obtém $1 Milhão em Financiamento

A Psicologia no Trading Forex: O Caminho para o Sucesso Sustentável

Por Que o Futuro do AI Trading Pode Depender da Energia Nuclear?

ATFX Integra Ferramentas BlackArrow para Melhorar Experiência de Trading

FXRoad: Cliente Afirma ter Perdido Mais de 91 Mil Dólares

Cálculo da taxa de câmbio