MINTCFD

Resumo:MINTCFD, a trading platform based in India that caters to stock, commodity, forex, and crypto investors. MINTCFD provides a demo account, leverage of 1:100, and tight spreads on EUR/USD pairs. The trading platforms offered include WebTrader and the MintCFD Trading App, ensuring accessibility for all types of traders. Additionally, MINTCFD offers visitors access to reported scam alerts related to their services, reaffirming their dedication to transparency and investor protection. Notably, MINTCFD operates in an unregulated regulatory environment.

| MINTCFD Review Summary | |

| Registered Country/Region | India |

| Regulation | Unregulated |

| Market Instruments | Stocks, commodity, index, cryptocurrency and forex |

| Demo Account | Available |

| Leverage | 1:100 |

| EUR/ USD Spread | Tight |

| Trading Platforms | WebTrader and MintCFD Trading App |

| Minimum Deposit | N/A |

| Customer Support | Live chat, phone, email, online messaging |

What is MINTCFD?

MINTCFD, a trading platform based in India that caters to stock, commodity, forex, and crypto investors. MINTCFD provides a demo account, leverage of 1:100, and tight spreads on EUR/USD pairs. The trading platforms offered include WebTrader and the MintCFD Trading App, ensuring accessibility for all types of traders. Additionally, MINTCFD offers visitors access to reported scam alerts related to their services, reaffirming their dedication to transparency and investor protection. Notably, MINTCFD operates in an unregulated regulatory environment.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros of MINTCFD:

- A Range of Trading Instruments: MINTCFD offers a variety of trading instruments, providing diversification opportunities for traders to access different markets and assets.

- Demo Accounts Available: The availability of demo accounts allows traders to practice and familiarize themselves with the platform before committing real funds, helping to mitigate risks associated with trading.

- Commission-Free Trading: MINTCFD does not charge commissions on trades, potentially reducing trading costs for investors and allowing them to keep a larger portion of their profits.

- Live Chat Support: The presence of live chat support can provide real-time assistance to traders, helping to address queries or issues promptly during trading hours.

Cons of MINTCFD:

- Not Regulated: MINTCFD is not regulated by a financial authority that raises concerns about the lack of oversight and investor protection, potentially exposing traders to higher risks.

- Reports of Scams: The existence of reports of scams related to MINTCFD will erode trust in the platform and raise doubts about the integrity and security of the trading environment.

Is MINTCFD Safe or Scam?

MINTCFD claims to offer a secure online trading system, essential trading tools and our dedicated customer support are our commitment to the traders.

However, MINTCFD lacks proper regulation, exposing investors to risks due to the absence of government or financial oversight. As there is no regulation, the people running the platform can pocket your money while bearing no responsibility for their criminal actions. They can disappear any time without notice.

Prior to investing with MINTCFD, conduct thorough research and carefully assess the risks versus the potential rewards. Opting for brokers that are well-regulated is advisable to safeguard your funds. Without regulation, the platform operators could abscond with funds without being held accountable for any wrongful activities.

Market Instruments

MINTCFD provides a wide range of trading instruments encompassing various asset classes:

- Stocks: Traders can engage in the trading of individual stocks, allowing them to speculate on the price movements of specific companies listed on global exchanges.

- Commodity: MINTCFD enables trading in a variety of commodities, such as precious metals (e.g., gold, silver), energy products (e.g., crude oil, natural gas), agricultural products (e.g., wheat, corn), and other raw materials.

- Index: Traders have the opportunity to trade on stock market indices, which represent a basket of underlying stocks and track the performance of specific markets or sectors.

- Cryptocurrency: MINTCFD allows for trading in cryptocurrencies like Bitcoin, Ethereum, Ripple, and other digital assets, providing exposure to the dynamic cryptocurrency market.

- Forex: Traders can participate in the foreign exchange market through MINTCFD, accessing a diverse range of currency pairs, including major, minor, and exotic pairs for trading activities.

Besides, MINTCFD also provides CFD on stocks, commodity, index and cryptocurrency. CFD Trading, or Contract for Differences Trading, is a form of derivative trading where traders speculate on the price movements of various financial instruments without owning the underlying assets. As mentioned in your detailed explanation, traders enter into an agreement with a broker to pay or receive the difference between the asset's current value at the time of opening the contract and its future value at the time of closing the contract.

Account Types

At MINTCFD, traders can access the following types of trading accounts:

- Equity Trading Account: Traders can use the equity trading account to trade stocks, futures, options, and currency futures. This account enables traders to engage in a variety of financial instruments within the equity market.

- Commodity Trading Account: For those interested in trading commodities, MINTCFD offers a commodity trading account. This account is essential for investors looking to participate in the commodities market and trade various commodity products.

- Full-Service Trading Account: MINTCFD provides a full-service trading account that offers a comprehensive range of facilities for trade execution. In comparison to discount broking accounts, this account type offers additional services and support for traders. MINTCFD offers three live account types, each with a different set of features and benefits, along with varying minimum deposit requirements to cater to different trading needs and preferences.

Additionally, MINTCFD offers demo accounts for traders who wish to practice and acquaint themselves with the trading platform before using real funds. These demo accounts replicate real market conditions, allowing traders to execute trades using virtual funds and gain valuable experience in a risk-free environment.

How to Open an Account?

To open an account with MINTCFD, please follow these steps:

| Step | |

| 1 | Provide your mobile number to express interest in opening an account with MINTCFD. |

| 2 | Create a unique username for your account. |

| 3 | Set a password and confirm it for account security. |

| 4 | Optionally enter a promo code if available. |

| 5 | Complete the account registration process with the provided information to open your MINTCFD account. |

Leverage

MINTCFD offers a maximum leverage of 1:100 to its clients, which means that traders can control a position size that is 100 times larger than their actual invested amount. Leverage allows traders to amplify their potential profits, as even a small price movement can result in significant gains. However, it is essential to understand that while high leverage presents the opportunity for higher returns, it also comes with increased risk.

The use of leverage in trading magnifies both gains and losses, and traders can quickly face substantial losses if the market moves against their position. It is crucial for traders to exercise caution and manage their risk appropriately when using high leverage. It is recommended that traders carefully consider their risk tolerance and financial situation before choosing the level of leverage to apply to their trading activities.

Spreads & Commissions

MINTCFD provides competitive spreads to its clients. The spread is the difference between the buying (ask) price and the selling (bid) price of an asset, and it serves as the primary way for brokers like MINTCFD to generate revenue. Tight spreads are advantageous for traders as they can lead to lower trading costs and better opportunities for profit.

In addition to offering tight spreads, MINTCFD does not charge any commissions on trades conducted through its platform. This means that traders can participate in the markets without incurring additional fees on top of the spread. Commission-free trading can be appealing to traders looking to keep their trading costs low and maximize their potential profits.

Trading Platforms

MINTCFD provides its clients with two main trading platforms: WebTrader and MintCFD Trading App.

WebTrader

The WebTrader is a web-based platform that allows traders to open and close positions online without the need to download any additional software. Through a web browser, traders can monitor Bid-Ask spreads, set Stop Loss and Take Profit orders, and keep track of all executed and current positions. Additionally, the WebTrader platform offers technical analysis indicators and a range of drawing tools to help users better analyze trading opportunities.

MintCFD Trading App

On the other hand, the MintCFD Trading App is a mobile application that has gained popularity for its user-friendly interface and comprehensive features. It offers access to over 200 of the world's most popular markets, including indices, commodities, forex, equities, and cryptocurrencies. The app ensures fast order execution with tight spreads, real-time market updates, and price notifications to keep traders informed of market movements.

Furthermore, MINTCFD's trading platforms provide free trading education through a knowledge center, trading videos, and expert daily tips to help clients improve their trading skills. Traders can create personalized watchlists to track selected markets and receive dynamic price alerts to stay updated on market fluctuations. MINTCFD is known for not charging any brokerage fees and having no hidden charges, making it a transparent and cost-effective option for online CFD trading activities.

Fees

MINTCFD prides itself on offering all of its financial services to investors without any charges. This means that if there are any fees to be imposed, they will be clearly communicated upfront. The fees primarily revolve around spread charges, which are positioned to be competitive within the market. Additionally, MINTCFD assures clients that there are no hidden fees associated with various aspects of the trading process. This includes no fees on deposits, withdrawals, real-time quotes, opening/closing trades, additional materials, and customer support. By being transparent about their fee structure and providing a fee-free environment for essential services, MINTCFD aims to create a more trustworthy and accessible trading experience for its investors.

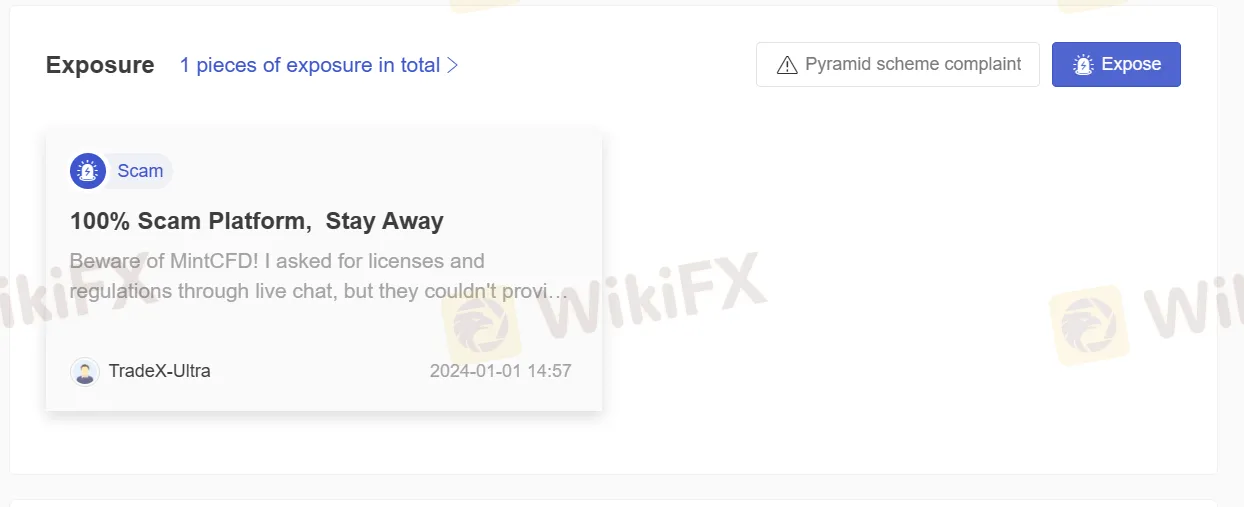

User Exposure on WikiFX

Visitors to our website have access to a section that highlights reported scams related to MINTCFD. Traders are advised to thoroughly inspect the provided details and take into account the potential risks linked to trading on an unregulated platform. Prior to initiating any trades, it is recommended to consult our platform for relevant information. In the event that you come across deceptive brokers or have fallen prey to fraudulent activities, we encourage you to inform us through the Exposure section. Your cooperation is valued, and our team of professionals is committed to addressing and resolving any issues you may encounter.

Customer Service

MINTCFD offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have. It's a convenient and effective communication channel that can improve customer satisfaction and increase sales.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +380 934400618

Email: customercare@mintcfd.com

Address:

Moreover, clients could get in touch with this broker through the social media, such as Instagram and Telegram.

MINTCFD offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Conclusion

In conclusion, MINTCFD offers a variety of trading instruments and services, variety of trading instruments, demo accounts, commission-free trading, and live chat support. However, it has many drawbacks, such as its lack of regulation, reports of scams, and potential safety concerns. These raise flags regarding its credibility and trustworthiness. Traders should weigh these pros and cons carefully before engaging with MINTCFD.

Frequently Asked Questions (FAQs)

| Q 1: | Is MINTCFD regulated by any financial authority? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at MINTCFD? |

| A 2: | You can contact via telephone: +380 934400618, email: customercare@mintcfd.com, live chat, online messing, Instagram and Telegram. |

| Q 3: | Does MINTCFD offer demo accounts? |

| A 3: | Yes. |

| Q 4: | What platform does MINTCFD offer? |

| A 4: | It offers WebTrader and MintCFD Trading App. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Corretora WikiFX

Últimas notícias

MultiBank Group: Uma Corretora Globalmente Regulamentada e Altamente Competitiva

DeepSeek Revoluciona o Mercado de IA e Impacta Investimentos Globais

Dólar Hoje (31/01): Fechando o Mês com Queda Acumulada

InteractiveTrade: Argentino tem 1200 USDT Bloqueados em Armadilha

NAGA Revoluciona o Trading de Criptomoedas com Nova Oferta de CFDs

Cálculo da taxa de câmbio