Shriram Insight

Resumo: Shriram Insight is an unregulated financial services company that offers a range of investment and trading services to clients. They provide access to Equities, Equity Derivatives, Mutual Funds, Tax Free Bonds, ETFs, Sovereign Gold Bonds, Commodity Futures, and Currency Derivatives. The minimum amount required to place a Fixed Deposit with STFC/ SCUF is Rs. 5000/- for Cumulative Deposit and Rs.10000 for Fixed Deposit, and thereafter in multiples of Rs. 1,000.

| Shriram Insight Review Summary | |

| Founded | 2006 |

| Registered Country/Region | India |

| Regulation | No Regulation |

| Market Instruments | Equities, Equity Derivatives, Mutual Funds, Tax Free Bonds, ETFs, Sovereign Gold Bonds, Commodity Futures, Currency Derivatives |

| Demo Account | ✅ |

| Trading Platform | Shriram Netpro |

| Minimum Deposit | Rs. 5000 |

| Customer Support | Contact Form |

| Phone: +91 7604089448, +91 7604082779 | |

| Fax: 033 23218429 | |

| Email: helpdesk@shriraminsight.com | |

| Social Media: Facebook, Twitter, LinkedIn, Google, YouTube | |

| Shriram Insight Share Brokers Ltd Admin Office: CK-5 & CK-6, Sector-II, Salt Lake City, Kolkata-700 091 | |

Shriram Insight Information

Shriram Insight is an unregulated financial services company that offers a range of investment and trading services to clients. They provide access to Equities, Equity Derivatives, Mutual Funds, Tax Free Bonds, ETFs, Sovereign Gold Bonds, Commodity Futures, and Currency Derivatives. The minimum amount required to place a Fixed Deposit with STFC/ SCUF is Rs. 5000/- for Cumulative Deposit and Rs.10000 for Fixed Deposit, and thereafter in multiples of Rs. 1,000.

Pros and Cons

| Pros | Cons |

| Various tradable assets | No regulation |

| Demo accounts available | Unclear fee structure |

| Multiple contact channels | No info on deposit and withdrawal |

| Shriram Netpro supported |

Is Shriram Insight Legit?

Shriram Insight is an unregulated firm, which means risk might be involved in its trading activities.

What Can I Trade on Shriram Insight?

Shriram Insight offers a diverse range of tradable assets, including Equities, Equity Derivatives, Mutual Funds, Tax Free Bonds, ETFs, Sovereign Gold Bonds, Commodity Futures, and Currency Derivatives.

| Trading Asset | Available |

| Equities | ✔ |

| Equity Derivatives | ✔ |

| Mutual Funds | ✔ |

| Tax Free Bonds | ✔ |

| ETFs | ✔ |

| Sovereign Gold Bonds | ✔ |

| Commodity Futures | ✔ |

| Currency Derivatives | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

Account Type

Shriram Insight offers three types of accounts. One of the accounts is the combination of the other two.

A Demat (dematerialized) Account is a facility that allows investors to hold shares in an electronic format. You need a demat account to trade on Indias stock exchanges.

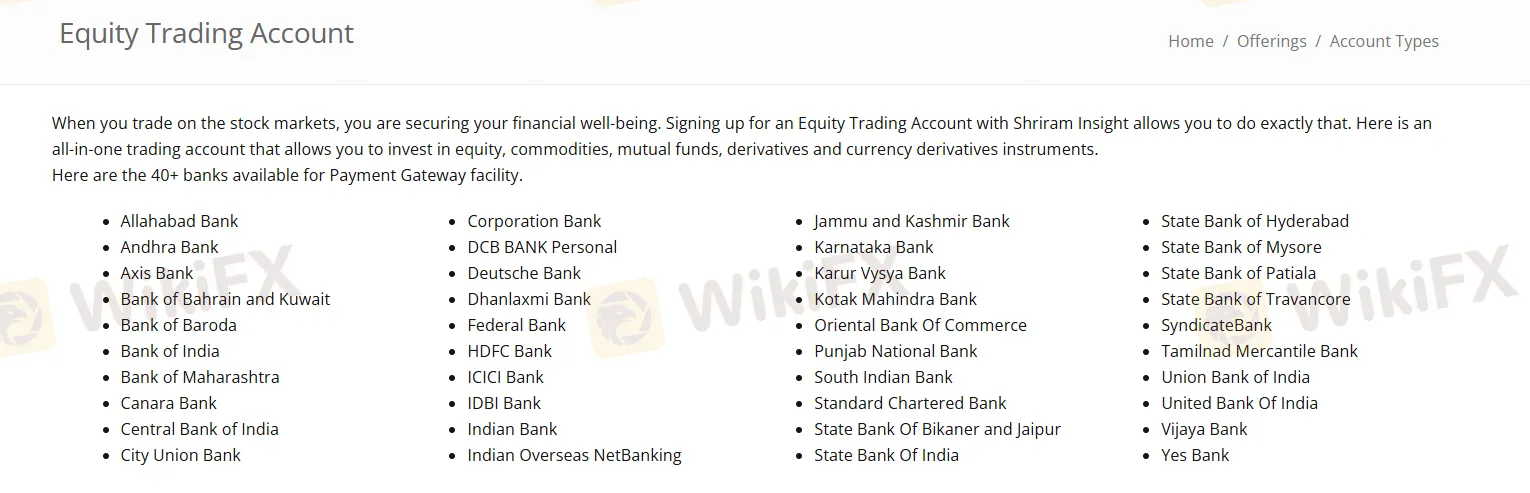

Equity Trading Account

- You can link anyone of your savings accounts to your Equity trading account.

- Transfer funds securely from your savings account to the Equity Trading Account via Shriram Insight's Payment Gateway.

- Trade in equities, equity derivatives, currencies, commodities, and more with your Equity Trading account.

- The shares will be paid into your Equity Trading Account in T+2. (“T” stands for the day the trade was carried out.)

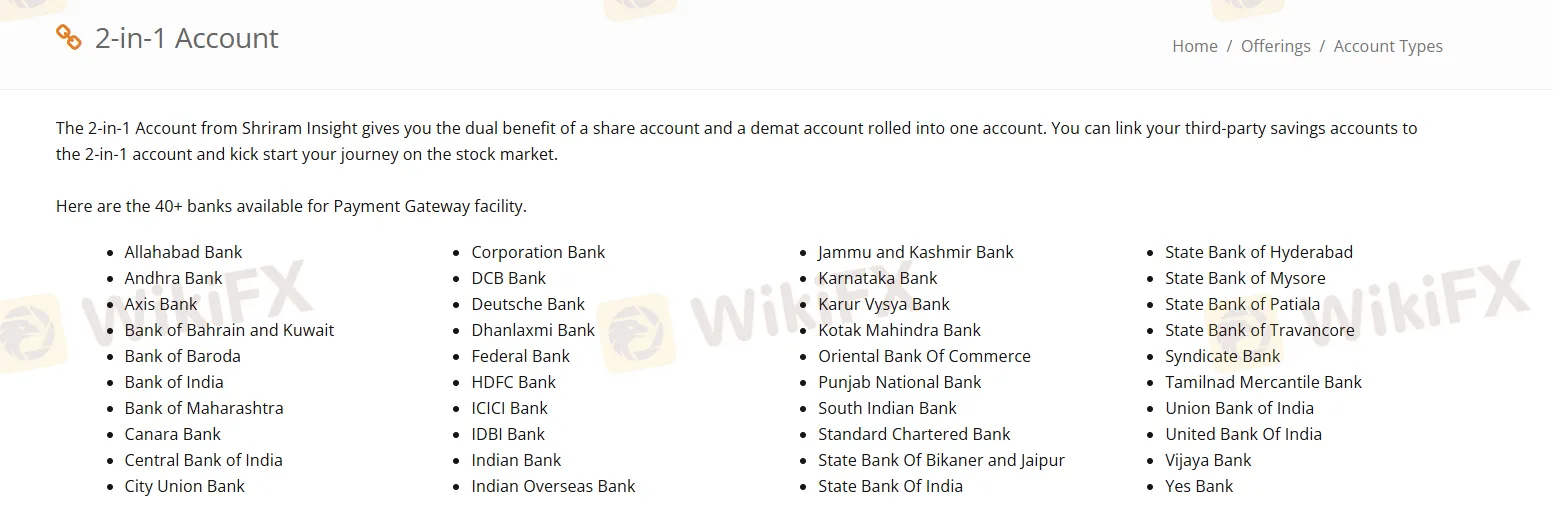

The 2-in-1 Account gives you the dual benefit of a share account and a demat account rolled into one account. You can link your third-party savings accounts to the 2-in-1 account and kick-start your journey on the stock market.

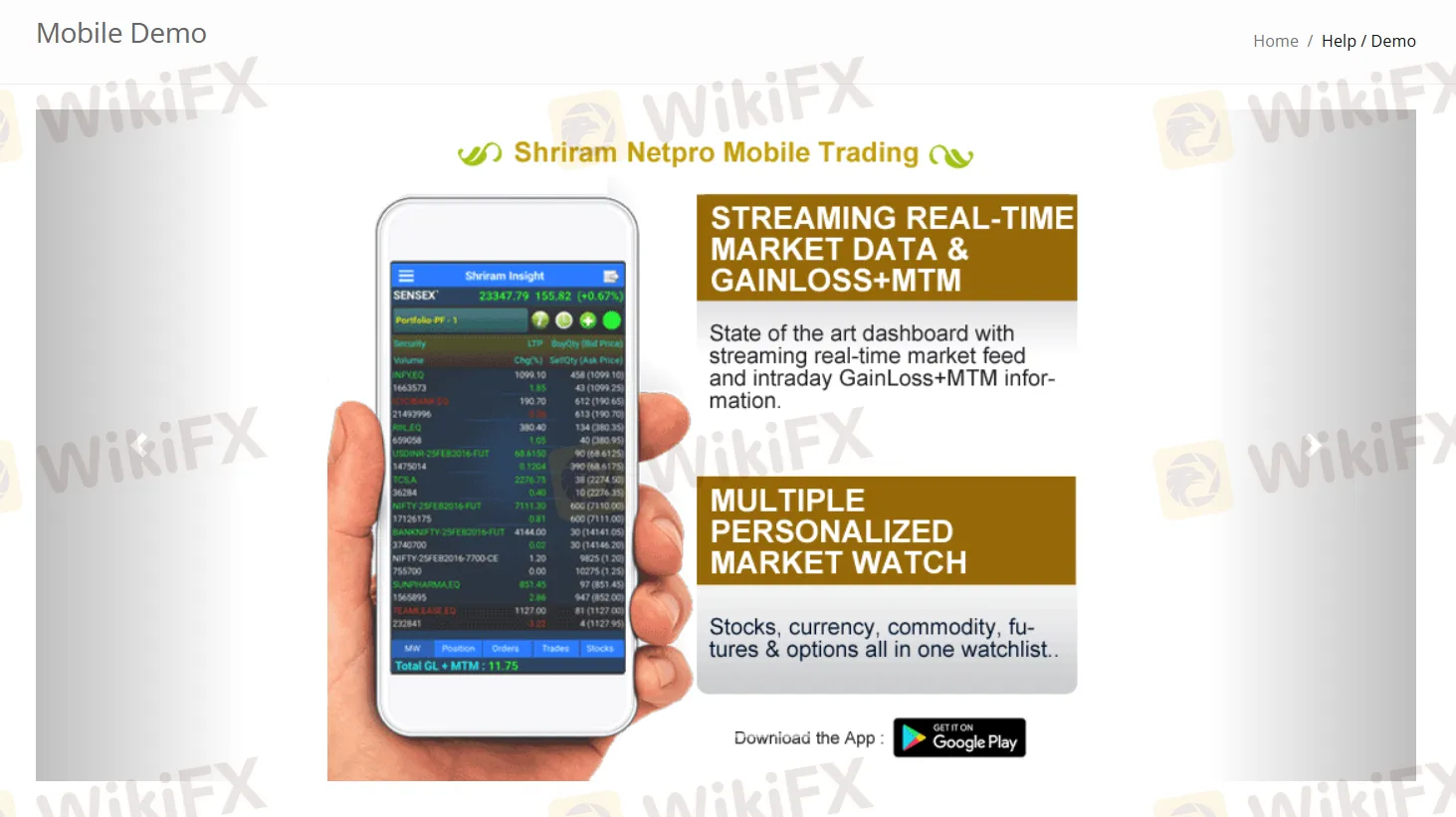

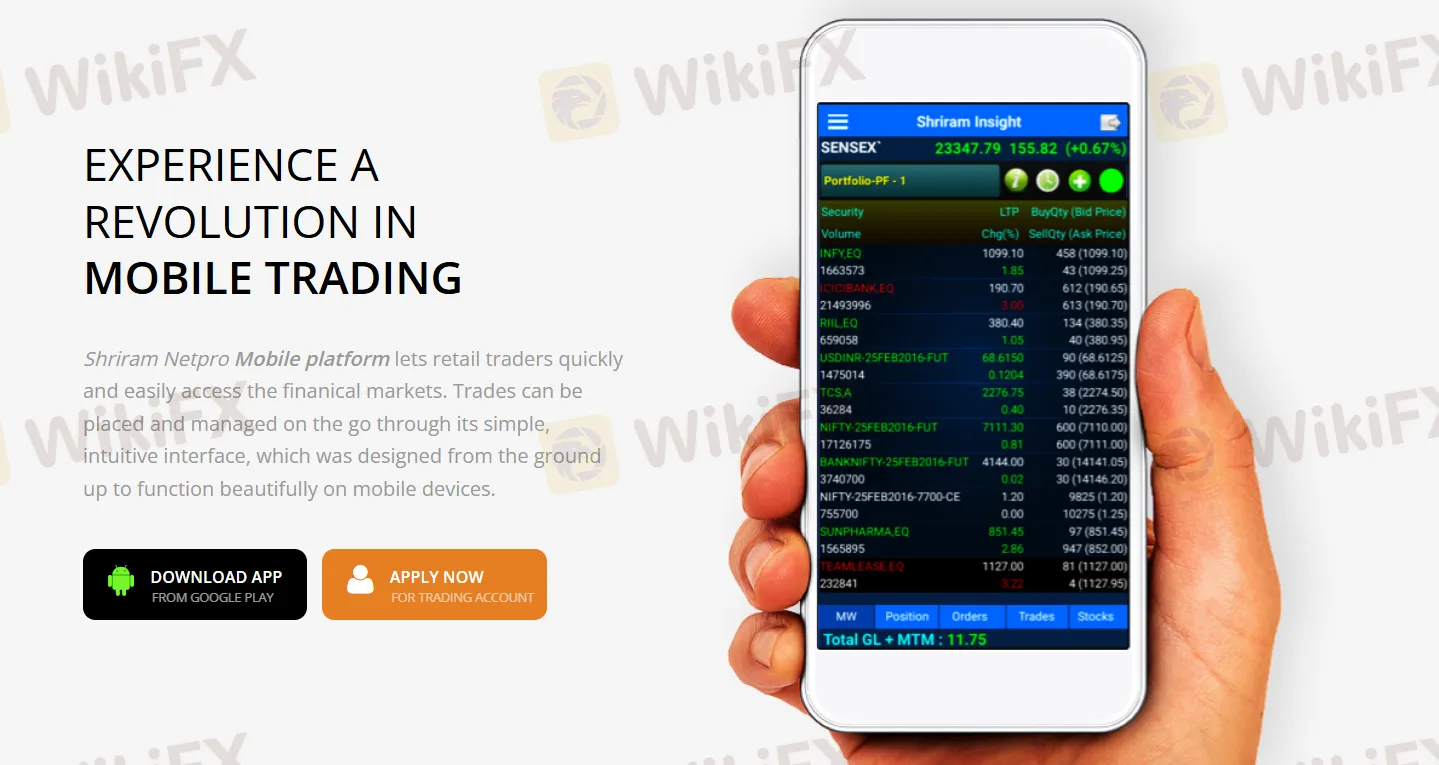

In addition to live accounts, Shriram Insight also offers access to a mobile demo account for traders to test out the platform without risking real money.

Trading Platform

Shriram Netpro is Shriram Insight's proprietary platform. It's accessible on desktop, web, and mobile.

| Trading Platform | Supported | Available Devices |

| Shriram Netpro | ✔ | Desktop, Mobile, Web |

Corretora WikiFX

Últimas notícias

Ouro Hoje (03/03): Preço Recua com Dólar Forte, Mas Tensão Geopolítica Mantém Viés de Alta

Ouro em Queda Livre: Metal Precioso Despenca 5% e Testa Suporte Crítico de US$ 5.000

ACM: Investidores de Hong Kong Perdem US$ 12.000 ao terem Contas Fechadas sem Consentimento

1x Trade: Roubou US$ 31.238 de Trader Polonês e Ainda Ofereceu "Bônus" em Troca de Silêncio

EUR/USD em Queda Livre: Guerra no Oriente Médio e Dólar Avassalador Empurram Euro para Mínimas do An

Dólar Dispara para R$ 5,26 com Guerra no Oriente Médio: Moeda Americana Busca Refúgio em Meio ao Cao

Warren Bowie & Smith: A Máquina de Moer Dinheiro da América Latina

Petróleo em Alerta: Conflito no Oriente Médio Dispara Preços e Ameaça Economia Global

Programa de Recompensas por Convite da WikiFX

Cálculo da taxa de câmbio