2025-01-31 17:56

Na indústriaHow to Determine your forex trading lot sizes.

#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

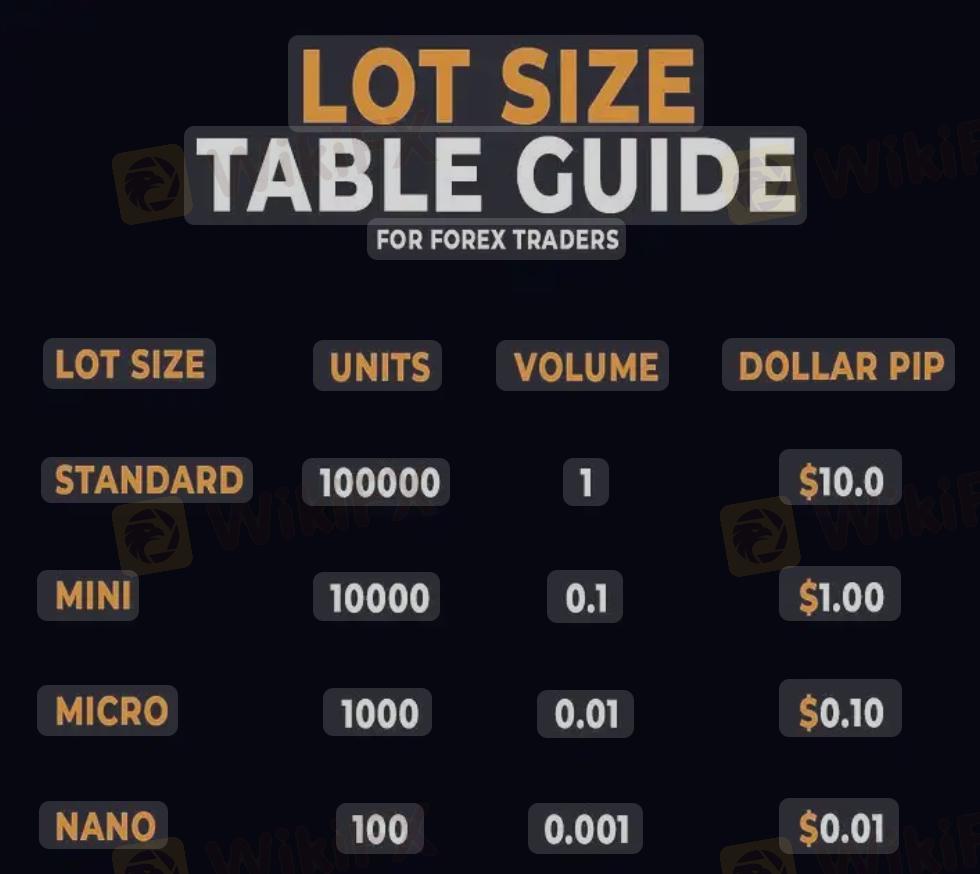

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

Gostar 0

Boss8889

Trader

Discussões populares

Análise de mercado

Brasileiros FX

Análise de mercado

Brasileiros no FOREX

Análise de mercado

Don't buy Bitcoin now! Look at my review and description in the print!

Análise de mercado

análises do mercado financeiro ao vivo confira

Na indústria

Não consegui sacar meus peofits

Na indústria

Não é possível retirar

Categoria do mercado

Plataforma

Exibições

IB

Recrutamento

EA

Na indústria

Mercado

Índice

How to Determine your forex trading lot sizes.

Nigéria | 2025-01-31 17:56

Nigéria | 2025-01-31 17:56#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

Gostar 0

Também quero comentar.

Perguntar

0Comentários

Ainda não há comentários. Faça o primeiro.

Perguntar

Ainda não há comentários. Faça o primeiro.