2025-02-06 15:11

Na indústriaThe role of market makers in trading

#firstdealofthenewyearFateema

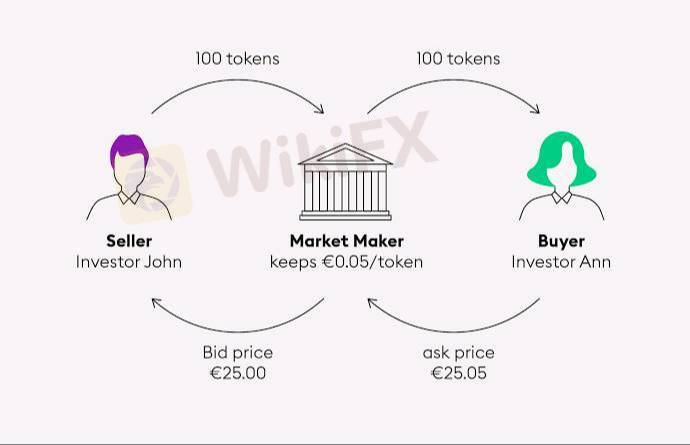

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

Gostar 0

murphy

Trader

Discussões populares

Análise de mercado

Brasileiros FX

Análise de mercado

Brasileiros no FOREX

Análise de mercado

Don't buy Bitcoin now! Look at my review and description in the print!

Análise de mercado

análises do mercado financeiro ao vivo confira

Na indústria

Não consegui sacar meus peofits

Na indústria

Não é possível retirar

Categoria do mercado

Plataforma

Exibições

IB

Recrutamento

EA

Na indústria

Mercado

Índice

The role of market makers in trading

Nigéria | 2025-02-06 15:11

Nigéria | 2025-02-06 15:11#firstdealofthenewyearFateema

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

Gostar 0

Também quero comentar.

Perguntar

0Comentários

Ainda não há comentários. Faça o primeiro.

Perguntar

Ainda não há comentários. Faça o primeiro.