2025-02-06 23:38

Na indústriaCORRELATION BETWEEN FOREX PAIRS

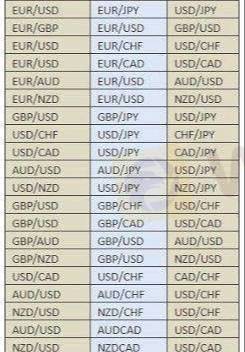

Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Gostar 0

BeastBoy2159

Nhà đầu tư

Discussões populares

Análise de mercado

Brasileiros FX

Análise de mercado

Brasileiros no FOREX

Análise de mercado

Don't buy Bitcoin now! Look at my review and description in the print!

Análise de mercado

análises do mercado financeiro ao vivo confira

Na indústria

Não consegui sacar meus peofits

Na indústria

Não é possível retirar

Categoria do mercado

Plataforma

Exibições

IB

Recrutamento

EA

Na indústria

Mercado

Índice

CORRELATION BETWEEN FOREX PAIRS

Argélia | 2025-02-06 23:38

Argélia | 2025-02-06 23:38Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Gostar 0

Também quero comentar.

Perguntar

0Comentários

Ainda não há comentários. Faça o primeiro.

Perguntar

Ainda não há comentários. Faça o primeiro.