2025-02-18 01:03

Na indústriaTHE EFFECTS OF THE EUROPEAN SOVEREIGN DEBT CRISIS

#firstdealofthenewyearastylz

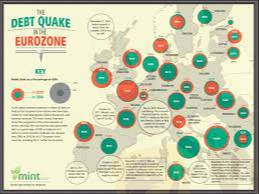

The European Sovereign Debt Crisis (2009–2012) had a significant impact on forex markets, mainly affecting the euro (EUR) and global currency stability. Here’s how it influenced forex trading:

1. Euro (EUR) Depreciation

Investors lost confidence in the euro due to rising debt in Greece, Spain, Italy, and other European nations.

Many traders sold off euros, causing the EUR/USD to decline sharply.

Example: In 2011, the EUR/USD fell from around 1.49 to 1.20, showing a major loss in value.

2. Flight to Safe-Haven Currencies

Traders shifted funds to safer currencies like:

US Dollar (USD) → Strengthened as investors saw the U.S. as a stable economy.

Swiss Franc (CHF) → Surged in value, forcing the Swiss National Bank (SNB) to intervene and cap its exchange rate.

Japanese Yen (JPY) → Gained strength as investors moved capital to Japan.

3. Increased Forex Volatility

The crisis caused panic selling and high uncertainty, leading to unpredictable swings in forex prices.

Central banks, like the European Central Bank (ECB), had to intervene with bailouts and stimulus programs, which also affected forex trends.

4. Weakening of Eurozone Trade Partners

Countries with close economic ties to Europe (e.g., the UK) saw their currencies affected.

The British pound (GBP) also faced pressure due to exposure to European debt.

5. Policy Actions Shaped Forex Trends

The ECB introduced quantitative easing (QE) and lower interest rates, making the euro less attractive to investors.

International financial institutions like the IMF and the EU bailout funds helped stabilize the euro over time.

Bottom Line

The European Sovereign Debt Crisis led to:

✅ Euro depreciation

✅ Strengthening of safe-haven currencies (USD, CHF, JPY)

✅ High forex market volatility

✅ Policy interventions that shaped currency movements

Gostar 0

Momo403

Corretoras

Discussões populares

Análise de mercado

Brasileiros FX

Análise de mercado

Brasileiros no FOREX

Análise de mercado

Don't buy Bitcoin now! Look at my review and description in the print!

Análise de mercado

análises do mercado financeiro ao vivo confira

Na indústria

Não consegui sacar meus peofits

Na indústria

Não é possível retirar

Categoria do mercado

Plataforma

Exibições

IB

Recrutamento

EA

Na indústria

Mercado

Índice

THE EFFECTS OF THE EUROPEAN SOVEREIGN DEBT CRISIS

Hong Kong | 2025-02-18 01:03

Hong Kong | 2025-02-18 01:03#firstdealofthenewyearastylz

The European Sovereign Debt Crisis (2009–2012) had a significant impact on forex markets, mainly affecting the euro (EUR) and global currency stability. Here’s how it influenced forex trading:

1. Euro (EUR) Depreciation

Investors lost confidence in the euro due to rising debt in Greece, Spain, Italy, and other European nations.

Many traders sold off euros, causing the EUR/USD to decline sharply.

Example: In 2011, the EUR/USD fell from around 1.49 to 1.20, showing a major loss in value.

2. Flight to Safe-Haven Currencies

Traders shifted funds to safer currencies like:

US Dollar (USD) → Strengthened as investors saw the U.S. as a stable economy.

Swiss Franc (CHF) → Surged in value, forcing the Swiss National Bank (SNB) to intervene and cap its exchange rate.

Japanese Yen (JPY) → Gained strength as investors moved capital to Japan.

3. Increased Forex Volatility

The crisis caused panic selling and high uncertainty, leading to unpredictable swings in forex prices.

Central banks, like the European Central Bank (ECB), had to intervene with bailouts and stimulus programs, which also affected forex trends.

4. Weakening of Eurozone Trade Partners

Countries with close economic ties to Europe (e.g., the UK) saw their currencies affected.

The British pound (GBP) also faced pressure due to exposure to European debt.

5. Policy Actions Shaped Forex Trends

The ECB introduced quantitative easing (QE) and lower interest rates, making the euro less attractive to investors.

International financial institutions like the IMF and the EU bailout funds helped stabilize the euro over time.

Bottom Line

The European Sovereign Debt Crisis led to:

✅ Euro depreciation

✅ Strengthening of safe-haven currencies (USD, CHF, JPY)

✅ High forex market volatility

✅ Policy interventions that shaped currency movements

Gostar 0

Também quero comentar.

Perguntar

0Comentários

Ainda não há comentários. Faça o primeiro.

Perguntar

Ainda não há comentários. Faça o primeiro.