Introdution of Access Bank UK

Resumo:Access Bank registered in the United Kingdom offers a broad range of innovative products and services including trade finance, commercial banking, and asset management, as well as supports the flow of investment into markets in Nigeria, Africa, and the MENA region. The bank's objective is to grow the international business of the Access Bank Group through customer service and innovative solutions in Trade Finance, Commercial Banking, and Asset Management.

| Access Bank Review Summary | |

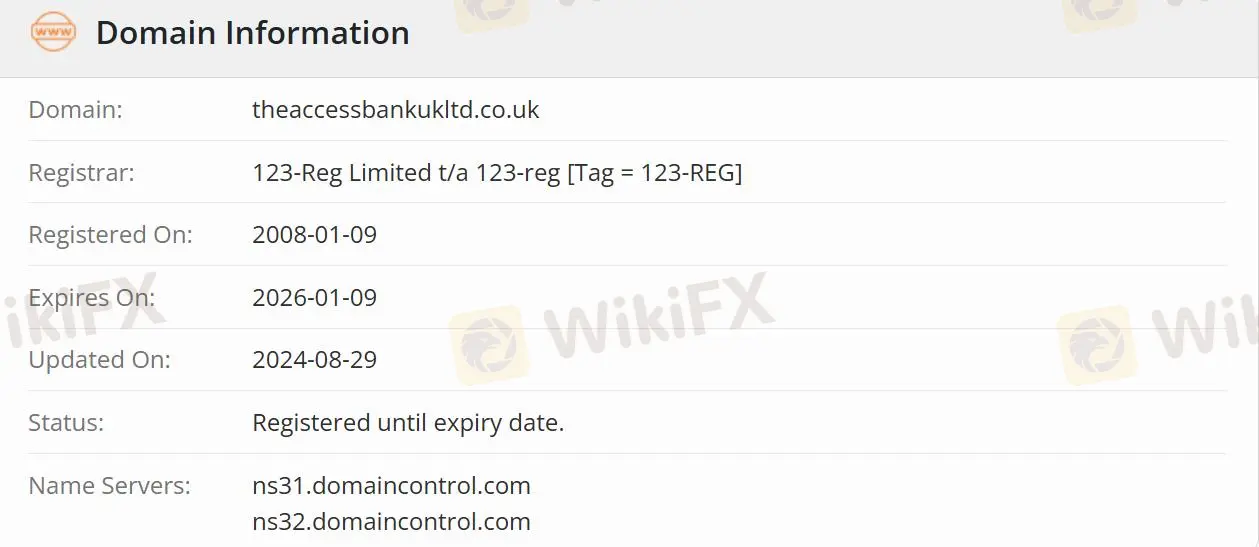

| Founded | 2008-01-19 |

| Registered Country/Region | United Kingdom |

| Regulation | Regulated |

| Services | Trade Finance/Commercial Banking/Asset Management/Investment |

| Customer Support | Email: ccontactaaccessprivatebank.com |

| Telephone: 0333 222 4516 (UK)/+44 1606 813020 | |

Access Bank Information

Access Bank registered in the United Kingdom offers a broad range of innovative products and services including trade finance, commercial banking, and asset management, as well as supports the flow of investment into markets in Nigeria, Africa, and the MENA region. The bank's objective is to grow the international business of the Access Bank Group through customer service and innovative solutions in Trade Finance, Commercial Banking, and Asset Management

Is Access Bank Legit?

Access Bank is authorized and regulated by the Financial Conduct Authority(FCA) with license No. 478415. A regulated company is safer than an unregulated one.

What services does Access Bank provide?

Access Bank provides various financial services to individuals, businesses, and private individuals in the UK. Other international users can enjoy services such as commercial banking and trade financing.

UK personal customers can choose personal banking, current accounts, property loans, foreign exchange services, faster payments, frequently asked questions, and notice deposit accounts.

The bank provides UK business customers with business banking, business accounts, trade finance, property loans, notice deposit accounts, direct lending, faster payments, and frequently asked questions.

UK private customers exclusive private banking, discretionary portfolios, execution-only portfolios, property loans, notice deposit accounts, faster payments, and portfolio-secured lending.

Corretora WikiFX

FXCM

D prime

IC Markets Global

TICKMILL

STARTRADER

Vantage

FXCM

D prime

IC Markets Global

TICKMILL

STARTRADER

Vantage

Corretora WikiFX

FXCM

D prime

IC Markets Global

TICKMILL

STARTRADER

Vantage

FXCM

D prime

IC Markets Global

TICKMILL

STARTRADER

Vantage

Últimas notícias

Ouro Hoje (03/03): Preço Recua com Dólar Forte, Mas Tensão Geopolítica Mantém Viés de Alta

Ouro em Queda Livre: Metal Precioso Despenca 5% e Testa Suporte Crítico de US$ 5.000

ACM: Investidores de Hong Kong Perdem US$ 12.000 ao terem Contas Fechadas sem Consentimento

1x Trade: Roubou US$ 31.238 de Trader Polonês e Ainda Ofereceu "Bônus" em Troca de Silêncio

EUR/USD em Queda Livre: Guerra no Oriente Médio e Dólar Avassalador Empurram Euro para Mínimas do An

Dólar Dispara para R$ 5,26 com Guerra no Oriente Médio: Moeda Americana Busca Refúgio em Meio ao Cao

Warren Bowie & Smith: A Máquina de Moer Dinheiro da América Latina

Petróleo em Alerta: Conflito no Oriente Médio Dispara Preços e Ameaça Economia Global

Programa de Recompensas por Convite da WikiFX

Cálculo da taxa de câmbio