Some Detailed Information about PayPay Securities

Resumo:PayPay Securities is a regulated broker, offering trading on investment trusts, US stocks, Japanese stocks, and CFDs on PayPay Securities App, PayPay Asset Management, Tsumitate Robo Savings, Japanese Stock CFD App, 10x CFD App, PC trading site, CFD Trading Site.

| PayPay Securities Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Investment Products | investment trusts, US stocks, Japanese stocks, CFDs |

| Trading Platform | PayPay Securities App, PayPay Asset Management, Tsumitate Robo Savings, Japanese Stock CFD App, 10x CFD App, PC trading site, CFD Trading Site |

| Customer Support | Contact form |

| Address: 2-1-6 Uchisaiwaicho, Chiyoda-ku, Tokyo Hibiya Park Front | |

| X, YouTube | |

PayPay Securities Information

PayPay Securities is a regulated broker, offering trading on investment trusts, US stocks, Japanese stocks, and CFDs on PayPay Securities App, PayPay Asset Management, Tsumitate Robo Savings, Japanese Stock CFD App, 10x CFD App, PC trading site, CFD Trading Site.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited payment methods |

| Various investment products | No direct contact channel |

| Clear fee structure |

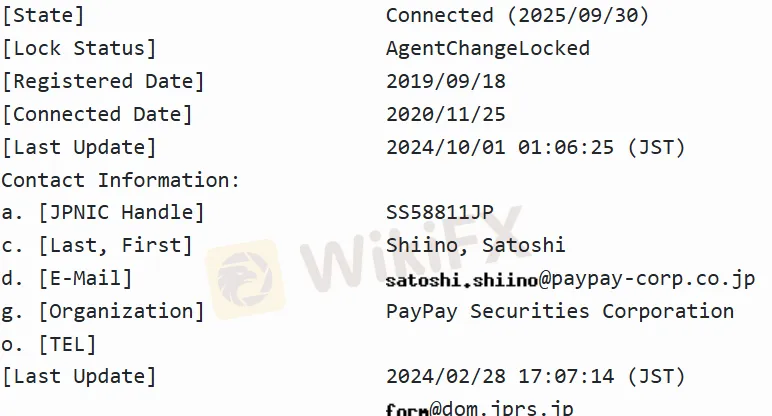

Is PayPay Securities Legit?

Yes. PayPay Securities is licensed by FSA to offer services.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Japan | FSA (Financial Services Agency) | Regulated | PayPay証券株式会社 | Retail Forex License | 関東財務局長(金商)第2883号 |

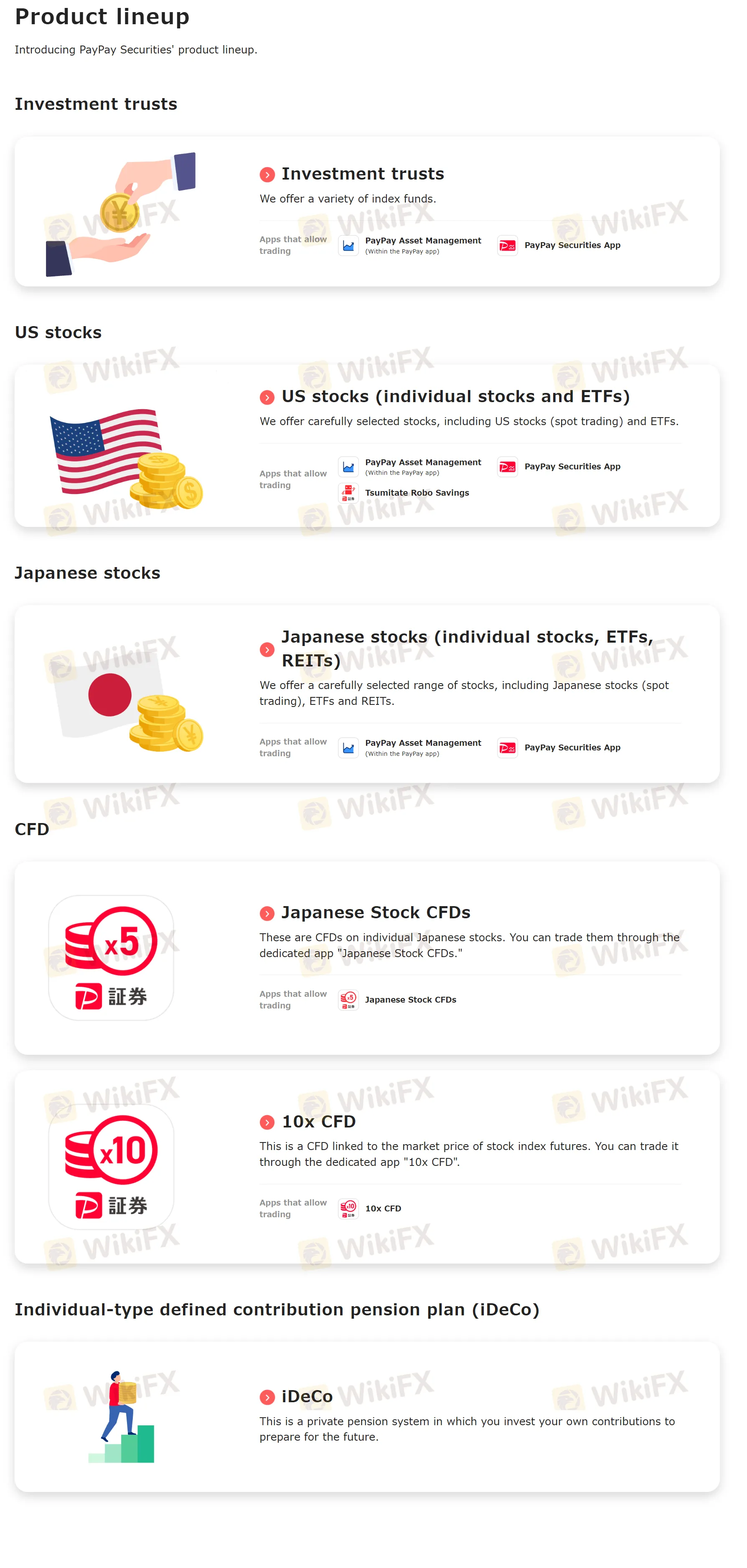

Investment Products

PayPay Securities offers investments in investment trusts, US stocks, Japanese stocks, and CFDs.

| Investment Products | Supported |

| Investment trusts | ✔ |

| US stocks | ✔ |

| Japanese stocks | ✔ |

| CFDs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

PayPay Securities Fees

| Fee Type | Specific Items | Fee Details |

| Transaction Fees (Included in Transaction Price) | Investment Trusts | - Purchase fee: ¥0 |

| - Trust fees, reserve amounts, etc.: Vary by product | ||

| Japanese Stocks | - During Tokyo Stock Exchange trading hours (9:00:10-11:29:00, 12:30:10-15:24:00): 0.5% of the “base price” (added for purchase, subtracted for sale) | |

| US Stocks | - During local trading hours (9:30-16:00 local time = 23:30-6:00 JST, 22:30-5:00 JST in summer): 0.5% of the “base price” (added for purchase, subtracted for sale) | |

| - Other time zones: 0.7% of the “base price” (added for purchase, subtracted for sale) | ||

| - Foreign exchange fee: ¥0.35 per USD (added for purchase, subtracted for sale) | ||

| Robo-Savings (Tsumi Tate Robo Savings) | - Automatic purchase/sale: 0.5% spread (added for purchase, subtracted for sale) | |

| - Non-automatic sale: Refer to “foreign-listed securities” rules | ||

| - Foreign exchange fee: ¥0.35 per USD (added for purchase, subtracted for sale) | ||

| Japanese Stock CFDs / 10x CFDs | - Fees included in spreads (varies by product and market conditions, e.g., volatility, liquidity) | |

| - Possible additional adjustments: Interest, rights, price adjustments, etc. | ||

| - Foreign exchange for non-JPY profits: ¥0.35 per USD (added/subtracted based on transaction type) | ||

| Deposit/Withdrawal Fees | Deposits | - Covered by the user (check with your bank for details) |

| Withdrawals | - To Mizuho Bank: ¥110 (tax included) for amounts under ¥30,000; ¥220 (tax included) for ¥30,000 and above | |

| - To other banks: ¥275 (tax included) for amounts under ¥30,000; ¥385 (tax included) for ¥30,000 and above | ||

| - Free for automatic withdrawals to PayPay Bank | ||

| Transfer Fees for Linked Accounts | - PayPay Bank: Free (regardless of purchase amount) | |

| - Other linked accounts (e.g., PayPay Money, SoftBank Card): ¥110 (tax included) per transaction for amounts under ¥20,000; free for ¥20,000 and above | ||

| Other Fees | Account Management Fee | Free |

| Document Issuance (e.g., balance certificates, abolition notices) | - Free for electronic delivery | |

| - ¥1,100 (tax included) per document for postal delivery (including reissues) |

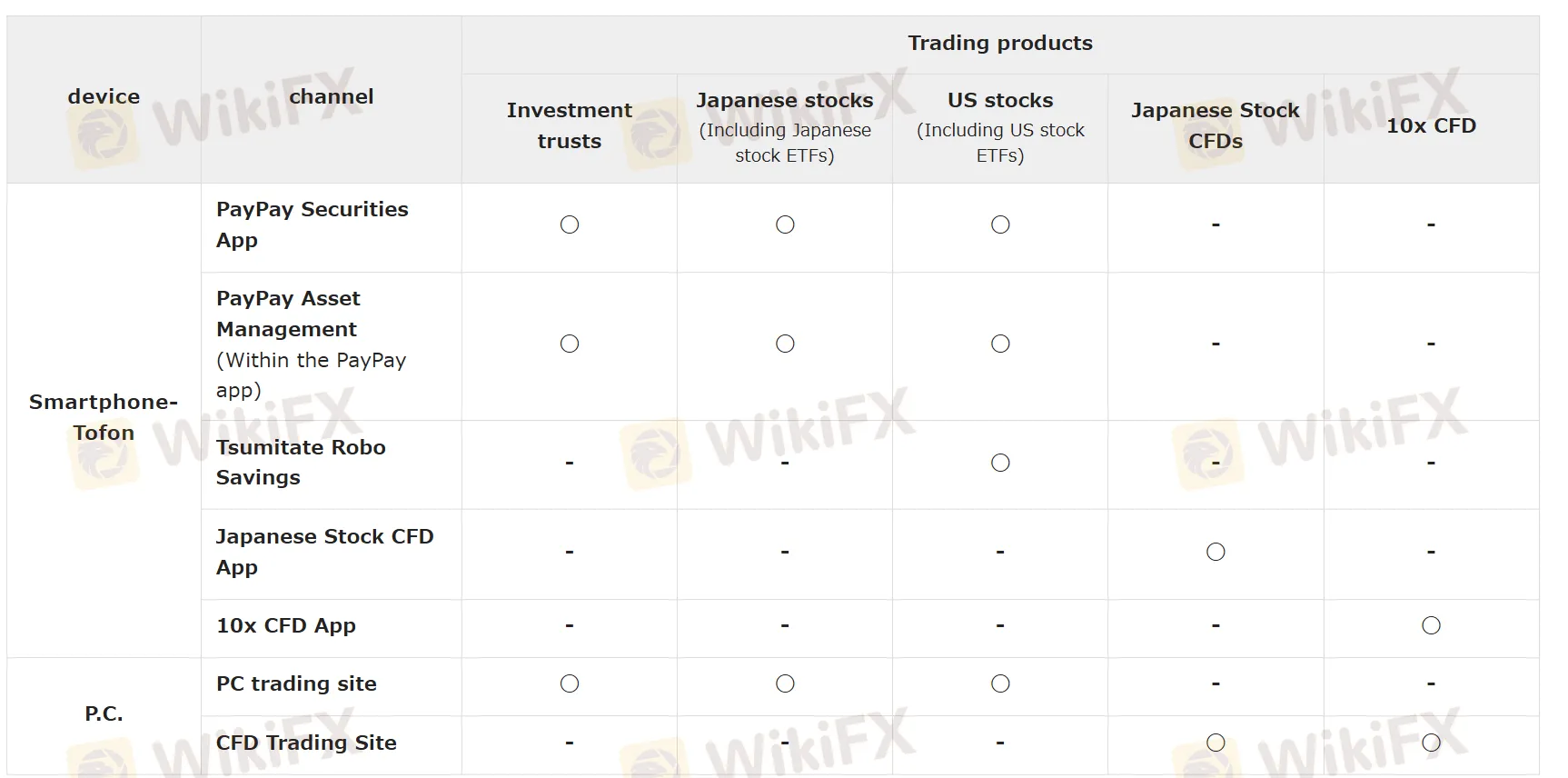

Trading Platform

| Trading Platform | Supported | Available Devices |

| PayPay Securities App | ✔ | Mobile |

| PayPay Asset Management | ✔ | Mobile |

| Tsumitate Robo Savings | ✔ | Mobile |

| Japanese Stock CFD App | ✔ | Mobile |

| 10x CFD App | ✔ | Mobile |

| PC trading site | ✔ | PC |

| CFD Trading Site | ✔ | PC |

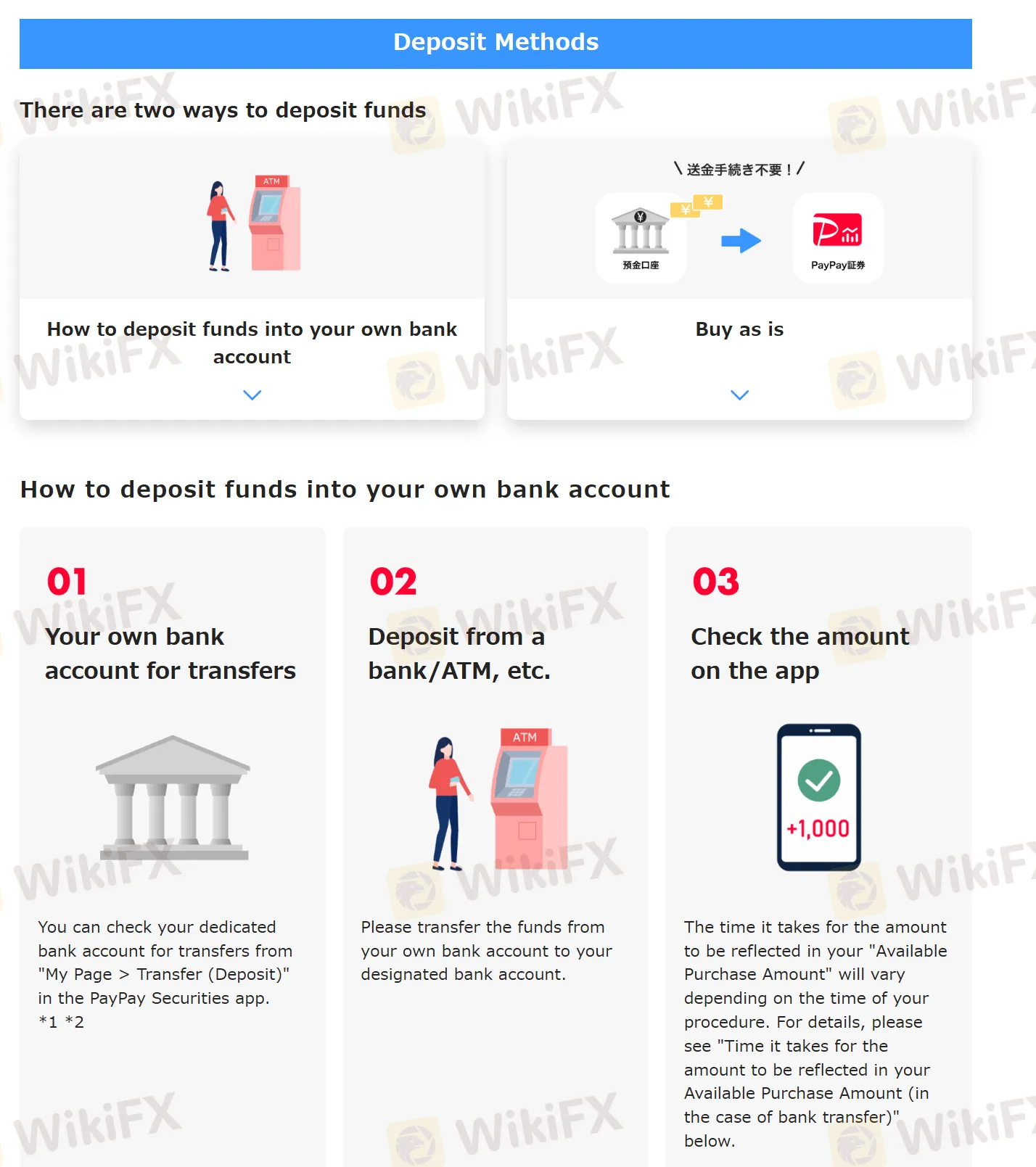

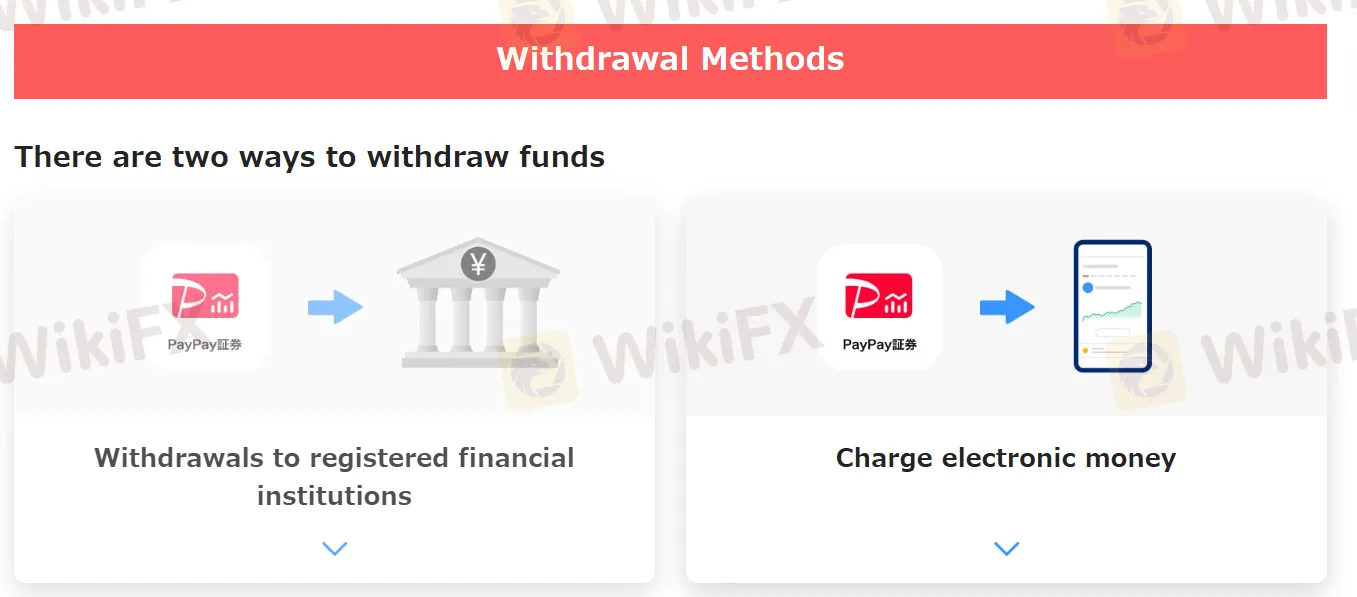

Deposit and Withdrawal

PayPay Securities accepts payments via bank transfer. However, specific info like deposit and withdrawal processing time and associated fees is not revealed.

Corretora WikiFX

Corretora WikiFX

Últimas notícias

Dólar Dispara com Guerra no Oriente Médio: Moeda Americana Busca Refúgio em Meio ao Caos Global

Euro Abre a R$ 6,08 em Meio à Turbulência Global: O Que Esperar da Moeda Europeia?

Projeções e Análises: Guerra no Oriente Médio, Petróleo em Alta e Oportunidades em Ouro

Ouro em Alta: Guerra EUA-Irã Aciona Busca por Refúgio e Abre Caminho para Novos Recordes

Ouro Dispara para Máxima Mensal com Guerra no Oriente Médio: Metal Precioso Rompe US$ 5.400 e Atinge

Previsões Forex para a Semana: USD/CAD, EUR/USD, USD/MXN, BTC/USD, USD/JPY, DAX, NASDAQ 100, USD/CHF

Cálculo da taxa de câmbio