Trade360 -Some Detailed Information about This Broker

Resumo:Trade360 is the trading name of Crowd Tech Ltd, a Cyprus-registered online trader and financial services company founded in 2012 that provides forex, spreads, stocks, and other trading services to retail and professional traders.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Information |

| Registered Country/Region | Cyprus |

| Found | 2012 |

| Regulation | CYSEC |

| Market Instrument | CFDs on currencies, commodities, ETFs, stocks and indexes |

| Account Type | Classic, Premium and Zero Spread |

| Demo Account | N/A |

| Maximum Leverage | 1:30/1:400 |

| Spread | Vary on the account type |

| Commission | Vary on the account type |

| Trading Platform | Mobile Platform, WebTrader, CrowdTrading, Trading Central and MetaTrader5 |

| Minimum Deposit | $/€/£450 |

| Deposit & Withdrawal Method | credit/debit cards, e-wallets, and online/local bank transfers |

Trade360 is the trading name of Crowd Tech Ltd, a Cyprus-registered online trader and financial services company founded in 2012 that provides forex, spreads, stocks, and other trading services to retail and professional traders.

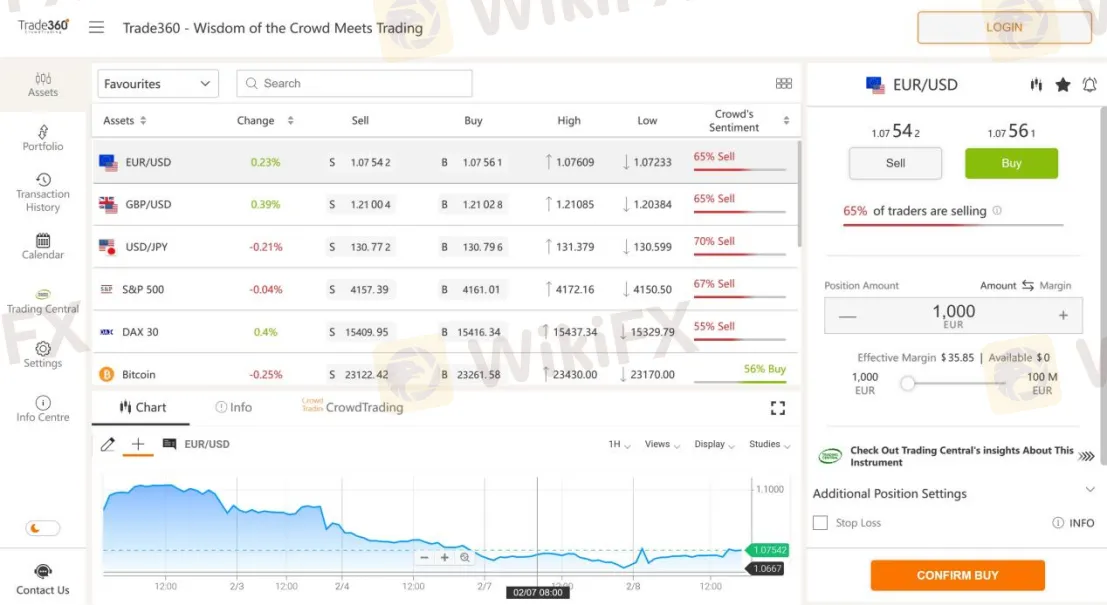

Here is the home page of this brokers official site:

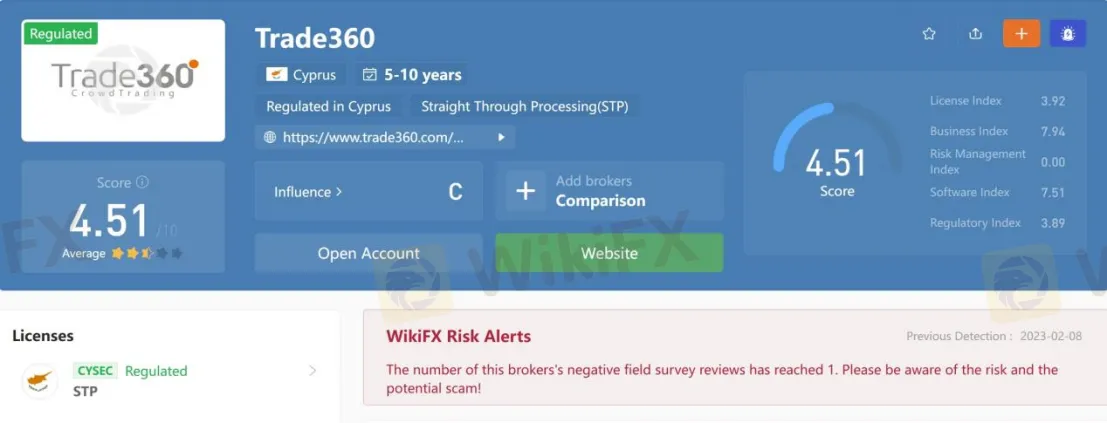

Crowd Tech Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CYSEC), with regulatory license number 202/13.

Note: The screenshot date is February 8, 2023. WikiFX gives dynamic scores, which will update in real-time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

Market Instruments

Tradable financial assets tradable on the Trade360 platform include CFDs on currencies, commodities, ETFs, stocks and indexes.

Account Types

Trade360 offers 3 different trading accounts, namely Classic, Premium and Zero Spread, with minimum initial capital requirements of $/€/£450, $/€/£10,000 and $/€/£50,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

Trade360 offers maximum leverage of 1:30 for retail clients and 1:400 for professional traders, 1:30 for forex, 1:20 for Gold and indices, and 1:5 for stocks and exchange-traded funds.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Spreads and commissions with Trade360 are scaled with the accounts offered. Specifically, the spread starts from 1.8 pips on the Classic account, from 1 pip on the Premium account and 0 pips on the Zero Spread account.

As for the commission, there is no commission on the Classic and Premium accounts, while the Zero Spread account holders have to pay a commission of $7.

Trading Platform

Trade360 says it offers 5 trading platforms for investors, covering Mobile Platform, WebTrader, CrowdTrading, Trading Central and MetaTrader5. Anyway, you had better choose brokers who offer the leading MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

Trade360 supports traders to access their accounts via credit/debit cards, e-wallets, and online/local bank transfers.

Customer Support

The Trader360 customer support can be reached 24/5 through telephone: +357-25-262-200 +357-25-583-294, Fax: +357-25-281-710, email: support@trade360.com, send messages online, as well as some social media platforms, like Facebook, Twitter, Linkedin, YouTube and Instagram. Company address: 116 Gladstonos, M. Kyprianou House, 3rd & 4th Floors, 3032, Limassol, Cyprus.

Pros & Cons

| Pros | Cons |

| • CYSEC-regulated | • Regional restrictions |

| • Multiple tradable assets and funding options | • High minimum deposit ($/€/£450) |

| • MT5 supported |

Frequently Asked Questions (FAQs)

| Q 1: | Is Trader360 regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At Trader360, are there any regional restrictions for traders? |

| A 2: | Yes. Trader360 does not offer its service to residents of certain jurisdictions such as Australia, New Zealand, Canada, Iran, North Korea and Belgium. USA nationals are not accepted regardless of the country of residence. The information on this site is not intended for distribution to, or use by any person in any country where such distribution or use would be contrary to the local law or regulation, or any person under the age of 18. |

| Q 3: | Does Trader360 offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Trader360 supports Mobile Platform, WebTrader, CrowdTrading, Trading Central and MetaTrader5. |

| Q 4: | What is the minimum deposit for Trader360? |

| A 4: | The minimum initial deposit to open an account is $/€/£450. |

| Q 5: | Is Trader360 a good broker for beginners? |

| A 5: | Yes. Trader360 is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT5 platform. |

Corretora WikiFX

FOREX.com

IC Markets Global

EC Markets

FBS

XM

Pepperstone

FOREX.com

IC Markets Global

EC Markets

FBS

XM

Pepperstone

Corretora WikiFX

FOREX.com

IC Markets Global

EC Markets

FBS

XM

Pepperstone

FOREX.com

IC Markets Global

EC Markets

FBS

XM

Pepperstone

Últimas notícias

CPT Markets: Conheça Antes de Investir

Vittaverse: Cliente Perde Bônus de $800 e Lucro de $5609

Dólar Hoje: Moeda Opera Perto de R$5,89 em meio ao Acirramento Guerra Comercial

Ouro Sobe Quase 2%: Oportunidade para Investidores Diante da Instabilidade Global

Quais as Vantagens do Mercado Forex?

REALHX: Espanhol tem 30 mil Euros Bloqueados

eToro Expande Seu Catálogo com Novas Cryptoassets

Cálculo da taxa de câmbio