Fusion Trade

Resumo:Fusion Trade is an online trading platform headquartered in the Marshall Islands. It operates as an unregulated entity and has been established for less than a year. The platform offers a range of trading instruments, including Forex, CFDs, and Options, catering to traders of varying preferences. With account types like Bronze, Silver, and Gold, traders can select the one that aligns best with their needs. Fusion Trade requires a minimum initial deposit of $250 and offers accessibility through web-based and mobile platforms on Android and iPhone. Its flexibility extends to deposit and withdrawal methods, including cryptocurrencies. Moreover, the platform provides round-the-clock customer support through 24/7 live chat, aiming to assist traders at any time of the day or night.

| Company Information | Details |

| Company Name | Fusion Trade |

| Registered In | Marshall Islands| |

| Regulation Status | Unregulated |

| Years of Establishment | Within 1 year |

| Trading Instruments | Forex, CFDs, Options |

| Account Types | Bronze, Silver, Gold |

| Minimum Initial Deposit | 250 USD |

| Trading Platform | Web, Android, iPhone |

| Deposit and Withdrawal Methods | Various, including cryptocurrencies |

| Customer Service | 24/7 Live Chat |

Overview of Fusion Trade

Fusion Trade is an online trading platform headquartered in the Marshall Islands. It operates as an unregulated entity and has been established for less than a year. The platform offers a range of trading instruments, including Forex, CFDs, and Options, catering to traders of varying preferences. With account types like Bronze, Silver, and Gold, traders can select the one that aligns best with their needs.

Fusion Trade requires a minimum initial deposit of $250 and offers accessibility through web-based and mobile platforms on Android and iPhone. Its flexibility extends to deposit and withdrawal methods, including cryptocurrencies. Moreover, the platform provides round-the-clock customer support through 24/7 live chat, aiming to assist traders at any time of the day or night.

Is Fusion Trade Legit or a Scam?

Fusion Trade's unregulated status is a substantial cause for concern in the realm of online trading. Regulation serves as a vital safeguard for traders, ensuring fair and transparent practices, investor protection, and financial stability. The absence of regulatory oversight places traders at a higher risk of encountering questionable practices, fraud, and a lack of accountability in case of disputes. While Fusion Trade may present enticing features, the lack of regulation should serve as a red flag for potential investors, necessitating meticulous due diligence and consideration of the associated risks before engaging with the platform.

Pros and Cons

| Pros | Cons |

| Wide Range of Tradable Assets | Lack of Regulation |

| Swift Withdrawal Processing | Potential Bonus Conditions |

| Non-Stop Trading | High Return Promise and Risk |

| Multifaceted Trading Platforms | Limited Information on Fees |

| Comprehensive Customer Support | Verification Delays |

Wide Range of Tradable Assets: Fusion Trade offers a diverse selection of assets for traders to choose from, enhancing portfolio diversification.

Swift Withdrawal Processing: The platform's commitment to processing withdrawals within one hour can provide traders with quick access to their funds.

Non-Stop Trading: Fusion Trade allows trading even over weekends, ensuring flexibility for traders with different schedules.

Multifaceted Trading Platforms: With a web-based platform and mobile options for Android and iPhone, Fusion Trade offers accessibility to traders on various devices.

Comprehensive Customer Support: The 24/7 live video chat support, along with multilingual assistance, fosters efficient communication and problem resolution.

Cons:

Lack of Regulation: Fusion Trade operates without regulatory oversight, raising concerns about user protection and fair practices.

Potential Bonus Conditions: The platform's bonuses might come with terms and conditions that traders should thoroughly review to understand their implications.

High Return Promise and Risk: The promise of high returns in a short time can be enticing but may also involve higher risk and potential losses.

Limited Information on Fees: Specific details about spreads, commissions, and other fees were not provided, leaving traders in need of more transparency.

Verification Delays: The verification process may introduce delays if users fail to submit required documents promptly, affecting account functionality.

Market Instruments

Fusion Trade provides a broad spectrum of market instruments for its traders. Users can engage in Forex, which involves trading currency pairs, CFDs (Contracts for Difference), a method of trading the price movements of global financial markets without owning the underlying asset, and Options that offer the opportunity to predict market direction. The sheer variety promises diversification, which is always beneficial in risk management.

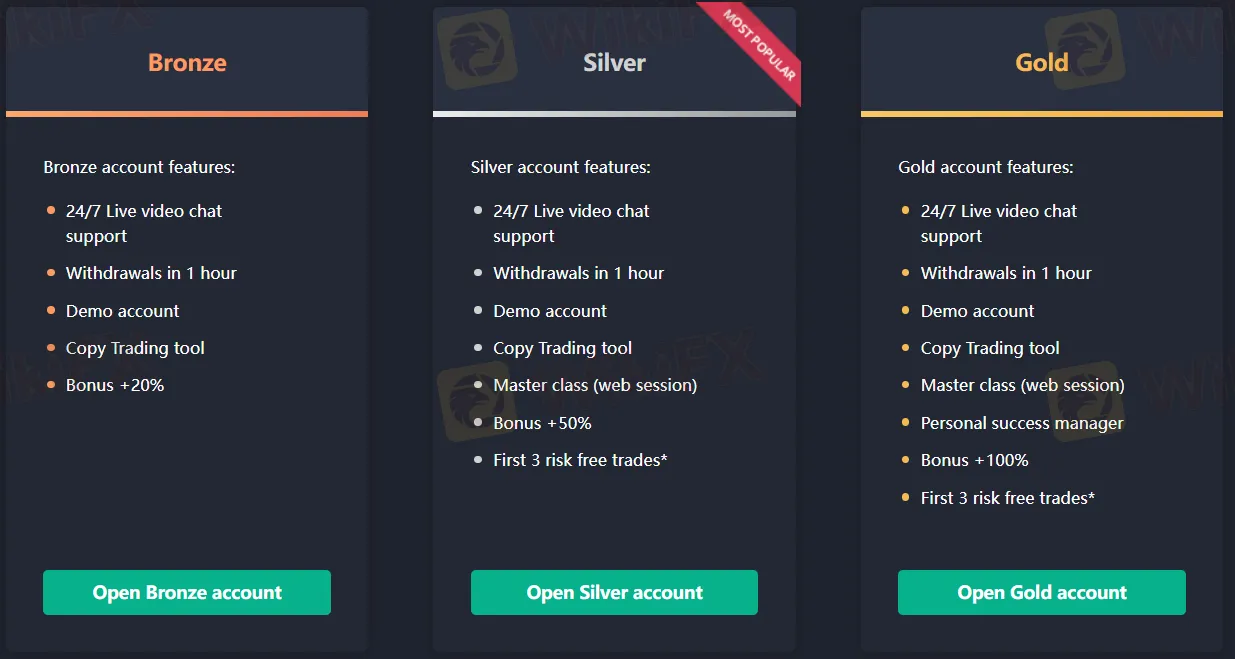

Account Types

Fusion Trade offers a range of account types to cater to different traders' needs and preferences. These include the Bronze account, which provides basic features like 24/7 live video chat support and withdrawals within one hour, the Silver account, which includes additional benefits such as access to a Master class web session and the opportunity for the first three risk-free trades, and the Gold account, which offers a personal success manager and a 100% bonus, along with the features of the previous account types.

Each account tier is designed to provide traders with varying degrees of support and bonuses, allowing them to choose the one that aligns best with their trading goals and experience level. However, it's crucial to remember that Fusion Trade operates as an unregulated broker, so traders should carefully consider the risks associated with each account type before making a decision.

| Account Type | Features | Bonus |

| Bronze | 24/7 Live video chat, Withdrawals in 1 hour, Demo account, Copy Trading tool | 20% |

| Silver | Above + Master class (web session), First 3 risk-free trades | 50% |

| Gold | Above + Personal success manager | 100% |

Each account offers its unique advantages, catering to both beginners and seasoned traders.

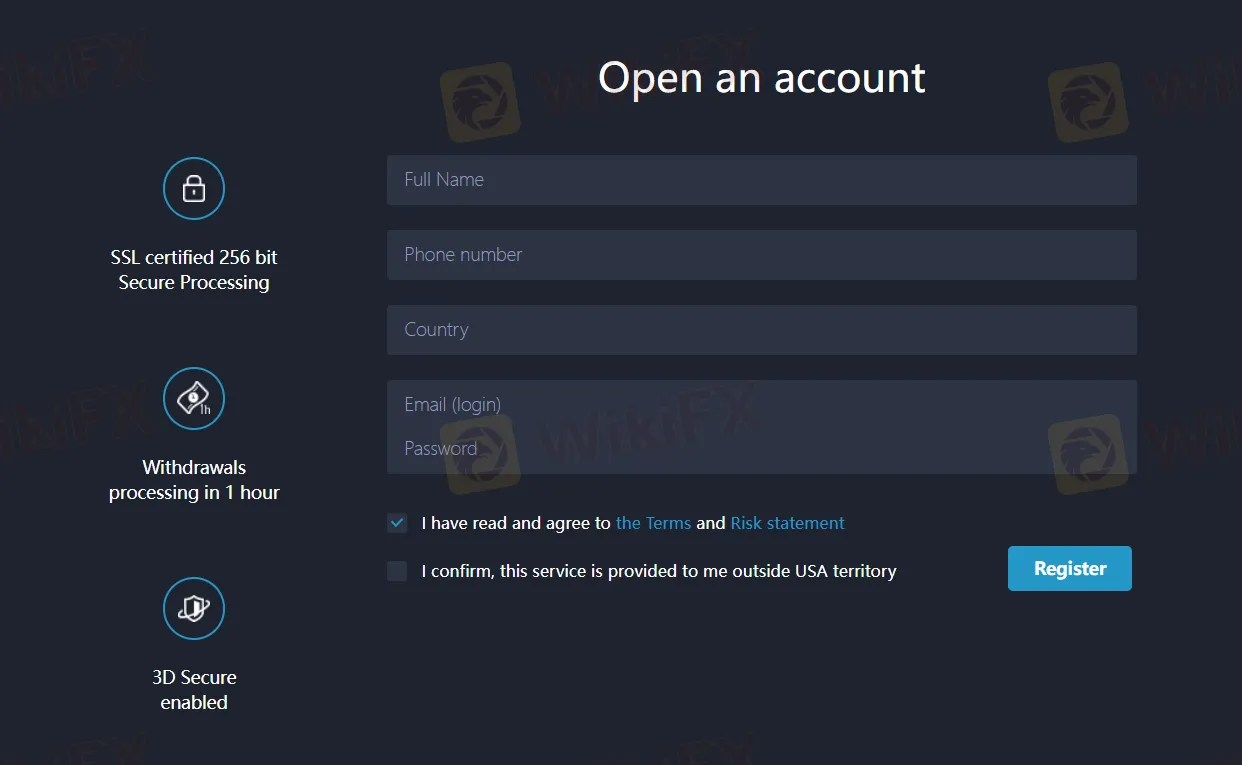

How to Open an Account?

Opening an account with Fusion Trade is a straightforward process, typically consisting of several key steps. Although the specific steps may vary slightly depending on the platform's current procedures, I can provide a general outline based on the information available:

Visit the Fusion Trade Website: Start by visiting the official Fusion Trade website at https://fusiontrade24.com/. Ensure that you are on the official website to avoid phishing or scam attempts.

Registration: Look for a “Sign Up” or “Register” button on the homepage and click on it. You will be directed to a registration page where you need to provide essential information such as your name, email address, and phone number. Create a secure password for your account.

Account Verification: After registering, you may need to verify your email address by clicking on a verification link sent to your email inbox. This step helps confirm the authenticity of your account.

Profile Setup: Once your email is verified, you'll need to complete your profile by providing additional personal information, including your address and possibly some financial details.

Deposit Funds: To start trading, you'll need to deposit funds into your Fusion Trade account. The platform typically offers various deposit methods, such as credit cards, bank transfers, and cryptocurrencies. Choose your preferred method and follow the instructions to fund your account.

Leverage

Leverage is a double-edged sword in trading, allowing traders to amplify their position and potential profits, but it also magnifies losses. Fusion Trade, like many other platforms, might offer different leverage rates based on the account type and asset being traded. While specific leverage rates weren't provided, traders should always be cautious and use leverage judiciously. Proper risk management strategies should be employed, as high leverage can lead to significant losses, sometimes even exceeding the initial deposit. Before employing leverage, it's essential to understand its implications and how it aligns with one's risk appetite.

Spreads & Commissions

While the specific spreads and commissions for Fusion Trade were not detailed in the given data, these are critical factors to consider. Spread, the difference between the buy and sell price, is one way brokers make their money. The narrower the spread, the better for the trader.

Commissions, on the other hand, can be fixed or percentage-based. Traders should seek clarity on these aspects before committing as they directly impact profitability. Ideally, a competitive trading platform would offer tight spreads and low or zero commissions, ensuring traders retain a larger portion of their profits.

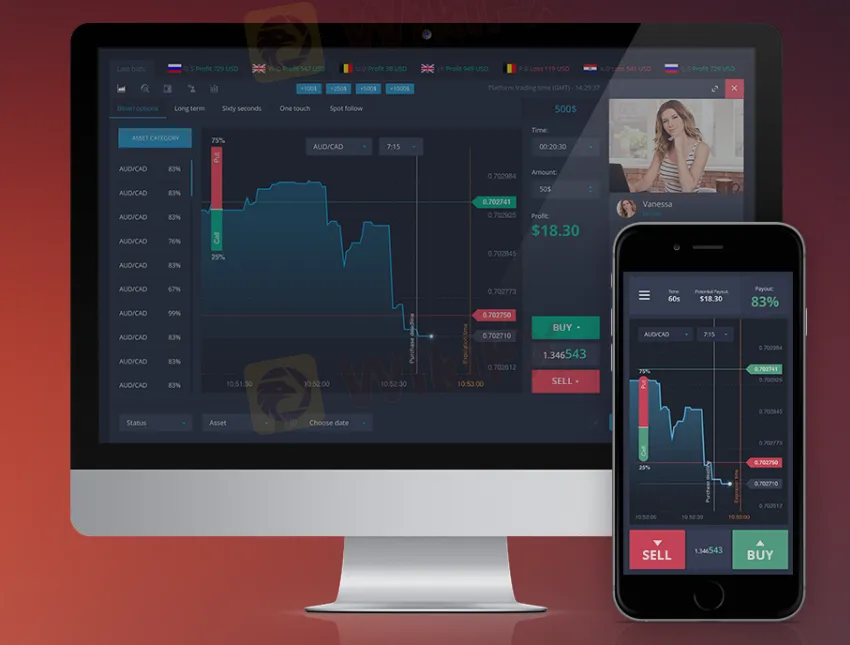

Trading Platform

Fusion Trade takes pride in offering a multifaceted platform, available on Web, Android, and iPhone. The convenience of trading on-the-go is underscored by their mobile platform, which promises real-time chart updates, a seamless deposit and withdrawal process, and an integrated account view. Such features empower traders to act promptly on market changes, a critical factor in the fast-paced world of trading. Additionally, the assertion of a live video chat suggests Fusion Trade's dedication to transparent communication and user support.

Deposit & Withdrawal

One of Fusion Trade's standout features is its swift withdrawal process, processed within an hour. Moreover, the platform appears flexible, offering an array of deposit and withdrawal methods, from traditional bank transfers and credit cards to contemporary cryptocurrency options like Bitcoin and Ethereum.

This wide range ensures convenience for a global user base with varied financial preferences. However, a point of consideration is the verification process, which might introduce delays if proper documentation is not provided promptly by the user.

Customer Support

Effective customer support is the backbone of any service platform. Fusion Trade emphasizes its 24/7 live video chat support, a feature not commonly found in many platforms. This approach, coupled with multilingual support, showcases a robust framework aimed at addressing user queries and concerns efficiently.

Immediate assistance, especially in the intricate realm of trading, can make a significant difference in user experience and outcomes. If you require immediate assistance, you can contact Fusion Trade's customer support at +1 (321) 804‑1857, available round the clock.

Conclusion

In conclusion, Fusion Trade presents itself as an advanced online trading platform offering Forex, CFD, and Options trading, with features like real-time trading, rapid withdrawals, and live video chat support to enhance user experience. However, the platform's unregulated status raises significant concerns about investor protection and fair practices, urging potential users to exercise caution and conduct thorough due diligence.

hile it offers diverse assets, convenient platforms, and comprehensive customer support, traders must carefully consider the associated risks, such as potential bonus conditions and verification delays. Fusion Trade's varied account types aim to cater to different trader profiles, but users should be mindful of the lack of regulatory oversight. Ultimately, the decision to engage with Fusion Trade should be made after thorough consideration of its offerings and risks.

FAQs

Q: What is Fusion Trade's regulatory status?

A: Fusion Trade is currently an unregulated trading platform, which may raise concerns regarding investor protection.

Q: Can I trade on Fusion Trade during weekends?

A: Yes, Fusion Trade allows non-stop trading even over weekends, providing flexibility for traders with different schedules.

Q: How quickly are withdrawal requests processed on Fusion Trade?

A: Fusion Trade commits to processing withdrawal requests within one hour, ensuring swift access to funds.

Q: What types of assets can I trade on Fusion Trade?

A: Fusion Trade offers a diverse range of tradable assets, including Forex, CFDs, and Options, enhancing portfolio diversification.

Q: Does Fusion Trade offer customer support in multiple languages?

A: Yes, Fusion Trade provides multilingual customer support 24/7, ensuring efficient communication for traders worldwide.

Q: Are there any potential risks associated with Fusion Trade's high return promises?

A: Yes, while promising high returns, traders should be aware that it also involves higher risk and potential losses.

Q: What should I consider before choosing an account type on Fusion Trade?

A: Before selecting an account type, carefully evaluate your trading goals and risk tolerance, considering the unique advantages and risks associated with each tier, especially in light of Fusion Trade's unregulated status.

Corretora WikiFX

Últimas notícias

FXORO: Reclamações de Clientes e Riscos Associados à Corretora

Mercado Forex em Alerta: Como os Últimos Eventos Globais Afetam o Câmbio

Fusion Markets: Uma Corretora Confiável para Traders de Forex?

Octa Broker é Eleita a "Melhor Corretora de CFDs da Ásia 2025”

Queda das Taxas Futuras de Juros e Dólar: O Que Isso Significa para Traders brasileiros?

USD/JPY Sob Pressão: O Que Esperar Após os Dados de Payrolls dos EUA?

FBS Celebra 16 Anos com o FBS Birthday IB Contest: Prêmios Exclusivos para Parceiros

Saxo Bank: Uma Corretora de Investimentos Completa para Traders de Forex e Multiativos

Bolsas Europeias em Destaque: BCE e Concessões de Trump Influenciam Mercados

Impactos da Guerra Comercial no Mercado Forex: Oportunidades e Riscos para Traders

Cálculo da taxa de câmbio