Core Financial

Resumo:Core Financial, an international brokerage firm headquartered in the Comoros Union while operates in India and Dubai, offers a diverse range of financial instruments, including Forex, Oil, Gold, Stocks, and CFDs. However, it operates without valid regulatory oversight, raising concerns about its legitimacy and accountability.

| Core Financial Review Summary in 10 Points | |

| Founded | 2023 |

| Registered Country/Region | Comoros Union |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Oil, Gold, Stocks, CFDs |

| Demo Account | Not Available |

| Leverage | Up to 1:400 |

| EUR/USD Spread | From 1.4 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | USD 1000 |

| Customer Support | Phone, email, address, contact us form, Telegram |

What is Core Financial?

Core Financial, an international brokerage firm headquartered in the Comoros Union while operates in India and Dubai, offers a diverse range of financial instruments, including Forex, Oil, Gold, Stocks, and CFDs. However, it operates without valid regulatory oversight, raising concerns about its legitimacy and accountability.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Multiple account types | • Unregulated |

| • MT5 trading platform | • High minimum deposit |

| • Floating leverage | • Not accept clients from certain countries |

Pros:

Multiple account types: Core Financial offers three account options tailored to different trading preferences and levels of experience. This allows traders to select an account type that aligns with their specific needs and trading style, providing flexibility and customization.

MT5 trading platform: Core Financial provides access to the MetaTrader 5 (MT5) platform, renowned for its advanced charting tools, technical indicators, and algorithmic trading capabilities.

Floating leverage: Core Financial offers floating leverage from 1:100 to 1:400, allowing traders to adjust their leverage levels based on market conditions and risk tolerance. This flexibility empowers traders to optimize their trading strategies and manage their risk exposure effectively.

Cons:

Unregulated: Core Financial operates without valid regulatory oversight, which raises concerns about the protection of client funds and overall transparency. The lack of regulation can leave traders vulnerable to potential risks and uncertainties in the market.

High minimum deposit: Core Financial imposes a high minimum deposit requirement from $1000, which can be prohibitive for some traders, especially those with limited initial capital or those seeking to start with smaller account sizes.

Not accept clients from certain countries: Core Financial does not accept clients from specific countries such as Cuba, Iraq, Sudan due to regulatory restrictions. This limitation excludes traders from accessing the broker's services based on their geographical location, limiting market access and opportunities.

Is Core Financial Safe or Scam?

When considering the safety of a brokerage like Core Financial or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Currently, this broker operates without any legitimate regulatory oversight, raising concerns about transparency and accountability.

User feedback: For a deeper insight into the brokerage, traders should read reviews and feedback from existing clients. These valuable inputs from users, available on trustworthy websites and discussion forums, can provide firsthand information about the company's operations.

Security measures: Core Financial implements a robust Anti-Money Laundering (AML) policy, employing stringent security measures to prevent illicit activities.

In the end, choosing whether or not to engage in trading with Core Financial is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

Core Financial provides an extensive range of financial instruments, offering traders access to over 120 markets. These include global Forex pairs, enabling traders to participate in the foreign exchange market, Indices for tracking the performance of global stock markets, Oil and Gold commodities for diversifying portfolios, Stocks for investing in leading companies, and CFDs for trading on various assets without owning them outright.

With such a diverse selection, traders have ample opportunities to explore different markets and implement varied trading strategies based on their preferences and risk tolerance levels.

Account Types

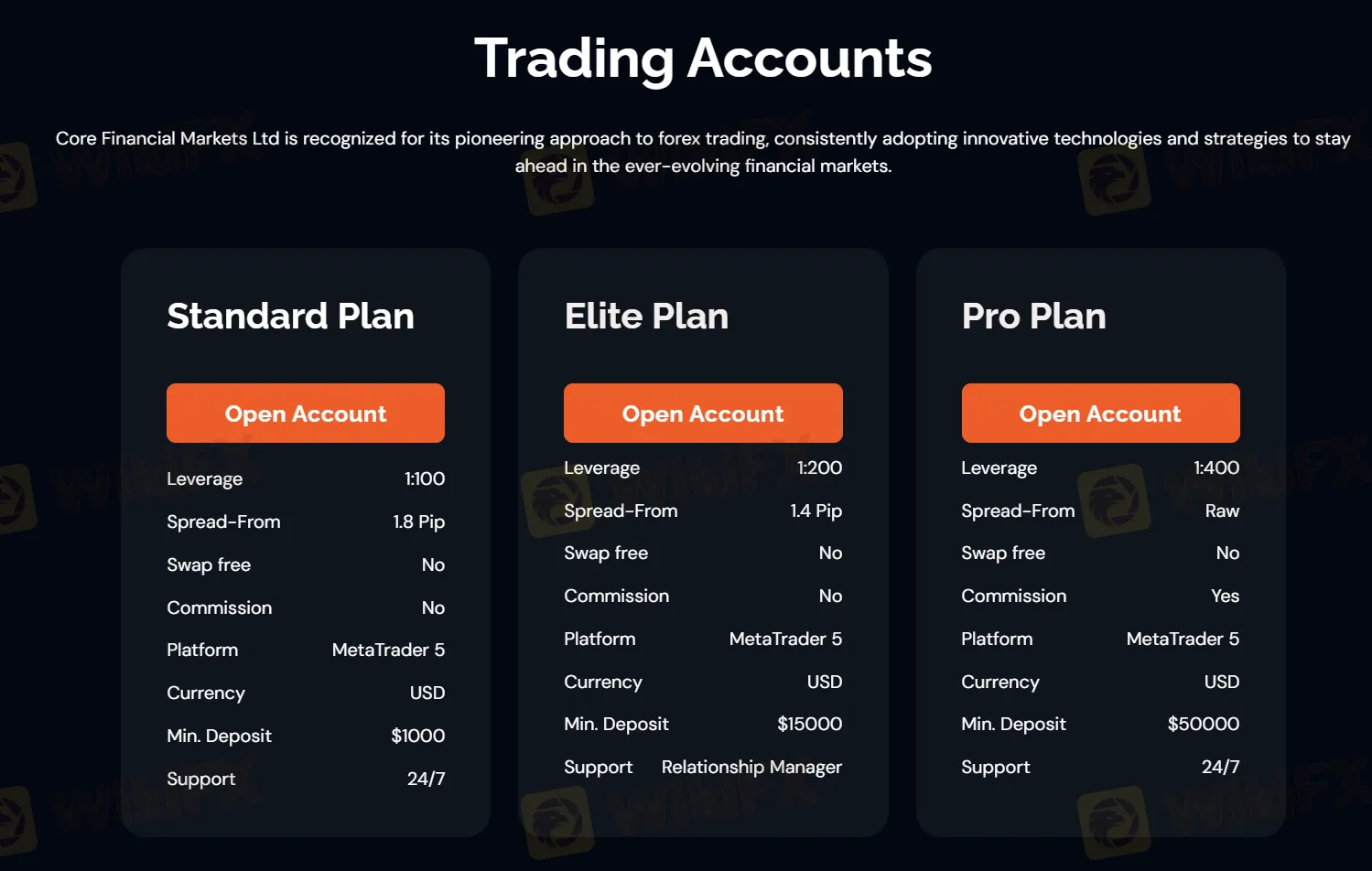

Core Financial meets diverse trading needs with three specialized account types.

The Standard Plan Account, starting with a minimum deposit of $1000, grants access to fundamental trading features.

Traders preferring tighter spreads and personalized assistance can opt for the Elite Plan Account, necessitating a $15000 minimum deposit.

For advanced traders seeking premium features, the Pro Plan Account demands a minimum deposit of $50000.

How to Open an Account?

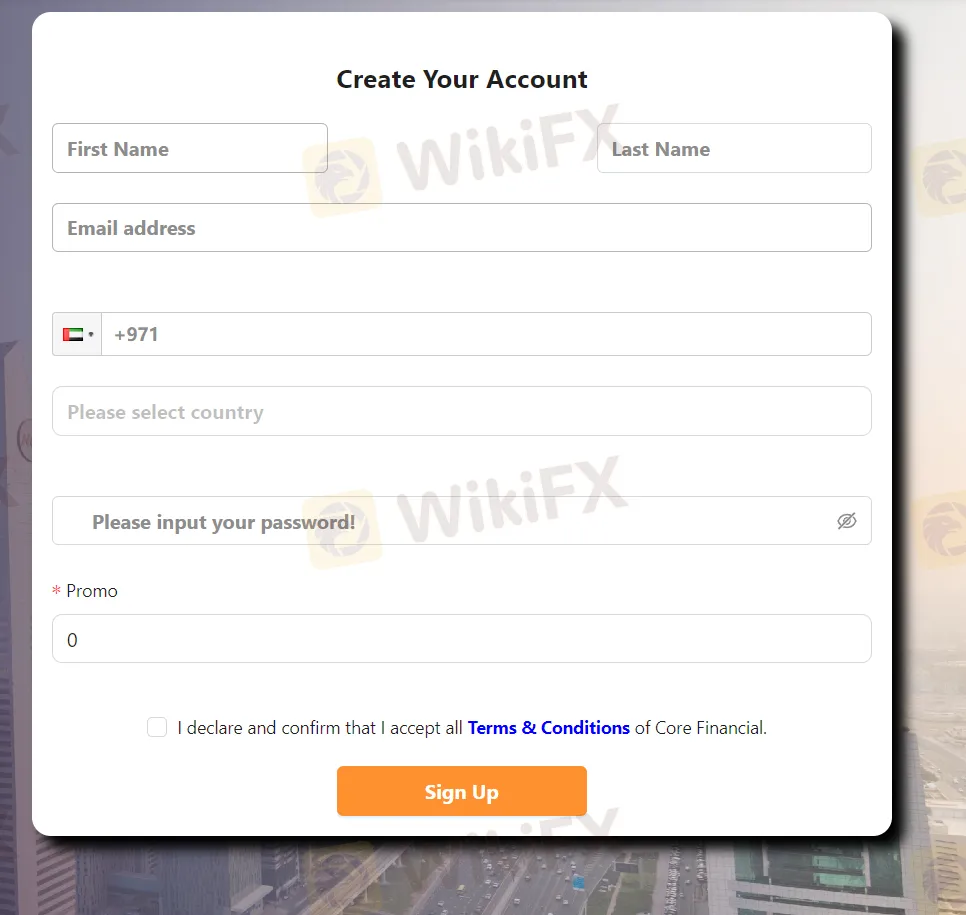

To open an account with Core Financial, you have to follow below steps:

Visit the Core Financial website, locate and click on the 'Open Account'.

Fill in the necessary personal details required.

Complete any verification process for security purposes.

Once your account has been approved, you can set up your investment preferences and start trading.

Leverage

Core Financial offers traders with varying risk appetites and trading strategies by offering different leverage options across its account types.

The Standard Plan Account provides leverage up to 1:100, offering a balanced approach to trading. For those seeking higher leverage, the Elite Plan Account offers up to 1:200, while the Pro Plan Account provides the highest leverage of 1:400.

This range of leverage options allows traders to tailor their positions to their risk tolerance and trading objectives, offering flexibility and control. However, it's essential for traders to use leverage cautiously, as it can magnify both gains and losses in their trading activities.

Spreads & Commissions

Core Financial offers competitive spreads and transparent commission structures across its account types. With spreads starting from 1.4 pips on the Elite Plan Account, 1.8 pips on the Standard Plan Account and raw spreads available on the Pro Plan Account, traders can benefit from cost-effective trading conditions.

Additionally, Core Financial does not charge commissions on trades for its Standard and Elite Plans, while the Pro Plan offers commission-based trading. This ensures traders have clear visibility into their trading costs and can choose the account type that best aligns with their trading strategy and budget.

| Account Type | Leverage | Spread (From) | Swap Free | Commission | Platform |

| Standard Plan | 1:100 | 1.8 pips | No | No | MetaTrader 5 |

| Elite Plan | 1:200 | 1.4 pips | No | No | MetaTrader 5 |

| Pro Plan | 1:400 | Raw | No | Yes | MetaTrader 5 |

Trading Platforms

Core Financial empowers traders with the highly versatile MetaTrader 5 (MT5) platform, accessible across various devices and operating systems. Whether on Windows, iOS, or Android, traders can enjoy seamless access to advanced trading tools, comprehensive charting capabilities, and real-time market data.

The MT5 platform's intuitive interface facilitates efficient order execution and portfolio management, empowering traders to stay connected to the markets and execute trades with ease from anywhere, anytime.

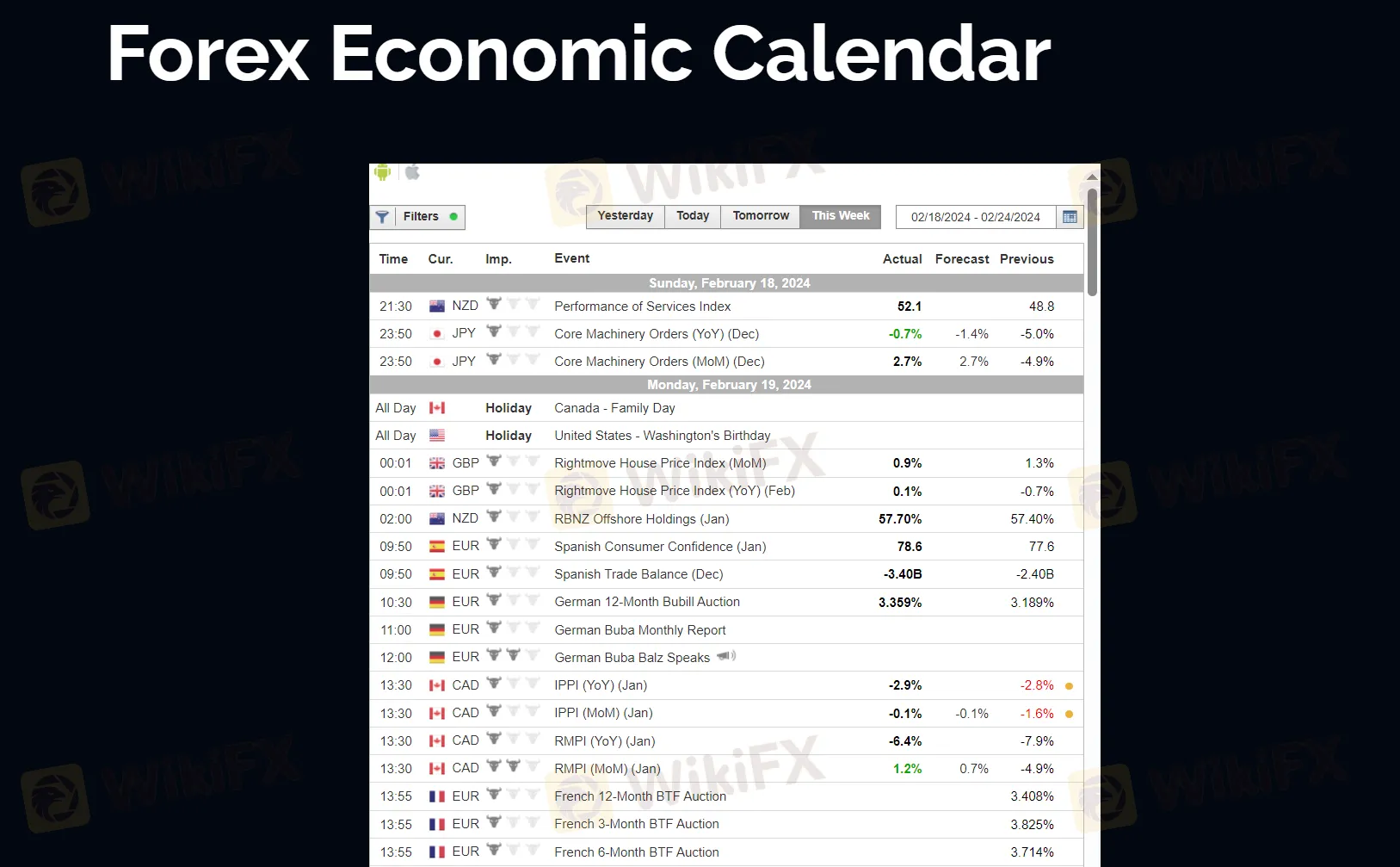

Trading Tools

Core Financial equips traders with a comprehensive suite of trading tools, including an economic calendar, to enhance their trading experience. The economic calendar provides real-time updates on key economic events, such as interest rate decisions, GDP releases, and employment reports, allowing traders to stay informed about potential market-moving events. By leveraging this tool, traders can make well-informed decisions, anticipate market volatility, and adjust their trading strategies accordingly.

Customer Service

Core Financial offers a range of customer service channels for trader support, including phone and email assistance, a physical address for inquiries, a convenient contact us form on their website, and communication via Telegram. This multi-channel approach ensures timely and accessible support for traders' queries and concerns.

Registered address: Bonovo Road - Fomboni, Island of Moheli, Comoros Union.

Physical address: Office 3228, Gruham Plaza, Opposite Kosad Lake Garden, New Kosad Road, Amroli, Surat, Gujarat 394107, India.

Office location: Office No 1707, Opal Tower, Business Bay, Dubai, UAE.

Phone: 00912614402594.

Email: support@thecoremarkets.com.

Conclusion

In summary, Core Financial is an online brokerage firm registered in the Comoros Union with branch offices in India and Dubai, offering a wide range of trading instruments, including Forex, Indices, Oil, Gold, Stocks, and CFDs. However, it's crucial to note that Core Financial currently operates without valid regulations, raising concerns about its accountability and commitment to client safety.

Therefore, you should be cautious when deciding to trade with this broker and consider alternative brokers with established regulatory oversight to mitigate potential risks.

Frequently Asked Questions (FAQs)

| Q 1: | Is Core Financial regulated? |

| A 1: | No, its been confirmed that the broker is currently under no valid regulation. |

| Q 2: | Is Core Financial a good broker for beginners? |

| A 2: | No, it is not a good broker because its not regulated by any authorities. |

| Q 3: | Does Core Financial offer the industry leading MT4 & MT5? |

| A 3: | Yes, it offers MT5 on Windows, iOS and Android. |

| Q 4: | Does Core Financial offer demo accounts? |

| A 4: | No. |

| Q 5: | What is the minimum deposit for Core Financial? |

| A 5: | The minimum initial deposit to open an account is $1000. |

| Q 6: | At Core Financial, are there any regional restrictions for traders? |

| A 6: | Yes, it does not offer services citizens/residents of the United States, Cuba, Iraq, Myanmar, North Korea, Sudan. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Corretora WikiFX

Últimas notícias

Você Conhece os Principais Tipos de Negociação no Mercado Forex?

Dólar em Queda: Como a Desvalorização Afeta o Mercado Forex Brasileiro

Trading de Ranges no Mercado Forex: Estratégias e Gestão de Risco para Traders Brasileiros

IFA: Cliente Não Consegue Sacar 10 Mil USD da sua Conta

Bitcoin Dispara com Apoio da Casa Branca: Oportunidades para Traders Brasileiros

Super Trades no Japão: O Que Traders de Forex Brasileiros Precisam Saber?

GBP/USD: Perspectivas para Traders Brasileiros Diante da Volatilidade do Dólar

Cálculo da taxa de câmbio