GRD

Resumo:GRD is a stock brokerage firm registered in India. It offers many services, including equities, derivatives, commodities, mutual funds, etc. Customers can trade on the mobile APP or web page. Although GRD provides a variety of products and services, it is not regulated by any financial authorities.

| GRD Review Summary | |

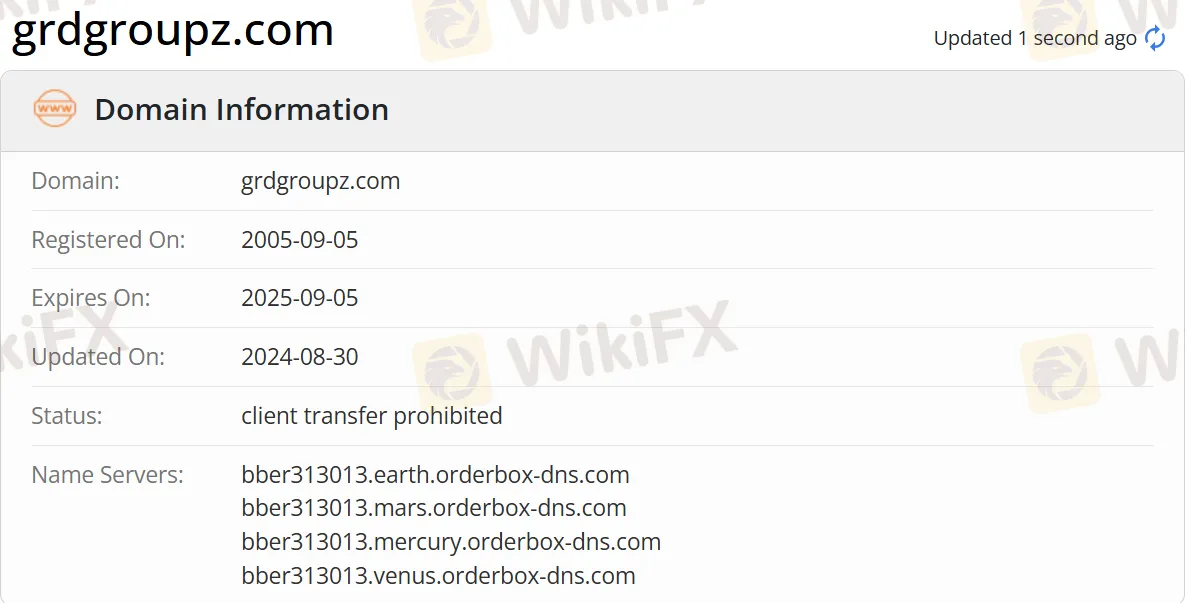

| Founded | 2005 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Products & Services | Equities, Derivatives, Commodities, Currencies, Mutual Funds, Depository, FPI, IPOs |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Mobile APP, WebTrader |

| Minimum Deposit | / |

| Customer Support | Working hours: Monday - Saturday: 09:00 am – 7:00 pm |

| Tel: +(033) 4084 4444 | |

| Fax: +91 33 4084 4499 | |

| Email: customercare@grdgroupz.com | |

| Address: KOLKATA238A, A. J. C. Bose, 6th floor, Kolkata – 700020 | |

GRD is a stock brokerage firm registered in India. It offers many services, including equities, derivatives, commodities, mutual funds, etc. Customers can trade on the mobile APP or web page. Although GRD provides a variety of products and services, it is not regulated by any financial authorities.

Pros and Cons

| Pros | Cons |

| Multiple services | No regulation |

| Long operational history in India | Lack of transparency |

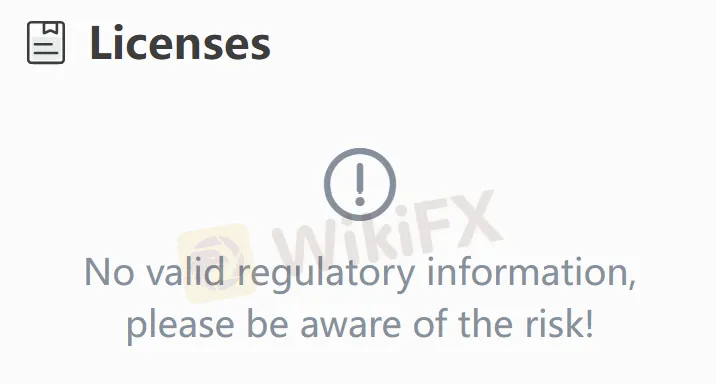

Is GRD Legit?

No, GRD is not regulated. It is recommended to choose brokers that are regulated well by famous authorities such as FCA, ASCI, and so on.

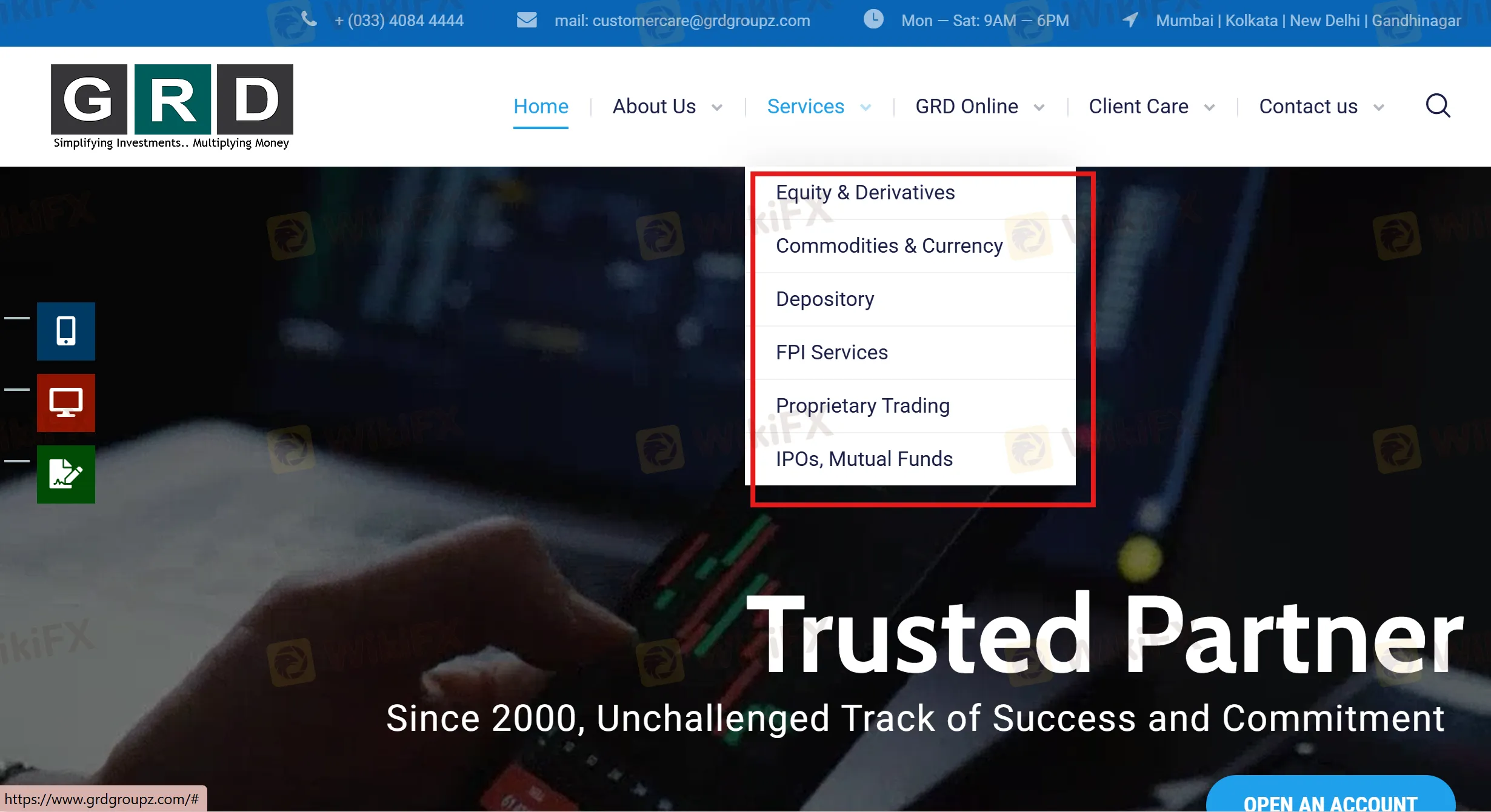

Products & Services

| Products & Services | Supported |

| Equities | ✔ |

| Derivatives | ✔ |

| Commodities | ✔ |

| Mutual Funds | ✔ |

| Currencies | ✔ |

| Depository Services | ✔ |

| FPI Services | ✔ |

| IPO Services | ✔ |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Mobile APP | ✔ | Mobile | / |

| WebTrader | ✔ | PC, web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Corretora WikiFX

Últimas notícias

Ouro Rompe Recordes (02/09): Metal Precioso Ultrapassa US$ 3.500

Do Escambo ao Trading Digital: Uma Breve História do Forex

Anúncio: Loja de Pontos Agora Online!

Libertex: Caso de Fraude Envolvendo Investidor Argentino Expõe Riscos Ocultos no Forex

IQ Option: Investidor Venezuelano Denuncia Bloqueio de Fundos e Perdas Elevadas

Dólar Hoje: Cotação em Alta e Expectativas com o Payroll dos EUA

Supertrend: O Indicador que Pode Transformar sua Negociação no Forex

Trive é Confiável? Avaliação Completa da Corretora para Traders de Forex

Xpoken: Investidor Brasileiro Denuncia Perda Total de Fundos

Moedas Asiáticas Sob Pressão (04/09): Análise do Iene, Yuan, Rupia e Dólar Australiano

Cálculo da taxa de câmbio