Bostonmex- Some Detailed Information about This Broker

Абстракт:Bostonmex is said to be operated by Bostonmex LLC, a company allegedly registered in Saint Vincent and the Grenadines (SVG).

| Aspect | Information |

| Company Name | Bostonmex |

| Registered Country/Area | Saint Lucia |

| Years | 2-5 years |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Commodities, CFD, Stocks, and Cryptocurrency |

| Account Types | Standard, Fixed, Premium, ECN, and Crypto |

| Maximum Leverage | 1:1000 |

| Spreads | 0 |

| Trading Platforms | Metatrader 5 |

| Customer Support | Phone: +90 212 271 00 60, Email: support@bostonmex.com, and Messenger |

| Deposit & Withdrawal | VISA, Mastercard, Bitcoin, Bank Transfer, PayPal, Skrill, and Neteller |

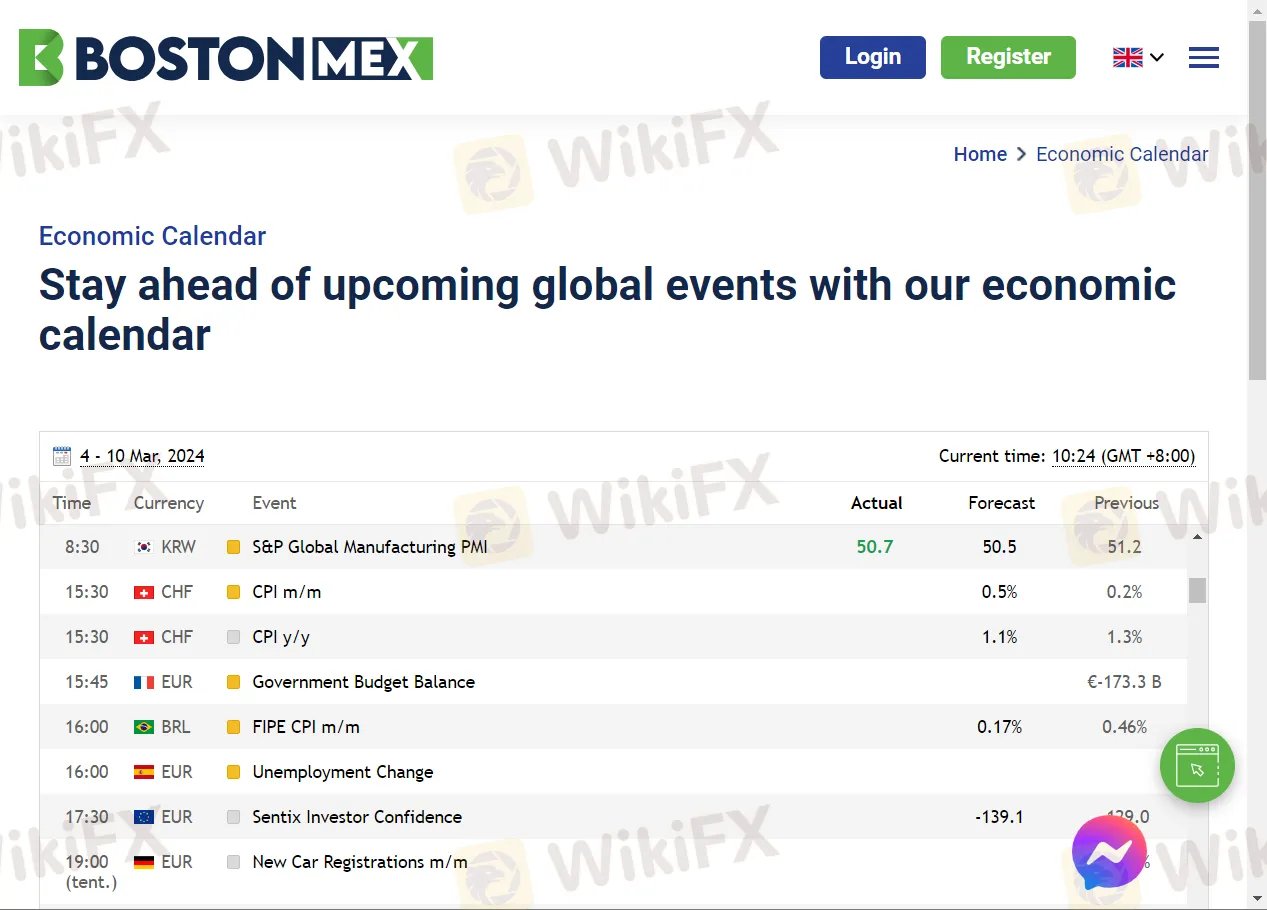

| Educational Resources | Economic Calendar |

Overview of Bostonmex

Bostonmex is a trading platform registered in Saint Lucia and has been operating for 2-5 years. It operates without regulation, offering trading services in various financial instruments, including Forex, Indices, Commodities, CFDs, Stocks, and Cryptocurrency. The platform provides multiple account types, namely Standard, Fixed, Premium, ECN, and Crypto.

With a maximum leverage of 1:1000 and spreads starting from 0, Bostonmex offers competitive trading conditions. The platform utilizes the Metatrader 5 trading platform, known for its advanced features and user-friendly interface.

Customer support is available via phone, email, and messenger, assisting users whenever needed. Deposits and withdrawals can be made using various methods, including VISA, Mastercard, Bitcoin, Bank Transfer, PayPal, Skrill, and Neteller, offering convenience and flexibility to traders.

Bostonmex also offers educational resources such as an Economic Calendar, enabling traders to stay informed about key economic events and their potential impact on the financial markets.

Regulatory Status

Bostonmex operates as an unregulated trading platform. Unregulated exchanges may lack proper security measures and risk management practices, making them more susceptible to fraudulent activities such as theft, market manipulation, and scams. Without regulatory oversight, investors are exposed to a higher risk of falling victim to fraudulent schemes.

Pros and Cons

| Pros | Cons |

| Multiple account types | Lack of regulation |

| Competitive maximum leverage | Limited educational resources |

| Zero spreads | Uncertain operational history |

| Variety of deposit/withdrawal methods | Potential security risks |

| Various Customer Support | / |

Pros:

Multiple Account Types: Bostonmex offers a variety of account types for different trading preferences and experience levels. This flexibility allows traders to choose an account type that aligns with their specific needs and risk tolerance.

Competitive Maximum Leverage: With a maximum leverage of 1:1000, Bostonmex provides traders with the opportunity to amplify their trading positions, potentially increasing their profit potential. Higher leverage can be advantageous for experienced traders seeking to maximize their trading strategies.

Zero Spreads: Bostonmex offers zero spreads on certain account types, providing traders with the opportunity to execute trades without incurring spread costs. This can lead to cost savings for active traders, particularly for high-frequency trading strategies.

Variety of Deposit/Withdrawal Methods: The platform supports a wide range of deposit and withdrawal methods, including VISA, Mastercard, Bitcoin, bank transfer, PayPal, Skrill, and Neteller. This variety offers convenience and flexibility for traders to fund their accounts and withdraw their profits using their preferred payment methods.

Various Customer Support: Bostonmex provides customer support through phone, email, and messenger. While these channels offer direct communication with support representatives, the availability and responsiveness of customer support may vary, leading to potential delays in resolving issues or inquiries.

Cons:

Lack of Regulation: As an unregulated exchange, Bostonmex operates without oversight from regulatory authorities. Investor protection, transparency, and compliance with industry standards will be concerning, potentially exposing traders to higher risks.

Limited Educational Resources: Bostonmex offers only an economic calendar as an educational resource. While an economic calendar can provide valuable information about upcoming market events, it may not be sufficient for traders seeking comprehensive educational materials to enhance their trading skills and knowledge.

Uncertain Operational History: With a relatively short operational history of 2-5 years, Bostonmex may lack an established track record and reputation compared to more established exchanges. Traders should conduct thorough due diligence and consider the platform's operational history when evaluating its reliability and credibility.

Potential Security Risks: As with any online trading platform, Bostonmex may be susceptible to security risks such as hacking, fraud, and data breaches. Traders should implement robust security measures, such as using strong passwords, enabling two-factor authentication, and exercising caution when disclosing personal information or engaging in transactions on the platform.

Market Instruments

Bostonmex offers a range of market instruments for the trading preferences of its users.

Forex: Bostonmex provides access to the foreign exchange market, allowing traders to speculate on the price movements of currency pairs. Traders can trade major, minor, and exotic currency pairs, taking advantage of leverage to amplify potential profits.

Indices: Traders can access a variety of global stock market indices through Bostonmex. These indices represent the performance of a basket of stocks from a specific region or sector, providing traders with exposure to broader market trends.

Commodities: Bostonmex offers trading opportunities in commodities such as gold, silver, oil, and agricultural products. Traders can speculate on the price movements of these physical assets, diversifying their portfolios and hedging against inflation and geopolitical risks.

CFDs (Contracts for Difference): Bostonmex allows traders to trade Contracts for Difference (CFDs) on various underlying assets, including stocks, commodities, and indices. CFDs enable traders to profit from price movements without owning the underlying asset, offering flexibility and leverage.

Stocks: Bostonmex provides access to a wide range of stocks from global exchanges, allowing traders to invest in individual companies' equity securities. Traders can capitalize on price fluctuations in the stock market, potentially generating profits through buying and selling shares.

Cryptocurrency: Bostonmex offers trading opportunities in popular cryptocurrencies such as Bitcoin, Ethereum, Ripple, and others. Traders can speculate on the price movements of digital currencies, taking advantage of volatility and market trends in the cryptocurrency market.

Account Types

Bostonmex offers a variety of account types tailored to meet the needs of its traders.

The Standard account features spreads starting from 1.1 pips, with a maximum leverage of 1:1000 and zero commission. Additionally, traders can benefit from bonuses and swap-free options with this account type.

The Fixed account offers spreads from 1.3 pips, along with the same maximum leverage and commission structure as the Standard account. Traders can also take advantage of bonuses and swap-free options with the Fixed account.

The Premium account boasts tighter spreads, starting from 0.5 pips, while maintaining the same leverage and commission terms. Like the other account types, traders using the Premium account can benefit from bonuses and swap-free options.

The ECN account provides traders with the opportunity to trade with zero spreads, making it ideal for those seeking low-cost trading options. While the maximum leverage remains the same at 1:1000, commissions may vary from $0 to $10 per trade. Traders using the ECN account can also enjoy bonuses and swap-free trading.

Finally, the Crypto account offers raw spreads, allowing traders to access the cryptocurrency market with maximum flexibility. With a maximum leverage of 1:1000 and zero commission, traders can benefit from bonuses and swap-free trading when using the Crypto account.

| Account Type | Spread From | Max Leverage | Commission | Bonus | Swap Free |

| Standard | 1.1 pips | 1:1000 | $0 | Yes | Yes |

| Fixed | 1.3 pips | 1:1000 | $0 | Yes | Yes |

| Premium | 0.5 pips | 1:1000 | $0 | Yes | Yes |

| ECN | 0.0 pips | 1:1000 | $0-$10 | Yes | Yes |

| Crypto | Raw | 1:1000 | $0 | Yes | Yes |

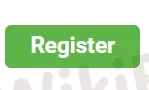

How to Open an Account?

Opening an account with Bostonmex is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the Bostonmex website and click “Register.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: Bostonmex offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the Bostonmex trading platform and start making trades.

Leverage

1:1000, as offered by Bostonmex, poses several risks for traders.

Firstly, such high leverage magnifies both potential profits and losses, significantly increasing the volatility of trading activities. While it can amplify gains in favourable market conditions, it also heightens the risk of substantial losses, especially during periods of market volatility or unexpected price movements.

Additionally, traders may be more susceptible to margin calls and liquidation events, particularly if proper risk management strategies are not employed.

Trading Platform

Metatrader 5 (MT5) serves as one of the primary trading platforms offered by Bostonmex, providing traders with a comprehensive and user-friendly interface to execute their trading strategies effectively.

With Metatrader 5, traders gain access to a wide range of features designed to enhance their trading experience. These features include advanced charting tools, technical indicators, and analytical resources that enable traders to conduct in-depth market analysis and make informed trading decisions.

Additionally, Metatrader 5 supports automated trading through Expert Advisors (EAs) and allows traders to develop and backtest their own trading algorithms. The platform also offers a customizable interface, allowing traders to tailor their workspace to suit their preferences and trading style.

Furthermore, Metatrader 5 is available across various devices, including desktop computers, web browsers, and mobile devices, ensuring traders can access the platform conveniently from anywhere with an internet connection.

Deposit & Withdrawal

Bostonmex offers a range of deposit and withdrawal methods for the varied preferences of its users.

VISA and Mastercard: Traders can fund their Bostonmex accounts conveniently using debit or credit cards issued by VISA or Mastercard. This method offers instant deposits, allowing traders to quickly access the funds in their trading accounts.

Bitcoin: Bostonmex supports deposits and withdrawals in Bitcoin, one of the most widely used cryptocurrencies. Traders can utilize Bitcoin for fast and secure transactions, benefiting from the decentralized nature of cryptocurrency payments.

Bank Transfer: Bank transfer provides a traditional yet reliable method for depositing and withdrawing funds on Bostonmex. Traders can initiate bank transfers directly from their bank accounts, facilitating large transactions with ease.

PayPal: As a popular online payment system, PayPal offers a convenient and secure way for traders to deposit and withdraw funds on Bostonmex. With PayPal, traders can transfer funds quickly and efficiently, leveraging the platform's robust security features.

Skrill: Skrill, a digital wallet service, enables traders to deposit and withdraw funds on Bostonmex with ease. Traders can link their Skrill accounts to their Bostonmex trading accounts, facilitating transactions and enhanced flexibility.

Neteller: Similar to Skrill, Neteller provides traders with a convenient e-wallet solution for depositing and withdrawing funds on Bostonmex. Traders can transfer funds securely using Neteller, benefiting from its user-friendly interface and advanced security measures.

Customer Support

Bostonmex prioritizes customer satisfaction by providing a comprehensive customer support system to address traders' inquiries and concerns promptly.

Phone Support: Traders can reach Bostonmex's customer support team directly by phone at +90 212 271 00 60. This allows for real-time communication with support representatives, enabling traders to receive immediate assistance with any trading-related issues or questions they may have.

Email Support: Bostonmex offers email support at support@bostonmex.com, providing traders with an alternative channel to reach out to the customer support team. Traders can send detailed queries or requests via email and expect a timely response from the support team, typically within a few hours or less.

Messenger Support: In addition to phone and email support, Bostonmex offers messenger support as another convenient communication option. Traders can utilize messaging platforms such as WhatsApp or Telegram to contact the customer support team, allowing for quick and convenient communication on the go.

Educational Resources

The Economic Calendar, offered as part of Bostonmex's educational resources, serves as a valuable tool for traders looking to stay informed about key economic events and their potential impact on the financial markets.

The Economic Calendar tracks a wide array of economic events, including indicators, announcements, and reports from various countries and regions worldwide. This allows traders to monitor upcoming events that could influence market volatility and asset prices.

Conclusion

In summary, Bostonmex offers a variety of account types and competitive leverage options, making it appealing for traders. The platform also provides zero spreads and deposit/withdrawal methods, enhancing accessibility.

However, concerns arise for the lack of regulation, limited educational resources, uncertain operational history, and potential security risks.

FAQs

Q: What are the different types of accounts offered by Bostonmex?

A: Bostonmex offers multiple account types, including Standard, Fixed, Premium, ECN, and Crypto accounts, each with varying features and trading conditions.

Q: Can I access the Metatrader 5 trading platform on Bostonmex?

A: Yes, Bostonmex provides access to the Metatrader 5 (MT5) platform, which offers advanced charting tools, technical indicators, and automated trading capabilities.

Q: Does Bostonmex offer educational resources for traders?

A: Yes, Bostonmex provides educational resources such as an Economic Calendar, which helps traders stay informed about important economic events and their potential impact on the markets.

Q: Are there any fees associated with trading on Bostonmex?

A: Bostonmex may charge fees such as spreads or commissions on trades, depending on the account type and trading conditions. Traders should review the fee schedule provided by Bostonmex for more information.

Q: How can I open an account with Bostonmex?

A: To open an account with Bostonmex, you can visit their website and follow the account opening process, which typically involves providing personal information and agreeing to the terms and conditions of the platform.

WikiFX брокеры

Подсчет курса