Phillip Futures-Overview of Minimum Deposit, Spreads & Leverage

Абстракт:Phillip Futures, regulated in Indonesia by ICDX and BAPPEBTI, is an online trading platform that provides access to Gold & Forex, US Stocks, Stock Indices, and Commodities via platforms like Nova 2.0, MetaTrader 5, and JAFeTS NOW. With a demo account option, they provide both individual and corporate accounts with a high minimum deposit of $500.

| Phillip Futures Review Summary | |

| Founded | 1975 |

| Registered Country/Region | Indonesia |

| Regulation | ICDX, BAPPEBTI |

| Market Instruments | Gold & Forex, US Stocks, Stock Indices, and Commodities |

| Demo Account | ✅ |

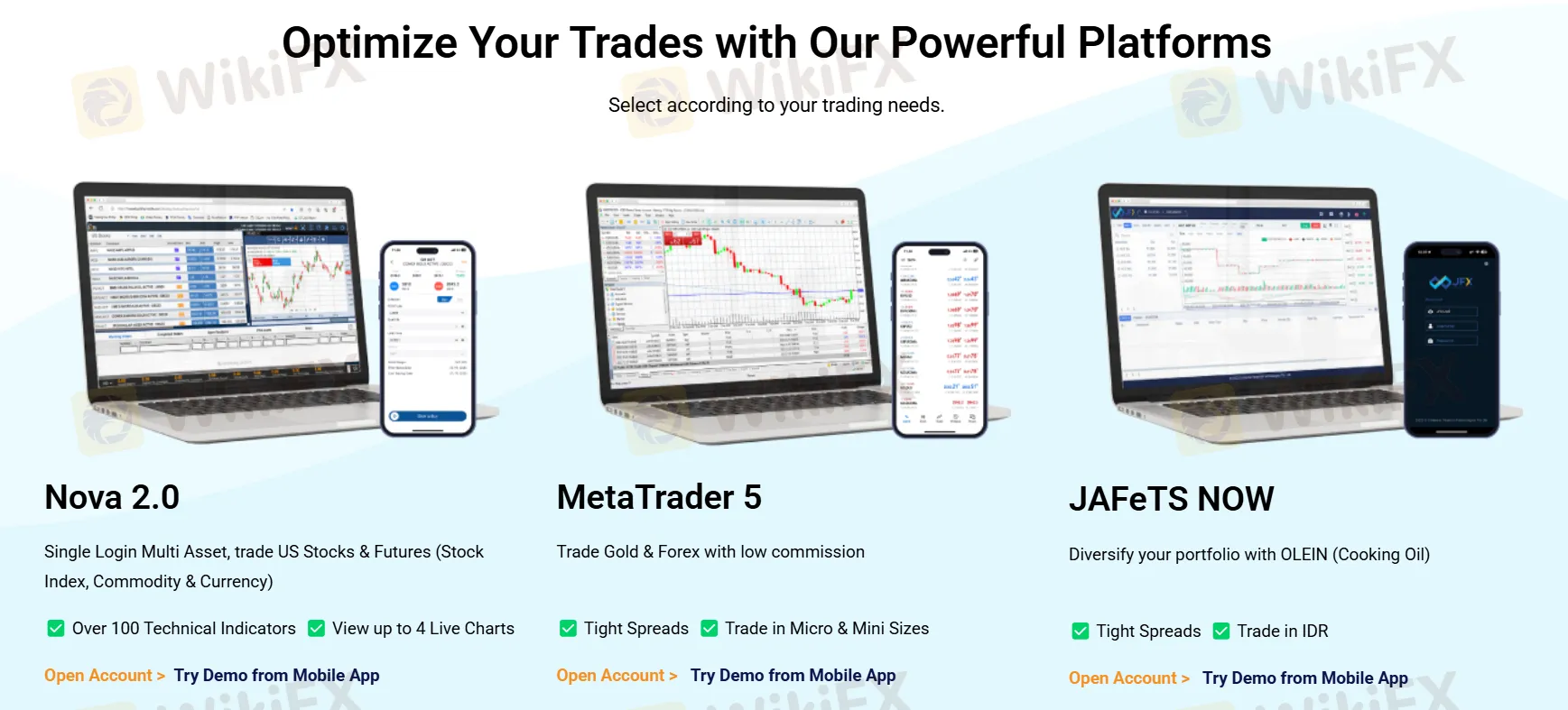

| Trading Platform | Nova 2.0, MetaTrader 5, and JAFeTS NOW |

| Minimum Deposit | USD 500 or equivalent |

| Customer Support | Tel: (021) 5790 6525 |

| Email: futures@phillip.co.id | |

Phillip Futures Information

Phillip Futures, regulated in Indonesia by ICDX and BAPPEBTI, is an online trading platform that provides access to Gold & Forex, US Stocks, Stock Indices, and Commodities via platforms like Nova 2.0, MetaTrader 5, and JAFeTS NOW. With demo accountS option, they provide both individual and corporate accounts with a high minimum deposit of $500.

Pros and Cons

| Pros | Cons |

|

|

|

|

| |

| |

| |

|

Is Phillip Futures Legit?

Phillip Futures has a Retail Forex License regulated by the Indonesia Commodity and Derivatives Exchange (ICDX) in Indonesia.

It also has another Retail Forex License regulated by BAPPEBTI in Indonesia with a license number of 69/BAPPEBTI/SI/9/2010.

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Indonesia Commodity and Derivatives Exchange (ICDX) | Regulated | Indonesia | Retail Forex License | Unreleased |

| Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI) | Regulated | Indonesia | Retail Forex License | 69/BAPPEBTI/SI/9/2010 |

What Can I Trade on Phillip Futures?

Phillip Futures offers trading in Gold & Forex, US Stocks (Apple, Tesla, Nike), Stock Indices (Micro E-mini US, FTSE Indonesia, FTSE China A50), and Commodities (Micro WTI Crude Oil, E-micro Gold, Soft).

| Tradable Instruments | Supported |

| Gold | ✔ |

| Forex | ✔ |

| US Stocks | ✔ |

| Stock Indices | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

Phillip Futures offers two main account types: individual and corporate. A demo account option is also available.

| Account Type | Minimum Deposit | Documents Required |

| Individual | USD 500 or equivalent | ID Card (KTP) / Passport, Recent Photograph, NPWP (Tax ID), Last 3 months bank/credit card/utility/phone bill/saving book (relevant part)/employment letter/income statement |

| Corporate | USD 25,000 or equivalent | Latest Audited Financial Statements, Certificate of Incorporation/Registration, Memorandum and Articles of Association, Board Resolution or Power of Attorney, List of Authorized Signatories and List of Authorized Traders, Photocopies of ID/Passport of All Directors, Authorized Signatories & Shareholders |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Nova 2.0 | ✔ | PC, IOS and Android | / |

| MetaTrader 5 | ✔ | PC, IOS and Android | Experienced traders |

| JAFeTS NOW | ✔ | PC, IOS and Android | / |

| MetaTrader 4 | ❌ | / | Beginners |

WikiFX брокеры

Подсчет курса