PHOENIX BROKAGE -Some important Details about This Broker

Абстракт:PHOENIX BROKAGE is an online forex broker registered in the United Kingdom, with the company behind it not disclosed to all. Since PHOENIX BROKAGEs website cannot be open for now, we could only catch minimal information about this brokerage house.

| Aspect | Information |

| Company Name | PHOENIX BROKAGE |

| Registered Country/Area | United Kingdom |

| Founded Year | 2-5 years ago |

| Regulation | Unregulated |

| Market Instruments | Currencies, Commodities, Indices, Stocks |

| Account Types | Basic, Standard, Premium |

| Minimum Deposit | $500 |

| Maximum Leverage | N/A |

| Spreads | N/A |

| Trading Platforms | Not provided |

| Customer Support | 1234 0293 2322, support@phoenixbrokage.com |

| Deposit & Withdrawal | Bank transfers, debit cards, and credit cards |

Overview of PHOENIX BROKAGE

PHOENIX BROKAGE, based in the United Kingdom, offers a wide range of trading assets, including currencies, commodities, indices, and stocks.

Founded approximately 2-5 years ago, it operates without regulatory oversight. The brokerage provides a user-friendly trading platform but lacks proprietary trading software.

While offering responsive customer support, it imposes high minimum deposits for premium plans. Additionally, the absence of comprehensive educational resources and research tools impact investor experience.

Regulatory Status

PHOENIX BROKAGE is not regulated by any financial authority.

This lack of regulation means there is no oversight to ensure fair practices, protect client funds, or enforce ethical behavior. Clients risk losing their investments with no legal recourse or protection against fraud and malpractice.

Pros and Cons

| Pros | Cons |

| Wide range of trading assets including currencies, commodities, indices, and stocks | High minimum deposit for Premium Plan starting from $5,000 |

| Multiple payment methods available | Limited educational resources |

| Responsive customer support | No trading software provided |

| No research tools | |

| Unregulated |

Pros:

Wide Range of Trading Assets: PHOENIX BROKAGE offers a various selection of trading assets, including currencies, commodities, indices, and stocks.

Multiple Payment Methods Available: Investors can fund their accounts using various payment methods, including bank transfers, debit cards, and credit cards. This flexibility accommodates different investor preferences and geographic locations.

Responsive Customer Support: PHOENIX BROKAGE provides responsive customer support to address investor inquiries promptly. Support channels include email and telephone, allowing investors to choose the most convenient communication method.

Cons:

High Minimum Deposit for Premium Plan: The Premium Plan of PHOENIX BROKAGE requires a high minimum deposit, ranging from $5,000 to $99,999.This elevated deposit requirement deters investors with limited capital or those seeking lower entry barriers.

Limited Educational Resources: PHOENIX BROKAGE offers limited educational resources to support investor knowledge and skill development.

No Trading Software Provided: PHOENIX BROKAGE does not offer proprietary trading software to facilitate trading activities. The absence of dedicated trading software inconveniences investors who prefer advanced trading tools and features.

No Research Tools: PHOENIX BROKAGE lacks comprehensive research tools to assist investors in making informed trading decisions.

Unregulated: PHOENIX BROKAGE operates without regulatory oversight from financial authorities. The absence of regulatory supervision raises risks regarding investor protection, and accountability.

Market Instruments

PHOENIX BROKAGE offers a wide range of trading assets, including:

Currencies: Trade in major and minor forex pairs.

Commodities: Access popular commodities like gold, silver, and oil for portfolio diversification.

Indices: Invest in global indices representing major stock markets for broad market exposure.

Stocks: Trade shares of leading companies across various industries, providing opportunities for growth and income.

Account Types

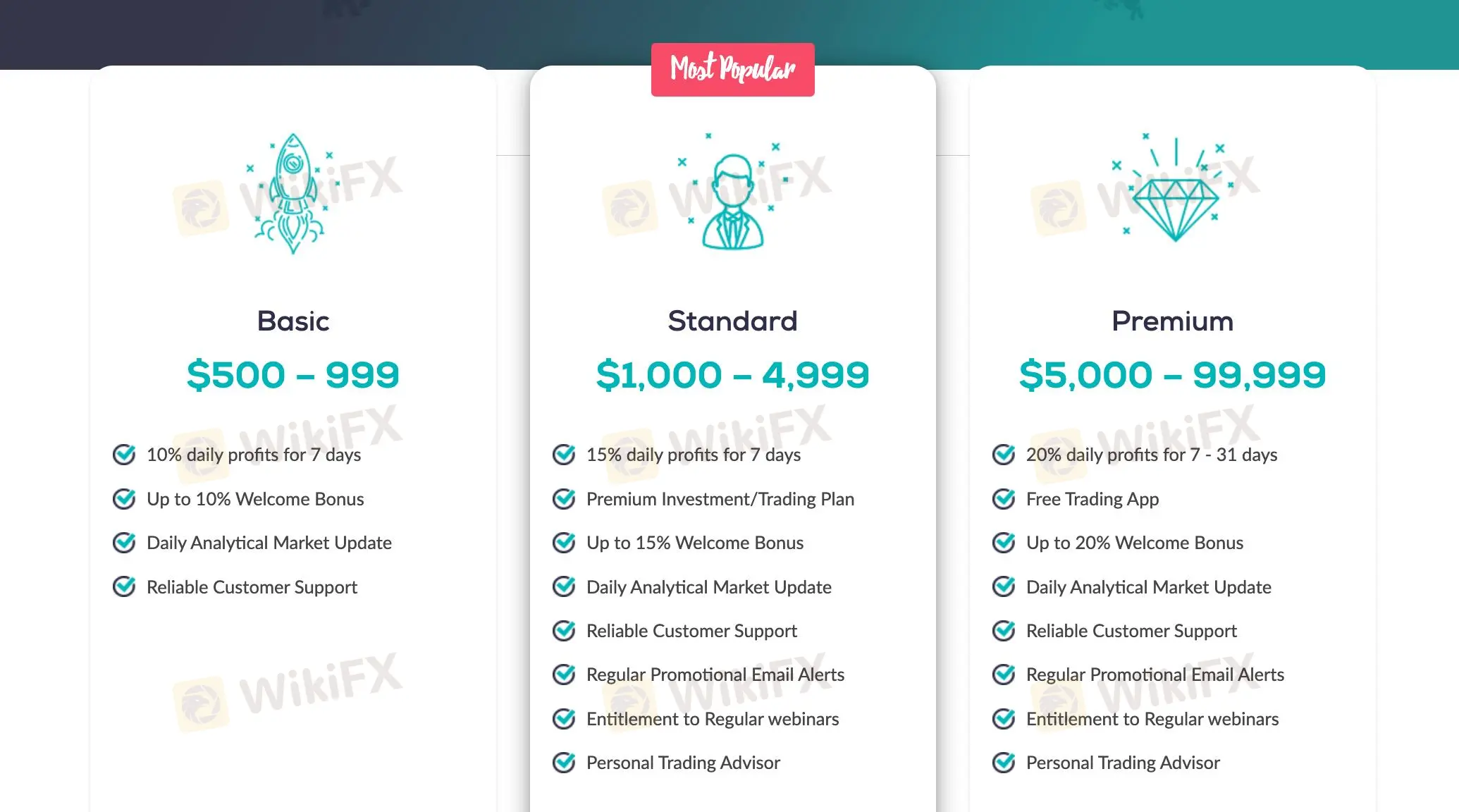

PHOENIX BROKAGE offers three distinct account types: Basic Plan, Standard Plan, and Premium Plan, each tailored to different investment levels and preferences.

The Basic Plan is designed for investors who are starting their journey in trading and have a moderate amount of capital to invest. With a minimum deposit of $500, it offers a daily profit of 10% for 7 days. This plan includes features such as up to 10% welcome bonus, daily analytical market updates, reliable customer support, and regular promotional email alerts. This plan is suitable for beginners who want to gain exposure to the trading world with lower initial investment and seek regular updates and support to help navigate their trading experience.

For those with a higher investment capacity, the Standard Plan is appropriate. With a minimum deposit of $1,000, it provides a daily profit of 15% for 7 days. The Standard Plan includes a premium investment/trading plan, up to 15% welcome bonus, daily analytical market updates, reliable customer support, regular promotional email alerts, and access to regular webinars. This plan is ideal for intermediate traders who have some experience in the market and are looking for enhanced features, including educational webinars, to refine their trading strategies and knowledge.

The Premium Plan is suited for experienced traders with significant capital, requiring a minimum deposit of $5,000. This plan offers the highest daily profit at 20% for 7 to 31 days and includes premium features such as a free trading app, up to 20% welcome bonus, daily analytical market updates, reliable customer support, regular promotional email alerts, access to regular webinars, and a personal trading advisor. The Premium Plan is best for seasoned investors who require advanced tools, personalized advice, and extensive market analysis to manage their substantial investments effectively.

| Feature | Basic Plan | Standard Plan | Premium Plan |

| Minimum Deposit | $500 - $999 | $1,000 - $4,999 | $5,000 - $99,999 |

| Daily Profits | 10% | 15% | 20% |

| Duration | 7 days | 7 days | 7-31 days |

| Welcome Bonus | Up to 10% | Up to 15% | Up to 20% |

| Analytical Market Update | Daily | Daily | Daily |

| Customer Support | Reliable | Reliable | Reliable |

| Promotional Email Alerts | Regular | Regular | Regular |

| Investment/Trading Plan | - | Premium | - |

| Webinars | - | Enment to Regular | Enment to Regular |

| Trading App | - | - | Free |

| Personal Trading Advisor | - | - | Yes |

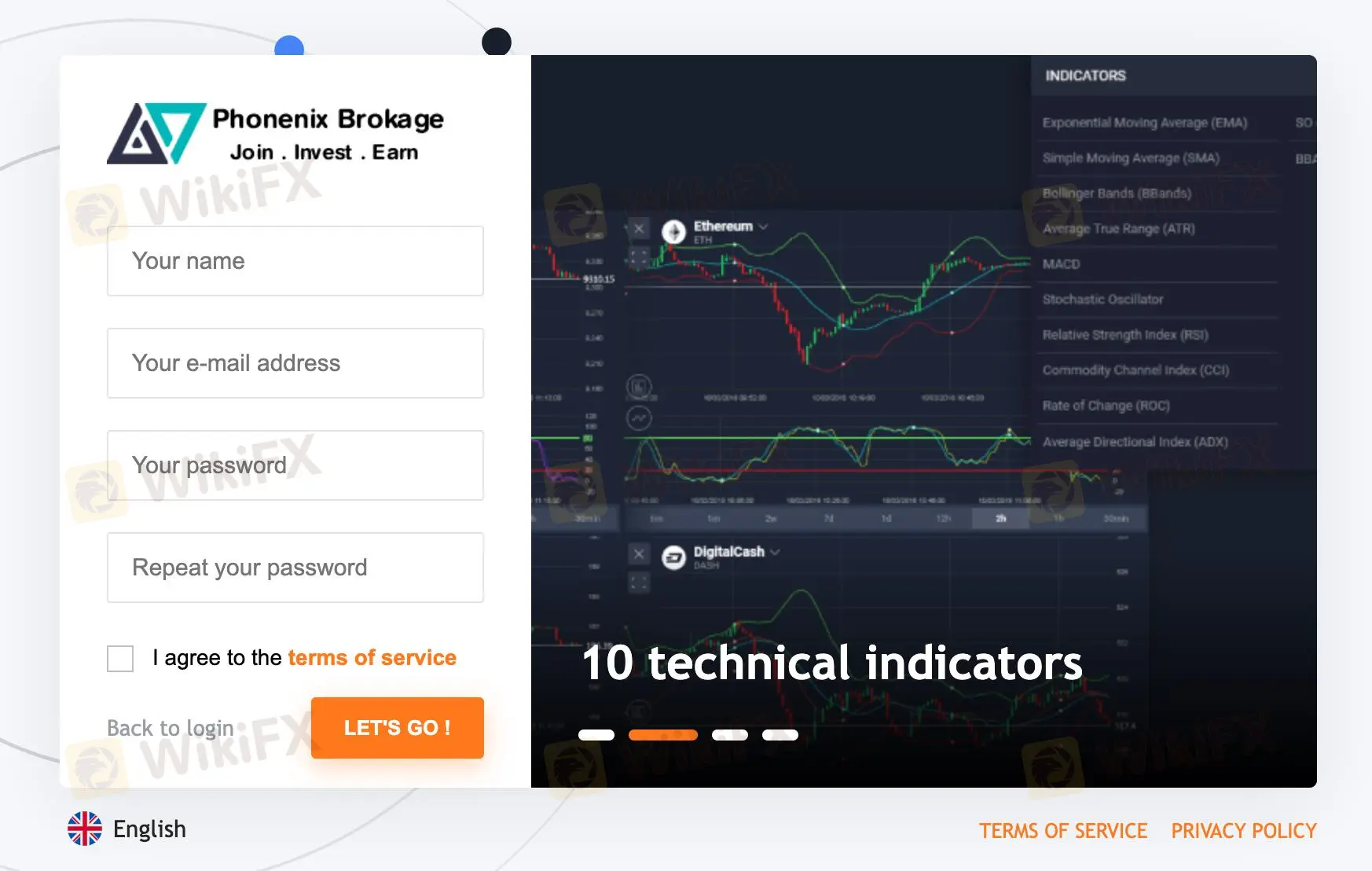

How to Open an Account?

To open an account with PHOENIX BROKAGE, follow these six steps:

Visit the Website: Go to the official PHOENIX BROKAGE website.

Click on 'Sign Up': Locate and click the 'Sign Up' button on the homepage.

Fill Out the Registration Form: Complete the registration form with your personal details, including your name, email address, phone number, and password.

Verify Your Email: Check your email for a verification link from PHOENIX BROKAGE and click on it to verify your email address.

Submit Identification Documents: Upload the required identification documents, such as a government-issued ID and proof of address, to comply with KYC (Know Your Customer) regulations.

Deposit Funds: Log in to your new account and deposit the minimum required funds using one of the available payment methods.

Deposit & Withdrawal

PHOENIX BROKAGE offers multiple payment methods for funding accounts, including bank transfers, debit cards, and credit cards.

The minimum deposit varies depending on the chosen account plan: $500 - $999 for the Basic Plan, $1,000 - $4,999 for the Standard Plan, and $5,000 - $99,999 for the Premium Plan.

Customer Support

PHOENIX BROKAGE offers reliable customer support through telephone and email.

You can contact the support team by calling 1234 0293 2322. For email inquiries, reach out to support@phoenixbrokage.com for general support or info@phoenixbrokage.com for compliance-related questions. The support team will respond to queries within 24 hours, Monday to Friday.

Educational Resources

PHOENIX BROKAGE offers a robust educational resource library divided into three sections.

The Investment/Mining Library provides in-depth information on cryptocurrency investing and mining, emphasizing education and support over quick-rich schemes. It highlights forex trading as a viable investment option.

The Crypto Strategies section outlines various cryptocurrency trading strategies tailored to individual goals and risk tolerance, stressing the importance of personal research.

Conclusion

In conclusion, PHOENIX BROKAGE offers a wide range of trading assets and responsive customer support, making it an attractive option for investors.

However, the high minimum deposit requirement for the Premium Plan, limited educational resources, and lack of regulatory oversight are significant drawbacks. While the company's wide range of market instruments and multiple payment methods enhance trading flexibility, investors should carefully consider the trade-offs.

With the Basic Plan requiring a minimum deposit of $500 - $999 and the absence of regulatory compliance measures, investors must weigh the benefits and risks before engaging with PHOENIX BROKAGE for their investment needs.

FAQs

Question: What are the account types offered by PHOENIX BROKAGE?

Answer: PHOENIX BROKAGE offers three account types: Basic, Standard, and Premium.

Question: How can investors contact customer support?

Answer: Investors can contact customer support through telephone and email for assistance with their inquiries.

Question: What is the minimum deposit required to open an account?

Answer: The minimum deposit varies based on the chosen account type, ranging from $500 to $99,999.

Question: Is PHOENIX BROKAGE regulated by any financial authority?

Answer: No, PHOENIX BROKAGE operates without regulatory oversight from financial authorities.

Question: What trading assets are available on PHOENIX BROKAGE?

Answer: PHOENIX BROKAGE offers a wide range of trading assets, including currencies, commodities, indices, and stocks.

WikiFX брокеры

Подсчет курса