Equiity

Абстракт:Equiity, established in 2023 in Mauritius, offers a range of trading assets, including Forex, Metals, Energies, Stocks, Indices, Cryptos, Commodities, and Bonds. The platform provides various account types such as Silver, Gold, Platinum, and Islamic accounts. With a minimum deposit starting from $0.01 and maximum leverage up to 1:200, Equiity serves traders of different experience levels. The web-based trading platform, Webtrader, ensures accessibility for users. While Equiity provides a range of trading instruments and account options, it's important to note that the platform operates without regulatory oversight. Traders should consider this factor along with variable spreads when evaluating the platform. The company emphasizes customer support through email and live chat during specific hours, making it essential for users to assess their preferences and risk tolerance when choosing Equiity for their trading needs.

| Aspect | Information |

| Company Name | Equiity |

| Registered Country/Area | Mauritius |

| Founded Year | 2023 |

| Regulation | Not regulated |

| Market Instruments | Forex, Metals, Energies, Stocks, Indices, Cryptos, Commodities, Bonds |

| Account Types | Silver, Gold, Platinum, Islamic |

| Minimum Deposit | Starting from $0.01 |

| Maximum Leverage | Up to 1:200 |

| Spreads | Variable |

| Trading Platforms | Webtrader |

| Customer Support | Email: support@equiity.com, Live Chat (Mon-Fri, 11:00-20:00 GMT) |

| Deposit & Withdrawal | Credit and Debit Cards, SEPA, SWIFT Wire Transfers |

Overview of Equiity

Equiity, established in 2023 in Mauritius, offers a range of trading assets, including Forex, Metals, Energies, Stocks, Indices, Cryptos, Commodities, and Bonds. The platform provides various account types such as Silver, Gold, Platinum, and Islamic accounts. With a minimum deposit starting from $0.01 and maximum leverage up to 1:200, Equiity serves traders of different experience levels. The web-based trading platform, Webtrader, ensures accessibility for users.

While Equiity provides a range of trading instruments and account options, it's important to note that the platform operates without regulatory oversight. Traders should consider this factor along with variable spreads when evaluating the platform. The company emphasizes customer support through email and live chat during specific hours, making it essential for users to assess their preferences and risk tolerance when choosing Equiity for their trading needs.

Is Equiity legit or a scam?

Equiity operates without regulation from any supervisory authority, potentially giving rise to apprehensions regarding the platform's transparency and oversight. Unregulated exchanges often lack the robust oversight and legal safeguards offered by regulatory bodies, creating an environment susceptible to increased risks such as fraud, market manipulation, and security breaches. The absence of proper regulation may pose challenges for users in addressing grievances or resolving disputes, as they may not benefit from the protective mechanisms established by regulatory authorities.

Pros and Cons

| Pros | Cons |

| User-Friendly Trading Platform | Not Regulated |

| Customized Account Options | Limited Educational Resources |

| Convenient Payment Methods | |

| Competitive Spreads and Commissions | |

| High Leverage |

Pros

User-Friendly Trading Platform: Equiity offers a user-friendly interface, ensuring a better experience for traders. The platform is to be intuitive and accessible for both beginners and experienced users.

Customized Account Options: Equiity provides diverse account options such as Silver, Gold, Platinum, and Islamic accounts. This variety serves traders with different experience levels and preferences, allowing them to choose an account that suits their needs.

Convenient Payment Methods: The platform supports various payment methods, including credit and debit cards, SEPA, and SWIFT wire transfers. This convenience enables users to deposit funds into their accounts with ease.

Competitive Spreads and Commissions: Equiity offers competitive spreads and commissions, providing traders with cost-effective options for executing their trades.

High Leverage: The platform offers high leverage, allowing traders to potentially amplify their positions. This feature can be beneficial for those seeking greater exposure in the market.

Cons

Not Regulated: Equiity lacks regulatory oversight, which can be a concern for traders. Regulation provides a level of transparency and security, and the absence of it may raise questions about the platform's reliability.

Limited Educational Resources: The platform may have limited educational resources, potentially affecting the learning experience for users. Comprehensive educational materials are crucial for traders to enhance their skills and make informed decisions.

Market Instruments

Equiity provides a wide range of trading assets across various financial markets, offering users the opportunity to engage in different investment instruments.

Commodity Trading:

Equiity facilitates the trading of commodities, allowing users to participate in the dynamic commodities market. This category typically includes agricultural products, energy resources, and precious metals.

Forex Trading:

The platform supports Forex trading, enabling users to engage in the foreign exchange market. Forex trading involves the exchange of different national currencies, providing opportunities for users to speculate on currency pairs' price movements.

Indices Trading:

Equiity offers the option to trade indices, allowing users to invest in a diversified portfolio of stocks representing a particular market or industry. Indices trading provides exposure to broader market trends.

Stock Market:

Equiity enables users to participate in the stock market, facilitating the buying and selling of shares in publicly-listed companies. Stock market trading provides users with ownership in companies and the potential for capital appreciation.

Metals Trading:

The platform supports trading in metals, including precious metals like gold and silver. Metals trading offers users an avenue to diversify their portfolios and hedge against market uncertainties.

Cryptocurrency Market:

Equiity includes the cryptocurrency market, allowing users to trade digital assets such as Bitcoin, Ethereum, and other cryptocurrencies. Cryptocurrency trading provides opportunities for both short-term speculation and long-term investment strategies.

Account Types

Equiity offers various account types:

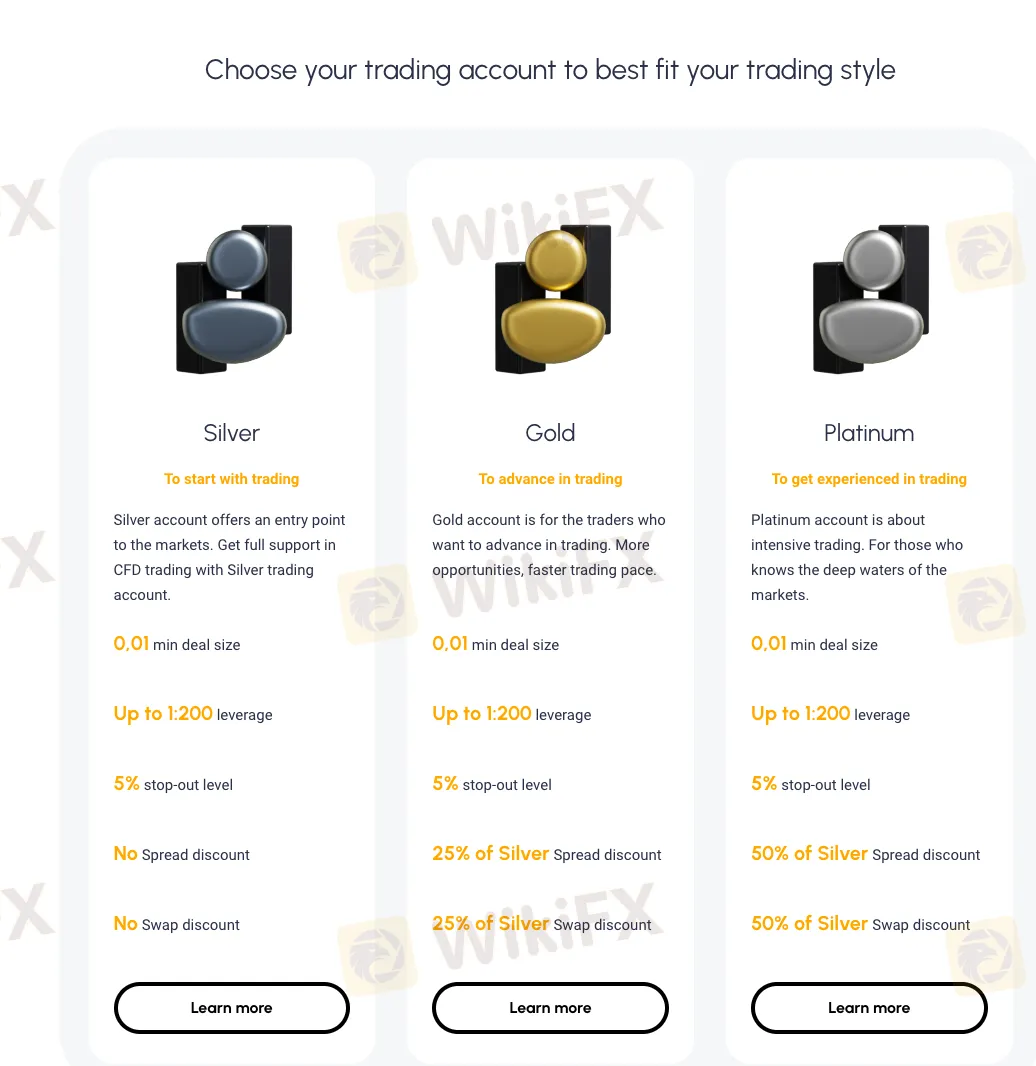

Silver Account:

The Silver account is designed as an entry-level option for individuals beginning their trading journey. It provides full support for CFD trading, making it suitable for novice traders looking to explore the markets. With a minimum deal size of 0.01, leverage of up to 1:200, and a 5% stop-out level, the Silver account offers a foundation for users to get acquainted with the world of trading.

Gold Account:

The Gold account is positioned for traders seeking advancement in their trading skills. It provides more opportunities and a faster trading pace compared to the Silver account. With a minimum deal size of 0.01, leverage up to 1:200, and a 5% stop-out level, the Gold account offers additional benefits, including a 25% discount on Silver spreads and swaps.

Platinum Account:

The Platinum account is for experienced traders engaged in intensive trading activities. With a minimum deal size of 0.01, leverage up to 1:200, and a 5% stop-out level, the Platinum account offers advanced benefits, including a 50% discount on Silver spreads and swaps. This account type is suitable for traders well-versed in navigating the complexities of the financial markets.

Islamic Account:

The Islamic Trading Account is tailored for traders who adhere to Shariah principles and prefer a trading environment that aligns with their religious beliefs. It ensures no night rollovers or interest charges for overnight positions, adheres to Shariah principles, and provides equitable risk distribution. The Islamic Account maintains all the advantages of regular trading accounts, offering access to a range of markets while respecting the religious considerations of Islamic traders.

| Account Type | Minimum Deal Size | Leverage | Stop-Out Level | Spread Discount | Swap Discount |

| Silver | 0.01 | Up to 1:200 | 5% | No Discount | No Discount |

| Gold | 0.01 | Up to 1:200 | 5% | 25% | 25% |

| Platinum | 0.01 | Up to 1:200 | 5% | 50% | 50% |

How to Open an Account?

Register:

Fill in the registration form with accurate information.

The provided information will be promptly verified.

Deposit:

Deposit funds into your account with no commission charges.

Choose a suitable payment method for your deposit.

Go to Markets:

Once your account is funded, navigate to the markets section.

Start trading on any asset of your choice available on the platform.

Leverage

Equiity offers a maximum leverage of up to 1:200 for traders, providing the opportunity to control a larger position size with a relatively smaller amount of capital. Leverage amplifies both potential profits and risks, making it a crucial aspect of trading.

Spreads & Commissions

Equiity offers varying spreads and commissions across its different account types.The Silver account, suitable for beginners, provides standard market spreads with no discounts. The Gold account, targeting advancing traders, introduces a 25% discount on both spreads and swaps compared to the Silver account. For experienced traders, the Platinum account offers a more substantial 50% discount on spreads and swaps, enhancing cost-efficiency.

It's important for users to assess their trading frequency, experience level, and budget when choosing an account type, as higher-tier accounts may provide more favorable fee structures but require more intensive trading activity. Equiity maintains transparency in presenting these fees, allowing traders to make informed decisions aligned with their individual preferences and goals.

Trading Platform

Equiity provides a trading platform that includes an array of features for users to execute their trades efficiently. The platform supports various order types, facilitating both market and pending orders. It offers real-time market quotes, allowing traders to make informed decisions. Equiity's platform integrates charting tools for technical analysis, enabling users to analyze price trends and patterns. It also supports one-click trading for swift order execution. The platform is accessible across devices, providing flexibility for users who prefer trading on desktop or mobile.

Deposit & Withdrawal

Equiity offers convenient options for depositing funds into your trading account. Accepted payment methods include Credit and Debit Cards, providing a swift and straightforward transaction process. Additionally, users can utilize SEPA (Single Euro Payments Area) for transfers within the Eurozone. For international transfers, Equiity supports SWIFT Wire Transfers, enabling users to fund their accounts securely. This wide range of payment methods serves the preferences and needs of traders, ensuring flexibility and accessibility in managing their financial transactions on the Equiity platform.

Customer Support

Equiity prioritizes responsive and professional customer support, offering assistance for any queries, issues, or problems traders may encounter. Users can reach out via email at support@equiity.comor engage in live chat support during specified hours from Monday to Friday, spanning 11:00 to 20:00 GMT. This customer-centric approach provide tsimely and effective solutions, fostering a positive user experience and addressing the needs of traders on the Equiity platform.

Conclusion

In conclusion, Equiity offers a user-friendly trading platform with customized account options, making it accessible for a range of traders. The convenience of multiple payment methods and competitive spreads enhances the overall trading experience.

However, the absence of regulatory oversight raises issues about transparency and user protection, a crucial aspect for building trust in the financial industry. Additionally, the platform's limited educational resources may hinder traders' potential for skill development and informed decision-making. While Equiity provides advantages such as user-friendliness and competitive offerings, traders should carefully consider the drawbacks, especially the lack of regulatory supervision and educational support, before engaging with the platform.

FAQs

Q: What account types does Equiity offer?

A: Equiity provides Silver, Gold, Platinum, and Islamic accounts for different trading preferences and experience levels.

Q: How can I contact Equiity's customer support?

A: You can reach Equiity's customer support via email at support@equiity.com or through live chat, available from Monday to Friday, 11:00 to 20:00 GMT.

Q: What is the minimum deposit required to open an Equiity account?

A: The minimum deposit varies based on the account type, starting from $0.01 for the Silver account.

Q: Are there educational resources available on Equiity?

A: Equiity offers limited educational resources, so traders may need to seek additional learning materials elsewhere.

Q: Is Equiity regulated?

A: No, Equiity is not regulated by any financial authority, which may impact transparency and investor protection.

WikiFX брокеры

Подсчет курса