Incomex

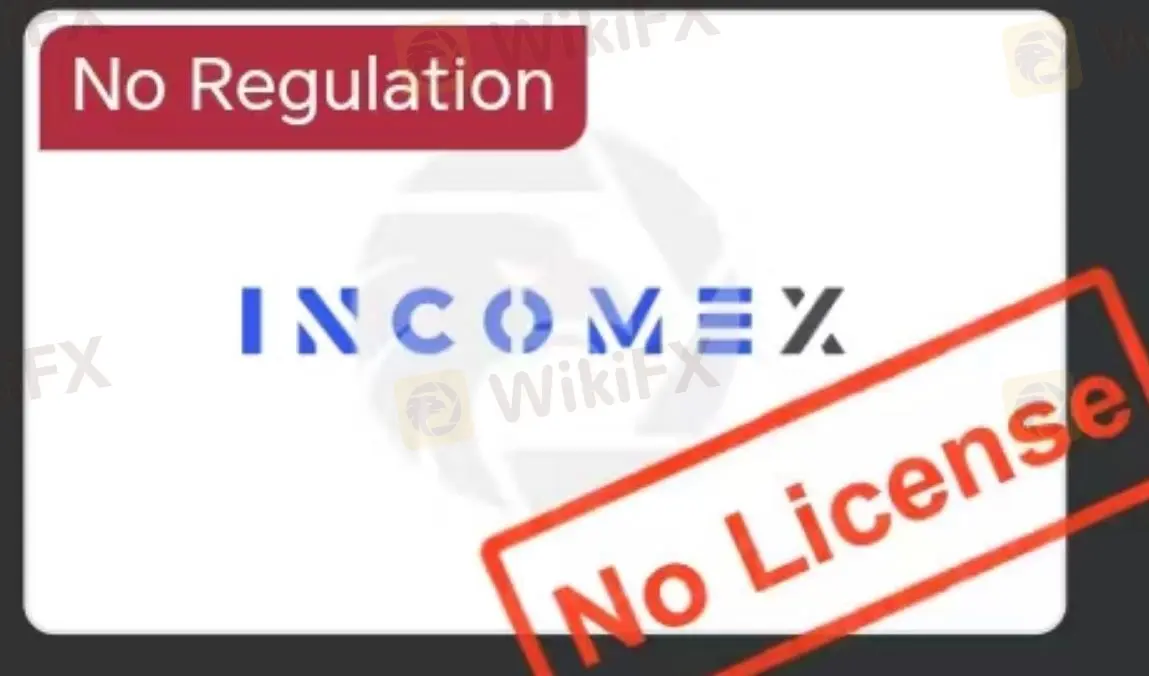

Абстракт:Incomex is an unregulated binary broker, offering a seemingly convenient platform for trading various market instruments, including currencies, commodities, cryptocurrencies, indices, and stocks. It boasts a user-friendly interface with features like multi-chart layout, technical analysis tools, and historical quotes.

| IncomexReview Summary | |

| Founded | 2023 |

| Registered Country/Region | Mauritius |

| Regulation | No regulation |

| Market Instruments | / |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | Adaptive platform |

| Min Deposit | $5 |

| Customer Support | Physical Address: 0óth Floor, Tower 1, NeXteracomBuilding, Ebene, Mauritius. |

Incomex Information

Incomex, a broker incorporated in Mauritius in 2023, claims to offer a variety of assets for traders to trade, as well as an adaptive platform. In addition, it supports simulated trading. Currently, Incomex is unregulated and too little information is publicly available.

Pros and Cons

| Pros | Cons |

| Minimum investment $5 | No regulation |

| Deposits and withdrawals are commission-free | No trading instruments information |

| MT4/5 is not supported |

Is Incomex Legit?

Incomex is not regulated and a query shows it is registered on its website in 2023.

What Can I Trade on Incomex?

Incomex said a variety of high-yielding assets are readily available for trading, without specifying.

Account Types

Incomex accounts require a minimum deposit of $5 and a minimum transaction amount of $10. In addition, demo accounts can receive $50,000 in virtual currency.

Incomex Fees

Incomex deposits and withdrawals are commission-free.

Trading Platform

Incomex provides the adaptive platform for desktop, mobile and tablet use.

| Trading Platform | Supported | Available Devices | Suitable for |

| Adaptive platform | ✔ | Desktop, Mobile, Tablet | All traders |

| MT4 | ❌ | ||

| MT5 | ❌ |

Deposit and Withdrawal

Payment methods supported by Incomex are: Mastercard, VISA, Skrill, NETELLER and PayPal.

WikiFX брокеры

Подсчет курса