BAVSA

Абстракт: BAVSA, founded in 1985 and headquartered in Argentina, provides a wide range of financial services, including capital market access, investment advising, and small and medium-sized enterprise finance. However, it is not regulated by the local securities authority (CNV), raising transparency concerns among investors.

| BAVSA Review Summary | |

| Founded | 1985 |

| Registered Country/Region | Argentina |

| Regulation | No regulation |

| Trading Products | Stocks, bonds, mutual funds, options (derivatives), financial trusts, futures |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | 0 |

| Customer Support | Tel: +54 11 3986-9050 |

| Email: comercial@bavsa.com | |

BAVSA Information

BAVSA, founded in 1985 and headquartered in Argentina, provides a wide range of financial services, including capital market access, investment advising, and small and medium-sized enterprise finance. However, it is not regulated by the local securities authority (CNV), raising transparency concerns among investors.

Pros and Cons

| Pros | Cons |

| Broad range of trading markets | No regulation |

| No minimum deposit to open an account | No clear trading platform mentioned |

| SME financing and personalized advisory available | Lacks demo and Islamic account options |

| No info on deposit and withdrawal |

Is BAVSA Legit?

In Argentina, where BAVSA (bavsa.com) is based, it is not a regulated financial services provider. There is no proof that it has a financial license from Argentina's Comisión Nacional de Valores (CNV).

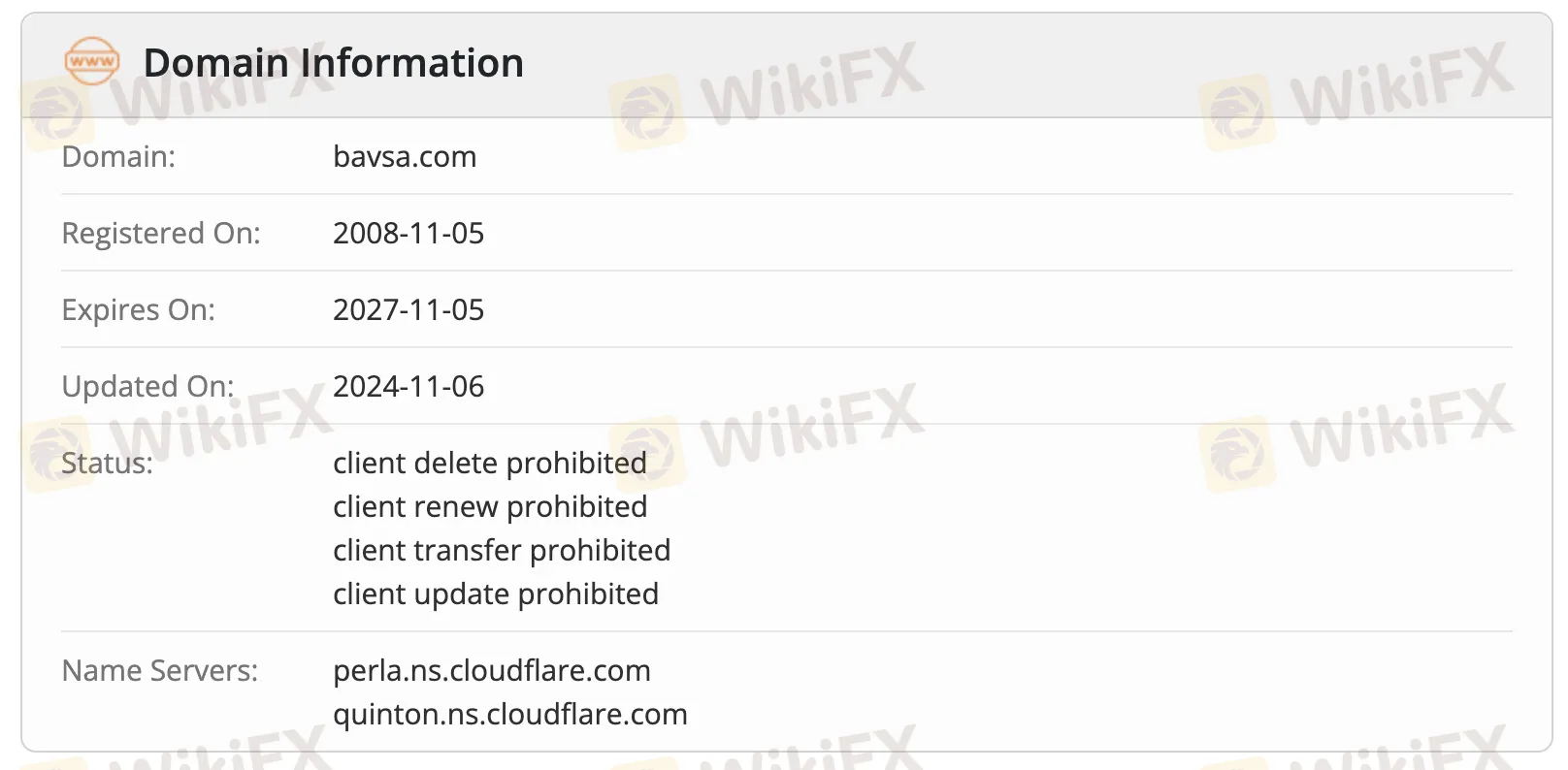

According to the WHOIS database, the domain bavsa.com was registered on November 5, 2008, and will end on November 5, 2027. The last time it was updated was on November 6, 2024. There are a number of status flags on the domain right now that protect it. These include “client delete prohibited,” “client renew prohibited,” “client transfer prohibited,” and “client update prohibited.”

What Can I Trade on BAVSA?

BAVSA provides a wide range of financial services and capital market products, providing access to both domestic and international securities. They offer portfolio advisory, SME finance, and market analysis to both individual and corporate clients.

| Trading Products | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Mutual Funds | ✔ |

| Options (Derivatives) | ✔ |

| Financial Trusts | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

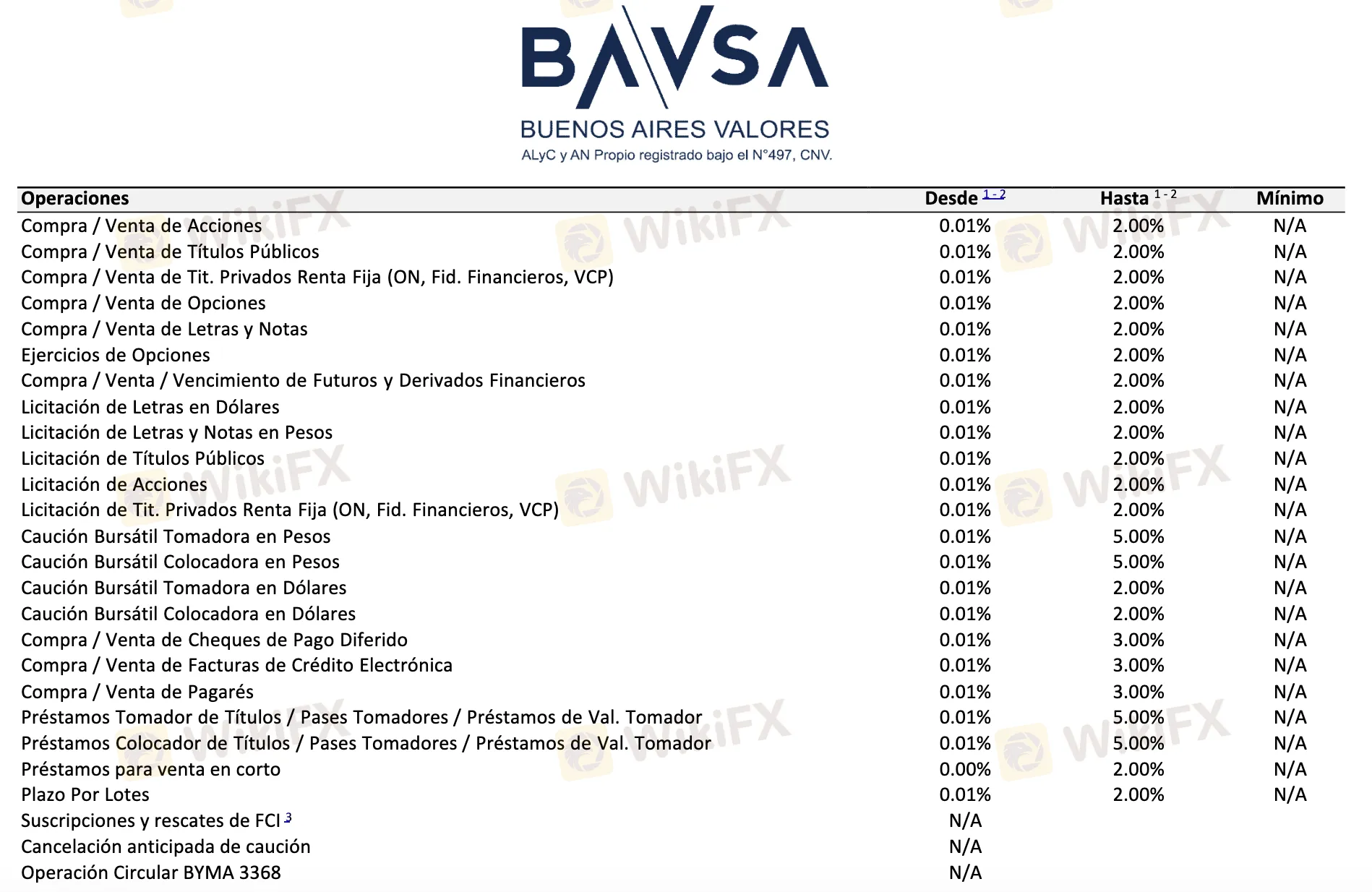

BAVSA Fees

BAVSA's costs are reasonable and flexible, ranging from 0.01% to 2-5% depending on the transaction type. Notably, there is no minimum amount necessary to start an account, making it accessible to a diverse group of investors.

Trading Fees

| Transaction Type | Fees |

| Buying/Selling Equities | 0.01% – 2.00% |

| Public Bonds | |

| Private Fixed Income Securities | |

| Options Trading & Exercise | |

| Futures & Derivatives | |

| Deferred Payment Checks / Facturas / Notes | 0.01% – 3.00% |

| Securities Lending (Borrower/Placer) | 0.01% – 5.00% |

| Mutual Funds Subscription/Redemption | Up to 3% |

Corporate Actions & Income Collection Fees

| Action | Fees |

| Dividend/Revaluation of Securities | 0.01% – 1.00% |

| Income from Bonds | |

| Amortization (Public/Private) | |

| Securities Exchange |

Non-Trading Fees

| Services | Fees |

| Monthly Account Maintenance | AR$ 60 |

| Foreign Transfer (USD) | USD 100–150 |

| Transfer to/from EUROCLEAR / DTC / Other Depositories | USD 25–100 |

| Internal Title Transfer | Mostly Free |

| Argentina Transfers | / |

| Rejected Checks | / |

| Liquidation in USD (Cable) | USD 50 |

| FED Instruction | USD 150 |

WikiFX брокеры

Подсчет курса