2024-12-23 13:57

ОтраслевойMarket analysis on December 23

Last Friday, one of the inflation indicators that the Fed pays attention to - the US core PCE data are lower than expected, the market for March 25 interest rate cut expectations have increased, the USDX fell from a two-year high, and finally closed at 107.82, down 0.55%, but continued to rise for three weeks. Treasury yields were weaker across the board, with the 2-year yield closing at 4.317 percent and the 10-year yield at 4.519 percent.

Again, considering the arrival of Christmas, which compresses the entire trading week, the market is less volatile and the dollar is more likely to fluctuate at high levels.

At present, it seems that the Federal Reserve will only cut interest rates twice next year, respectively in March and June next year, and the major central banks may have some opposing measures.

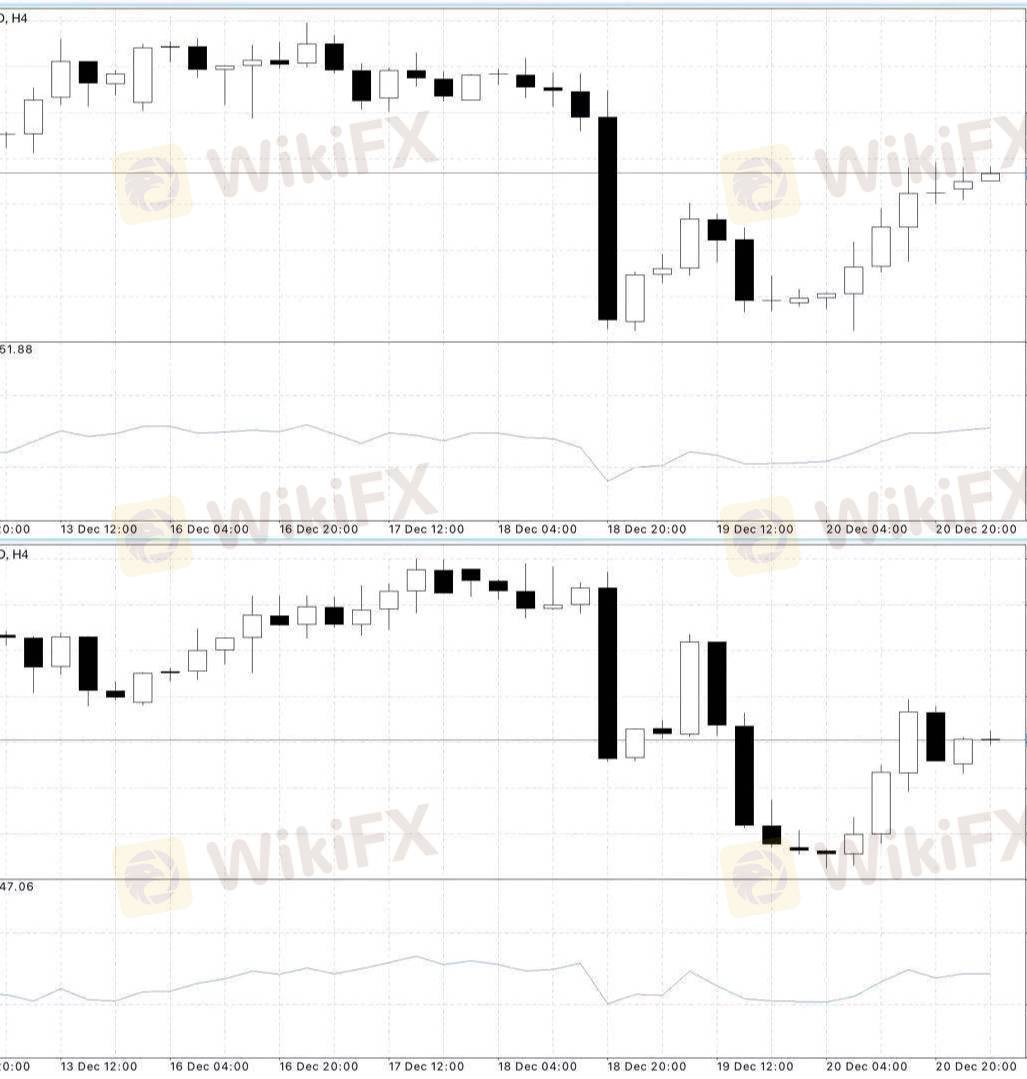

EUR/USD:

First support: 1.0436 First resistance: 1.0444

Second support: 1.0432 Second resistance: 1.0448

GBP/USD:

First support: 1.2582 First resistance: 1.2590

Second support: 1.2577 Second resistance: 1.2593

Нравится 0

Steven123

Trader

Популярные обсуждения

Технический показатель

Розыгрыш Xiaomi Redmi Note 9 и 20-и VIP-подписок

Технический показатель

ВЫСКАЗЫВАНИЯ БАЙДЕНА ДАВЯТ НА ВАЛЮТЫ РАЗВИВАЮЩИХСЯ СТРАН

Технический показатель

Европа заключила совместный контракт на поставку ремдесивира для лечения COVID-19...

Анализ котировок

Китай: Индекс деловой актив. в сф. услуг Caixin PMI, Сентябрь, 54,8 п.

Технический показатель

Индия: Решение Резерв. Банка Индии по проц. ставке, 4%, ожидалось 4%...

Технический показатель

События предстоящего дня: "АЛРОСА" опубликует результаты продаж за сентябрь...

Классификация рынка

Платфоома

Выставка

Агент

Вакансии

EA

Отраслевой

Котировки

Показатель

Market analysis on December 23

Гонконг | 2024-12-23 13:57

Гонконг | 2024-12-23 13:57

Last Friday, one of the inflation indicators that the Fed pays attention to - the US core PCE data are lower than expected, the market for March 25 interest rate cut expectations have increased, the USDX fell from a two-year high, and finally closed at 107.82, down 0.55%, but continued to rise for three weeks. Treasury yields were weaker across the board, with the 2-year yield closing at 4.317 percent and the 10-year yield at 4.519 percent.

Again, considering the arrival of Christmas, which compresses the entire trading week, the market is less volatile and the dollar is more likely to fluctuate at high levels.

At present, it seems that the Federal Reserve will only cut interest rates twice next year, respectively in March and June next year, and the major central banks may have some opposing measures.

EUR/USD:

First support: 1.0436 First resistance: 1.0444

Second support: 1.0432 Second resistance: 1.0448

GBP/USD:

First support: 1.2582 First resistance: 1.2590

Second support: 1.2577 Second resistance: 1.2593

Нравится 0

Я тоже хочу высказать замечания.

Задать вопрос

0Комментарии

Пока нет комментариев, оставьте комментарий первым

Задать вопрос

Пока нет комментариев, оставьте комментарий первым