2025-02-06 23:38

ОтраслевойCORRELATION BETWEEN FOREX PAIRS

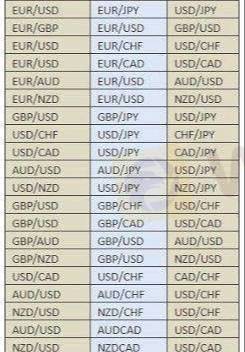

Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Нравится 0

BeastBoy2159

Trader

Популярные обсуждения

Технический показатель

Розыгрыш Xiaomi Redmi Note 9 и 20-и VIP-подписок

Технический показатель

ВЫСКАЗЫВАНИЯ БАЙДЕНА ДАВЯТ НА ВАЛЮТЫ РАЗВИВАЮЩИХСЯ СТРАН

Технический показатель

Европа заключила совместный контракт на поставку ремдесивира для лечения COVID-19...

Анализ котировок

Китай: Индекс деловой актив. в сф. услуг Caixin PMI, Сентябрь, 54,8 п.

Технический показатель

Индия: Решение Резерв. Банка Индии по проц. ставке, 4%, ожидалось 4%...

Технический показатель

События предстоящего дня: "АЛРОСА" опубликует результаты продаж за сентябрь...

Классификация рынка

Платфоома

Выставка

Агент

Вакансии

EA

Отраслевой

Котировки

Показатель

CORRELATION BETWEEN FOREX PAIRS

Алжир | 2025-02-06 23:38

Алжир | 2025-02-06 23:38Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Нравится 0

Я тоже хочу высказать замечания.

Задать вопрос

0Комментарии

Пока нет комментариев, оставьте комментарий первым

Задать вопрос

Пока нет комментариев, оставьте комментарий первым