ANALYC

Абстракт:Registered on 2022-01-13, ANALYC is an unregulated brokerage company registered in Saint Vincent engaged in CFD currency pairs, stocks, commodities, and more. The broker claims provide tight spreads but are unspecific.

Note: ANALYC's official website: https://www.analyc.com/ is currently inaccessible normally.

ANALYC Information

Registered on 2022-01-13, ANALYC is an unregulated brokerage company registered in Saint Vincent engaged in CFD currency pairs, stocks, commodities, and more. The broker claims provide tight spreads but are unspecific.

Is ANALYC Legit?

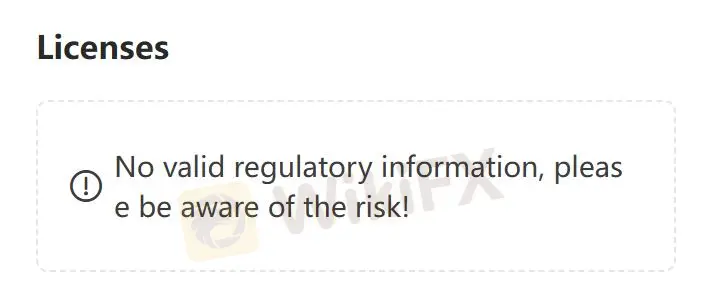

ANALYC is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with ANALYC.

Downsides of ANALYC

- Unavailable Website

Traders cannot access ANALYCs official website, which makes ANALYC unreliable.

- Lack of Transparency

Since ANALYC does not explain more transaction information, especially in terms of fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

ANALYC is not regulated and will be less safe than a regulated broker.

Conclusion

Trading with ANALYC will be exposed to the risk of property damage because of the unregulated status, inaccessible office website, and incomprehensive information.

WikiFX брокеры

Подсчет курса