JuraTrade

Абстракт:Jura Trade Limited, registered in Saint Vincent and the Grenadines, operates in the trading sector without any formal regulation.

| JuraTrade Review Summary | |

| Company Name | Jura Trade Limited |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No Regulation |

| Market Instruments | Forex, Indices, Cryptos, Commodities, Stocks, etc. |

| Demo Account | Not mentioned |

| Max.Leverage | 1:3000 |

| Spread | Not mentioned |

| Commission | $0 or $5 |

| Trading Platform | MT5 |

| Minimum Deposit | $10 |

| Regional Restrictions | Australia, Canada, the EU and EEA, Japan, the United States of America, and countries sanctioned by the EU, etc. |

| Customer Support | Contact Form |

| Company Address | Suite 305, Griffith Corporate Centre, Kingstown, Saint Vincent and the Grenadines |

What is JuraTrade?

Jura Trade Limited, registered in Saint Vincent and the Grenadines, operates in the trading sector without any formal regulation.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

Pros:

- MT5 Supported: JuraTrade offers compatibility with the MetaTrader 5 platform, so traders can access advanced trading tools and features for efficient trading strategies.

- Low Minimum Deposit: JuraTrade requires a low minimum deposit of $100, making it accessible for traders with varying capital levels to start trading.

- High Leverage: JuraTrade provides high leverage options, with a maximum leverage of 1:1000 for standard and ECN accounts, and up to 1:500 for professional accounts.

- No Commission Charged for Standard Accounts: JuraTrade does not charge commissions for standard accounts, so users can execute trades without incurring additional fees.

Cons:

- No Regulations: JuraTrade operates without regulatory oversight, which will concern users regarding the security and reliability of brokerage services.

- Strict Regional Restrictions: JuraTrade imposes strict regional restrictions on Australia, Canada, the EU and EEA, Japan, the United States of America, and countries sanctioned by the EU, etc., which limit access to its services for traders from certain countries or jurisdictions.

Is JuraTrade Legit?

- JuraTrade is currently functioning without any regulation, meaning it does not fall under the supervision of any financial regulatory bodies and does not possess any licenses to operate in the financial market.

Market Instruments

JuraTrade offers a certain range of market instruments. These include:

- Forex: JuraTrade facilitates trading in a wide range of currency pairs for traders to participate in the foreign exchange market and capitalize on currency fluctuations.

- Indices: Traders can access a selection of global stock market indices, so users can speculate on the performance of broader market segments and diversify their investment portfolios.

- Cryptos: JuraTrade offers trading opportunities in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

- Commodities: The platform provides access to commodity markets including gold, silver, crude oil, and agricultural products.

- Stocks: JuraTrade offers trading in individual stocks for investments in publicly traded companies across various sectors and industries.

Account Types

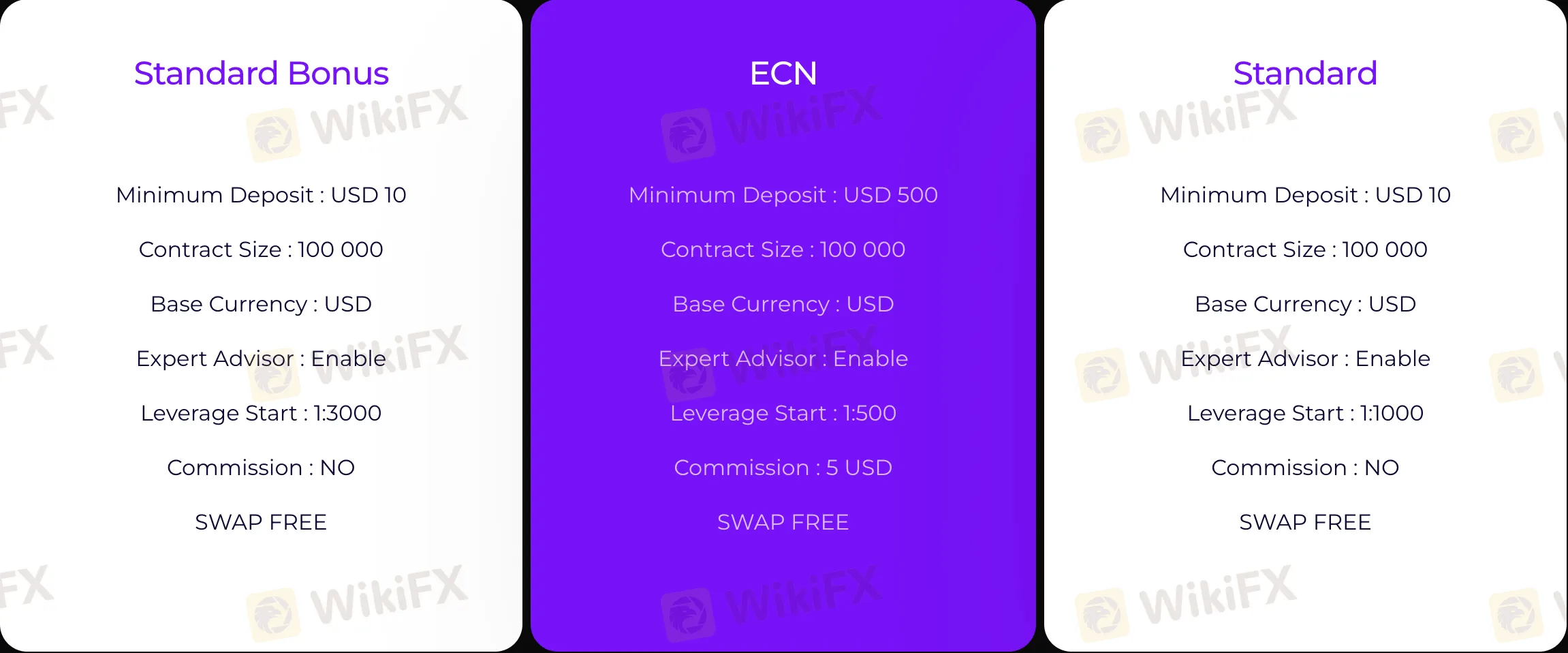

JuraTrade offers three account types: Standard Bonus, ECN, and Standard.

All accounts feature a contract size of 100,000, USD as the base currency, and enable Expert Advisors (EAs). They are also all swap-free.

- The Standard Bonus and Standard accounts have a minimum deposit of USD 10, with leverage starting at 1:1000 (Standard Bonus) and 1:3000 (Standard). There are no commissions for these accounts.

- The ECN account requires a minimum deposit of USD 500, offers leverage starting at 1:500, and charges a commission of 5 USD per trade.

Leverage

The maximum leverage is 1:3000.

Spread & Commissions

JuraTrade offers three account types with different fee structures. Both the Standard Bonus and Standard accounts have no commission fees and are swap-free. In contrast, the ECN account charges a 5 USD commission per trade, but it is also swap-free.

Overall, the key difference in fees is that only the ECN account incurs a commission, while the other two accounts are commission-free.

Trading Platform

JuraTrade provides the MetaTrader 5 (MT5) trading platform with the following features.

- Advanced charting tools: Analyze price movements with a variety of technical indicators, chart types, and drawing tools.

- Market analysis: Access real-time market news, economic calendars, and analysis tools to make informed trading decisions.

- Order execution: Execute trades quickly and efficiently with one-click trading and multiple order types, including market orders, limit orders, and stop orders.

- Algorithmic trading: Develop, test, and deploy automated trading strategies using the built-in Expert Advisors (EAs) and MQL5 scripting language.

- Multi-asset trading: Trade a diverse range of financial instruments, including forex, stocks, commodities, and cryptocurrencies, all from a single platform.

- Mobile trading: Stay connected to the markets and manage your trades on the go with the MT5 mobile app, available for both iOS and Android devices.

Customer Support

JuraTrade only provides a contact form without other more direct contact methods like phone or live chat.

Conclusion

As a broker, JuraTrade offers high-leverage options and supports the MT5 trading platform. It requires a relatively low minimum deposit and standard accounts are commission-free. However, it currently holds no regulations. In this case, we do not recommend users to trade with this broker.

Frequently Asked Questions (FAQs)

Does JuraTrade support MT4/5?

Yes, it does support MT5.

What is the minimum deposit required?

The minimum deposit required is $10.

What is the maximum leverage provided by JuraTrade?

The maximum leverage provided by JuraTrade is up to 1:3000.

Is there any regional restriction?

Yes. There are regional restrictions on Australia, Canada, the EU and EEA, Japan, the United States of America, and countries sanctioned by the EU, etc.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

WikiFX брокеры

Подсчет курса