TO FOREX,

บทคัดย่อ:TO FOREX, based in the United States, operates as an unregulated entity, posing potential risks for traders given the lack of oversight by any financial authority. While they offer a platform familiar to many in the trading community, MetaTrader 4 (MT4), the specifics regarding their spreads remain undisclosed. Furthermore, their support system is limited to email, lacking instant assistance options like live chat or phone. Their educational resources also seem inadequate, restricted merely to a basic Help Center, which could fall short for traders seeking comprehensive learning materials. The payment methods, although inclusive of domestic bank transfers and cryptocurrency deposits, are vaguely detailed, leaving traders in ambiguity regarding transaction procedures.

| Aspect | Details |

| Registered Country/Area | United States |

| Company Name | TO FOREX |

| Regulation | None (Unregulated) |

| Maximum Leverage | 1:100 |

| Spreads | Specifics not provided |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Foreign Exchange (FX), Commodity CFDs |

| Account Types | Standard Trading Account |

| Customer Support | |

| Payment Methods | Domestic Bank Transfers, Cryptocurrency Deposits (Specific methods not provided) |

| Educational Tools | Limited; Help Center |

Overview

TO FOREX, based in the United States, operates as an unregulated entity, posing potential risks for traders given the lack of oversight by any financial authority. While they offer a platform familiar to many in the trading community, MetaTrader 4 (MT4), the specifics regarding their spreads remain undisclosed. Furthermore, their support system is limited to email, lacking instant assistance options like live chat or phone. Their educational resources also seem inadequate, restricted merely to a basic Help Center, which could fall short for traders seeking comprehensive learning materials. The payment methods, although inclusive of domestic bank transfers and cryptocurrency deposits, are vaguely detailed, leaving traders in ambiguity regarding transaction procedures.

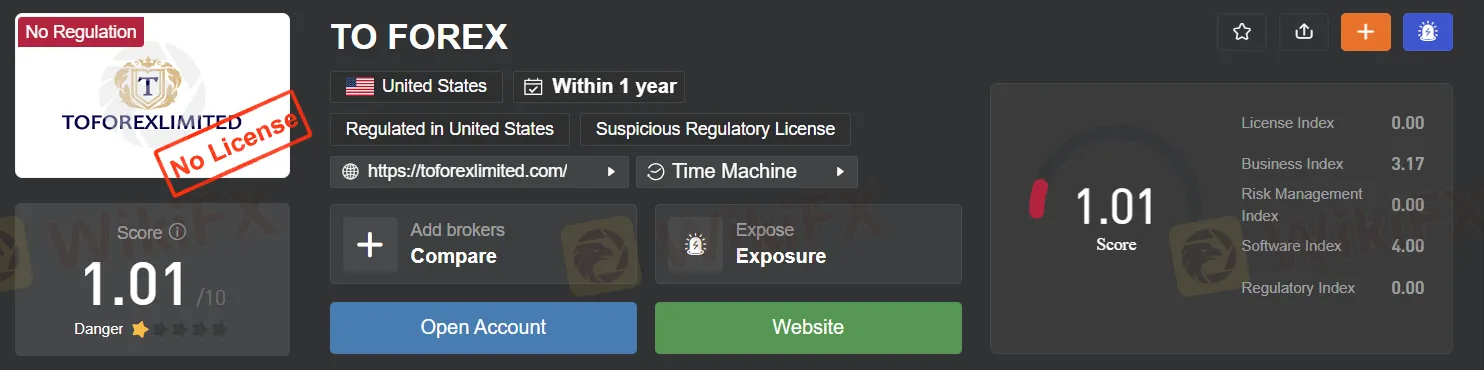

Regulation

None.

TO FOREX appears to be an unregulated forex broker, which means that it operates in the foreign exchange market without the oversight or regulatory compliance typically required by established financial authorities. This lack of regulation can raise concerns for traders and investors, as it may imply a lack of transparency and accountability in the broker's operations. Unregulated brokers often do not adhere to the strict standards and safeguards imposed by reputable regulatory bodies, leaving traders potentially exposed to higher risks such as fraud, unfair trading practices, and the absence of investor protection mechanisms. Therefore, individuals considering trading with TO FOREX should exercise caution and thoroughly research the broker's background, reputation, and customer feedback before making any financial commitments in order to mitigate potential risks associated with trading through an unregulated entity.

Pros and Cons

TO FOREX offers a diverse range of market instruments catering to various financial preferences and risk appetites. Their platform, using MT4, offers a user-friendly interface and comprehensive tools for traders. However, their unregulated status may raise concerns for potential traders, and the lack of diversified customer support channels might hinder immediate assistance.

| Pros | Cons |

| Wide range of market instruments available | Operates as an unregulated broker |

| Utilizes the popular MT4 trading platform | Limited customer support channels |

| Streamlined account opening process | Potential high risk due to unregulated status |

| No fees for account setup and maintenance | Limited educational resources |

| Offers leverage up to 1:100 |

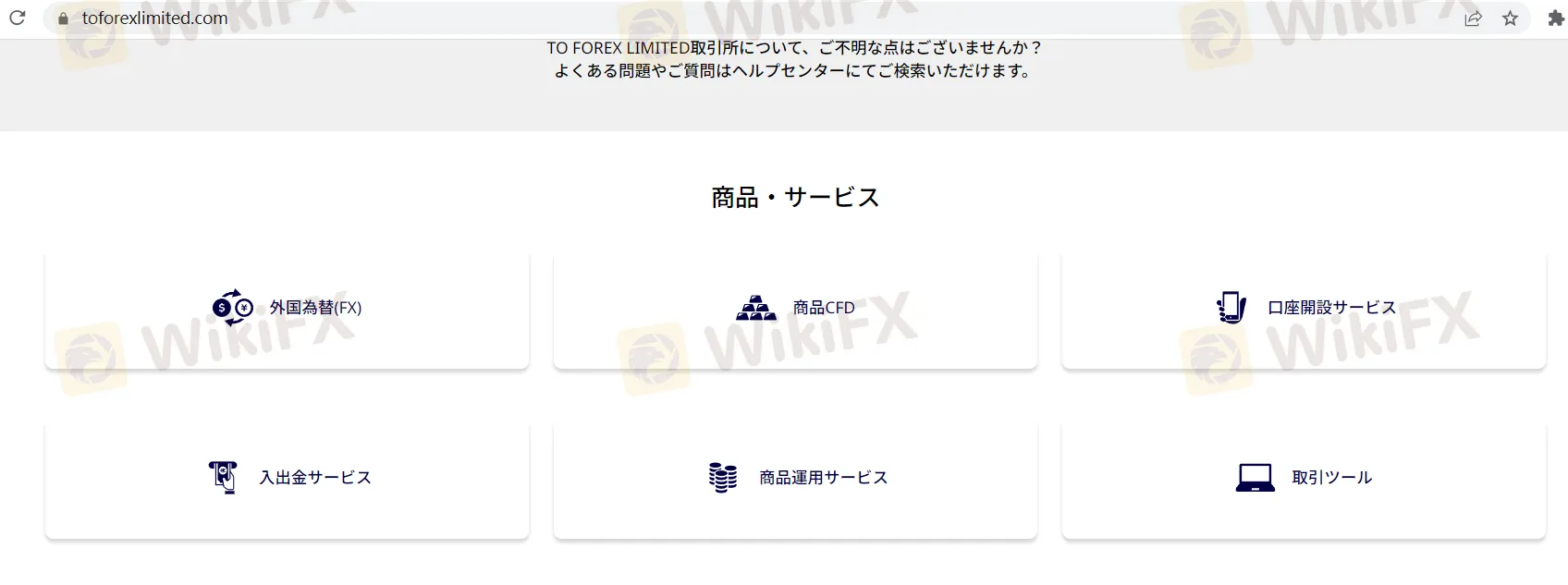

Market Instruments

TO FOREX offers a diverse range of market instruments for traders and investors, catering to various financial preferences and risk appetites. Their offerings encompass different asset classes and services designed to meet the needs of a wide spectrum of clients.

Foreign Exchange (FX): One of the primary market instruments provided by TO FOREX is foreign exchange (FX) trading. FX trading involves the buying and selling of currency pairs in the global forex market. This enables traders to speculate on the price movements of major currency pairs like EUR/USD, GBP/JPY, or USD/JPY. Forex is known for its liquidity and round-the-clock availability, making it a popular choice among traders seeking to capitalize on currency fluctuations.

Commodity CFD: Another significant offering is Commodity Contracts for Difference (CFDs). CFDs allow traders to speculate on the price movements of various commodities, including but not limited to gold, oil, natural gas, and agricultural products, without owning the underlying assets. This instrument provides traders with exposure to the commodities market without the need for physical ownership or delivery.

Account Opening Service: TO FOREX offers a streamlined account opening service, which is crucial for clients looking to start their trading journey. This service typically includes the registration process, identity verification, and the selection of account types that cater to different trading strategies and risk tolerance levels.

| Market Instruments and Services | Description |

| Foreign Exchange (FX) | Trading currency pairs in the forex market. |

| Commodity CFD | Speculating on commodity price movements. |

Account Types

TO FOREX offers a single standard trading account designed to accommodate traders of all levels. This account provides access to various markets, potentially offers leverage, features risk management tools, allows for diverse deposit and withdrawal options, offers customer support, and may provide educational resources. Specific account details, including leverage and minimum deposit requirements, may vary based on regulatory guidelines and the broker's policies.

Leverage

This broker offers a substantial maximum trading leverage of 1:100. Leverage is a tool that allows traders to control larger positions in the market with a smaller amount of capital. However, it's essential to remember that while this level of leverage can increase potential profits, it also raises the risk of significant losses. Traders should carefully assess their risk tolerance and trading strategies before using this 1:100 leverage option and stay updated on potential changes to leverage limits.

Spreads & Commissions

At TO FOREX LIMITED Trading Exchange, there's a priority on offering clients accurate and fair prices. Derived from pools of liquidity commonly accessed by institutional investors and market makers, the exchange's pricing structure ensures utmost transparency.

Spreads:

The spreads between the Bid (Sell) and Ask (Buy) prices of various currency pairs such as EURUSD, USDJPY, GBPUSD, AUDUSD, and USDCAD are set to be competitive, ensuring traders receive the best possible market rates.

Commissions:

Standard Trading Accounts: A fixed commission of 11 dollars (tax-inclusive) is charged for every 100,000 currency traded, which is equivalent to 1 lot on this platform.

Managed Investment Accounts: It's important to note that conditions might vary for managed investment accounts depending on the products under management.

Additionally, the exchange offers leverage at a maximum of 100x, with no minimum margin requirements. The smallest trade size permitted is 0.01 lot. It's noteworthy that there's a 100% margin maintenance rate for forced liquidation. More details about the leverage and the policy on covering losses from forced liquidations are provided in the Help Center.

Other Fees:

Account Setup & Maintenance: There are no fees associated with opening or maintaining an account with TO FOREX LIMITED.

Deposits: Clients have options for deposits, including domestic bank transfers and cryptocurrency deposits. For domestic bank transfers, any fees charged by the bank, such as those for ATM or counter services, will be borne by the client. Cryptocurrency deposit fees vary based on the type of cryptocurrency, and detailed information is available on the website.

Withdrawals: The exchange boasts free withdrawal services. Comprehensive details are accessible on the platform.

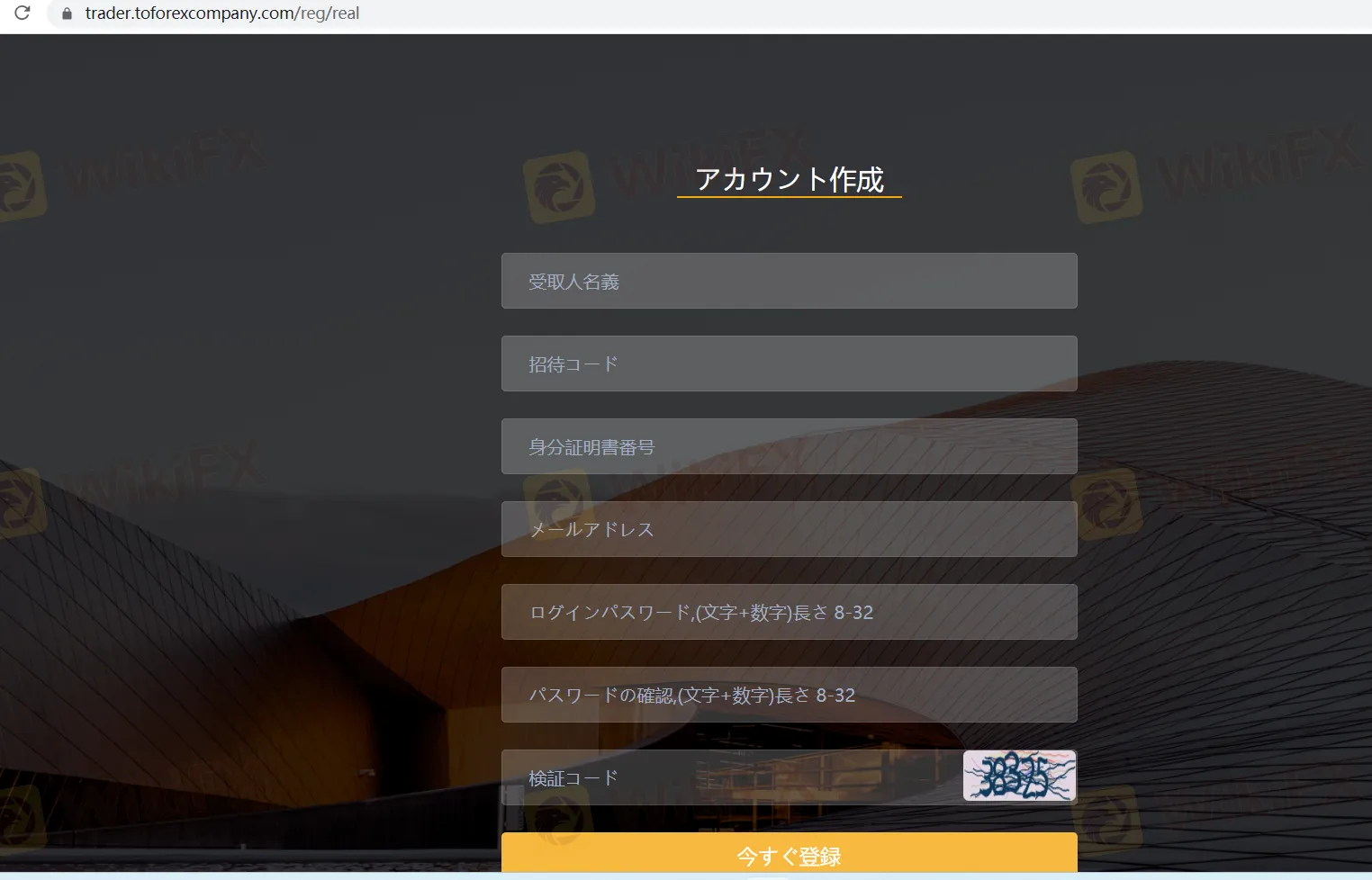

The account setup process at TO FOREX LIMITED is streamlined. Opening an account is entirely free, and the online registration can be wrapped up in as little as 3 minutes.

Potential clients are advised to always review the conditions associated with their type of trading account to understand the spreads and commissions that might apply.

Trading Platforms

MetaTrader 4 (MT4), developed by MetaQuotes Software in 2005, is among the top electronic trading platforms for online retail forex traders. Here's a concise breakdown:

User Interface: Intuitive and customizable, suitable for both beginners and experienced traders.

Charting Tools: Robust charting capabilities with multiple timeframes and over 30 built-in technical indicators.

Expert Advisors (EAs): Supports automated trading strategies, allowing traders to employ or create their own EAs.

MQL4 Language: Enables the creation of custom indicators, scripts, and EAs.

Security: Ensures safe trading with 128-bit encryption and RSA digital signatures.

Versatility: Supports multiple financial markets and languages, catering to a global audience.

Mobile Trading: MT4 is also optimized for on-the-go trading with its mobile applications.

Customer Support

Regrettably, the customer support here leaves much to be desired. The only mode of contact appears to be via email, offering no immediate help channels such as live chat or phone support. Even when reaching out through email, the requirement to provide both your name and email for identity verification, while understood as a measure for security, can feel invasive and cumbersome. It's disappointing to see a lack of instantaneous, user-friendly support options. Your patience and understanding are, unfortunately, prerequisites here.

Educational Resources

While the platform has made an effort with its Help Center, the educational resources appear somewhat limited. Within the Help Center, users can navigate a selection of topics to address various questions. From unraveling the intricacies of forex trading costs to account modifications, and from understanding specific terminologies to deciphering trading parameters like margin requirements, the center offers a basic assistance suite. However, for those seeking a comprehensive educational journey or in-depth tutorials, the current offerings might fall short of expectations. It's hoped that future enhancements might bring a richer educational experience for users at all levels.

Summary

TO FOREX is an unregulated forex broker, offering a diverse range of market instruments, including FX trading and Commodity CFDs. While its pricing structure is transparent, with competitive spreads and commissions, caution is advised due to its unregulated status. The broker provides standard trading accounts with notable features like a 1:100 leverage ratio, a fixed commission for trading, and varied deposit and withdrawal services. The MetaTrader 4 platform is available for trading, offering a range of tools and functionalities suitable for diverse traders. However, its customer support, primarily available via email, and its limited educational resources in the Help Center, might not fully cater to all users' needs. Potential traders are encouraged to thoroughly review the platform's features and the associated conditions before engaging.

FAQs

Q: Is TO FOREX a regulated broker?

A: No, TO FOREX operates as an unregulated forex broker.

Q: What trading platform does TO FOREX offer?

A: TO FOREX offers the MetaTrader 4 (MT4) trading platform.

Q: What is the maximum leverage provided by TO FOREX?

A: TO FOREX offers a maximum trading leverage of 1:100.

Q: Are there any fees associated with account setup and maintenance at TO FOREX?

A: No, there are no fees for opening or maintaining an account with TO FOREX LIMITED.

Q: How can I contact TO FOREX's customer support?

A: You can contact TO FOREX's customer support primarily via email.

อ่านเพิ่มเติม

เทรด Forex เลือก ‘Leverage’ เทรดยังไง เท่าไหร่ดี?

รู้หรือไม่ว่าสิ่งหนึ่งที่ทำให้ตลาด Forex ทำกำไรได้สูงปี๊ดดดดคือ ‘Leverage’ มันสามารถทำให้คุณได้กำไรเป็นร้อยเป็นพันเท่าจากเงินเพียงไม่กี่บาท แต่นี่ก็เป็นดาบสองคม เพราะมันก็เพิ่มความเสี่ยงให้สูงปี๊ดเช่นกัน! ตกลง Leverage มันคืออะไร ทำงานยังไง แล้วเทรดเดอร์ต้องเลือก Leverage เท่าไหร่ถึงจะดี?

ขอเตือนเป็นครั้งสุดท้ายกับโบรกเกอร์นี้ว่าให้หลีกเลี่ยง!

โบรกเกอร์เจ้านี้เป็นโบรกเกอร์ที่มีประวัติไม่ดีมาค่อนข้างนาน เพราะนักลงทุนหลายรายไม่สามารถถอนเงินออกมาได้ตั้งแต่ปีที่แล้ว

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

CXM Trading

HTFX

IC Markets Global

FXTM

Exness

DBG Markets

CXM Trading

HTFX

IC Markets Global

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

CXM Trading

HTFX

IC Markets Global

FXTM

Exness

DBG Markets

CXM Trading

HTFX

IC Markets Global

ข่าวล่าสุด

ทองปิดพุ่ง $18.70 ทำนิวไฮ สงครามการค้าหนุนแรงซื้อสินทรัพย์ปลอดภัย

วิกฤตหนี้ IMF กับผลกระทบที่วัยรุ่น 90’s ไม่อาจลืม

ข้อคิดดีๆ จากหนังสือ "วิถีผู้ชนะฉบับคนเก่งแบบเป็ด"

ราคาทองไทยไม่ได้ขึ้นเอง! เผยเบื้องหลังที่คุณอาจไม่เคยรู้

ทองปิดบวก $17.20 ทำนิวไฮ รับแรงซื้อสินทรัพย์ปลอดภัย

ประเภทคำสั่งซื้อขายที่ต้องรู้ ก่อนลุยตลาดการเงิน

ทองปิดลบ $16.30 จากแรงขายทำกำไร-ตลาดจับตาจ้างงานสหรัฐฯ

คำถามหนักใจ! อยู่ในวงการเทรดมา 4 ปีรู้สึกเหนื่อยกับตลาด ควรไปต่อหรือพอแค่นี้?

เคล็ดลับขยันแบบสุขใจ ไม่ให้ ‘Toxic Productivity’ มาแย่งความสุข

เงินดอลลาร์ร่วงต่ำสุดในรอบ 8 สัปดาห์เทียบกับเงินเยน เนี่องจากเสี่ยงสงครามการค้าลดลง

คำนวณอัตราแลกเปลี่ยน