2025-02-18 02:02

อุตสาหกรรมAvoiding emotional trading.

#forexrisktip#

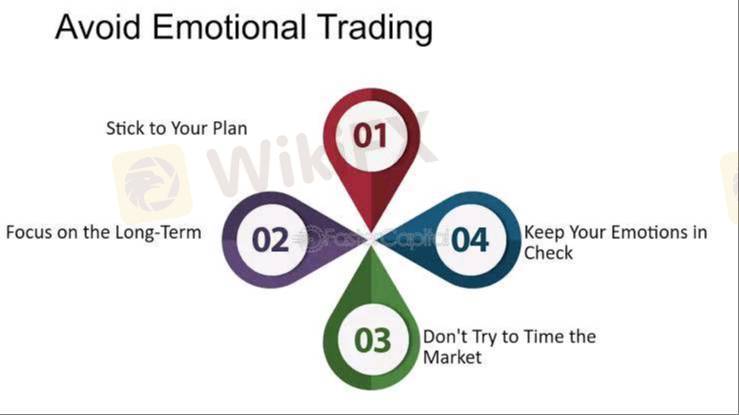

Emotional trading is when you make investment decisions based on fear, greed, or other feelings, rather than on a sound, logical strategy. This often leads to poor choices and significant losses. Here are some strategies to avoid emotional trading:

* Have a solid trading plan:

* Define your goals, risk tolerance, and investment strategy.

* Set clear entry and exit points for your trades.

* Stick to your plan and avoid impulsive decisions.

* Manage your risk:

* Only invest money you can afford to lose.

* Use stop-loss orders to limit potential losses.

* Diversify your portfolio to spread risk.

* Control your emotions:

* Recognize your emotional triggers and learn to manage them.

* Avoid making trades when you're feeling stressed, angry, or overly excited.

* Take breaks when needed to clear your head.

* Be patient:

* Don't chase quick profits or try to time the market.

* Wait for the right opportunities and don't rush into trades.

* Remember that investing is a long-term game.

* Keep a trading journal:

* Track your trades and analyze your decisions.

* Identify patterns of emotional trading and learn from your mistakes.

* Seek support:

* Talk to other traders or financial advisors.

* Join online communities to share experiences and learn from others.

Remember, successful trading requires discipline, patience, and a rational approach. By following these strategies, you can minimize the impact of emotions on your trading and increase your chances of success.

ถูกใจ 0

Jekam

โบรกเกอร์

การพูดคุยยอดนิยม

ดัชนีทางเทคนิค

สอบถามค่ะ

ดัชนีทางเทคนิค

ผูกบัญชี

ดัชนีทางเทคนิค

vps พึ่งใช้มาได้ 7 วัน

ดัชนีทางเทคนิค

ประกาศรายชื่อผู้โชคดี แจกหนังสือ Forex

ดัชนีทางเทคนิค

vps 7 วันแล้วถูกตัด

ดัชนีทางเทคนิค

ขอคำแนะนำหน่อยครับ

การแบ่งแยกตลาด

แพลตฟอร์ม

งานแสดงสินค้า

ตัวแทนโบรกเกอร์

รับสมัครงาน

EA

อุตสาหกรรม

ราคาตลาด

ดัชนี

Avoiding emotional trading.

อินเดีย | 2025-02-18 02:02

อินเดีย | 2025-02-18 02:02#forexrisktip#

Emotional trading is when you make investment decisions based on fear, greed, or other feelings, rather than on a sound, logical strategy. This often leads to poor choices and significant losses. Here are some strategies to avoid emotional trading:

* Have a solid trading plan:

* Define your goals, risk tolerance, and investment strategy.

* Set clear entry and exit points for your trades.

* Stick to your plan and avoid impulsive decisions.

* Manage your risk:

* Only invest money you can afford to lose.

* Use stop-loss orders to limit potential losses.

* Diversify your portfolio to spread risk.

* Control your emotions:

* Recognize your emotional triggers and learn to manage them.

* Avoid making trades when you're feeling stressed, angry, or overly excited.

* Take breaks when needed to clear your head.

* Be patient:

* Don't chase quick profits or try to time the market.

* Wait for the right opportunities and don't rush into trades.

* Remember that investing is a long-term game.

* Keep a trading journal:

* Track your trades and analyze your decisions.

* Identify patterns of emotional trading and learn from your mistakes.

* Seek support:

* Talk to other traders or financial advisors.

* Join online communities to share experiences and learn from others.

Remember, successful trading requires discipline, patience, and a rational approach. By following these strategies, you can minimize the impact of emotions on your trading and increase your chances of success.

ถูกใจ 0

ฉันต้องการที่จะแสดงความคิดเห็น

ถามคำถาม

0ความคิดเห็น

ยังไม่มีใครแสดงความคิดเห็น รีบแสดงความคิดเห็นก่อนเพื่อน

ถามคำถาม

ยังไม่มีใครแสดงความคิดเห็น รีบแสดงความคิดเห็นก่อนเพื่อน