MILIGO Information Revealed

บทคัดย่อ:MILIGO, operating as Millionyango Index Limited in Canada, offers a range of trading instruments including forex, commodities, indices, cryptocurrencies, and stocks. The company provides different account types tailored for businesses, individuals, and premium clients. Leverage is available at a maximum of 1:100, and spreads vary based on currency pairs. MILIGO employs the MetaTrader 4 platform for trading. However, concerns about its legitimacy arise due to lack of proper regulation and numerous complaints. Reviews suggest potential fraudulent activities, inadequate customer support, and allegations of unethical practices, cautioning against engagement with the platform.

| Aspect | Information |

| Registered Country/ Area | Canada |

| Founded Year | 2-5 years |

| Company Name | Millionyango Index Limited |

| Regulation | Operates without proper regulation |

| Minimum Deposit | No minimum deposit requirement |

| Maximum Leverage | 1:100 |

| Spreads | Around 0.1% for major pairs |

| Trading Platforms | MetaTrader 4 for Windows |

| Tradable Assets | Forex, Commodities, Indices, Cryptocurrencies, Stocks |

| Account Types | Business, Personal, Premium |

| Demo Account | Information not provided |

| Islamic Account | Information not provided |

| Customer Support | Insufficient available channels for assistance |

| Payment Methods | Bank transfers, Credit/Debit cards, E-wallets, Cryptocurrency |

| Educational Tools | Information not provided |

Overview of MILIGO

MILIGO, operating under the name Millionyango Index Limited, is a Canadian trading company with a presence of 2-5 years. Notably, MILIGO lacks proper regulatory oversight, raising concerns about its legitimacy. This caution is underscored by the accumulation of 10 complaints against the broker in the last 3 months, suggesting potential risks and possible fraudulent activities.

The platform offers a diverse range of trading options, including forex, commodities, indices, cryptocurrencies, and stocks. Account types cater to both businesses and individuals, with features like multiple user access, personalized reporting, and enhanced liquidity. Leverage is capped at 1:100, and spreads vary based on currency pairs.

Despite its offerings, MILIGO faces criticism for inadequate customer support and concerning reviews on platforms like WikiFX. Accusations of fraudulent practices, manipulation of prices, and difficulties with fund withdrawals have been reported. In conclusion, while MILIGO provides various trading avenues and account types, its lack of proper regulation and the presence of concerning feedback warrant caution for potential investors.

Pros and Cons

MILIGO presents a diverse range of trading instruments, encompassing forex, commodities, indices, cryptocurrencies, and stocks. It offers tailored account types for businesses, individuals, and premium customers, while providing a maximum leverage of 1:100. The platform facilitates depositing without fees for bank transfers and cryptocurrency transactions. However, MILIGO operates without proper regulation and faces accumulated complaints, while customer support is reported to be inadequate. Negative reviews suggest potential fraudulent practices and withdrawal challenges, compounded by an inaccessible main website. The trading is executed through MetaTrader 4, yet there is limited information on key trading parameters.

| Pros | Cons |

| Offers various trading instruments such as forex, commodities, indices, cryptocurrencies, and stocks. | Operates without proper regulation and has accumulated complaints. |

| Provides different account types tailored for businesses, individuals, and premium customers. | Insufficient customer support with limited channels for assistance. |

| Offers a maximum leverage of 1:100 for all trading accounts. | Numerous negative reviews indicating fraudulent practices and difficulties in withdrawing funds. |

| Minimum deposit requirement not specified. | Main website inaccessible |

| Uses MetaTrader 4 platform for trading operations. | Limited information on margin requirements and contract specifications. |

| No deposit fees for bank transfers and cryptocurrency transactions. | Lack of specific information on trading conditions and execution quality |

Is MILIGO Legit?

MILIGO operates without proper regulation, as confirmed. Caution is advised due to its lack of valid oversight. Notably, WikiFX has accumulated 10 complaints against this broker in the last 3 months, highlighting potential risks and the potential for fraudulent activities.

Market Instruments

FOREX: MILIGO offers a variety of forex trading instruments, allowing clients to engage in currency pairs like EUR/USD, USD/JPY, and GBP/JPY.

COMMODITIES: MILIGO provides access to commodity trading, enabling investors to trade commodities such as gold, silver, and crude oil.

INDICES: MILIGO allows trading on a range of global indices, including the S&P 500, NASDAQ, and FTSE 100.

CRYPTOCURRENCIES: MILIGO offers cryptocurrency trading, allowing users to trade popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

STOCKS: MILIGO provides the opportunity to trade stocks of various companies, including tech giants like Apple (AAPL), Amazon (AMZN), and Google (GOOGL).

Pros and Cons

| Pros | Cons |

| Offers cryptocurrencies | Lack of specific information on trading conditions |

| Provides access to various asset classes | Limited transparency regarding contract specifications |

| Opportunity to trade in multiple markets | Unclear details on margin requirements |

Account Types

BUSINESS ACCOUNT:

Tailored for businesses of various sizes, the Business Account encompasses features such as accommodating multiple users, the provision of an account manager, personalized reporting options, and an emphasis on enhanced liquidity to meet diverse business needs.

PERSONAL ACCOUNT:

Geared towards individuals, the Personal Account streamlines the account opening process, offers fee structures, facilitates online banking services, and provides access to MILIGO's widespread network of ATMs for easy transactions.

PREMIUM ACCOUNT:

Catering to discerning customers, the Premium Account encompasses all the attributes of both business and personal accounts. It includes expedited customer service, exclusive discounts, and offers, along with privileged access to MILIGO's VIP lounges, catering to a comprehensive and elevated banking experience.

Pros and Cons

| Pros | Cons |

| Tailored account options for various needs | Lack of detailed information on account features |

| Offers personalized reporting and support | Limited clarity on fee structures |

| Provides expedited service for premium customers | Potential disparities in benefits |

Leverage

MILIGO offers a maximum leverage of 1:100 for all trading accounts.

Spreads & Commissions

The spreads are typically around 0.1% for major currency pairs and can be higher for less liquid pairs. The commissions are typically around $1 for major currency pairs and can be higher for less liquid pairs.

Minimum Deposit

MILIGO does not have a minimum deposit requirement for opening a trading account.

Fees

Deposit fees at MILIGO are absent for bank transfers and cryptocurrency transactions, but a 3.5% charge is applicable for credit or debit card deposits. Withdrawal fees vary based on the chosen payment method, while MILIGO does not impose any inactivity fees.

Deposit & Withdrawal

MILIGO offers a variety of deposit and withdrawal methods, including bank transfers, credit cards, debit cards, e-wallets, and cryptocurrency. There are no fees for depositing funds via bank transfer or cryptocurrency, but there may be fees for withdrawing funds. The minimum withdrawal amount is also $100. The maximum deposit and withdrawal amounts depend on the payment method used.

Trading Platforms

MILIGO provides traders with the widely used MetaTrader 4 platform for Windows, offering a comprehensive interface for seamless trading operations, data analysis, and market monitoring.

Pros and Cons

| Pros | Cons |

| No deposit fees for bank transfers and cryptocurrency transactions. | Lack of specific information on trading conditions and execution quality. |

| Variety of deposit and withdrawal methods available. | Potential fees for withdrawing funds. |

| Minimum deposit requirement not specified. | Limited transparency on deposit and withdrawal limits. |

Customer Support

Customer support services provided by MILIGO appear to be insufficient, with reports indicating a lack of available channels for assistance or inquiries.

Reviews

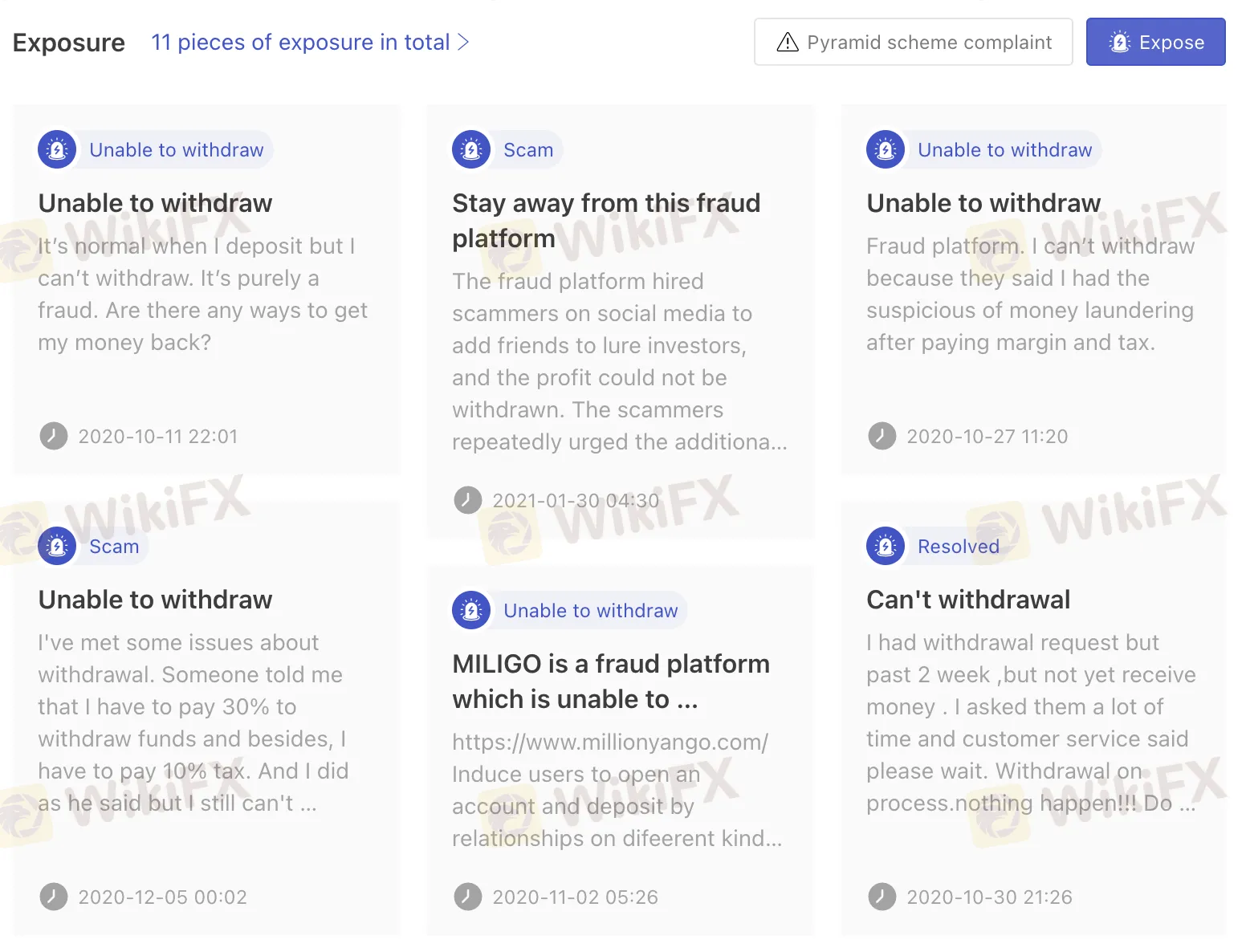

Reviews of MILIGO on WikiFX reveal concerning patterns. The broker has been accused of fraudulent practices, with instances of investors being lured through social media, promised profits that couldn't be withdrawn, and faced with incessant requests for additional investments. Reports detail manipulation of prices and account closures, often accompanied by accusations of money laundering. Numerous users from different regions have reported difficulties in withdrawing funds, encountering unresponsive customer service, and feeling victimized by MILIGO's actions, painting a picture of a platform that has faced accusations of scams and unethical practices.

Conclusion

In conclusion, MILIGO, operated by Millionyango Index Limited in Canada, offers a range of market instruments including forex, commodities, indices, cryptocurrencies, and stocks. The company provides different account types such as business, personal, and premium accounts, each with specific features tailored to different needs. MILIGO offers a maximum leverage of 1:100, with spreads and commissions varying based on currency pairs. While the absence of a minimum deposit requirement and various deposit/withdrawal methods can be advantageous, caution is advised due to the lack of proper regulation and concerning patterns highlighted by customer reviews on platforms like WikiFX. Reports indicate potential risks, including fraudulent activities, unresponsive customer support, and difficulties in fund withdrawals, suggesting the need for careful consideration before engaging with MILIGO.

FAQs

Q: What trading instruments does MILIGO offer?

A: MILIGO provides trading options for forex, commodities, indices, cryptocurrencies, and stocks.

Q: Are there different types of accounts on MILIGO?

A: Yes, MILIGO offers Business, Personal, and Premium accounts to cater to various needs.

Q: What leverage does MILIGO offer?

A: MILIGO offers a maximum leverage of 1:100 for all accounts.

Q: What are the spreads and commissions on MILIGO?

A: Spreads vary, typically around 0.1% for major currency pairs, with commissions starting at approximately $1.

Q: Is there a minimum deposit requirement for MILIGO?

A: MILIGO does not have a minimum deposit requirement.

Q: What are the deposit and withdrawal methods on MILIGO?

A: MILIGO supports bank transfers, credit/debit cards, e-wallets, and cryptocurrency for deposits and withdrawals.

Q: What trading platform does MILIGO offer?

A: MILIGO provides the MetaTrader 4 platform for trading.

Q: How is MILIGO's customer support?

A: Reports suggest MILIGO's customer support might be insufficient, lacking available channels.

Q: What do reviews say about MILIGO?

A: Reviews on WikiFX raise concerns about potential fraudulent practices, difficulties in fund withdrawals, and unresponsive customer service.

Q: Is MILIGO considered legitimate?

A: MILIGO operates without proper regulation and has accumulated complaints, indicating potential risks and the need for caution.

อ่านเพิ่มเติม

เทรด Forex เลือก ‘Leverage’ เทรดยังไง เท่าไหร่ดี?

รู้หรือไม่ว่าสิ่งหนึ่งที่ทำให้ตลาด Forex ทำกำไรได้สูงปี๊ดดดดคือ ‘Leverage’ มันสามารถทำให้คุณได้กำไรเป็นร้อยเป็นพันเท่าจากเงินเพียงไม่กี่บาท แต่นี่ก็เป็นดาบสองคม เพราะมันก็เพิ่มความเสี่ยงให้สูงปี๊ดเช่นกัน! ตกลง Leverage มันคืออะไร ทำงานยังไง แล้วเทรดเดอร์ต้องเลือก Leverage เท่าไหร่ถึงจะดี?

ขอเตือนเป็นครั้งสุดท้ายกับโบรกเกอร์นี้ว่าให้หลีกเลี่ยง!

โบรกเกอร์เจ้านี้เป็นโบรกเกอร์ที่มีประวัติไม่ดีมาค่อนข้างนาน เพราะนักลงทุนหลายรายไม่สามารถถอนเงินออกมาได้ตั้งแต่ปีที่แล้ว

Wiki โบรกเกอร์

FXTM

OANDA

STARTRADER

FXCM

FBS

HFM

FXTM

OANDA

STARTRADER

FXCM

FBS

HFM

Wiki โบรกเกอร์

FXTM

OANDA

STARTRADER

FXCM

FBS

HFM

FXTM

OANDA

STARTRADER

FXCM

FBS

HFM

ข่าวล่าสุด

“ทรัมป์” เตรียมประกาศรีดภาษีนำเข้าเหล็กและอลูมิเนียม 25% จากทุกประเทศวันนี้

เหตุการณ์สำคัญทางเศรษฐกิจที่น่าสนใจสัปดาห์นี้

ทองฟิวเจอร์พุ่ง $25.70 ทำนิวไฮ นลท.แห่ซื้อสินทรัพย์ปลอดภัยหลังทรัมป์ขึ้นภาษีเหล็ก

โพลรอยเตอร์คาดเฟดเบรกลดดอกเบี้ยอีกหลายเดือน กังวลภาษีทรัมป์ดันเงินเฟ้อพุ่ง

เลือกคู่สกุลเงินที่ใช่ เหมือนเลือกคู่รักที่เข้าใจ

FTMO ปิดดีลสำคัญ! การเข้าซื้อ OANDA

WikiFX รีวิวโบรกเกอร์ |MH Markets โพสต์นี้มีคำตอบ !

ทรัมป์กำหนดภาษีนำเข้าเหล็กและอะลูมิเนียม 25% โดยไม่มีข้อยกเว้น

คำนวณอัตราแลกเปลี่ยน