CDB Bank

บทคัดย่อ:CDB Bank, founded in Cyprus in 1963, has a distinguished history as the first financial institution in Cyprus to provide project financing and advise governmental bodies on vital infrastructure matters. With a well-established reputation, it has gained trust and recognition in the financial sector. The bank offers a diverse range of financial products and services, catering to a wide clientele, making it a versatile choice for investments and trading. CDB Bank's global presence, with branches and offices in over 50 countries, ensures accessibility to an international client base. The bank also prioritizes financial education, offering online courses, webinars, and tutorials to enhance clients' financial literacy and trading skills. Additionally, its robust customer support, available 24/7 via phone, email, and live chat, ensures clients can readily access assistance and information. However, it's important to note that CDB Bank operates without regulatory oversight, potentially imp

| Aspect | Information |

| Company Name | CDB Bank |

| Registered Country/Area | Cyprus |

| Founded Year | 1963 |

| Regulation | Not regulate |

| Minimum Deposit | $200 |

| Maximum Leverage | Up to 500:1 |

| Spreads | Starting from 1 pip |

| Trading Platforms | CDB Trader, CDB WebTrader, CDB Mobile Trader |

| Tradable Assets | Forex, Equities, Commodities, Fixed Income |

| Account Types | Personal, Corporate, Institutional |

| Customer Support | Telephone: +357 22 846 500, email at info@cdb.com.cy |

| Deposit & Withdrawal | Wire transfer, Bank transfer, Credit card, Debit card |

| Educational Resources | Online courses, Webinars, Tutorials |

Overview of CDB Bank

CDB Bank, founded in Cyprus in 1963, has a distinguished history as the first financial institution in Cyprus to provide project financing and advise governmental bodies on vital infrastructure matters. With a well-established reputation, it has gained trust and recognition in the financial sector. The bank offers a diverse range of financial products and services, catering to a wide clientele, making it a versatile choice for investments and trading.

CDB Bank's global presence, with branches and offices in over 50 countries, ensures accessibility to an international client base. The bank also prioritizes financial education, offering online courses, webinars, and tutorials to enhance clients' financial literacy and trading skills. Additionally, its robust customer support, available 24/7 via phone, email, and live chat, ensures clients can readily access assistance and information.

However, it's important to note that CDB Bank operates without regulatory oversight, potentially impacting financial stability and industry standards adherence.

Is CDB Bank legit or a scam?

CDB Bank operates without any regulatory oversight, posing significant risks. The absence of regulatory control leaves customers and investors vulnerable to potential misconduct and malpractices. Without regulatory supervision, there is no guarantee of the bank's financial stability, operational transparency, or adherence to industry standards. This lack of oversight also hinders the resolution of disputes and conflicts, potentially jeopardizing the interests of depositors and stakeholders. It is crucial for individuals and organizations to exercise caution when dealing with unregulated financial institutions like CDB Bank, as they may lack the safeguards and protections provided by regulatory authorities in the event of unforeseen issues or crises.

Pros and Cons

| Pros | Cons |

| Wide range of financial products | Unregulatory |

| Established Reputation | Minimum Deposit Requirements |

| Global Presence | |

| Educational Resources | |

| Customer Support |

Pros:

Established Reputation: CDB Bank is a well-established financial institution with a strong track record, instilling a sense of trust and reliability.

Diverse Financial Products: The bank offers a wide range of financial products and services, catering to the needs of a variety of clients, ensuring a broad array of options for investment and trading.

Global Presence: With branches and offices in over 50 countries, CDB Bank has a global reach, making it accessible to a wide and international client base.

Educational Resources: CDB Bank provides clients with educational resources, including online courses, webinars, and tutorials, enhancing financial literacy and trading skills.

Customer Support: The bank offers comprehensive customer support with 24/7 phone assistance, email support, and live chat options, ensuring clients can access help and information when needed.

Cons:

Lack of Regulatory Safeguards: Without regulatory supervision, there is no guarantee of the bank's financial stability, operational transparency, or adherence to industry standards.

Minimum Deposit Requirements: While CDB Bank offers various account types, some have relatively higher minimum deposit requirements, which might be a barrier for individuals or smaller businesses looking to start trading with the bank.

Market Instruments

CDB Bank presents a diverse array of market instruments to its customers, including Forex, Equities, Commodities, and Fixed Income options.

Forex

CDB Bank offers trading in over 60 currency pairs, including major, minor, and exotic currencies. Forex trading is a popular way to trade on the movement of currencies against each other. Forex traders can speculate on short-term or long-term price movements.

Equities

CDB Bank offers trading in equities on stock exchanges around the world. Equities are shares in publicly traded companies. Equity traders can buy and sell shares in companies they believe have the potential to grow or appreciate in value.

Commodities

CDB Bank offers trading in a variety of commodities, including energy products, metals, and agricultural products. Commodity trading is a way to speculate on the prices of raw materials. Commodity traders can buy and sell contracts to buy or sell commodities at a future date.

Fixed income

CDB Bank offers trading in a variety of fixed-income securities, including bonds, bills, and certificates of deposit. Fixed-income securities are debt obligations that pay investors a fixed rate of interest over a set period of time. Fixed-income traders can buy and sell fixed-income securities to generate income or to profit from price movements.

Account Types

CDB Bank offers a range of account types, each designed to meet various trading needs.

For the “Personal” account type, customers can enjoy leverage of up to 500:1, allowing for amplified trading positions. The spread is variable, starting from 1 pip, which can be competitive. With a minimum deposit of $200, it provides an accessible entry point for individual traders. Additionally, a demo account is available, enabling users to practice trading strategies risk-free.

The “Corporate” account type also offers up to 500:1 leverage and a variable 1 pip spread. However, it requires a higher minimum deposit of $1,000, making it suitable for businesses and corporations. Like the “Personal” account, it includes a demo account for practice.

For more substantial institutions, the “Institutional” account offers the same leverage and spread. It comes with a minimum deposit requirement of $5,000, catering to larger organizations and institutions. Additionally, a demo account is available for those who wish to test strategies before committing real capital.

These account types provide flexibility to accommodate a range of traders and organizations with varying levels of experience and capital.

| Aspects | Personal | Corporate | Institutional |

| Leverage | Up to 500:1 | Up to 500:1 | Up to 500:1 |

| Spread | Variable from 1 pip | Variable from 1 pip | Variable from 1 pip |

| Minimum Deposit | $200 | $1,000 | $5,000 |

| Demo Account | Yes | Yes | Yes |

| Customer Support | 24/7 Live Chat, Email, Phone | 24/7 Live Chat, Email, Phone | 24/7 Live Chat, Email, Phone |

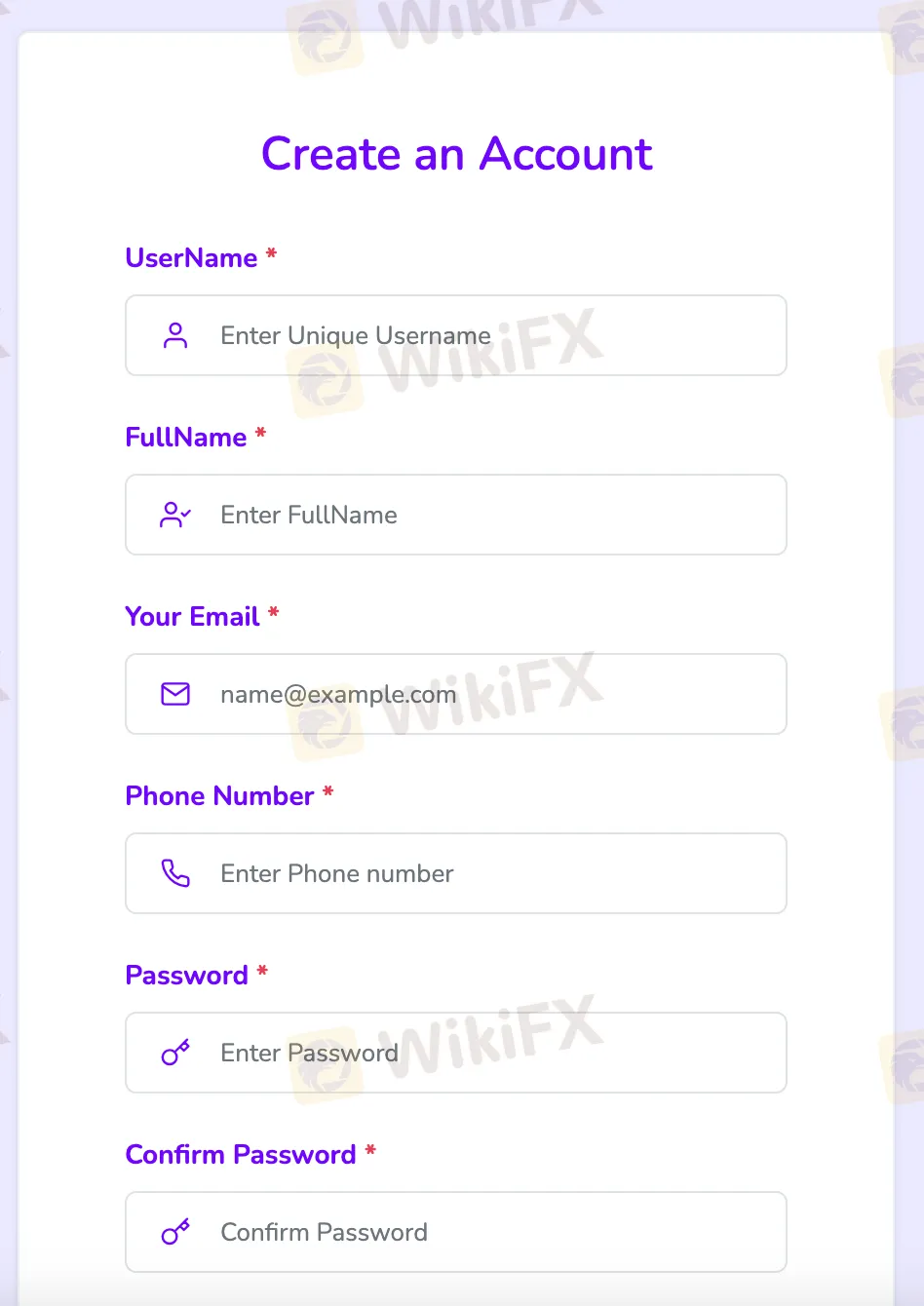

How to Open an Account?

To open an account with CDB Bank, follow these six steps:

Registration:

Start by visiting the official CDB Bank website and locating the “Open an Account” or “Register” button. You will be prompted to provide personal information, such as your name, contact details, and address.

Account Type Selection:

Choose the type of account that suits your needs, whether it's a personal, corporate, or institutional account. Each account type has specific features and requirements.

Documentation:

Prepare the necessary documents, which typically include identification, proof of address, and financial information. CDB Bank may request additional documentation based on the type of account you're opening.

Application Submission:

Complete the application form provided on the website, ensuring that you provide accurate and up-to-date information. Double-check all details to avoid errors.

Verification:

CDB Bank will review your application and documents. This process may take some time, as the bank needs to verify your identity and assess your eligibility.

Account Activation:

Once your application is approved, CDB Bank will provide you with the necessary details to access your new account. You will receive login credentials and instructions on how to fund your account.

Leverage

Leverage at CDB Bank allows traders to amplify their positions, with all account types offering up to 500:1 leverage, enhancing the potential for both gains and losses in their trades.

Spreads & Commissions

CDB Bank's spreads and commissions vary depending on the type of account you have and the market instrument you are trading. However, here are some general examples:

Forex: CDB Bank's forex spreads are typically around 1 pip for major currency pairs and 3 pips for minor currency pairs. Commissions are charged on a per-trade basis and are typically around 0.02% of the trade value.

Equities: CDB Bank's equity commissions are typically around 0.01% of the trade value for US stocks and 0.05% of the trade value for international stocks.

Commodities: CDB Bank's commodity commissions vary depending on the commodity being traded. For example, the commission for trading gold is typically 0.03% of the trade value and the commission for trading oil is typically 0.05% of the trade value.

Fixed income: CDB Bank's fixed income commissions vary depending on the type of security being traded. For example, the commission for trading bonds is typically 0.01% of the trade value and the commission for trading certificates of deposit is typically 0.02% of the trade value.

Trading Platform

CDB Bank provides a selection of trading platforms to cater to diverse customer preferences and needs. These platforms include CDB Trader, CDB WebTrader, and CDB Mobile Trader.

CDB Trader is a desktop-based trading platform that offers a comprehensive range of features for experienced traders. It provides access to various financial instruments and allows for in-depth technical analysis. Traders can execute orders, access real-time data, and utilize advanced charting tools. However, this platform may have a steeper learning curve and is primarily designed for those with prior trading experience.

CDB WebTrader is a web-based platform, which means it can be accessed directly through a web browser without the need for installation. It offers a user-friendly interface, making it suitable for traders of all levels, including beginners. WebTrader provides access to essential trading tools, real-time data, and order execution capabilities, making it a convenient choice for those who prefer a more accessible and intuitive trading experience.

CDB Mobile Trader is designed for traders on the go. It's available as a mobile app, providing flexibility and convenience. This platform allows users to access their accounts, monitor the markets, and execute trades from their smartphones or tablets. While it may lack some of the advanced features of desktop platforms, it is a suitable option for those who prioritize mobility and accessibility.

Each of these platforms caters to different trading needs, from advanced and feature-rich to user-friendly and mobile-focused. Customers can choose the platform that aligns best with their trading skills and preferences.

Deposit & Withdrawal

CDB Bank supports a variety of payment methods, including:

Wire transfer

Bank transfer

Credit card

Debit card

The minimum deposit for a CDB Bank account varies depending on the type of account you open. For example, the minimum deposit for a personal account is $500 and the minimum deposit for a corporate account is $10,000.

CDB Bank typically processes payments within 24 hours. However, in some cases, it may take up to 3 business days for payments to be processed.

| Aspects | Personal | Corporate | Institutional |

| Minimum Deposit | $200 | $1,000 | $5,000 |

Customer Support

CDB Bank provides comprehensive customer support services in English. Customers can avail themselves of round-the-clock assistance through 24/7 phone support. Additionally, they have the option to seek help and information via email at info@cdb.com.cy and marketing@cdb.com.cy. Live chat support is also available for real-time queries.

The bank's contact information is as follows:

Address:

Alpha House, 50 Arch. Makarios III Ave., CY-1065 Nicosia, P.O. Box 21415, CY-1508 Nicosia

Telephone:

+357 22 846 500

Fax:

+357 22 846 600

This array of customer support options ensures that clients can easily access assistance and information to address their banking needs and inquiries.

Educational Resources

CDB Bank offers a variety of educational resources to help clients learn about financial products and services. These resources include:

Online courses: CDB Bank offers a variety of online courses covering topics such as forex trading, stock investing, and fixed income. These courses are self-paced and can be accessed from anywhere in the world.

Webinars: CDB Bank hosts regular webinars on a variety of financial topics. These webinars are led by CDB Bank experts and provide valuable insights and information.

Tutorials: CDB Bank offers a variety of tutorials on how to use its trading platforms and other services. These tutorials are designed to help clients get the most out of their CDB Bank accounts.

Conclusion

In conclusion, CDB Bank, with its extensive history and global presence, offers a diverse range of financial products and services, making it an attractive choice for clients seeking versatility and financial education. However, the absence of regulatory oversight raises concerns about financial stability and industry standards. The bank's high minimum deposit requirements may also limit accessibility for smaller investors. Despite these drawbacks, CDB Bank provides market instruments like Forex, Equities, Commodities, and Fixed Income options, catering to a variety of trading strategies. Clients should carefully weigh the advantages and disadvantages when considering CDB Bank as a financial partner, taking into account their specific needs and risk tolerance.

FAQs

Q: How can I contact CDB Bank's customer support?

A: You can reach CDB Bank's customer support via 24/7 live chat, email at info@cdb.com.cy, or by phone at +357 22 846 500.

Q: What are the minimum deposit requirements for CDB Bank's different account types?

A: The minimum deposit varies depending on the account type. For a Personal account, it's $200, for a Corporate account, it's $1,000, and for an Institutional account, it's $5,000.

Q: What trading platforms does CDB Bank offer?

A: CDB Bank provides three trading platforms: CDB Trader, CDB WebTrader, and CDB Mobile Trader to cater to different trading preferences.

Q: Does CDB Bank offer educational resources for clients?

A: Yes, CDB Bank provides clients with educational resources, including online courses, webinars, and tutorials to enhance financial literacy and trading skills.

Q: Is CDB Bank regulated by any financial authorities?

A: No, CDB Bank operates without regulatory oversight, which can be a concern for some clients in terms of financial stability and industry standards.

Q: What types of market instruments are available for trading at CDB Bank?

A: CDB Bank offers a variety of market instruments, including Forex, Equities, Commodities, and Fixed Income options to suit different trading strategies and preferences.

Wiki โบรกเกอร์

FXCM

FP Markets

AvaTrade

IB

Exness

OANDA

FXCM

FP Markets

AvaTrade

IB

Exness

OANDA

Wiki โบรกเกอร์

FXCM

FP Markets

AvaTrade

IB

Exness

OANDA

FXCM

FP Markets

AvaTrade

IB

Exness

OANDA

ข่าวล่าสุด

วิกฤตหนี้ IMF กับผลกระทบที่วัยรุ่น 90’s ไม่อาจลืม

ข้อคิดดีๆ จากหนังสือ "วิถีผู้ชนะฉบับคนเก่งแบบเป็ด"

ทองปิดบวก $17.20 ทำนิวไฮ รับแรงซื้อสินทรัพย์ปลอดภัย

ทองปิดลบ $16.30 จากแรงขายทำกำไร-ตลาดจับตาจ้างงานสหรัฐฯ

คำถามหนักใจ! อยู่ในวงการเทรดมา 4 ปีรู้สึกเหนื่อยกับตลาด ควรไปต่อหรือพอแค่นี้?

เคล็ดลับขยันแบบสุขใจ ไม่ให้ ‘Toxic Productivity’ มาแย่งความสุข

เงินดอลลาร์ร่วงต่ำสุดในรอบ 8 สัปดาห์เทียบกับเงินเยน เนี่องจากเสี่ยงสงครามการค้าลดลง

WikiFX รีวิวโบรกเกอร์ | Moneta Markets โพสต์นี้มีคำตอบ !

คำนวณอัตราแลกเปลี่ยน