Gkoudai

บทคัดย่อ:Founded in China in 2011, Gkoudai operates as a trading platform with a focus on precious metals, futures, and accumulation funds. The platform offers a range of account types, providing flexibility for various traders, and allows leverage up to 100x for margin trading. While providing 24/7 customer support and a demo account for practice, Gkoudai emphasizes comprehensive educational resources to empower users in navigating the financial markets. However, it operates without regulatory oversight, posing risks, and users should carefully consider factors like spread and commission. The platform strives to provide a user-friendly experience accessible on PC, Android, and iOS platforms.

| Aspect | Information |

| Company Name | Gkoudai |

| Registered Country/Area | China |

| Founded Year | 2011 |

| Regulation | Unregulated |

| Minimum Deposit | $20 |

| Maximum Leverage | Up to 100x |

| Spreads | Fluctuates within ±6% |

| Trading Platforms | Pocket Precious Metals software available on PC, Android, and iOS platforms |

| Tradable Assets | Precious metals, futures, accumulation funds |

| Account Types | Standard |

| Customer Support | Email at support@gkoudai.com, phone at 4000-186-025 |

| Deposit & Withdrawal | Wire transfer and credit card |

| Educational Resources | Market trend analysis, physical gold education, Pocket Live Room sessions |

Overview of Gkoudai

Founded in China in 2011, Gkoudai operates as a trading platform with a focus on precious metals, futures, and accumulation funds. The platform offers a range of account types, providing flexibility for various traders, and allows leverage up to 100x for margin trading. While providing 24/7 customer support and a demo account for practice, Gkoudai emphasizes comprehensive educational resources to empower users in navigating the financial markets. However, it operates without regulatory oversight, posing risks, and users should carefully consider factors like spread and commission. The platform strives to provide a user-friendly experience accessible on PC, Android, and iOS platforms.

Is gkoudai legit or a scam?

Gkoudai operates without regulatory oversight, posing inherent risks. The absence of regulatory scrutiny raises concerns about transparency, accountability, and compliance. Investors may face uncertainties regarding financial practices, ethical standards, and consumer protection. Without regulatory checks, Gkoudai's activities lack a safeguard against potential misconduct, fraud, or market manipulation. This unregulated status heightens the need for due diligence, as the absence of regulatory supervision amplifies the vulnerability to financial and operational risks. Investors are advised to carefully evaluate and understand the potential consequences associated with engaging with an unregulated entity like Gkoudai.

Pros and Cons

| Pros | Cons |

| Various market instruments | Unregulated |

| Account Types | Relatively high spread&commission |

| Leverage up to 100x | |

| 24/7 customer support | |

| Comprehensive educational resources |

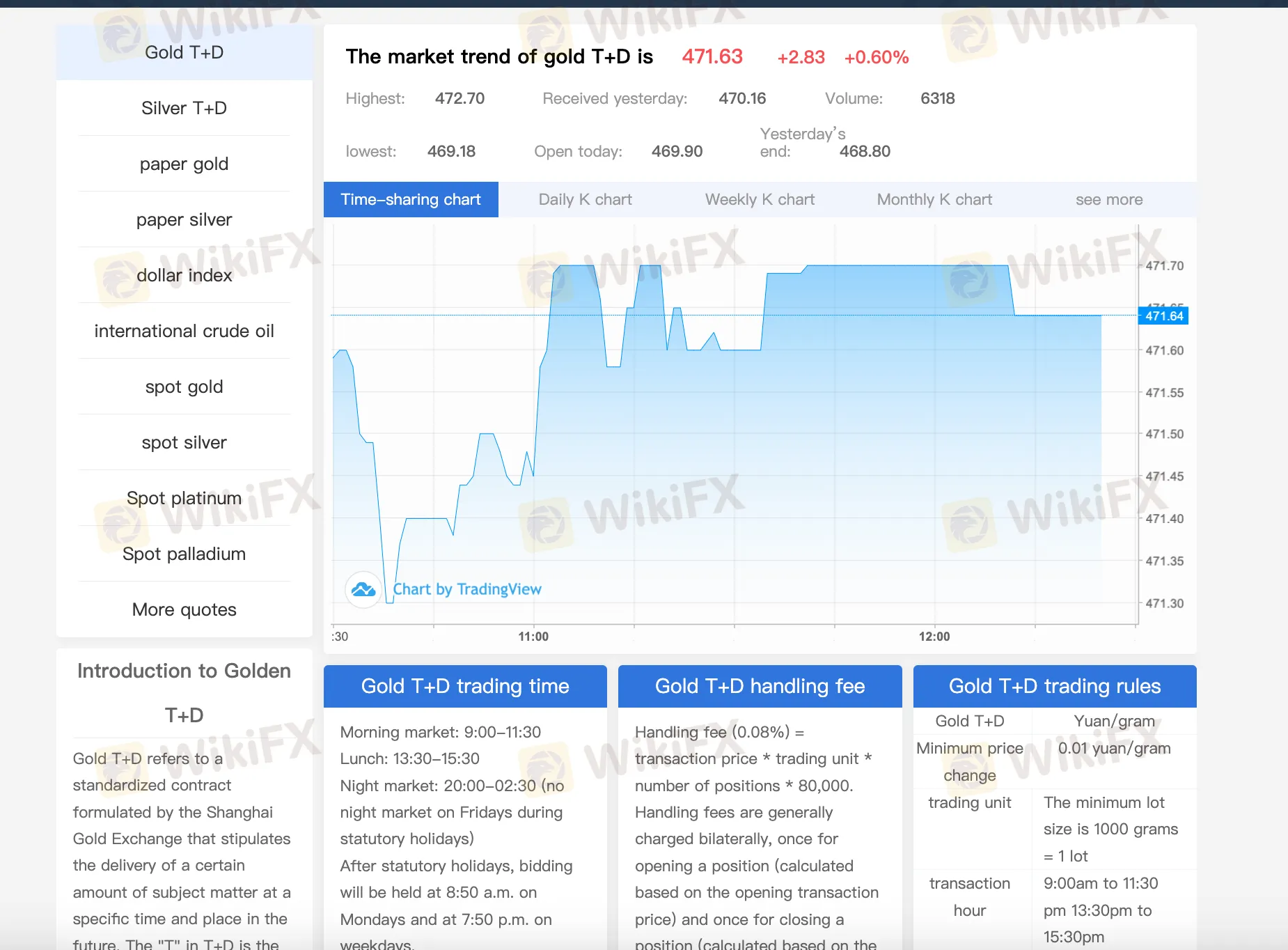

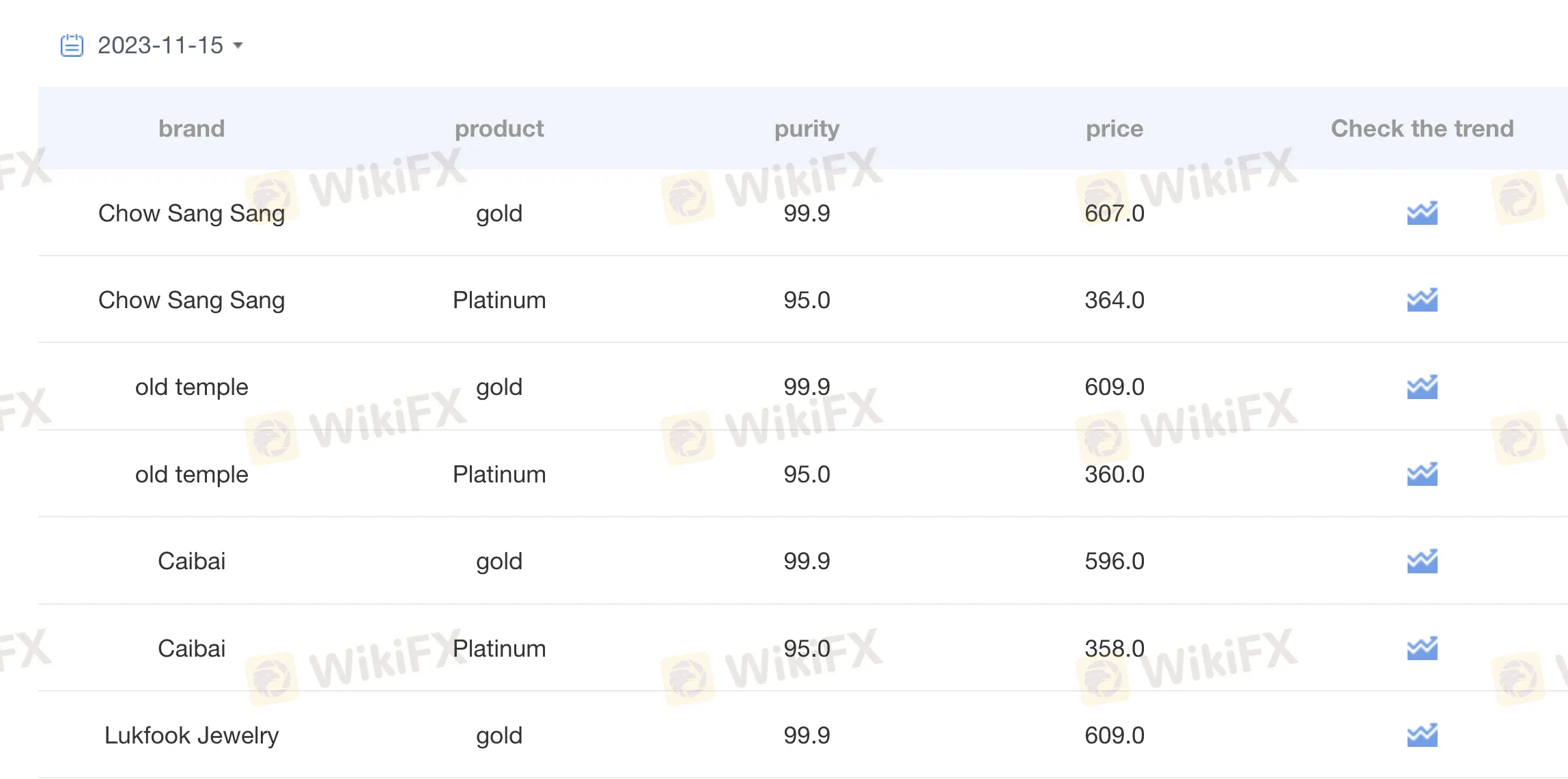

Market Instruments

Gkoudai provides diverse educational resources centered around the types of products tradable on its platform. Here's a breakdown of their educational offerings:

Pocket Precious Metals:

Gkoudai's educational resources cover trading in precious metals, futures, and accumulation funds through its feature “Pocket Precious Metals.”

Precious Metals Trading:

Users can learn about various precious metals supported on the platform, including silver T+D, gold T+D, gold 9999, gold 9995, gold 100g, mini gold T+D, gold T+N1, gold T+N2, i gold 100g, i gold 995, i gold 9999, and the panda 30g gold coin.

Bank Partnerships for Account Opening:

Educational content informs users about the supported banks for account opening, such as Shanghai Pudong Development Bank, Industrial and Commercial Bank of China, and Guangxi Financial.

Futures Trading:

Gkoudai collaborates with three futures companies—Zhongda Futures, New Era Futures, and Haizheng Futures. Users can access educational materials on trading the five major exchange varieties offered through these partnerships.

Accumulative Fund Trading:

Gkoudai's educational resources cover the cooperation with Bank of China for accumulation fund trading, allowing users to benefit from gold fluctuations and fixed dividends.

Through these resources, Gkoudai aims to educate users on the intricacies of trading various products on its platform, enabling informed investment decisions.

Account Types

Gkoudai's Standard account offers traders leverage of up to 100x, allowing substantial control over positions. The spread for Gold T+D fluctuates within ±6%, subject to the previous trading day's settlement price. Commission fees for gold trading are determined by futures companies. The minimum deposit for the Standard account is $20, making it accessible for various traders. Gkoudai provides a demo account for risk-free practice, utilizing the Pocket Precious Metals trading tool. Customer support is available 24/7 through email, live chat, and phone, ensuring assistance and guidance whenever needed.

| Feature | Standard account |

| Leverage | Up to 100x |

| Spread | Fluctuates within ±6% |

| Commission | Set by futures companies |

| Minimum Deposit | $20 |

| Demo Account | Yes |

| Trading Tool | Pocket Precious Metals |

| Customer Support | 24/7 through email, live chat, and phone. |

How to Open an Account?

Here is a guide to open an account with Gkoudai:

Visit Gkoudai Website:

Go to the official Gkoudai website to initiate the account opening process.

Provide Personal Information:

Fill in the required information, including your name, email, contact details, and any additional details as prompted.

Submit Identification Documents:

Upload necessary identification documents, which may include a government-issued ID, proof of address, and any other documents required for account verification.

Deposit Funds:

Once your account is verified, deposit funds using the available payment methods, such as wire transfer or credit card, to start trading on the Gkoudai platform.

Leverage

Gkoudai provides margin trading with an impressive leverage of up to 100x, allowing you to command a position valued at 100 times your initial deposit. This feature enhances your trading flexibility, enabling potentially substantial profits. However, it's crucial to recognize that the use of leverage can magnify both gains and losses.

Spreads & Commissions

Precious Metal Trading with Gkoudai:

Gkoudai offers gold trading with a focus on Gold T+D contracts, where investors can participate in standardized agreements for the future delivery of a specific amount of gold.

The spread for Gold T+D is subject to a ±6% fluctuation limit based on the settlement price of the previous trading day.

It's essential for traders to be aware of this limit, as it impacts the potential price variation within the trading environment. The commission for gold trading is charged by futures companies, and the handling fees vary based on the specific terms and conditions of the trading lots or total transaction volume.

| Product | Spread | Commission |

| Gold T+D | ±6% | Charged by Futures Companies |

| Silver T+D (AG T+D) | ±8% | Charged by Futures Companies |

| Mini Gold T+D (mAu T+D) | ±6% | Charged by Futures Companies |

Futures Trading with Gkoudai:

In the realm of futures trading on Gkoudai, investors can engage in various futures contracts, each subject to its own set of trading rules and fees. Futures trading involves contracts like Gold T+D, Silver T+D (AG T+D), and Mini Gold T+D (mAu T+D). These contracts have distinct characteristics, including specific fluctuation limits and trading hours. The spread and commission for futures trading are influenced by the terms established by futures companies. Handling fees are applied, with methods of calculation based on factors such as trading lots or total transaction volume. It's crucial for traders to understand these fees to make informed decisions within the futures market on Gkoudai.

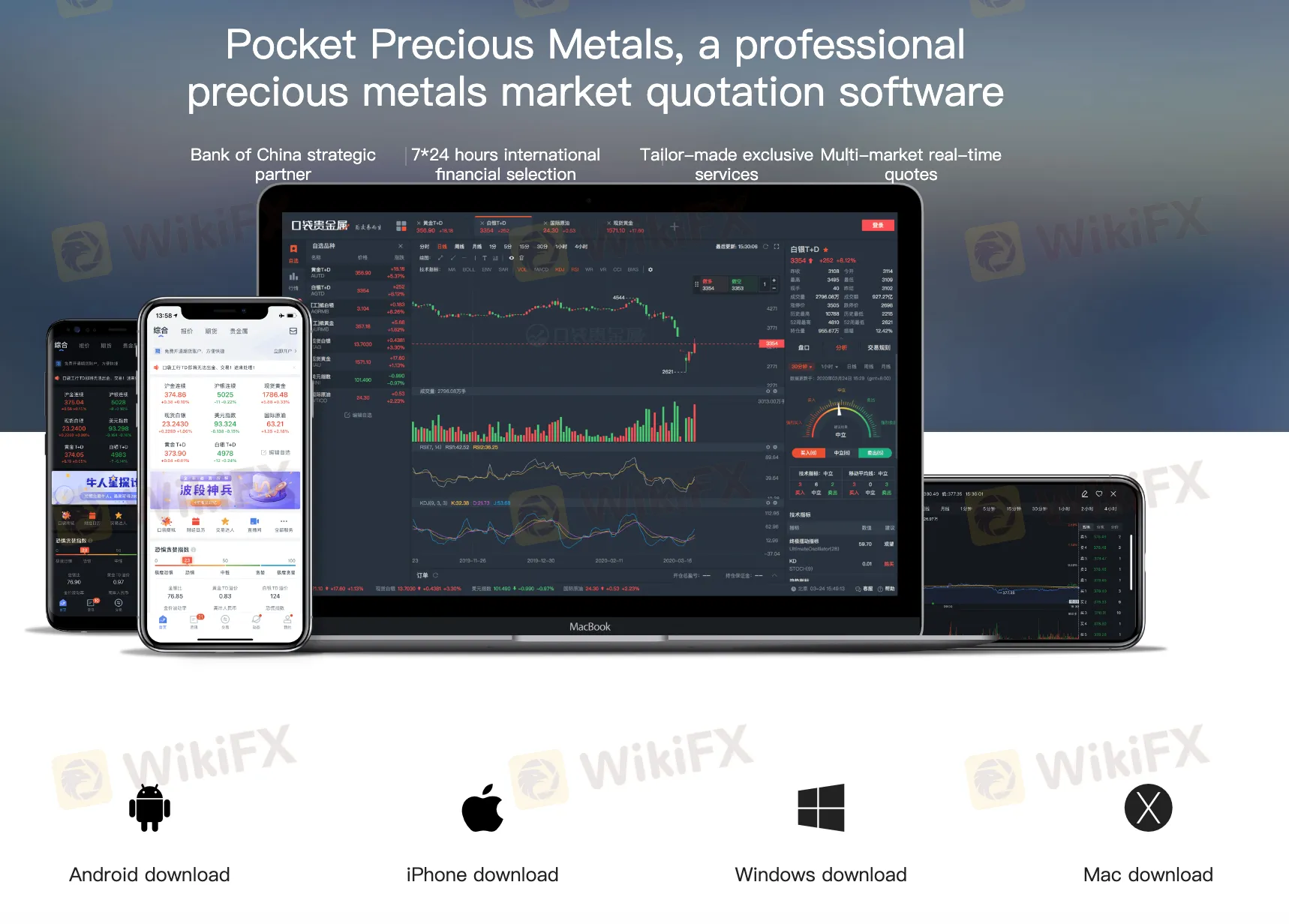

Trading Platform

Gkoudai offers the Pocket Precious Metals software, available on PC, Android, and iOS platforms, ensuring user-friendly accessibility. Key features include:

Strategic Partnership with Bank of China: The platform underscores its strategic collaboration with the Bank of China, establishing a noteworthy association with a major financial institution.

24/7 International Financial Selection: Gkoudai emphasizes continuous accessibility, providing users with 24/7 international financial options, enabling engagement with the platform at any time.

Tailor-Made Exclusive Services: Gkoudai prioritizes personalized services, delivering tailor-made exclusive offerings to meet individual user needs or preferences.

Multi-Market Real-Time Quotes: The platform empowers users to access real-time quotes across diverse markets, showcasing comprehensive coverage of market data to aid traders in making well-informed decisions.

Deposit & Withdrawal

Gkoudai provides diverse payment methods for deposits and withdrawals, encompassing wire transfer and credit card transactions. The minimum deposit requirement varies according to the chosen payment method, with wire transfers requiring a minimum of $50 and credit card deposits having a minimum threshold of $20.

The processing times for payments differ based on the selected method. Wire transfers typically take 3-5 business days to complete, ensuring the secure transfer of funds. In contrast, credit card deposits boast instant processing, facilitating swift and efficient transactions for users.

This flexibility in payment options and transparent information on minimum amounts and processing times contribute to a seamless financial experience for Gkoudai users.

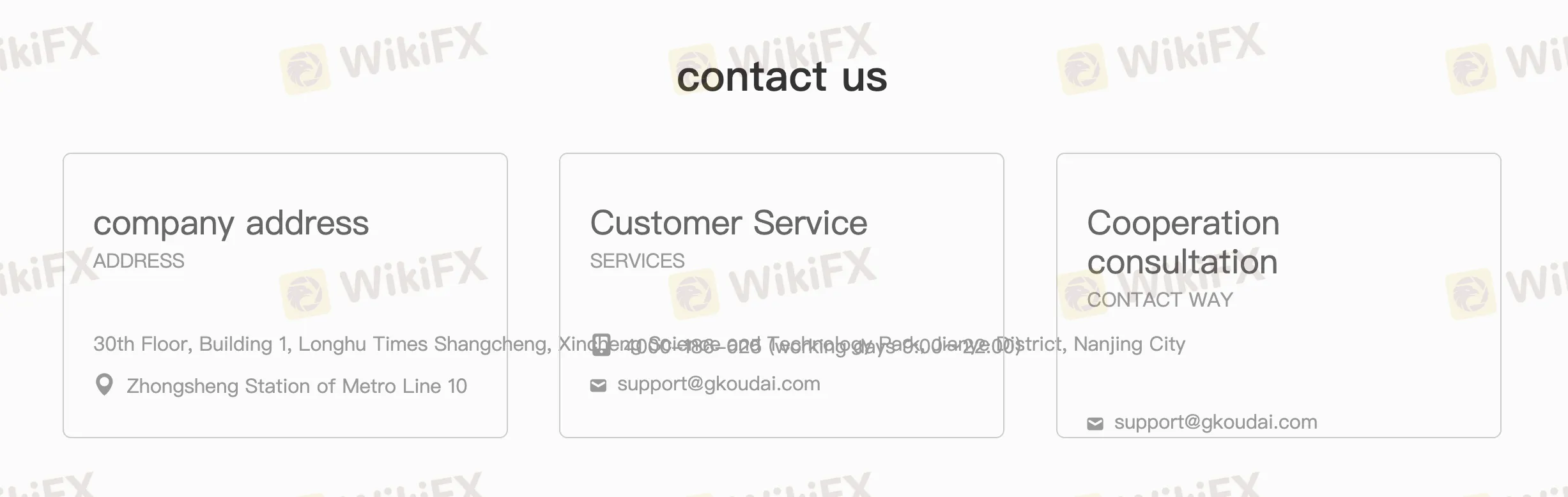

Customer Support

Gkoudai provides customer support through various channels.

Users can reach out via email at support@gkoudai.com for general inquiries and services.

The company also offers cooperation consultation through the same email address.

For those preferring direct communication, the customer service hotline at 4000-186-025 is available on working days from 9:00 to 22:00.

Additionally, the company is reachable at its physical address on the 30th Floor, Building 1, Longhu Times Shangcheng, Xincheng Science and Technology Park, Jianye District, Nanjing City. The convenient location near Zhongsheng Station of Metro Line 10 enhances accessibility for clients seeking in-person assistance or consultation.

Educational Resources

Gkoudai provides educational resources focusing on market trends and investment opportunities, particularly in physical gold trading. Here's a breakdown of their educational offerings:

Market Trend Analysis

- Gkoudai offers comprehensive resources for analyzing market trends. Investors can access insights and information to stay informed about current market dynamics, aiding in strategic decision-making.

Physical Gold Education

- The platform emphasizes education on physical gold trading, guiding users on the intricacies of investing in this precious metal. Topics may include understanding market factors influencing gold prices and the logistics of physical gold transactions.

Pocket Live Room

- Gkoudai introduces the “Pocket Live Room,” providing an interactive space where users can engage with live sessions. These sessions likely cover diverse aspects of trading, fostering a learning environment through real-time discussions, market updates, and expert insights.

Through these educational resources, Gkoudai aims to empower users with the knowledge needed to navigate the complexities of the financial markets and make informed investment decisions.

Conclusion

Gkoudai is a trading platform specializing in precious metals, futures, and accumulation funds. Offering diverse account types and leverage up to 100x, it caters to various traders. Despite comprehensive educational resources, 24/7 customer support, and a user-friendly interface, the absence of regulatory oversight raises concerns about transparency. The platform's emphasis on market instruments and strategic partnerships, notably with the Bank of China, adds to its appeal. However, users should be cautious about potential risks associated with unregulated trading. Gkoudai strives to empower users through education while navigating the complexities of financial markets.

FAQs

Q: How do I open an account on Gkoudai?

A: To open an account on Gkoudai, visit the official website, select your preferred account type, provide personal information, submit identification documents, and deposit funds.

Q: What payment methods are accepted for deposits on Gkoudai?

A: Gkoudai accepts wire transfer and credit card transactions for deposits. The minimum deposit amount varies based on the chosen payment method.

Q: Can I practice trading without risking real money on Gkoudai?

A: Yes, Gkoudai offers a demo account that allows users to practice trading without risking real money.

Q: What is the leverage offered by Gkoudai?

A: Gkoudai provides margin trading with leverage of up to 100x, allowing substantial control over positions.

Q: How is customer support provided on Gkoudai?

A: Gkoudai offers 24/7 customer support through email, live chat, and phone. Users can also visit the company's physical address for in-person assistance.

Q: What educational resources are available on Gkoudai?

A: Gkoudai provides educational resources covering market trends, physical gold trading, futures trading, and more. Users can access insights and information to make informed investment decisions.

Wiki โบรกเกอร์

EC Markets

FP Markets

Vantage

FXTM

FXCM

Pepperstone

EC Markets

FP Markets

Vantage

FXTM

FXCM

Pepperstone

Wiki โบรกเกอร์

EC Markets

FP Markets

Vantage

FXTM

FXCM

Pepperstone

EC Markets

FP Markets

Vantage

FXTM

FXCM

Pepperstone

ข่าวล่าสุด

ทรัมป์ปัดตอบประเด็นภาวะถดถอยทางเศรษฐกิจจากนโยบายภาษีปัจจุบัน

เหตุการณ์สำคัญทางเศรษฐกิจที่น่าสนใจสัปดาห์นี้

WikiFX รีวิวโบรกเกอร์ | BOQ โพสต์นี้มีคำตอบ !

ชาวเน็ตแชร์! 3 เหตุการณ์ที่อาจทำให้ได้มุมมองใหม่ๆ ในการเลือกโบรกเกอร์

คำนวณอัตราแลกเปลี่ยน