TMax Group

บทคัดย่อ:TMax Group, an international brokerage firm headquartered in the Marshall Islands, provides a broad selection of financial instruments. These include Forex, indies, stocks, commodities futures and Cryptocurrencies. However, it’s noteworthy that it currently operates with no valid regulatory oversight from any recognized authorities.

| TMax Group Review Summary in 10 Points | |

| Founded | 2018 |

| Registered Country/Region | Marshall Islands |

| Regulation | Ungulated |

| Market Instruments | Forex, indies, stocks, commodities futures, Cryptocurrencies |

| Demo Account | Available |

| Leverage | Up to 1:400 |

| EUR/USD Spread | From 0.0 pips |

| Trading Platforms | Web-based TMax mobile app |

| Minimum Deposit | USD 50 |

| Customer Support | Live chat, phone, email, address, social media |

What is TMax Group?

TMax Group, an international brokerage firm headquartered in the Marshall Islands, provides a broad selection of financial instruments. These include Forex, indies, stocks, commodities futures and Cryptocurrencies. However, its noteworthy that it currently operates with no valid regulatory oversight from any recognized authorities.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Acceptable minimum deposit | • Unregulated |

| • No deposit fees | • Lack of transparency on commission |

| •Stop-loss and take-profit orders implemented | • Not accept clients from some countries |

| • Demo account available | • Non-functional buttons for account opening and platform download |

| • No MT4/5 platforms |

Pros:

Acceptable Minimum Deposit: TMax Group sets a reasonable minimum deposit requirement at $50, allowing a wider range of individuals to participate in trading.

No Deposit Fees: TMax Group does not charge fees for depositing funds into a trading account, thereby reducing the cost incurred by traders.

Implementation of Stop-loss and Take-profit Orders: These essential risk management tools are implemented in TMax's trading platform, helping traders to manage potential losses and capture profits at a preferred level.

Demo Account Availability: TMax provides a demo trading account, allowing newcomers to practice their trading strategies without risking real money.

Cons:

Unregulated: TMax Group lacks official regulatory oversight. This could raise concerns regarding their adherence to ethical practices and customer protection measures.

Lack of Transparency on Commission: The undisclosed commissions create potential hidden costs for traders.

Not Accepting Clients from Some Countries: Certain jurisdictions are restricted from accessing TMaxs services due to regulatory reasons or internal policies.

Non-functional Buttons for Account Opening and Platform Download: Users will have difficulties when attempting to open accounts or download trading platform from the brokers website, indicating technical issues that hinder user experience.

Absence of MT4/5 Platforms: TMax does not support MetaTrader 4 or 5 platforms, which are widely used and preferred by many traders due to their advanced analytical features.

Is TMax Group Safe or Scam?

When considering the safety of a brokerage like TMax Group or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Without any regulatory oversight, TMax Group's current operating model can incite questions about its authenticity and reliability. The lack of regulation suggests inherent risks for customers.

User feedback: For a deeper insight into the brokerage, traders should read reviews and feedback from existing clients. These valuable inputs from users, available on trustworthy websites and discussion forums, can provide firsthand information about the company's operations.

Security measures: TMax Group employs stop-loss and take-profit orders as part of their security measures. These enable traders to automatically close positions at predefined levels, safeguarding against extreme market fluctuations.

In the end, choosing whether or not to engage in trading with TMax Group is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

TMax Group offers a diverse range of market instruments to traders.

Forex forms the heart of their offering, providing numerous currency pairs for trading. Additionally, they offer Indices, enabling traders to speculate on the price movements of top global indices markets.

Investment opportunities extend to the stocks market, where investors can trade shares from major global companies.

The broker also provides commodity futures, offering a chance to speculate on commodities such as metals, crude oil, and agricultural products.

Moreover, recognizing the growing trend in digital assets, they provide Cryptocurrencies as another investment avenue, further diversifying their clients' portfolios.

Accounts

The broker provides two primary account types to cater to different trading preferences and expertise levels - the demo account and the live account.

The demo account is ideal for novice traders or those who wish to test their trading strategies without risking real money, offering a safe environment where users can practice and understand the dynamics of the market.

On the other hand, the live account is designed for real-time trading and can be opened by making a minimum deposit of $50. This relatively low entry barrier enables even those with a limited budget to participate in the world of trading.

How to Open an Account?

While there are designated buttons for account creation or registration on the broker's website, they seem to direct you to error pages instead of providing valid information. Due to these circumstances, we recommend you to directly contact the broker and seek guidance for the appropriate account opening process.

Leverage

TMax Group provides its clients with the opportunity to trade with leverage up to 1:400. This level of leverage implies that for each $1 in their account, clients can effectively manage $400 in the market. It presents a powerful tool that allows traders to control large positions with a relatively small amount of capital, interacting in larger transactions then would otherwise be possible.

However, while utilizing leverage can potentially magnify profits, it can equally magnify losses. Therefore, while this is lucrative, you should be cautious and knowledgeable about the potential loss, thus to protect and maximize your investment.

Spreads & Commissions

TMax Group offers a competitive spread starting from as low as 0.0 pips, providing traders with an advantageous position to start trading potentially from the point of market prices.

However, the information related to commission charges is currently not available. This is a key aspect, as commission fees form part of transaction costs and could impact the overall profit or loss from trading activities. Therefore, you can try to verify this missing detail with TMax Group's customer service directly to fully understand the cost structure before commencing trading.

Trading Platforms

TMax Group offers a comprehensive web-based trading platform which is also available as a mobile application on iOS and Android devices. This makes trading convenient, as clients can manage their accounts and access market data wherever they go.

In addition, the broker also provides a Windows desktop version of the application which comes with a combination of advanced trading tools, designed to enhance trading performance by enabling users to closely monitor the markets and efficiently manage their trades.

Essentially, with TMax Group's multi-platform presence, trading can be done seamlessly across different devices, aligning with the needs of modern-day traders.

However, the download links on its website lead to nothing after click, if you are considering to choose this broker, its recommended of you to seek for clarification from the broker directly before committing any actual trades.

Trading Tools

TMax Group provides a comprehensive suite of trading tools designed to optimize their clients' trading experience.

Market insights provide essential economic trends, market news and analyst opinions, bolstering traders to make informed trading decisions.

Product analysis, another valuable tool, delivers in-depth insights into specific trading assets, enabling traders to better assess their investment potential.

Risk management tools such as stop-loss and take-profit orders are also provided, these are vital in managing potential losses and in securing profits.

Additionally, TMax offers portfolio tracking capabilities, allowing traders to monitor their open positions, watchlists, and overall performance in real-time.

Deposit & Withdrawal

TMax Group offers a broad blend of payment methods to facilitate smooth and convenient transactions for its clients.

Recognizing the widespread utilization of credit and debit cards, they accept payments from major card providers such as Visa, MasterCard, JCB, and American Express.

Moreover, in line with the digitization of financial services, they also accommodate payments through online wallets like bitwallet and sticpay, providing instantaneous transactions.

Traditional banking methods such as local bank transfer and bank wire are also available for those who prefer it.

Reflecting the rise of digital currencies, TMax Group also permits crypto payments, broadening the spectrum of their financial inclusivity.

Furthermore, they offer instant deposit ensuring immediate account credit, and a '0 deposit fees' policy that reduces the transaction costs for their clients, making their financial dealings all the more convenient and user-friendly.

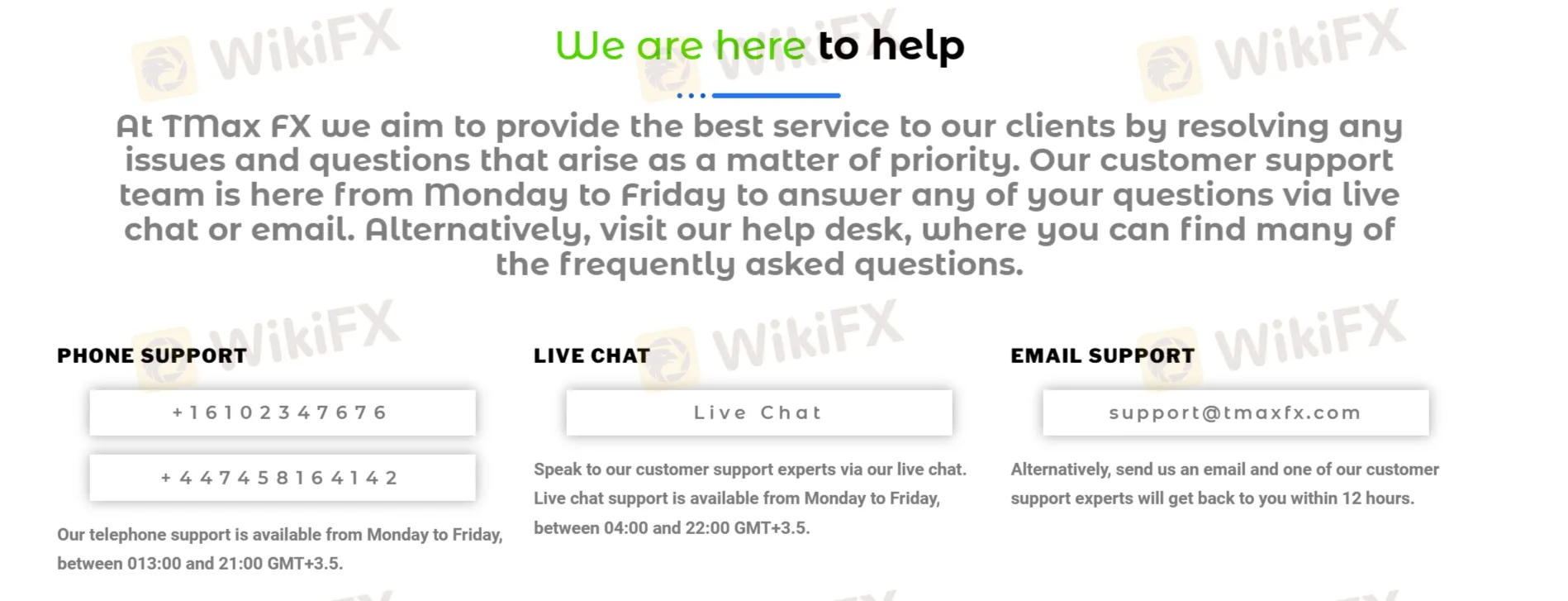

Customer Service

TMax Group provides comprehensive customer support through live chat, phone and email, ensuring timely assistance. They also provide a physical address for direct reach.

Moreover, the broker maintains social media accounts including Instagram and Twitter as supplement customer support channels.

Address: 3992, Lagoon Road, Majuro, 96960, REPUBLIC OF THE MARSHALL ISLANDS.

Phone: +16102347676; +447458164142 (from Monday to Friday, between 013:00 and 21:00 GMT+3.5).

Email: support@tmaxfx.com.

Education

TMax Group offers valuable educational resources such as a glossary that is intended to enhance their client's understanding of the trade market.

The glossary provides detailed explanations of market-specific terminologies and concepts, serving as a helpful guide for both novice and seasoned traders. It broadens customers trading lexicon, leading to a more profound understanding of trading activities and strategies of them.

Conclusion

In summary, TMax Group is an online brokerage firm headquartered in the Marshall Islands. The firm offers a broad range of market instruments such as Forex, Indices, Stocks, Commodity Futures, and Cryptocurrencies. However, it is noteworthy that the firm lacks official regulatory oversight, which raises concerns. The absence of regulation brings into question TMax Group's commitment to ethical practices and customer protection.

Thus, if you intend to trade with this broker, you should be at utmost caution and ideally opt for alternative brokerages demonstrating clear adherence to transparency, regulatory compliance, and professional conduct if possible.

Frequently Asked Questions (FAQs)

| Q 1: | Is TMax Group regulated? |

| A 1: | No, it‘s been verified that the broker is currently operating without valid regulatory oversight. |

| Q 2: | Is TMax Group a good broker for beginners? |

| A 2: | No, it not a good broker for beginners because it’s not regulated by any recognized authorities which raises concerns about its adherence to industry norms. |

| Q 3: | Does TMax Group offer the industry leading MT4 & MT5? |

| A 3: | No. |

| Q 4: | Does TMax Group offer demo accounts? |

| A 4: | Yes. |

| Q 5: | What is the minimum deposit for TMax Group? |

| A 5: | The minimum initial deposit to open an account is $50. |

| Q 6: | At TMax Group, are there any regional restrictions for traders? |

| A 6: | Yes, it does not offer services to residents of certain jurisdictions such as Canada, China, Romania, Singapore, the United States. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Wiki โบรกเกอร์

FP Markets

EC Markets

IC Markets Global

XM

Exness

Neex

FP Markets

EC Markets

IC Markets Global

XM

Exness

Neex

Wiki โบรกเกอร์

FP Markets

EC Markets

IC Markets Global

XM

Exness

Neex

FP Markets

EC Markets

IC Markets Global

XM

Exness

Neex

ข่าวล่าสุด

ทรัมป์ยืนยันมาตรการภาษีของเม็กซิโก และแคนาดาจะมีผลบังคับใช้ในวันนี้

“ทรัมป์” เตือนญี่ปุ่น-จีนอย่าลดค่าเงินพร่ำเพรื่อ ขู่เก็บภาษีชดเชยเสียเปรียบ

"ทรัมป์" ประกาศตั้งกองทุนสำรองคริปโทเคอร์เรนซี หนุนราคาบิตคอยน์พุ่ง 10%

เหตุการณ์สำคัญทางเศรษฐกิจที่น่าสนใจสัปดาห์นี้

WikiFX รีวิวโบรกเกอร์ | AIMS โพสต์นี้มีคำตอบ !

7 ความเชื่อผิดๆ เกี่ยวกับบิตคอยน์ อันตรายจริงหรือแค่เรื่องลวง?

ราคาทองคำปรับตัวลดลงต่อเนื่อง ท่ามกลางแรงขายทำกำไร

ทองปิดพุ่ง $52.60 รับแรงซื้อสินทรัพย์ปลอดภัย-ดอลล์อ่อนหนุนตลาด

คำนวณอัตราแลกเปลี่ยน