eToro

บทคัดย่อ:eToro, founded in 2007, is a brokerage platform offering a diverse range of market instruments including stocks, cryptocurrencies, indices, commodities, currencies (Forex), and ETFs. While the company is regulated by authorities such as the Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA), and Australian Securities and Investments Commission (ASIC), there are suspicions regarding the authenticity of these licenses, raising concerns about its regulatory status. The platform provides a seamless account opening process through online sign-up, identity verification, and deposit funds. With its proprietary trading platform and educational resources like eToro Academy, users can access a wealth of information to enhance their trading skills. eToro also offers multi-faceted customer support, various deposit methods, and additional features such as social trading, copy trading, and a mobile app. However, users should be aware of potential withdrawal fees and

| Aspect | Information |

| Company Name | eToro |

| Founded | 2007 |

| Regulatory Authorities | Fake Licenses |

| Market Instruments | Stocks, cryptocurrencies, indices, commodities, currencies (Forex), ETFs |

| Account Opening Process | Online sign-up, email verification, profile completion, identity verification, deposit funds |

| Trading Platforms | Proprietary platform (no support for external platforms like MT4/MT5) |

| Fees and Commissions | Spreads, withdrawal fees, inactivity fees (no trading commissions for stocks and ETFs) |

| Educational Resources | eToro Academy (articles, tutorials, videos, courses) |

| Customer Support | Multi-faceted support system, including phone support, email inquiries, and localized offices |

| Deposit Methods | Visa/Mastercard, PayPal, Skrill, Neteller, Webmoney |

| Withdrawal Processing Time | Varied depending on method (up to 10 days for bank transfers, up to 2 days for e-wallets) |

| Additional Features | Social trading, copy trading, demo account, mobile app |

| Languages Supported | Multilingual support including English, Spanish, French, German, Italian, and more |

Overview

eToro, founded in 2007, is a brokerage platform offering a diverse range of market instruments including stocks, cryptocurrencies, indices, commodities, currencies (Forex), and ETFs. While the company is regulated by authorities such as the Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA), and Australian Securities and Investments Commission (ASIC), there are suspicions regarding the authenticity of these licenses, raising concerns about its regulatory status. The platform provides a seamless account opening process through online sign-up, identity verification, and deposit funds. With its proprietary trading platform and educational resources like eToro Academy, users can access a wealth of information to enhance their trading skills. eToro also offers multi-faceted customer support, various deposit methods, and additional features such as social trading, copy trading, and a mobile app. However, users should be aware of potential withdrawal fees and longer processing times for certain methods. Despite regulatory concerns, eToro remains a popular choice for traders seeking a comprehensive trading experience with a user-friendly interface and diverse market offerings.

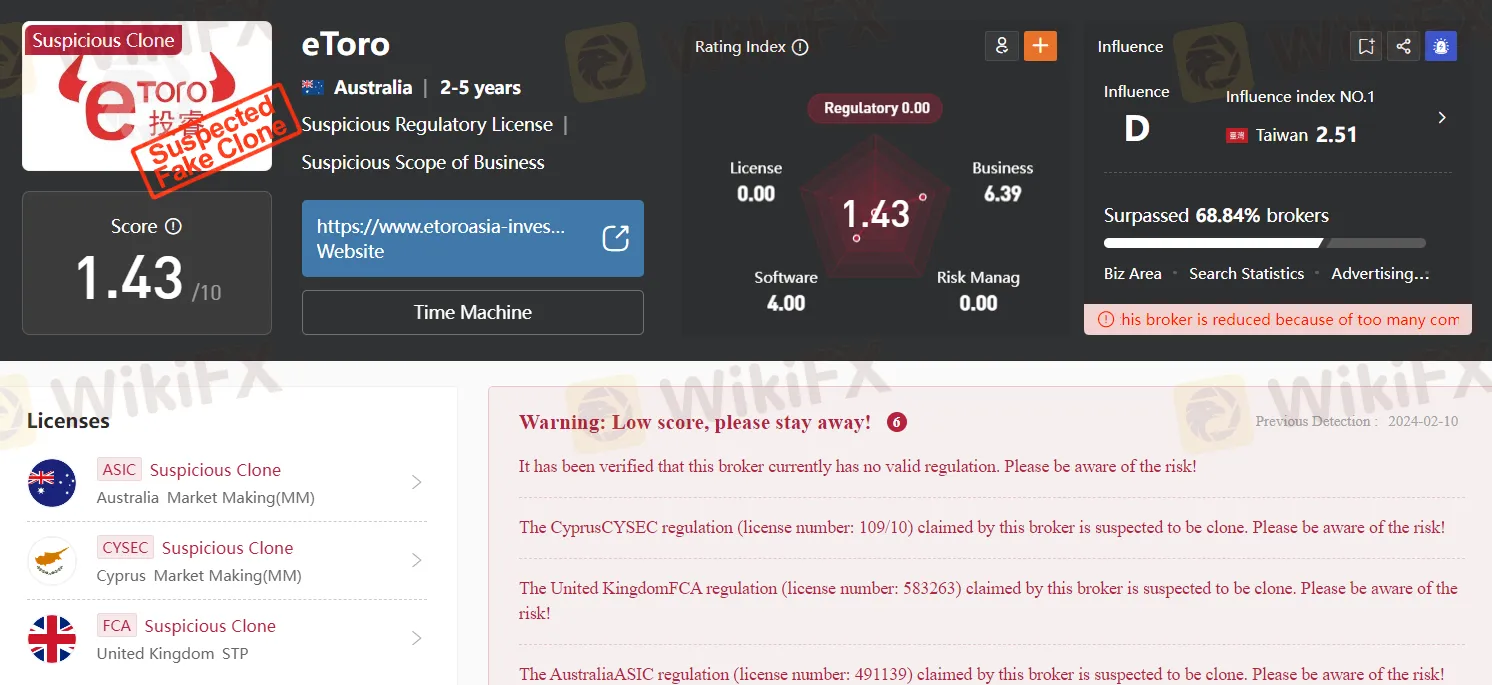

Regulation

It has come to our attention that the broker eToro has claimed regulatory licenses from various authorities, including CyprusCYSEC (license number: 109/10), United KingdomFCA (license number: 583263), and AustraliaASIC (license number: 491139). However, there are suspicions that these licenses may be clones, raising significant concerns regarding the legitimacy and credibility of eToro's regulatory status. It is imperative for individuals considering or currently engaged with this broker to exercise utmost caution and thorough due diligence. The potential risks associated with dealing with a broker whose regulatory licenses are under suspicion necessitate careful consideration and possibly seeking alternative options for investment and trading activities. Traders and investors are strongly advised to verify the authenticity of regulatory licenses claimed by brokers and to ensure compliance with established regulatory standards to safeguard their interests and investments effectively.

Pros and Cons

eToro offers a range of advantages and disadvantages for traders and investors. Its diverse range of market instruments, user-friendly platform, and educational resources make it an appealing option for many. However, concerns about the legitimacy of its regulatory licenses and certain fees, such as withdrawal and inactivity fees, may deter some users.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Market Instruments

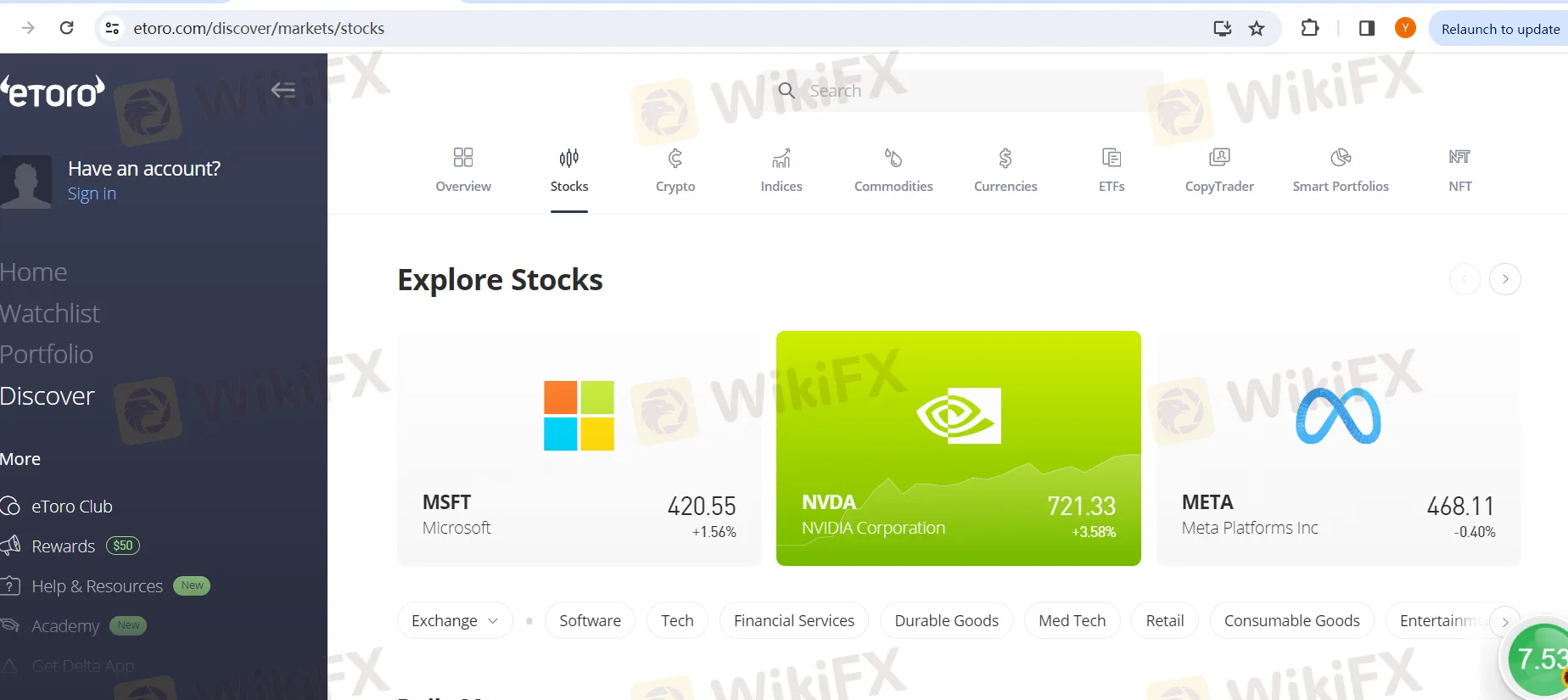

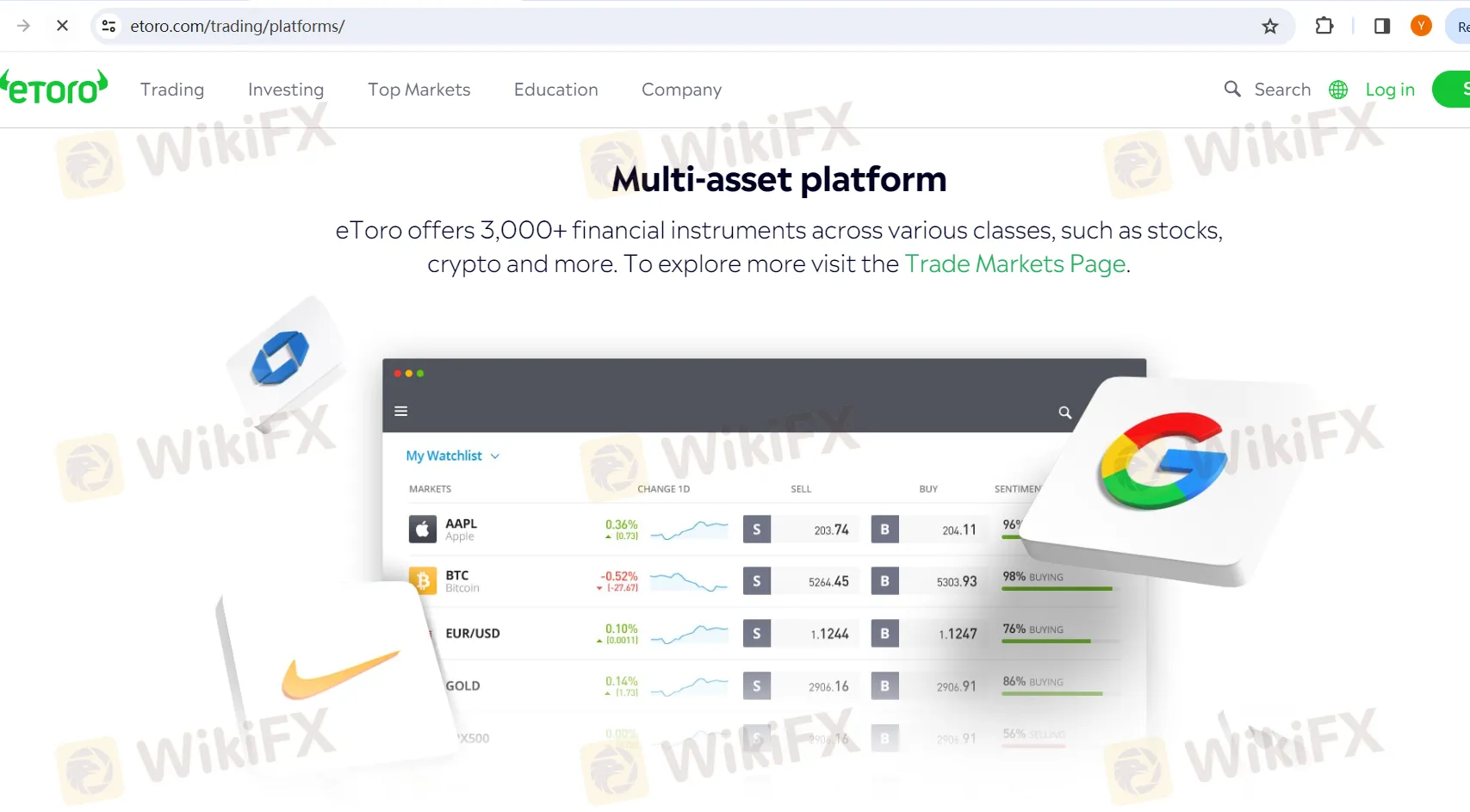

eToro offers a diverse range of market instruments across various asset classes, catering to the needs of traders and investors with different risk appetites and investment goals. Here's a breakdown of the market instruments available on eToro:

Stocks: eToro provides access to a wide selection of stocks from global markets, allowing users to invest in individual companies across different sectors and industries. This includes well-known companies such as Apple, Microsoft, Amazon, and many others.

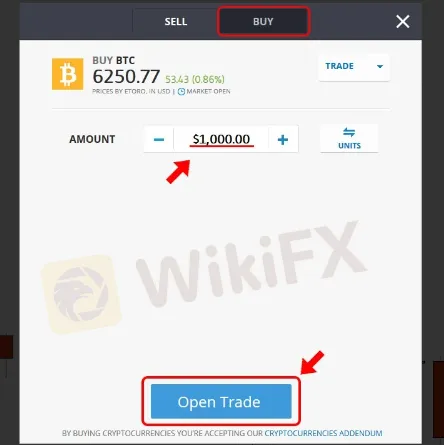

Cryptocurrencies: eToro offers a range of cryptocurrencies for trading, allowing users to buy, sell, and speculate on the price movements of popular digital assets such as Bitcoin, Ethereum, Ripple, Litecoin, and more. Cryptocurrency trading on eToro is available 24/7.

Indices: eToro enables users to trade indices, which represent the performance of a group of stocks from a particular market or sector. Traders can speculate on the price movements of major indices like the S&P 500, Dow Jones Industrial Average, NASDAQ, FTSE 100, and others.

Commodities: eToro provides access to commodity trading, allowing users to invest in various commodities such as gold, silver, oil, natural gas, and agricultural products. Commodity trading offers diversification opportunities and the ability to hedge against inflation and geopolitical risks.

Currencies (Forex): eToro offers currency trading in the foreign exchange (Forex) market, enabling users to trade major, minor, and exotic currency pairs. Traders can take advantage of currency fluctuations and engage in forex trading with leverage to amplify potential returns.

ETFs (Exchange-Traded Funds): eToro allows users to invest in a diverse range of Exchange-Traded Funds (ETFs), which are investment funds that track the performance of a specific index, commodity, or basket of assets. ETFs offer exposure to various markets and sectors while providing diversification benefits.

Overall, eToro provides a comprehensive selection of market instruments, spanning stocks, cryptocurrencies, indices, commodities, currencies (Forex), and ETFs, catering to the diverse investment preferences and strategies of its users.

How to open an account?

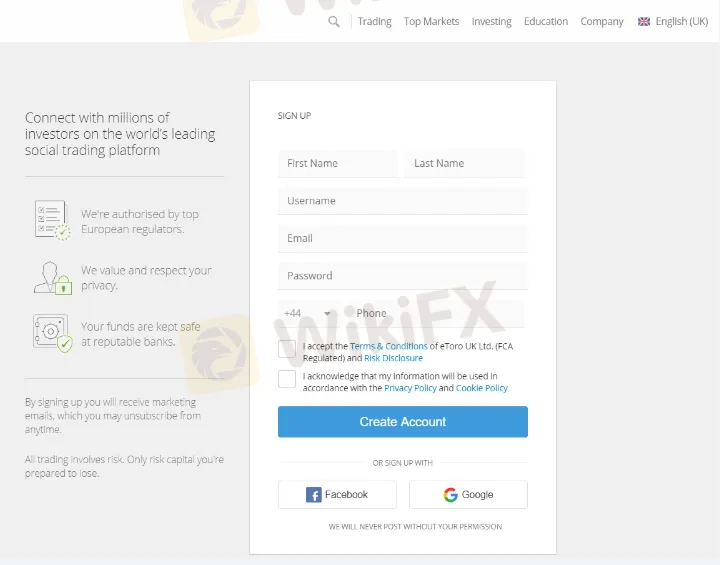

To open an account with eToro, follow these steps:

Visit the eToro website: Go to the official eToro website to begin the account opening process.

Sign up: Click on the “Sign Up” or “Join Now” button on the homepage. You will be prompted to enter your name and email address, choose a password, and agree to eToro's terms and conditions.

Confirm email: After providing your information, eToro will send a confirmation email to the address you provided. Check your inbox and click on the link in the email to verify your registration.

Complete profile: Once your email is confirmed, log in to your eToro account using the username and password you created. Complete your profile by providing additional personal information, such as your date of birth, address, and contact details.

Verify identity: To fully confirm your account, you will need to provide identification documents, including a valid ID (passport, ID card, etc.) and proof of address (bank statement, utility bill). Follow the instructions provided by eToro to upload these documents securely.

Deposit funds: After your account is verified, you can deposit funds into your eToro account using one of the available payment methods. eToro offers various deposit options, including bank transfer, credit/debit card, and e-wallets. Choose your preferred method and enter the amount you wish to deposit.

Start trading: Once your account is funded, you can start trading on the eToro platform. Navigate to the “Trade Markets” section to explore the available assets, including stocks, cryptocurrencies, indices, commodities, currencies (Forex), and ETFs. Select the asset you want to trade, enter the desired investment amount, and execute your trade.

6. Manage your trades: Monitor your open positions, track market movements, and manage your portfolio directly from the eToro platform. You can use features like stop-loss orders and take-profit orders to manage risk and maximize potential returns.

By following these steps, you can successfully open an account with eToro and start trading in the financial markets. Remember to carefully consider the risks involved and ensure that you understand how trading CFDs works before investing your money.

Spreads and Commissions

eToro employs a fee structure that is important for users to understand when considering trading on the platform. Here's an overview of the associated fees:

Spreads: eToro uses spreads, the difference between the buy and sell prices of an asset. The platform sets the spread for trading all cryptocurrencies at a fixed rate of 1%, positioning eToro as a choice for cryptocurrency traders seeking specific pricing.

Trading Commissions:

Stocks and ETFs: eToro charges no trading commissions for stocks or ETFs, generating revenue through spreads only.

Cryptocurrencies: Although eToro does not impose trading commissions on cryptocurrencies, there is a 1% markup when converting cryptocurrency CFDs to USD.

Currencies, Indices, and Commodities: These assets are traded on eToro with built-in spreads only, without any additional trading commissions.

Non-Trading Fees:

Withdrawals: eToro applies a $5 fee for withdrawals, setting a minimum withdrawal amount of $25 for wire transfers.

Inactivity: A $10 per month inactivity fee is charged to users who have not engaged in any trading activity for 12 consecutive months.

Conversion: Converting currencies within the eToro platform may incur a small fee.

Overall, eToro's fee structure is relatively straightforward compared to other online brokers. While certain actions like withdrawals and inactivity incur fees, the lack of trading commissions for stocks and ETFs, along with competitive spreads for cryptocurrencies, positions eToro as a viable option for traders aiming to reduce costs. However, it is crucial for users to carefully review and understand the fee schedule before engaging in trading activities on the platform.

Deposit & Withdrawal

eToro offers a range of deposit options, including e-wallets like PayPal, Skrill, Neteller, and Webmoney, providing flexibility in funding accounts. It's notable that an initial deposit with a card may be required before utilizing e-wallet options. Bank transfers, another available method, tend to have a longer processing time, often taking more than a week, unlike the instant processing of other methods.

The deposit options on eToro are:

Visa or Mastercard

PayPal

Skrill

Neteller

Webmoney

A distinctive feature of eToro is its support for PayPal for both deposits and withdrawals, which is not commonly offered by many brokers.

For the financial aspects, the minimum trading amount on eToro is $10 USD, with a minimum deposit requirement of $50 USD for those using a debit card or linking a bank account. This enables users to start trading with a low initial investment and also invest in fractional shares, allowing for the purchase of a portion of a share with any amount above $10 USD.

Withdrawal processes on eToro vary by payment method. According to eToro, the wait time for debit and credit cards, as well as bank transfers, can be up to 10 days. Withdrawals to e-wallets like PayPal and Skrill may take up to 2 days, although user experience often reports shorter withdrawal times, especially for Visa, MasterCard, and e-wallet options.

eToro applies a fixed withdrawal fee of $5 for each transaction, which is a standard practice. This fee is charged regardless of the withdrawal amount or the chosen payment method, contributing to the overall cost of trading on the platform.

Trading Platforms

eToro operates on a proprietary trading platform, distinguishing itself by not offering support for external APIs or third-party trading platforms. APIs, which allow users to interact directly with a platform's backend rather than through its graphical user interface, are not compatible with eToro's system. Additionally, widely recognized third-party platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are prevalent in the forex trading community for their advanced features and flexibility, are also not supported on eToro.

This approach signifies that eToro prioritizes a streamlined, user-friendly interface over the customization and technical capabilities offered by external platforms. The absence of support for MT4, MT5, and other third-party platforms underlines eToro's focus on providing a self-contained environment that caters to traders seeking simplicity and ease of use in their trading experience. This design philosophy aims to make the platform accessible to a broad range of users, from beginners to those who prefer a more straightforward trading process without the need for technical integrations or the complexity of external trading systems.

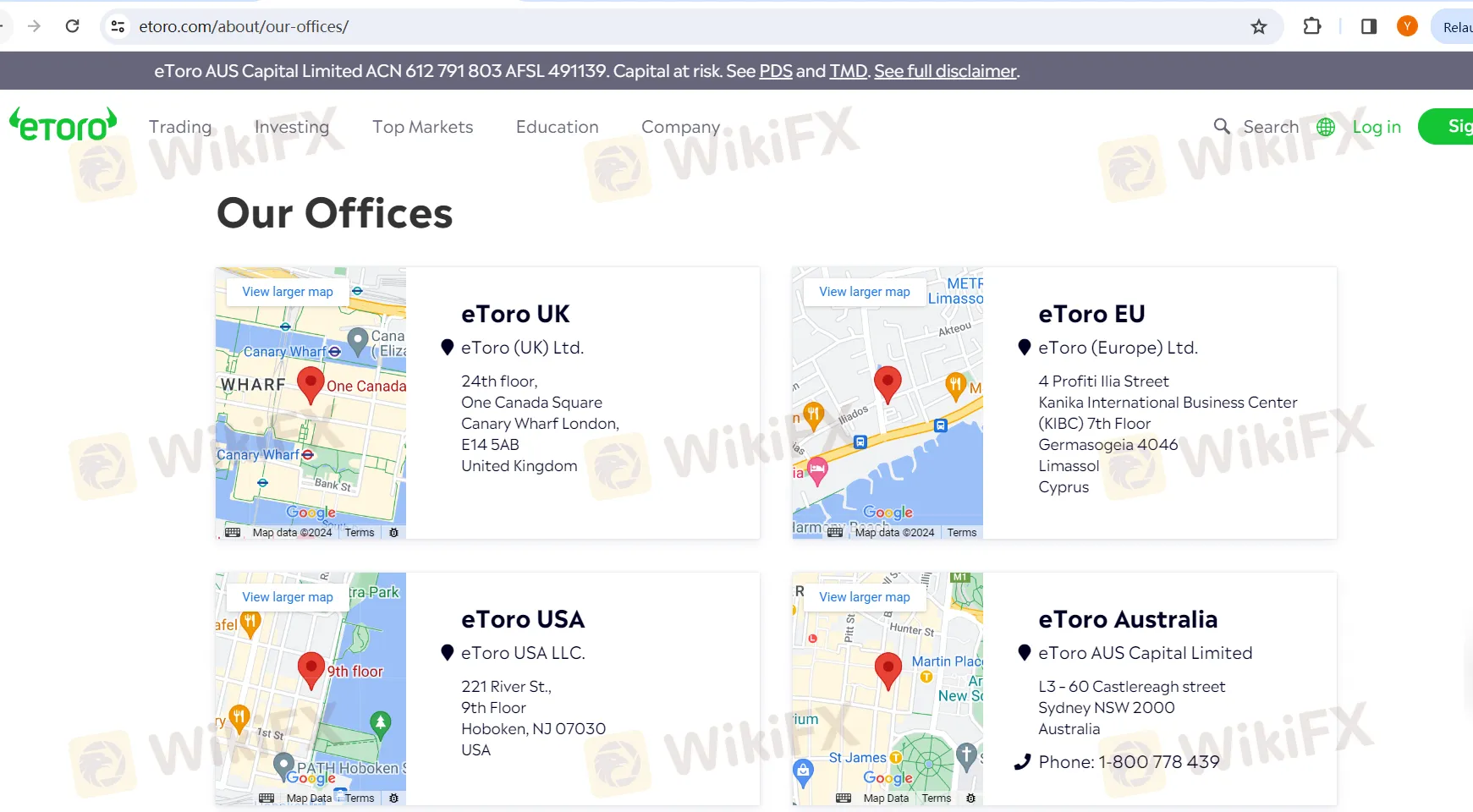

Customer Support

eToro offers a structured and multi-faceted customer support system designed to cater to a wide range of needs, from media inquiries to affiliate relationships and business development. The company's global presence is underscored by its offices in key financial hubs across the UK, EU, USA, and Australia, each providing localized support in addition to the broader services offered by the platform.

For direct customer support, eToro's Australian office provides a dedicated phone line, offering a direct channel for users in that region to receive assistance. This service demonstrates eToro's commitment to accessible support, ensuring that users can have voice conversations with support staff when needed.

In terms of public relations, eToro maintains a specific email address (pr@eToro.com) for media-related inquiries, indicating a structured approach to handling press and media communications efficiently. This channel is likely managed by a dedicated team focused on media relations, highlighting eToro's attention to its public image and interactions with the media.

For affiliate partners, eToro directs inquiries to its eToro Partners Website, providing a specific resource for affiliates. This suggests a streamlined process for managing affiliate relationships, ensuring that partners have access to necessary information and support to promote eToro effectively.

Business development inquiries are directed to a dedicated email address (bizdev@eToro.com), indicating that eToro values potential partnerships and business opportunities. This channel is likely managed by a team responsible for evaluating and pursuing strategic business initiatives and collaborations.

Overall, eToro's customer support and communication structure is designed to address a wide array of inquiries and services, from user support to media relations and business development, reflecting the company's global operation and its commitment to providing comprehensive assistance to its users and partners.

Educational Resources

You can access eToro's educational resources by visiting their Academy page at https://www.etoro.com/academy/.This platform provides valuable learning materials and resources for traders and investors of all levels. Whether you're a beginner looking to understand the basics of trading or an experienced trader seeking advanced strategies, eToro Academy offers a wide range of articles, tutorials, videos, and courses to help you enhance your trading knowledge and skills. From learning about different asset classes to mastering technical analysis and risk management techniques, eToro Academy covers various topics to support your trading journey. Take advantage of these educational resources to improve your trading proficiency and make informed investment decisions.

Conclusion

In summary, eToro is a brokerage platform that offers a diverse range of market instruments across various asset classes, including stocks, cryptocurrencies, indices, commodities, currencies (Forex), and ETFs. However, there are suspicions regarding the legitimacy of eToro's regulatory licenses, raising concerns about the credibility of the platform. Despite this, eToro provides a user-friendly interface for account opening and trading, with competitive fee structures such as spreads and commissions. The platform also offers educational resources through its Academy to help traders enhance their skills and knowledge. Users should exercise caution and conduct thorough due diligence before engaging with eToro.

FAQs

Q1: Is eToro regulated?

A1: Yes, eToro is regulated by authorities such as CyprusCYSEC, United KingdomFCA, and AustraliaASIC, although there are suspicions surrounding the authenticity of these licenses.

Q2: What market instruments can I trade on eToro?

A2: eToro offers a wide range of market instruments including stocks, cryptocurrencies, indices, commodities, currencies (Forex), and ETFs.

Q3: How do I open an account with eToro?

A3: To open an account with eToro, simply visit their website, sign up, complete your profile, verify your identity, deposit funds, and start trading.

Q4: What fees does eToro charge?

A4: eToro charges fees such as spreads for trading, withdrawal fees, and inactivity fees. However, there are no trading commissions for stocks and ETFs.

Q5: Does eToro provide educational resources?

A5: Yes, eToro offers educational resources through its Academy, providing articles, tutorials, videos, and courses to help traders improve their skills and knowledge.

Wiki โบรกเกอร์

Vantage

TMGM

ATFX

Pepperstone

XM

FOREX.com

Vantage

TMGM

ATFX

Pepperstone

XM

FOREX.com

Wiki โบรกเกอร์

Vantage

TMGM

ATFX

Pepperstone

XM

FOREX.com

Vantage

TMGM

ATFX

Pepperstone

XM

FOREX.com

ข่าวล่าสุด

วิกฤตหนี้ IMF กับผลกระทบที่วัยรุ่น 90’s ไม่อาจลืม

ข้อคิดดีๆ จากหนังสือ "วิถีผู้ชนะฉบับคนเก่งแบบเป็ด"

ทองปิดบวก $17.20 ทำนิวไฮ รับแรงซื้อสินทรัพย์ปลอดภัย

ทองปิดลบ $16.30 จากแรงขายทำกำไร-ตลาดจับตาจ้างงานสหรัฐฯ

คำถามหนักใจ! อยู่ในวงการเทรดมา 4 ปีรู้สึกเหนื่อยกับตลาด ควรไปต่อหรือพอแค่นี้?

เคล็ดลับขยันแบบสุขใจ ไม่ให้ ‘Toxic Productivity’ มาแย่งความสุข

เงินดอลลาร์ร่วงต่ำสุดในรอบ 8 สัปดาห์เทียบกับเงินเยน เนี่องจากเสี่ยงสงครามการค้าลดลง

WikiFX รีวิวโบรกเกอร์ | Moneta Markets โพสต์นี้มีคำตอบ !

คำนวณอัตราแลกเปลี่ยน