KRX

บทคัดย่อ:KRX, founded in 2005 and headquartered in Korea, operates as an unregulated broker, listing various financial products and services such as stocks, bonds, REPO bonds, ETPs, derivatives, and commodities. While KRX offers a wide range of trading options, its lack of regulation raises concerns about the safety and security of funds. Customer support is provided through email, and educational resources include market news updates and an Information Center. However, traders should be aware of the risks involved in online trading and verify information directly with KRX before making decisions.

| KRX | Basic Information |

| Company Name | KRX |

| Founded | 2005 |

| Headquarters | KRX |

| Regulations | Not regulated |

| Products and Services | Stocks, bonds (including treasury bonds, REPO bonds, general bonds), ETPs (ETFs, ETNs, ELWs), derivatives (underlying assets: stock price indices, individual stocks, ETFs, treasury bonds), other products (e.g., petroleum, gold, emissions) |

| Fees | Listing fees vary based on individual contracts; low listing fees and annual dues compared to other exchanges |

| Customer Support | Email support: kospilisting.global@krx.co.kr (KOSPI listings), kosdaq.tech.global@krx.co.kr (KOSDAQ technical support) |

| Education Resources | Market news updates, Information Center (publications, Korea Investment Guide) |

| Trading Tools | KRX Market Data System provides statistics, market activity, insights, and data products for trading |

Overview of KRX

Korea Exchange (KRX), founded in 2005 and headquartered in Seoul, South Korea, is a major financial market operator. It serves as the primary exchange for trading various financial instruments, including stocks, bonds, ETPs (Exchange-Traded Products), and derivatives. KRX operates several markets, including the KOSPI, KOSDAQ, and KONEX. With a diverse range of products and services, KRX provides investors with access to a well-balanced and liquid market, attracting a wide range of investors. However, it's important to note that KRX is not regulated, which may raise concerns about the safety and security of trading on its platform.

Is KRX Legit?

KRX is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Pros and Cons

KRX offers a wide range of financial products and services, including stocks, bonds, ETPs, and derivatives, providing investors with diverse investment opportunities. The exchange is known for its well-balanced investor base and product diversity, making it a popular choice among traders. However, one major drawback is that KRX is not regulated by any recognized financial regulatory authority. This lack of regulation raises concerns about the safety and security of trading on the exchange, as there is no oversight of its activities. Additionally, while KRX imposes low listing fees and annual dues on listed companies, the costs for underwriting can vary significantly depending on individual contracts, potentially leading to higher expenses for companies seeking to list on the exchange.

| Pros | Cons |

|

|

|

|

|

|

Products and Services

On the KRX markets, stocks, bonds, including treasury bonds, REPO bonds, general bonds, etc. and REPO bonds, ETPs, such as ETFs, ETNs, and ELWs, are listed. Derivatives products of which underlying assets are stock price indices, such as KOSPI200 and KOSDAQ150, V-KOSPI200, individual stocks, ETFs, treasury bonds, etc., and other products, such as petroleum, gold, emissions, etc. are traded as well.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Commodities | Crypto | CFD | Indices | Stock | ETF | Options |

| KRX | No | Yes | No | No | Yes | Yes | Yes | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| IC Markets | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| Exness | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

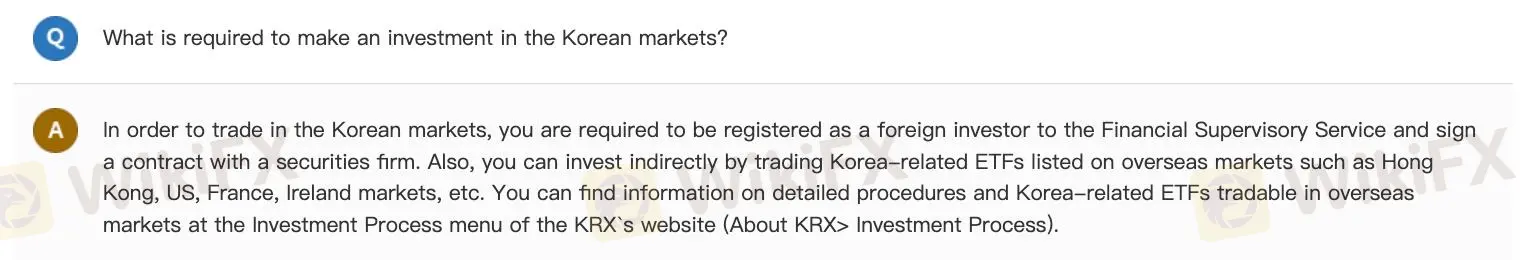

How to Open an Account

To open an account on KRX, follow these steps:

1. Register with the Financial Supervisory Service: Foreign investors need to register with the Financial Supervisory Service to trade in the Korean markets.

2. Sign a contract with a securities firm: After registration, sign a contract with a securities firm to start trading.

3. Trade Korea-related ETFs: Alternatively, investors can trade Korea-related ETFs listed on overseas markets such as Hong Kong, US, France, Ireland markets, etc.

4. Find detailed procedures: For detailed procedures and tradable ETFs, visit the Investment Process menu on KRX's website.

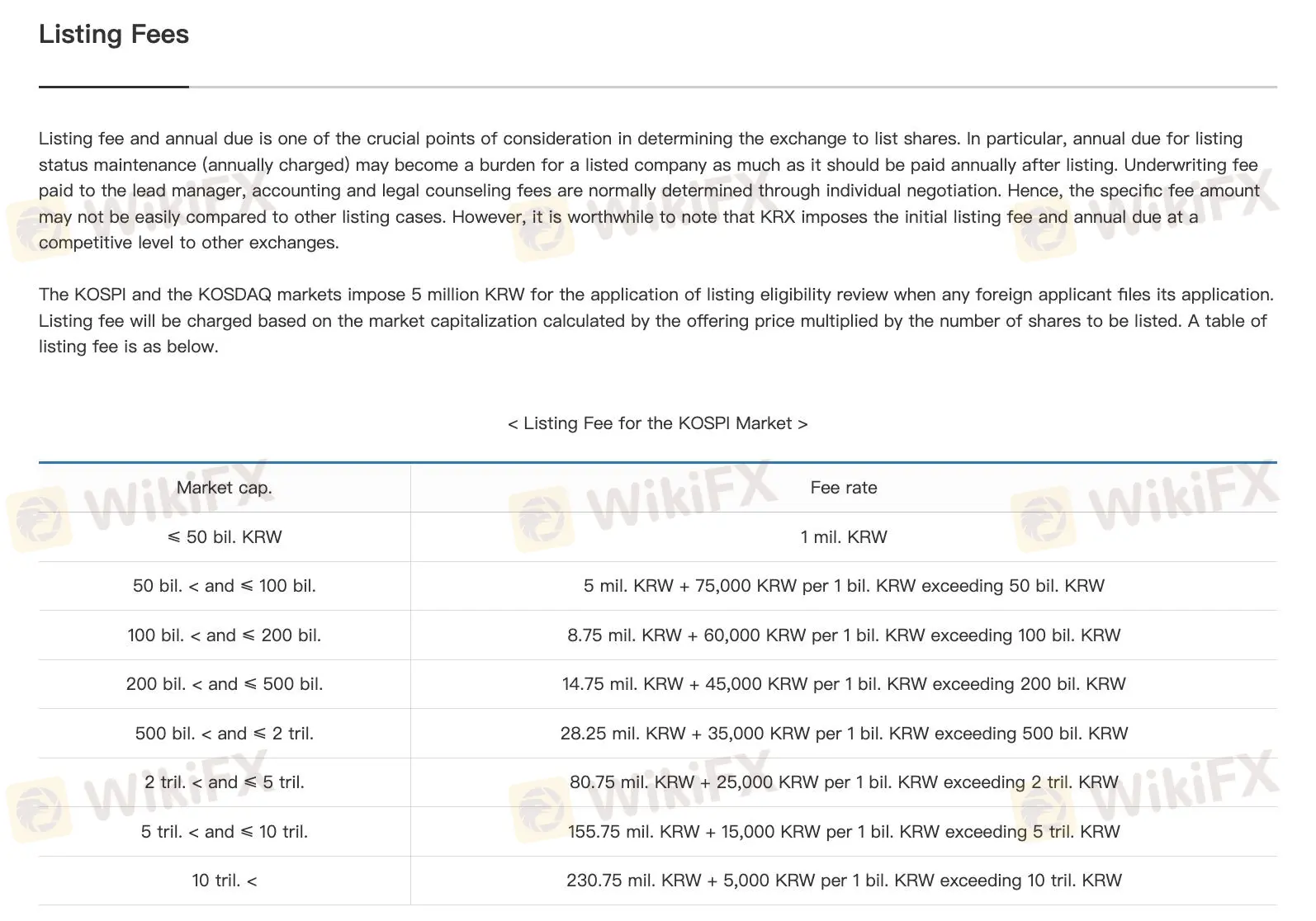

Fees

Since costs for underwriting, such as costs for lead managing, accounting, legal consulting, etc. are determined by individual contracts, listing fees can vary case by case. Additionally, KRX imposes on listed companies very low listing fees and annual due at a much lower level than any other exchanges. You can find such costs on the KRX website (global.krx.co.kr -> Listing -> Cost & Disclosure).

Customer Support

KRX provides customer support through email. For KOSPI listings, the contact email is kospilisting.global@krx.co.kr, and for KOSDAQ technical support, the email is kosdaq.tech.global@krx.co.kr.

Educational Resources

KRX provides educational resources through market news updates and an Information Center offering publications and the Korea Investment Guide.

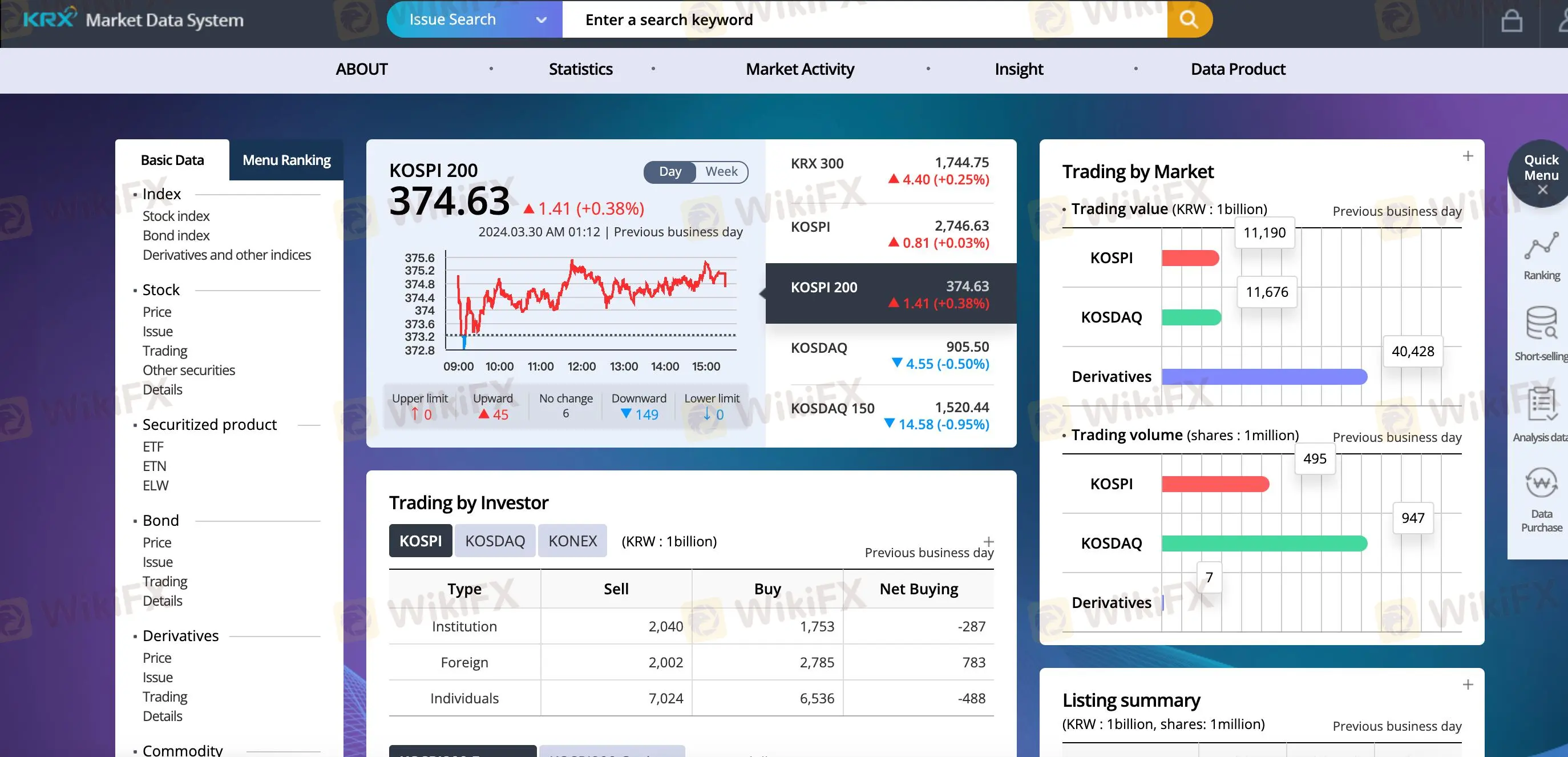

Trading Tools

KRX offers a Market Data System that provides statistics, market activity, insights, and data products for trading.

Conclusion

KRX offers a wide range of financial products and services, making it a comprehensive trading venue. It boasts a well-balanced investor base and diverse product offerings. However, being unregulated raises concerns about transparency and investor protection. Despite this, KRX imposes low listing fees and annual dues for listed companies, making it an attractive option for those looking to list their securities.

FAQs

Q: Is KRX regulated by any financial regulatory authority?

A: No, KRX is not regulated by any recognized financial regulatory authority.

Q: What are the costs involved in listing on KRX?

A: Costs for underwriting, such as lead managing, accounting, and legal consulting fees, can vary significantly. KRX imposes low listing fees and annual dues for listed companies compared to other exchanges.

Q: How can I contact KRX for customer support?

A: You can contact KRX for customer support through email. For KOSPI listings, the email is kospilisting.global@krx.co.kr, and for KOSDAQ technical support, the email is kosdaq.tech.global@krx.co.kr.

Q: Does KRX offer educational resources?

A: Yes, KRX provides educational resources through market news updates and an Information Center offering publications and the Korea Investment Guide.

Q: What trading tools does KRX offer?

A: KRX offers a Market Data System that provides statistics, market activity, insights, and data products for trading.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Wiki โบรกเกอร์

TMGM

Pepperstone

FxPro

ATFX

IB

IC Markets Global

TMGM

Pepperstone

FxPro

ATFX

IB

IC Markets Global

Wiki โบรกเกอร์

TMGM

Pepperstone

FxPro

ATFX

IB

IC Markets Global

TMGM

Pepperstone

FxPro

ATFX

IB

IC Markets Global

ข่าวล่าสุด

ทรัมป์ยืนยันมาตรการภาษีของเม็กซิโก และแคนาดาจะมีผลบังคับใช้ในวันนี้

“ทรัมป์” เตือนญี่ปุ่น-จีนอย่าลดค่าเงินพร่ำเพรื่อ ขู่เก็บภาษีชดเชยเสียเปรียบ

ทองปิดบวก $19.50 สงครามการค้าหนุนแรงซื้อต่อเนื่อง

รู้หรือไม่? ใครบ้างที่ต้องเสียภาษีจากการใช้คริปโต

7 ความเชื่อผิดๆ เกี่ยวกับบิตคอยน์ อันตรายจริงหรือแค่เรื่องลวง?

ถ้ารู้จัก "เงินเย็น" ก็เป็นนักเทรดที่ดีได้ เพราะเป็นเรื่องสำคัญกับการลงทุน

ทรัมป์อาจเปิดทางเจรจาลดภาษีให้เม็กซิโกและแคนาดาในวันนี้

WikiFX รีวิวโบรกเกอร์ | AXEL โพสต์นี้มีคำตอบ !

ทองปิดบวก $5.40 รับแรงซื้อสินทรัพย์ปลอดภัย-จับตาจ้างงานสหรัฐฯ

นี่อาจเป็น NFT ตัวแรกของโลก? หลังพบเบาะแสคนขาย JPG แลก BTC

คำนวณอัตราแลกเปลี่ยน