MoneyKit

บทคัดย่อ:MoneyKit (SONY Bank), established in 2005 and based in Japan, operates as an unregulated financial services provider. It offers a various array of products and services including Trading and Investment options such as Foreign Exchange Margin Trading (FX), crowdfunding through Sony Bank GATE, various investment trusts, iDeCo (individual pension plans), Robo-advisory through WealthNavi, and securities via ALTERNA Mitsui & Co. Digital Securities.

| Aspect | Information |

| Company Name | MoneyKit(SONY Bank) |

| Registered Country/Area | Japan |

| Founded Year | 2005 |

| Regulation | Unregulated |

| Products & Services | 1.Trading and Investment (Foreign Exchange Margin Trading (FX), Sony Bank GATE (Crowdfunding), Investment Trust/NISA, iDeCo, WealthNavi (RoboAd), Stocks/Bonds, ALTERNA Mitsui & Co. Digital Securities)2.Loans (Housing Loan, Card Loan, Purpose-specific Loan)3.Insurance (Overseas Travel Insurance, Car Insurance, Fire Insurance/Life Insurance)Family Financial Planning (Tsunagu Trust for Family) |

| Rate/Interest/Fees | Exchange Rate:from 0.09;FX rate:Spreads from 0.00040Interest Rate:depend on the products;Commissions:Transfer from 3 sen |

| App & Tools | App:SONY Bank APPTools:Yen/Foreign Currency Simulation,Mortgage loan simulation,information |

| Deposit & Withdrawal | Account transfer,WEB transfer payment,Smartphone payment |

| Customer Support | Phone:0120-365-723,0120-365-866,Live Chat |

| Educational Resources | What's New,Security information |

Overview of MoneyKit

MoneyKit (SONY Bank), established in 2005 and based in Japan, operates as an unregulated financial services provider.

It offers a various array of products and services including Trading and Investment options such as Foreign Exchange Margin Trading (FX), crowdfunding through Sony Bank GATE, various investment trusts, iDeCo (individual pension plans), Robo-advisory through WealthNavi, and securities via ALTERNA Mitsui & Co. Digital Securities.

Additionally, MoneyKit provides Loans (housing, card, and purpose-specific), Insurance products (overseas travel, car, fire, and life insurance), and Family Financial Planning services with Tsunagu Trust for Family.

The bank supports a variety of rate and fee structures, including competitive exchange and FX rates. Its digital platform is supported by the SONY Bank APP and tools like currency and mortgage loan simulations.

Customer support is robust, offering phone and live chat options, while updates and security information are available through its educational resources.

Regulation Status

MoneyKit (SONY Bank) operates in Japan as an unregulated financial entity, meaning it does not fall under stringent oversight typically provided by financial regulatory authorities.

This status allows for a flexible operation in terms of product offerings and service delivery but may also present certain risks to consumers, as the absence of regulatory oversight can affect the protection measures available to customers in case of financial discrepancies or disputes.

Pros and Cons

| Pros | Cons |

| Long History | Unregulated |

| Diverse Trading Option | Limited Customer Support |

| Accessible Educational Resources | Uncertain Leverage |

| Various Rate and Interest | Short Deposit and Withdrawal ways |

| Useful Tools and APP |

Pros:

MoneyKit (SONY Bank) benefits from a long history since its inception in 2005, providing it with extensive experience in financial services. The bank offers a diverse range of trading options that meet various investment preferences, including foreign exchange, stocks, and digital securities.

It supports these services with accessible educational resources that help clients stay informed about financial security and new updates. Additionally, MoneyKit provides various competitive rates and interest options, making its financial products attractive in terms of potential returns.

The bank also enhances user experience with useful digital tools and a various banking app, facilitating easier management of finances and investments directly from mobile devices.

Cons:

Despite its established presence, MoneyKit operates as an unregulated entity, which may pose risks to clients due to the lack of formal financial oversight and protection typically afforded by regulatory bodies.

Customer support is reported to be limited, which could affect the resolution of client issues and general service satisfaction. The leverage options remain uncertain, potentially impacting investment strategies for traders who rely on borrowing to amplify their trading positions.

Moreover, the methods for deposit and withdrawal are described as less varied compared to other institutions, which will inconvenience clients who prefer multiple transactional avenues.

Products & Services

MoneyKit (SONY Bank) offers an extensive range of products and services tailored to meet diverse financial needs, encompassing areas of trading, loans, insurance, and family financial planning:

Trading and Investment:

Foreign Exchange Margin Trading (FX): Provides capabilities for forex trading with competitive spreads.

Sony Bank GATE (Crowdfunding): Offers opportunities to participate in crowdfunding projects.

Investment Trust/NISA: Includes various investment trusts and tax-advantaged Nippon Individual Savings Accounts (NISA).

iDeCo (Individual Defined Contribution Pension): Retirement savings plan that allows for tax-efficient retirement investments.

WealthNavi (RoboAd): A robo-advisor that automates investments based on individual risk tolerance and financial goals.

Stocks/Bonds: Facilitates investments in equity and debt securities.

ALTERNA Mitsui & Co. Digital Securities: Engages in the trading and management of digital securities.

Loans:

Housing Loan: Provides financing options for purchasing or refinancing homes.

Card Loan: Offers unsecured personal loans accessible through credit cards.

Purpose-specific Loan: Tailored loans designed for specific purposes such as education or medical expenses.

Insurance:

Overseas Travel Insurance: Covers medical and travel-related incidents abroad.

Car Insurance: Protects against the financial consequences of car accidents and theft.

Fire Insurance/Life Insurance: Offers protection against damages from fire and provides financial security for families in case of untimely death.

Family Financial Planning:

Tsunagu Trust for Family: Helps families set up trusts to manage and protect their assets effectively.

Rate/Interest/Fees

MoneyKit provides a lot of interest in different products.

| Product/Service | Details |

| Exchange Rate | - Range from 8.49 (ZAR) to 196.05 (GBP) against JPY. - Exchange costs vary, from 0.09 (HKD, SEK) to 0.90 (BRL). |

| FX Rates | - Rates against USD: EUR/USD 1.0789, GBP/USD 1.2537, AUD/USD 0.6608, NZD/USD 0.6027, CAD/USD 1.3669, CHF/USD 0.9073, HKD/USD 7.8120, BRL/USD 5.1549, CNH/USD 7.2437, ZAR/USD 18.4273, SEK/USD 10.8891. - Exchange costs vary, from 0.0018 (EUR) to 0.0250 (HKD, BRL, CNH, ZAR) for transactions in USD. |

| Interest Rates | - Yen deposits: Ordinary rate 0.020% annually. - Fixed-term deposits: 0.050% to 0.350% annually for <1 million yen, 0.050% to 0.100% for 1-3 years for 1 million yen+. |

| Mortgage Loan Rates | - Variable select: 0.397% to 0.757% for variable, 1.317% to 2.560% for fixed. - Refinancing: Similar rates. |

| Card Loan Rates | - Range from 13.800% (up to 500,000 yen) to 2.500% (up to 8 million yen) annually. Variable monthly based on market trends. |

| Commissions | - Transfer/ATM: Vary based on activity. - Card issuance/others: Fees for cards and tokens. - Foreign currency: Vary based on remittance type. - FX margin trading: Vary based on transaction type. |

Exchange Rate:The exchange rates against the Japanese yen for various currencies range from 8.49 for the South African Rand (ZAR) to 196.05 for the British Pound (GBP). Each currency pair has an associated exchange cost at the time of sale and purchase, influencing the total cost of currency exchange transactions. These costs vary significantly, from as low as 0.09 for the Hong Kong Dollar (HKD) and Swedish Krona (SEK) to 0.90 for the Brazilian Real (BRL), affecting the final amount received during currency conversions.

FX Rates: Against the US Dollar, the rates are as follows: EUR/USD at 1.0789, GBP/USD at 1.2537, AUD/USD at 0.6608, NZD/USD at 0.6027, CAD/USD at 1.3669, CHF/USD at 0.9073, HKD/USD at 7.8120, BRL/USD at 5.1549, CNH/USD at 7.2437, ZAR/USD at 18.4273, and SEK/USD at 10.8891. Exchange costs for transactions in USD range from 0.0018 (EUR) to 0.0250 (HKD, BRL, CNH, ZAR).

Interest Rates:The interest rates for MoneyKit from Sony Bank vary based on the type of deposit and amount. For ordinary yen deposits, the annual rate is 0.020% (pre-tax). Fixed-term yen deposits for amounts less than 1 million yen offer rates ranging from 0.050% to 0.350% annually (pre-tax), depending on the term length, which can be 1 month to 10 years. For deposits of 1 million yen or more, the rates are the same but may differ for some terms. Accumulated fixed-term deposits also offer rates between 0.050% and 0.100% annually (pre-tax) for terms of 1 to 3 years, with varying rates for different deposit amounts.

Mortogage Loan Rates:The mortgage loan rates for MoneyKit from Sony Bank vary based on the type of loan and the fixed period selected. For new borrowing, the variable select mortgage loan offers rates ranging from 0.397% to 0.757% for the variable interest rate and from 1.317% to 2.560% for the fixed interest rate, depending on the duration of the fixed period. Refinancing options offer similar rates, with the variable select mortgage loan ranging from 0.397% to 0.757% for the variable interest rate and from 1.217% to 2.460% for the fixed interest rate. These rates are expressed as annual interest rates and are subject to change based on market conditions.

Card Loan Rates:The interest rates for Sony Bank's card loans vary based on the loan amount, with rates ranging from 13.800% for amounts up to 500,000 yen to 2.500% for amounts up to 8 million yen. These rates are expressed as annual interest rates and are subject to change monthly based on market interest rate trends. Applicants who applied before July 10, 2011, may have different interest rates, and they are advised to check the “Contract Details Inquiry” in the “Card Loan” menu after logging in. For more details, customers are encouraged to refer to the card loan product details manual on the Sony Bank website.

Commissions

The commissions for Money Kit can be divided into four parts:

Transfer/ATM:

Transfer fee to other banks: Free for the first transfer every month, then 110 yen per transfer from the second time.

ATM usage fee: Free for deposit, card loan repayment, and balance inquiry. Withdrawals and card loan borrowing are free up to 4 times a month, then 110 yen per transaction after the 5th time.

Card issuance/Others:

Cash card issuance fee: 1,650 yen (including consumption tax).

Family card reissuance fee: 1,650 yen (including consumption tax).

Token issuance fee: First token is free, additional or reissued tokens cost 1,100 yen each (including consumption tax).

Account maintenance fee: Free.

Foreign currency deposit/foreign currency remittance:

Incoming remittance fee: Free for certain currencies, no limit on amount or number of times.

Destination remittance fee: 3,000 yen for remittance fee, plus potential additional bank charges, reversal fee, change fee, and inquiry fee.

Foreign exchange margin trading:

Foreign exchange margin transaction fee: Free per transaction unit (one way) for certain currency pairs.

Delivery fee: Varies per transaction unit for different currency pairs.

Conversion fee: Free.

Spread: The difference between the bid and ask prices, which serves as a transaction cost.

How To Open An Account?

To open an account with Sony Bank, follow these four steps:

Application: Visit the Sony Bank website and fill out the online application form. Provide your personal information, including your name, address, and contact details.

Verification: Upload a copy of your identification documents, such as a passport or driver's license, and any other required documents. This step is necessary to verify your identity.

Confirmation: Once your application and documents are reviewed and approved, you will receive a confirmation email or message from Sony Bank.

Activation: After confirmation, you will receive your account details, including your account number and instructions on how to activate your account. Follow the provided instructions to activate your account and start using Sony Bank's services.

App & Tools

Sony Bank's trading platform, MoneyKit, offers a convenient and secure experience for foreign currency transactions. It provides real-time exchange rates for various currency pairs against the Japanese Yen, allowing users to easily purchase, sell, and apply for limit orders for foreign currency savings deposits.

The platform also aggregates market news, major economic indicators, and current exchange rate information, ensuring users stay informed. With features like push notifications for significant exchange rate changes, transaction authentication, and a user-friendly interface that simplifies transfers by displaying recent recipient lists, MoneyKit ensures a convenient and safe trading environment.

Tools offered by Sony Bank include the Yen/Foreign Currency Simulation tool, which allows users to simulate currency exchanges between Yen and various foreign currencies. Another tool is the Mortgage Loan Simulation, which helps users estimate their mortgage loan repayment amounts based on different loan conditions.

Additionally, the bank provides various informational resources to help users understand their financial options better, including market news, economic indicators, and updates on foreign currency exchange rates.

Deposit & Withdrawal

Deposit & Withdrawal services at Sony Bank include Account Transfer, WEB Transfer Payment, and Smartphone Payment.

Account Transfer: Sony Bank's Account Transfer service enables customers to pay monthly bills such as credit card charges directly from their yen savings account to the receiving company, without any registration or withdrawal fees.

WEB Transfer Payment: This service allows customers to securely and instantly transfer money to member stores online, including securities and insurance companies, without any transfer fees from Sony Bank.

Smartphone Payment: Sony Bank's Smartphone Payment service enables customers to deposit money from their bank account to popular payment apps like PayPay and LINE Pay, providing convenient and instant transactions.

Customer Support

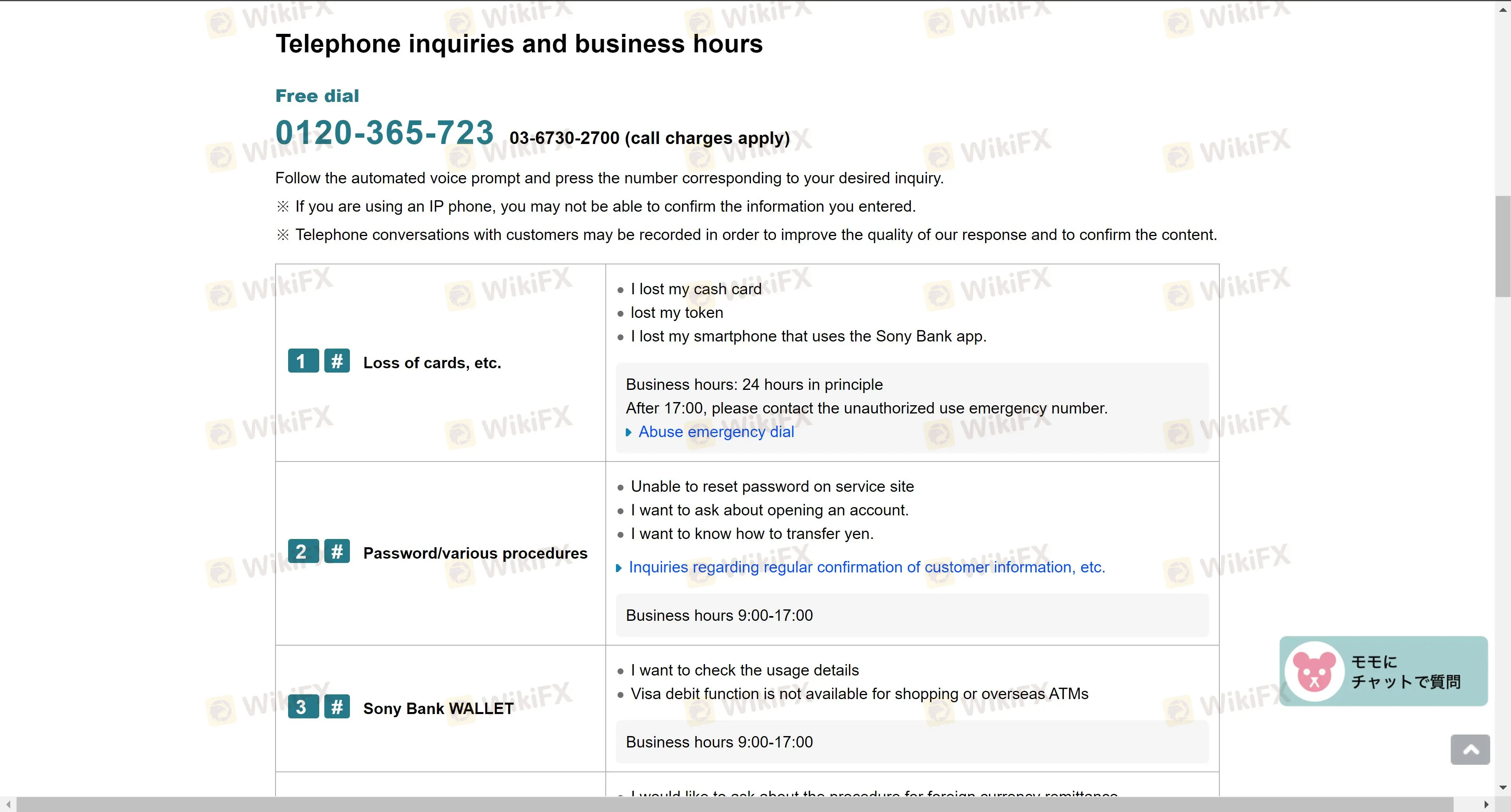

Sony Bank provides various customer support through various channels to assist its customers. For immediate assistance, customers can reach out via phone at 0120-365-723 or 0120-365-866, where dedicated support staff are available to address queries and provide guidance.

The bank also offers a live chat feature, allowing customers to engage with support representatives in real-time for quick solutions. Additionally, Sony Bank's website includes a detailed FAQ section, offering a self-service option for customers to find answers to common questions regarding account management, transactions, and other banking services.

Educational Resources

Sony Bank offers various educational resources to help customers stay informed about financial topics and security measures.

The “What's New” section provides updates on the latest bank announcements, campaigns, and events, keeping customers up-to-date with relevant information.

Additionally, the bank provides detailed security information to educate customers about how to protect their accounts and personal information from fraud and cyber threats. These resources aim to empower customers with knowledge to make informed decisions and safeguard their financial well-being.

Conclusion

In MoneyKit, we explored Sony Bank's services, including its offerings related to foreign currency deposits, transfers, and smartphone payments.

The bank provides a range of tools and resources to facilitate convenient and secure banking for its customers.

Additionally, Sony Bank offers various promotions and campaigns to enhance customer benefits and engagement. The bank's customer support is accessible through phone, live chat, and FAQs, ensuring that customers can easily get assistance when needed.

Overall, Sony Bank focuses on providing innovative banking solutions with a customer-centric approach.

FAQs

Question: How can I open an account with Sony Bank?

Answer: To open an account with Sony Bank, you can apply online through their website or visit a physical branch. You will need to provide identification and complete the required forms.

Question: What are the fees for foreign currency transactions with Sony Bank?

Answer: Sony Bank does not charge fees for foreign currency transactions, but there may be charges from the receiving or sending bank. It's best to check with both banks for the exact fees.

Question: How can I change my account information with Sony Bank?

Answer: You can update your account information by logging into the Sony Bank app or website and accessing the settings or contacting customer support.

Question: What security measures does Sony Bank have in place to protect my account?

Answer: Sony Bank employs various security measures, including encryption, two-factor authentication, and regular security audits, to protect your account from unauthorized access.

Wiki โบรกเกอร์

FxPro

FXCM

IC Markets Global

FBS

EC Markets

IB

FxPro

FXCM

IC Markets Global

FBS

EC Markets

IB

Wiki โบรกเกอร์

FxPro

FXCM

IC Markets Global

FBS

EC Markets

IB

FxPro

FXCM

IC Markets Global

FBS

EC Markets

IB

ข่าวล่าสุด

เหตุการณ์สำคัญทางเศรษฐกิจที่น่าสนใจสัปดาห์นี้

รู้หรือไม่? ความเสี่ยงในการลงทุนมีกี่ประเภท

รวมรีวิวโบรกเกอร์ประจำสัปดาห์ โบรกเกอร์ไหนดี โพสต์นี้มีคำตอบ !

ข้อมูลเศรษฐกิจสหรัฐฯ ทำราคาน้ำมันร่วง รัสเซีย-ยูเครนเจรจาสันติภาพ

ทองปิดบวก $10 ทำนิวไฮ รับข่าวกองทุน SPDR ทุ่มซื้อทอง

อยากเทรดให้ได้กำไรต้องมีกฎ 4 ข้อนี้!

คำนวณอัตราแลกเปลี่ยน