GoldRepublic-Some important Details about This Broker

Lời nói đầu:GoldRepublic is allegedly an unregulated financial firm broker established in 2010 and under license from the Dutch Authority for the Financial Markets (AFM) in the Netherlands with Registration Number 12020650. The broker claims to provide its clients with precious metals trading.

| Aspect | Information |

| Company Name | GoldRepublic |

| Registered Country/Area | Netherlands |

| Founded Year | 2008 |

| Regulation | Unregulatory |

| Minimum Deposit | No minimum deposit required |

| Maximum Leverage | N/A |

| Trading Platforms | Web Trader |

| Tradable Assets | Gold, silver, and platinum |

| Account Types | Personal Account and Business Account |

| Demo Account | Unavailable |

| Customer Support | Phone, email and message box |

| Deposit & Withdrawal | Bank transfers, credit/debit cards, or SOFORT |

| Educational Resources | Articles and Guides, News and Analysis,Calculators and FAQ |

Overview of GoldRepublic

Gold Republic is a Netherlands-based company specializing in the sale and storage of physical precious metals like gold, silver, and platinum. It emphasizes direct ownership of these tangible assets, offering secure vault storage and transparent pricing. Clients can choose from personal or business accounts and easily manage their holdings through Gold Republic's web-based trading platform. Deposits can be made through various methods, and withdrawals are available either by selling back to Gold Republic or requesting physical delivery.

However, the company's exclusive focus on precious metals limits investment diversification, and additional fees apply for storage and delivery.

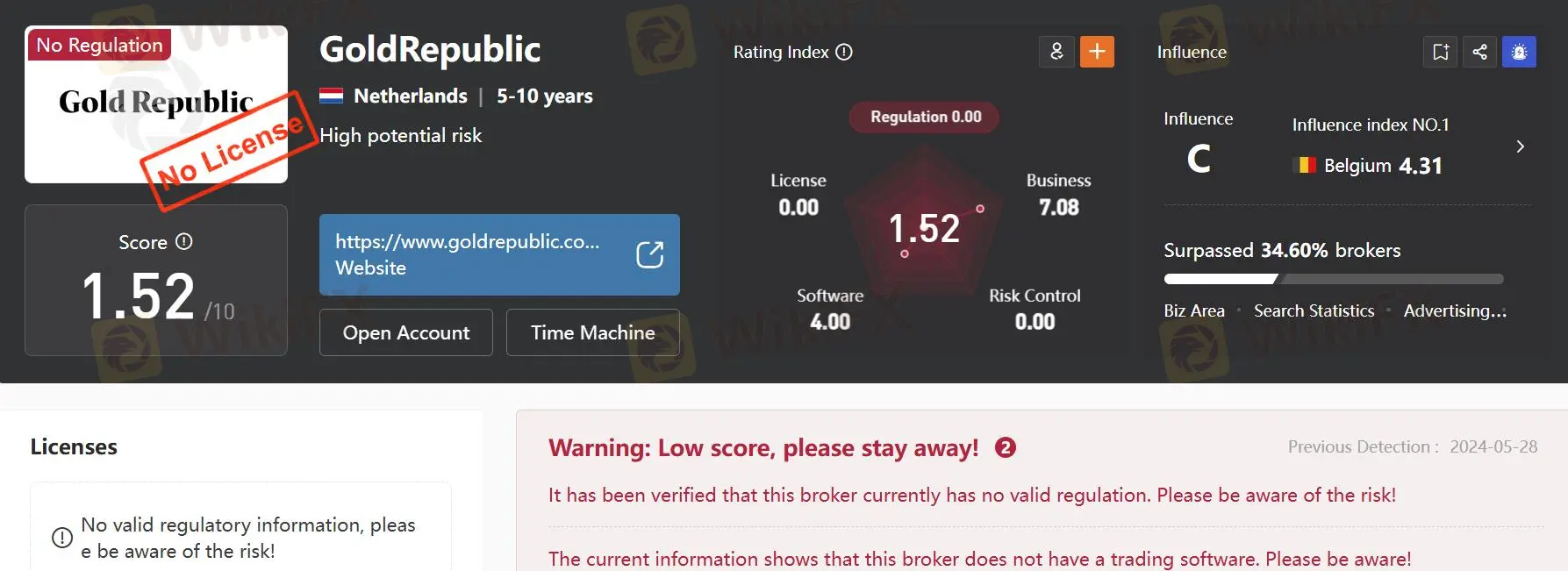

Regulatory Status

GoldRepublic, incorporated in Netherlands, operates without regulation from any recognized financial authority. This lack of regulatory oversight is a major red flag for potential traders, as it means there are no safeguards in place to protect client assets or ensure fair trading practices. Engaging with an unregulated broker like GoldRepublic carries substantial risks, and investors should be aware of the potential consequences before depositing funds.

Pros and Cons

Gold Republic offers several key advantages for investors interested in physical precious metals. The platform prioritizes direct ownership of assets, eliminating counterparty risk, and provides secure storage in high-security vaults. Transparent pricing and a wealth of educational resources empower investors with the knowledge to make informed decisions. The company's responsive and helpful customer support further enhances the user experience.

However, potential drawbacks include premium pricing over the spot price, which may make it less cost-effective compared to other investment options. The focus on physical precious metals limits diversification opportunities, and additional storage and delivery fees can accrue. Moreover, the lack of regulation by financial authorities sow doubts about investor protection and the enforcement of ethical practices.

| Pros | Cons |

| Direct ownership | Lack of valid regulatory certificates |

| Secure storage | Premium Pricing |

| Transparency | Limited Investment Options |

| Various customer support | Storage and Delivery Fees |

| Diverse educational resources |

Market Instruments

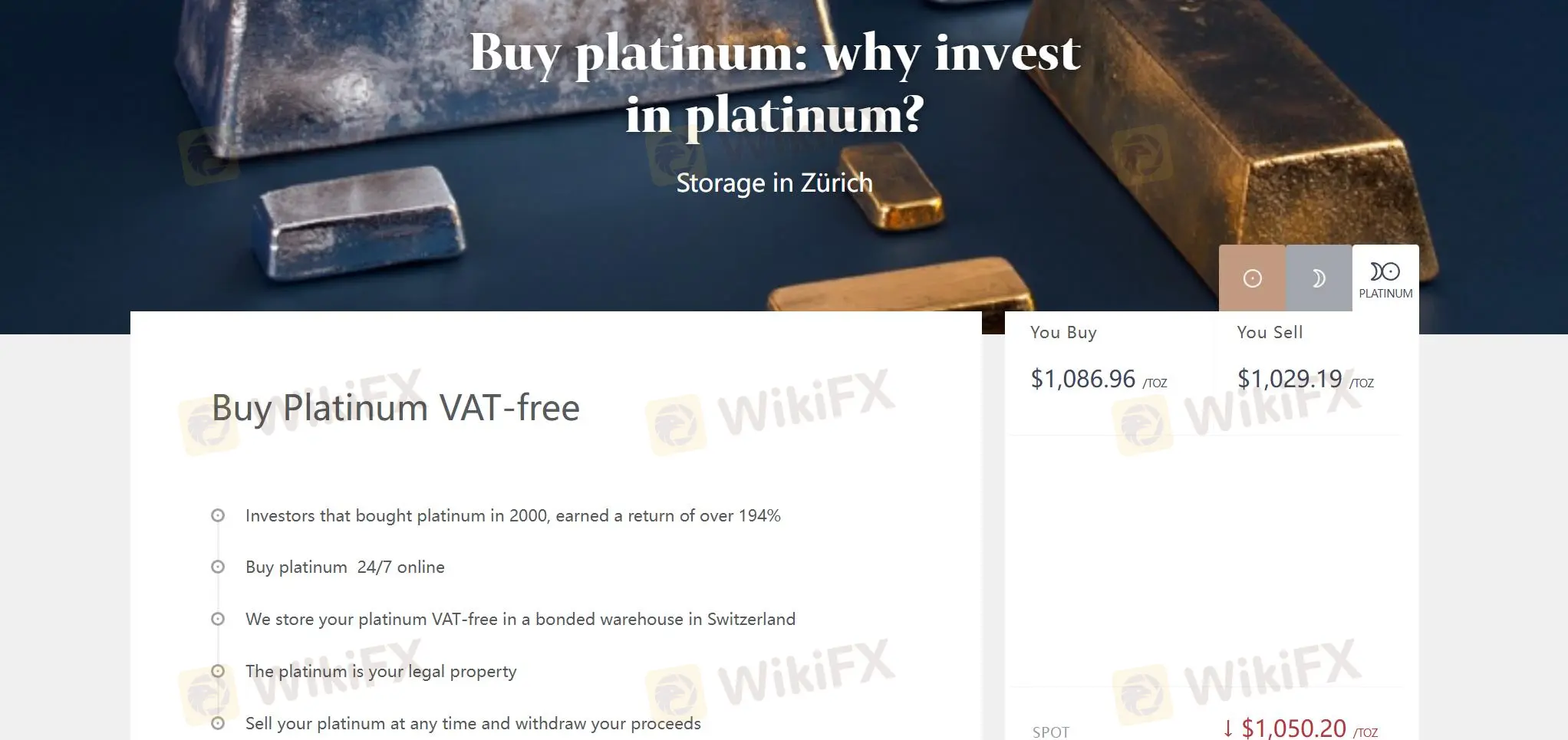

Gold Republic's core offerings revolve around physical precious metals. Customers can purchase and hold gold, silver and platinum in various forms, such as bars and coins.

Gold: Investors can purchase physical gold bullion, which is stored in secure vaults. Gold is sourced from LBMA-accredited refiners, ensuring high purity and quality. GoldRepublic offers full ownership, providing specific bar numbers for transparency.

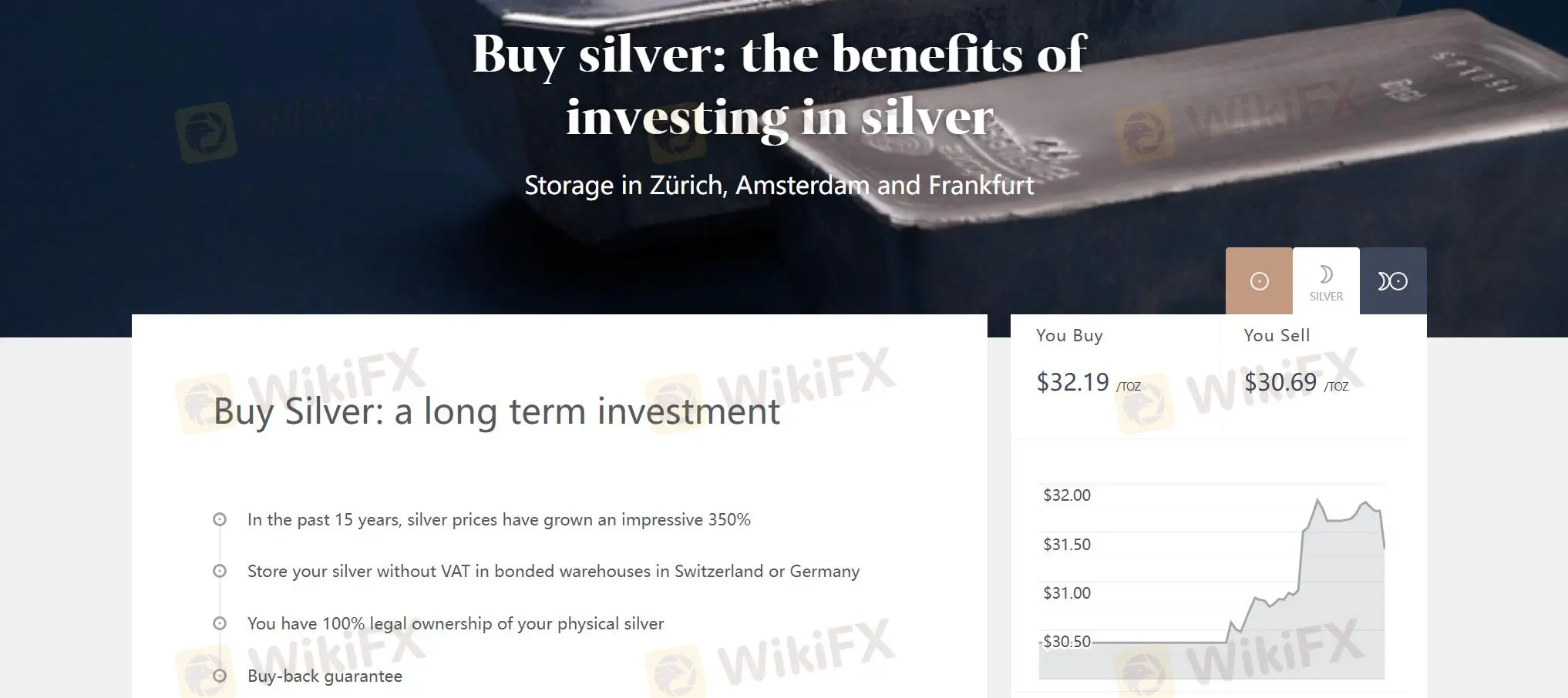

Silver: Similar to gold, silver bullion is available for purchase and secure storage. Silver offers a lower entry point for investors looking to diversify their precious metal holdings.

Platinum: Platinum bullion is also offered, stored under the same high-security conditions as gold and silver. This metal provides a unique investment opportunity due to its industrial uses and rarity.

Account Types

GoldRepublic simplifies its account offerings into two main categories:

Personal Account: For individual investors who want to buy and store precious metals.

Business Account: For companies and institutional investors, accommodating larger transactions and bulk storage needs.

Account Opening Process

Opening an account with Gold Republic is a simple and straightforward process:

Registration: Customers can create an account on the Gold Republic website by providing basic personal information such as name, email address, and country of residence.

Verification: To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, Gold Republic requires customers to verify their identity by submitting relevant documents like a passport or driver's license.

Funding: Once the account is verified, customers can fund their accounts using various payment methods, including bank transfers, credit/debit cards, and SOFORT.

Leverage

GoldRepublic does not offer leveraged trading options. The platform focuses on the outright purchase of physical metals, providing full ownership and security without the risks associated with leverage.

Trading Fees

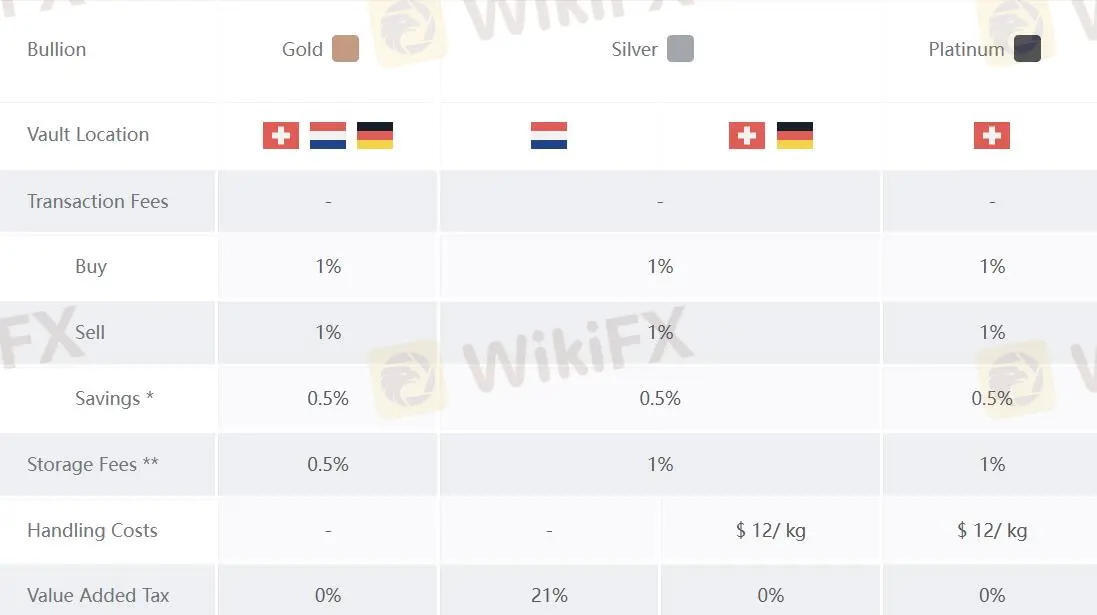

GoldRepublic's fee structure includes:

Transaction Fees: Applied to both buying and selling metals. For example, the transaction fee for gold is approximately 1% per transaction.

Storage Fees: An annual fee of around 0.5% based on the market value of the stored metals. This fee covers insurance and vault storage costs.

Trading Platform

GoldRepublic's trading platform is web-based, offering the following features:

Real-Time Pricing: Investors can view live prices for gold, silver, and platinum.

Portfolio Management: Tools to monitor and manage investments.

Secure Transactions: High-security measures ensure the safety of all transactions.

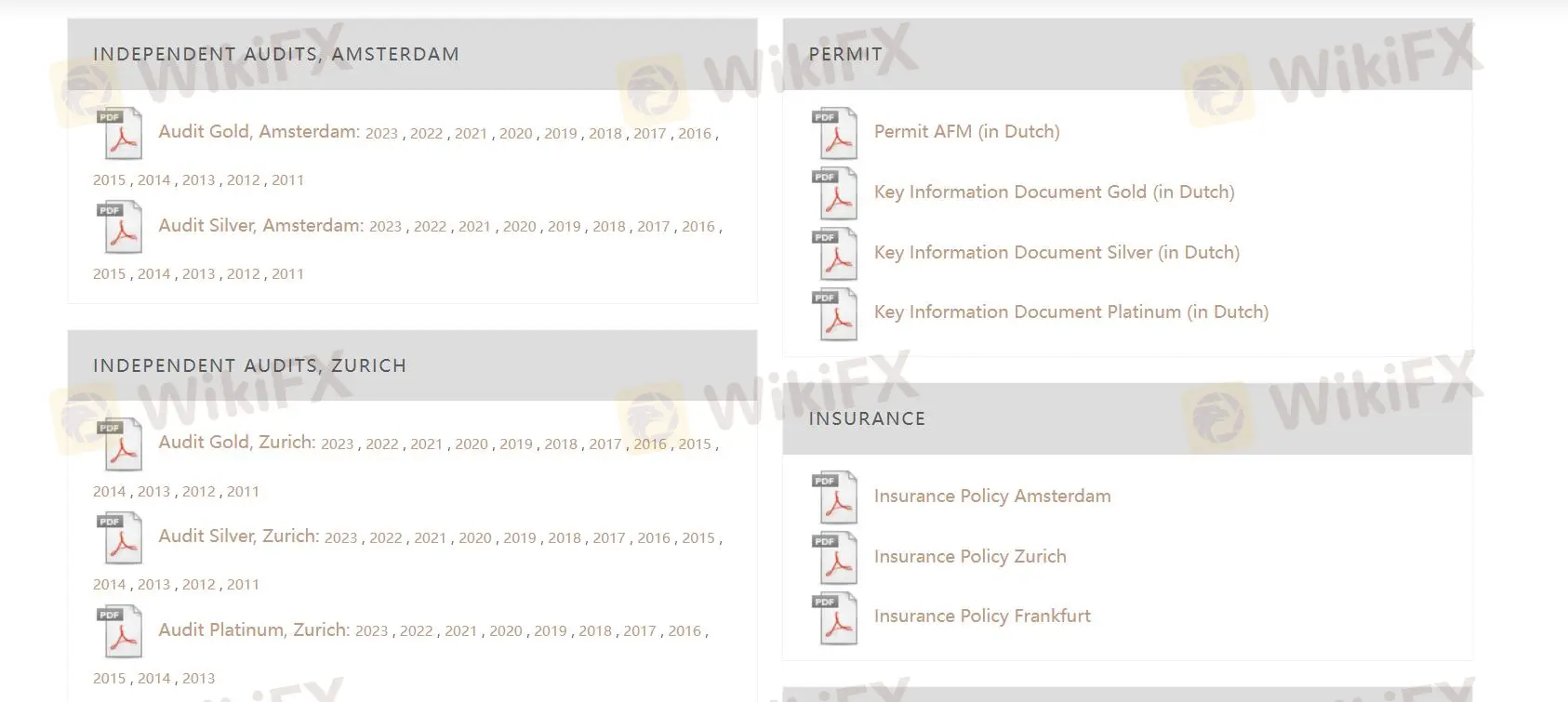

Audit Reports: Regular reports verify the presence and value of stored metals, ensuring transparency.

Deposit and Withdrawal

GoldRepublic provides flexible options for deposits and withdrawals:

Deposits: Customers can deposit funds into their Gold Republic accounts using bank transfers, credit/debit cards, or SOFORT. Bank transfers are generally the most cost-effective option, while credit/debit card payments may incur additional processing fees.

Withdrawals: Gold Republic offers two withdrawal options:

Sell-back: Customers can sell their precious metals back to Gold Republic at the prevailing market price. The proceeds are then credited to their account and can be withdrawn via bank transfer.

Physical Delivery: Customers can request physical delivery of their precious metals to a specified address. Delivery fees apply based on the weight and destination of the shipment.

Customer Support Options

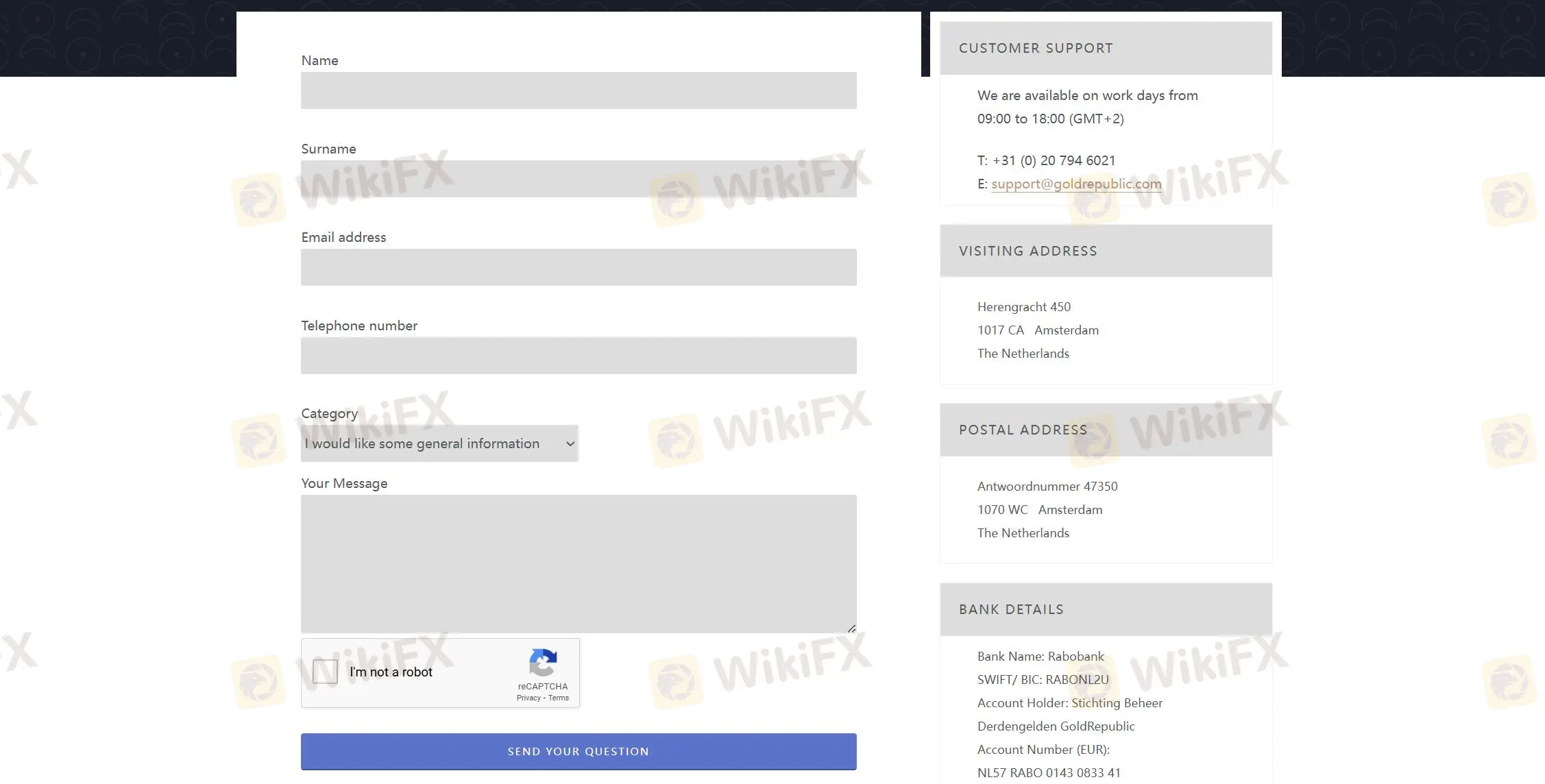

GoldRepublic offers robust customer support through various channels available on work days from 09:00 to 18:00 (GMT+2):

Phone Support: +31 (0) 20 794 6021, available during business hours for immediate assistance.

Email Support: For detailed inquiries and support requests through emai (support@goldrepublic.com).

Message box: Real-time assistance via their website.

Educational Resources

Gold Republic's website offers a wealth of educational resources on precious metals investing. This includes:

Articles and Guides: Informative articles and guides covering various aspects of precious metals, including market trends, investment strategies, and storage options.

News and Analysis: Regular updates on market news and expert analysis of the precious metals market.

Calculators: Tools for calculating the value of precious metal holdings and estimating potential returns.

FAQ Section: A comprehensive FAQ section addressing common questions about precious metals and Gold Republic's services.

Conclusion

Gold Republic offers a straightforward and transparent platform for investing in physical precious metals like gold, silver, and platinum, emphasizing direct ownership and secure storage. Their educational resources and accessible customer support cater to both novice and experienced investors. However, the lack of regulatory oversight, premium pricing, limited investment options, and additional fees for storage and delivery should be carefully considered by potential investors.

FAQs

Q: What types of metals can I buy on GoldRepublic?

A: You can purchase gold, silver, and platinum bullion.

Q: Where are my metals stored?

A: Your metals are stored in high-security vaults in Switzerland, Germany, or the Netherlands.

Q: Are my investments insured?

A: Yes, all stored metals are fully insured against theft and damage.

Q: How can I fund my GoldRepublic account?

A: Accounts can be funded via bank transfer with no minimum deposit requirement.

Q: Can I withdraw my metals physically?

A: Yes, you can choose to have your metals delivered to your home, but additional charges apply and you will lose the buy-back guarantee.

Người môi giới liên quan

Broker WikiFX

FXTM

ATFX

XM

STARTRADER

TMGM

AVATRADE

FXTM

ATFX

XM

STARTRADER

TMGM

AVATRADE

Broker WikiFX

FXTM

ATFX

XM

STARTRADER

TMGM

AVATRADE

FXTM

ATFX

XM

STARTRADER

TMGM

AVATRADE

Tin hot

Liquidity - Thanh khoản: Dòng tiền "đánh lừa" các chỉ số vĩ mô và đẩy thị trường lên đỉnh

Giải mã 'Công thức SNB': Lãi suất âm có thực sự quay lại trong năm 2026?

Nước Anh trong bẫy chính sách: Tại sao lạm phát vẫn cao mà Chính phủ lại phải thắt lưng buộc bụng?

Triệt phá đường dây lừa đảo “luật sư ma” chiếm đoạt gần 1.000 tỷ đồng của hàng trăm nạn nhân

Điểm danh 4 sàn forex có Net Inflow biến động nhất tháng 11/2025

Vụ án 7.500 tỷ tại Campuchia: “Cào khách” dụ tình, vét sạch ví nạn nhân

Tiệm vàng làm lá chắn, hơn 300 công ty "ma" rửa hàng chục nghìn tỷ đồng xuyên biên giới

Lạm phát Mỹ 2.7%: Cú hạ cánh "ảo diệu" từ sự hỗn độn dữ liệu

WikiFX đánh giá chi tiết spread và chi phí giao dịch của sàn Forex WisunoFX 2025

Shiller PE vượt ngưỡng 40.16 - Lịch sử 154 năm đang lặp lại hay "cú sập" mới đang chờ đợi?

Tính tỷ giá hối đoái