TBanque

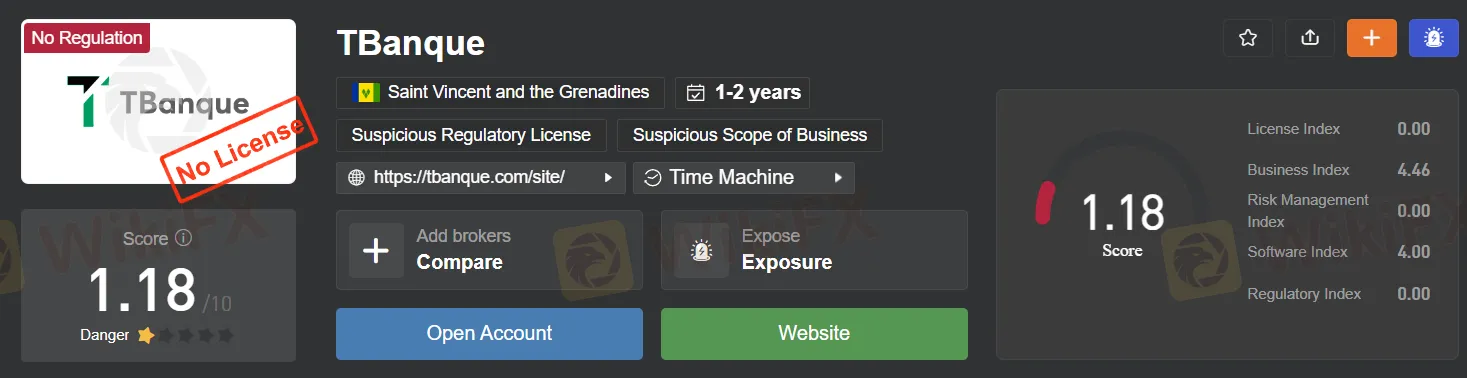

Lời nói đầu:TBanque, a company registered in Saint Vincent and the Grenadines, emerges as a concerning choice for prospective traders. Notably, the absence of regulatory oversight raises red flags about the broker's legitimacy and commitment to ensuring a secure trading environment. Transparency issues are evident in the lack of clarity surrounding spreads, a crucial factor in assessing the overall cost of trading. The primary trading platform offered, WebTrader, falls short of advanced alternatives like MetaTrader. Furthermore, the absence of educational resources handicaps traders seeking to enhance their skills. Perhaps most concerning is the severely lacking or non-existent customer support, leaving traders potentially stranded in critical situations. While TBanque provides diverse trading assets and account types, the drawbacks in regulation, transparency, support, and educational offerings make it a suboptimal choice for traders seeking a reliable and comprehensive trading experience.

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Company Name | TBanque |

| Regulation | None |

| Minimum Deposit | Varies by the trader's country |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Lack of transparency |

| Trading Platforms | WebTrader (No MetaTrader platforms) |

| Tradable Assets | Forex currency pairs, Indices, Commodities, Stocks, Crypto Assets, ETFs |

| Account Types | Retail Account, Professional Account |

| Customer Support | Severely lacking or non-existent |

| Payment Methods | TBanque Money, Debit/Credit Card, Wire Transfer, PayPal, Neteller, Skrill, Trustly, iDEAL |

| Educational Tools | Absent |

Overview

TBanque, a company registered in Saint Vincent and the Grenadines, emerges as a concerning choice for prospective traders. Notably, the absence of regulatory oversight raises red flags about the broker's legitimacy and commitment to ensuring a secure trading environment. Transparency issues are evident in the lack of clarity surrounding spreads, a crucial factor in assessing the overall cost of trading. The primary trading platform offered, WebTrader, falls short of advanced alternatives like MetaTrader. Furthermore, the absence of educational resources handicaps traders seeking to enhance their skills. Perhaps most concerning is the severely lacking or non-existent customer support, leaving traders potentially stranded in critical situations. While TBanque provides diverse trading assets and account types, the drawbacks in regulation, transparency, support, and educational offerings make it a suboptimal choice for traders seeking a reliable and comprehensive trading experience.

Regulation:

None.

TBanque, an unregulated forex broker, raises significant concerns for potential traders. In the forex market, a reputable, regulated broker is crucial for a secure and fair trading environment.

Regulated brokers adhere to essential rules and standards, offering protection against fraud and misconduct. They maintain segregated client accounts, provide transparent financial statements, and follow stringent compliance standards.

In contrast, unregulated brokers like TBanque lack oversight, exposing traders to risks like limited investor protection, higher fraud potential, and reduced transparency.

Pros and Cons

TBanque, an unregulated forex broker, presents a worrisome picture for potential traders. It operates without regulatory oversight, raising concerns about the safety and fairness of trading with this broker. The lack of transparency is striking, from undisclosed spreads to seemingly contradictory claims of commission-free trading. Furthermore, TBanque's minimum deposit requirements vary widely based on the trader's country, a practice that appears discriminatory. The absence of effective customer support compounds the issues, leaving traders without adequate assistance and support. Educational resources are virtually non-existent, disadvantaging traders who rely on such materials to enhance their trading knowledge. Moreover, the trading platform, primarily WebTrader, falls short in terms of advanced features, and the absence of renowned MetaTrader platforms is a notable drawback. In sum, TBanque's unregulated status, lack of transparency, discriminatory policies, and inadequate support make it a less-than-ideal choice for traders seeking a secure and comprehensive trading experience.

Pros and Cons of TBanque:

| Pros | Cons |

| Offers a wide variety of trading assets | Lack of regulatory oversight |

| Diverse trading opportunities | Lack of transparency in spreads |

| Various account types for different traders | Minimum deposit requirements vary widely |

| High leverage levels | Limited customer support |

| Flexible payment methods | Lack of educational resources |

| Basic trading platform (WebTrader) | |

| Absence of renowned MetaTrader platforms |

Market Instruments

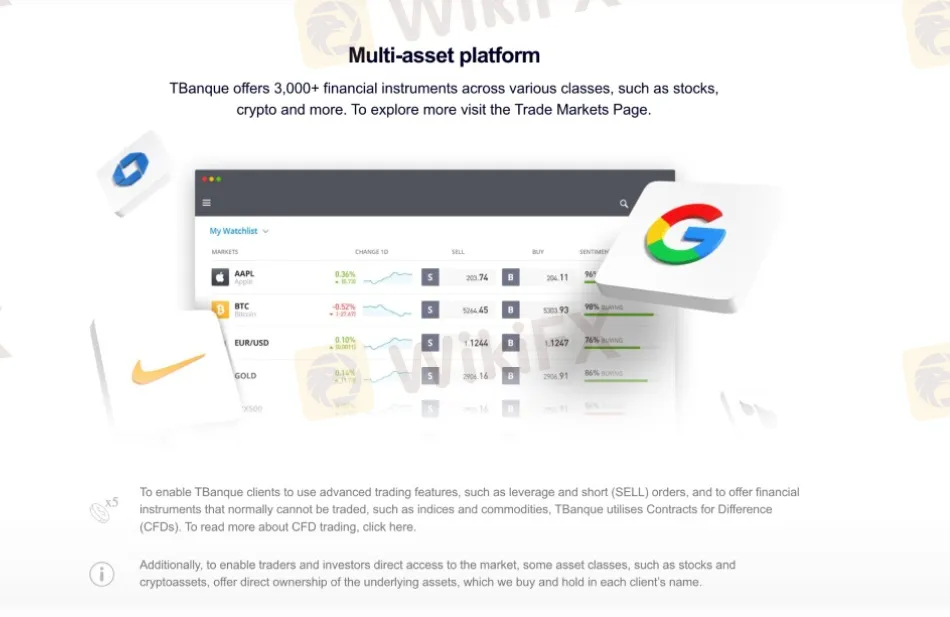

TBanque offers a wide variety of trading assets across different categories:

Forex Currency Pairs: Examples include EUR/USD, AUD/CAD, and CHF/JPY. Traders can speculate on the exchange rates between these currency pairs.

Indices: TBanque provides access to indices like S&P500, DOW30, and NIKKEI225, allowing traders to invest in the overall performance of specific markets.

Commodities: Trading options encompass natural gas, gold, and copper, providing opportunities to profit from price fluctuations in these physical goods.

Stocks: Investors can trade individual stocks of well-known companies such as Tesla, Samsung, and Renault, participating in their growth or decline.

Crypto Assets: Cryptocurrencies like BTC, USDT, DSH, and ETH are available for trading, offering exposure to the volatile crypto market.

ETFs (Exchange-Traded Funds): TBanque offers ETFs like AMPL, AAXJ, and AGG, which track various asset baskets for diversification.

These diverse assets cater to different trading preferences, allowing traders to explore various market opportunities. However, remember that TBanque is an unregulated broker, so caution and due diligence are essential when considering trading with them.

Account Types

TBanque offers two distinct trading account types to cater to traders with varying levels of experience and capital. These account types are:

Retail Account:

Initial Deposit Range: $10 to $10,000 (Dependent on the trader's country of residence).

Leverage: TBanque advertises 1:30 leverage for retail clients, but it's worth noting that the actual leverage can go as high as 1:1000, which can lead to substantial trading risks.

Features: The retail account is designed for traders with limited capital. It provides access to the forex and CFD markets, allowing traders to engage in various trading strategies.

Professional Account:

Minimum Deposit Requirement: > $500,000.

Leverage: TBanque states that professional account holders receive 1:400 leverage. However, the actual leverage cap is an astonishingly high 1:1000.

Perks: The professional account is promoted to come with advantages similar to those offered by licensed brokers. These perks may include enhanced customer support, access to additional trading tools, and potentially lower trading costs. However, it's essential to keep in mind that TBanque is an unregulated broker, which raises concerns about the legitimacy of these claims.

It's crucial to exercise caution when considering trading with TBanque, especially due to its unregulated status. The significantly high leverage levels, particularly in the professional account, can expose traders to substantial losses. The lack of regulatory oversight also means that clients may have limited protection and recourse in case of any issues with the broker.

Here's a table summarizing the TBanque account types:

| Account Type | Initial Deposit Range | Advertised Leverage | Actual Leverage Cap |

| Retail Account | $10 - $10,000 (Varies by Country) | 1:30 | Up to 1:1000 |

| Professional Account | > $500,000 | 1:400 | Up to 1:1000 |

Please note that the actual leverage levels are significantly higher than advertised, which can pose significant risks to traders.

Leverage

TBanque offers extremely high leverage levels of up to 1:1000 for both retail and professional trading accounts. While they advertise lower leverage ratios, the actual cap is significantly higher. This excessive leverage can magnify both potential profits and losses, making it a high-risk proposition for traders. It is crucial for traders to exercise caution, employ effective risk management strategies, and carefully evaluate their risk tolerance before engaging in trading activities with TBanque. Moreover, considering the broker's unregulated status, traders should be aware of the potential lack of regulatory protections and oversight.

Spreads & Commissions

When it comes to TBanque's spreads and commissions, there is a notable lack of transparency. The broker does not provide clear information about the spread levels on their platform. Furthermore, TBanque advertises commission-free trading, which appears contradictory.

Spread Information: TBanque does not disclose specific details about the spreads it offers to traders. Spreads represent the difference between the buying (ask) and selling (bid) prices of an asset and play a crucial role in a trader's overall cost. The absence of this information can make it challenging for traders to assess the competitiveness of TBanque's pricing.

Commission-Free Trading: The broker promotes itself as offering commission-free trading, which implies that traders do not pay a direct fee for executing trades. However, it's important to note that while there may not be explicit commissions, brokers often incorporate their costs into the spread. Therefore, traders should carefully consider the overall cost of trading, which includes both spreads and potential hidden fees.

The lack of transparency regarding spreads and the claim of commission-free trading may raise concerns about the broker's practices. Traders are advised to conduct thorough research and consider the overall cost structure when evaluating TBanque as their trading platform. Moreover, the fact that TBanque is an unregulated broker emphasizes the importance of due diligence before engaging in any trading activities with them.

Deposit & Withdrawal

TBanque's deposit and withdrawal policies have some key features:

Minimum Deposit Variability: The minimum deposit requirements differ based on the trader's country of residence, potentially leading to unequal financial burdens. For instance, a US trader may need only $10 to open an account, while an Israeli trader might have to deposit $10,000, raising concerns about fairness.

Payment Methods: TBanque offers a variety of payment options, including TBanque Money, debit/credit cards, wire transfers, PayPal, Neteller, Skrill, Trustly, and iDEAL, providing flexibility for traders.

Identity Verification: TBanque allows deposits without prior verification, but withdrawals necessitate identity confirmation. This policy raises questions about security and transparency, especially given the broker's unregulated status.

Traders should carefully assess these policies and exercise caution when engaging in financial transactions with TBanque.

Trading Platforms

While TBanque's website initially suggested a variety of trading platform options, our exploration led us to primarily one platform - WebTrader. However, our evaluation found that WebTrader is relatively basic, offering simple charts and indicators that may be suitable mainly for novice traders. Unfortunately, due to the absence of a real demo account and broken links, we couldn't fully verify its functionality.

Notably, TBanque does not offer the renowned MetaTrader platforms, known for their advanced features and extensive trading tools. The absence of these cutting-edge platforms might disappoint traders seeking more robust and comprehensive trading experiences.

In summary, TBanque's primary trading platform is WebTrader, which is relatively basic. The lack of MetaTrader platforms could limit the options for traders who prefer advanced tools. Thus, traders should carefully consider their platform preferences before selecting TBanque as their broker.

Customer Support

TBanque's customer support can be best described as severely lacking or non-existent. The broker's approach to customer service leaves much to be desired. Traders may encounter significant challenges when seeking assistance or resolving issues.

Lack of Responsiveness: Customers often find it frustratingly difficult to reach out to TBanque's support team. Responses to inquiries, if received at all, are typically delayed and lack the necessary urgency.

Limited Contact Channels: The broker's limited availability across communication channels, coupled with unresponsive support, can leave traders feeling isolated and unsupported in critical situations.

Inadequate Assistance: When traders do manage to get in touch with TBanque's support, the assistance provided is often insufficient and fails to address their concerns adequately.

Overall, the lack of effective customer support at TBanque can significantly hinder the trading experience, leaving traders feeling abandoned and unsupported, which is highly detrimental in the financial markets where timely assistance can be crucial.

Educational Resources

TBanque's educational resources are conspicuously absent, leaving traders without access to essential tools and materials for improving their trading knowledge and skills. This lack of educational support is a significant shortcoming for traders who rely on educational content to enhance their understanding of financial markets and trading strategies.

Traders often seek educational resources to learn about fundamental and technical analysis, risk management, and other critical aspects of trading. These resources can help traders make informed decisions and navigate the complexities of the financial markets successfully. Without such resources, traders using TBanque may find themselves at a disadvantage, particularly if they are new to trading or looking to expand their knowledge.

In an industry where knowledge and continuous learning are paramount, the absence of educational resources at TBanque can be a significant drawback, limiting traders' ability to make informed and profitable decisions in the financial markets.

Summary

TBanque, an unregulated forex broker, presents a worrisome picture for potential traders. It operates without regulatory oversight, raising concerns about the safety and fairness of trading with this broker. The lack of transparency is striking, from undisclosed spreads to seemingly contradictory claims of commission-free trading. Furthermore, TBanque's minimum deposit requirements vary widely based on the trader's country, a practice that appears discriminatory. The absence of effective customer support compounds the issues, leaving traders without adequate assistance and support. Educational resources are virtually non-existent, disadvantaging traders who rely on such materials to enhance their trading knowledge. Moreover, the trading platform, primarily WebTrader, falls short in terms of advanced features, and the absence of renowned MetaTrader platforms is a notable drawback. In sum, TBanque's unregulated status, lack of transparency, discriminatory policies, and inadequate support make it a less-than-ideal choice for traders seeking a secure and comprehensive trading experience.

FAQs

Q1: Is TBanque a regulated forex broker?

A1: No, TBanque operates as an unregulated forex broker, lacking oversight from financial regulatory authorities.

Q2: What is the minimum deposit requirement for a retail account at TBanque?

A2: The minimum deposit for a retail account can vary depending on the trader's country of residence, ranging from $10 to $10,000.

Q3: What is the maximum leverage offered by TBanque?

A3: TBanque advertises maximum leverage ratios of 1:30 for retail clients and 1:400 for professional clients, but the actual leverage cap can go as high as 1:1000.

Q4: Does TBanque offer the MetaTrader trading platforms?

A4: No, TBanque primarily offers the WebTrader platform, and MetaTrader platforms are not available.

Q5: Are there educational resources available for traders at TBanque?

A5: Unfortunately, TBanque lacks educational resources, leaving traders without access to materials for improving their trading knowledge and skills.

Broker WikiFX

FXTM

Exness

DBG Markets

FOREX.com

XM

IC Markets Global

FXTM

Exness

DBG Markets

FOREX.com

XM

IC Markets Global

Broker WikiFX

FXTM

Exness

DBG Markets

FOREX.com

XM

IC Markets Global

FXTM

Exness

DBG Markets

FOREX.com

XM

IC Markets Global

Tính tỷ giá hối đoái