Kaerm IM

Lời nói đầu:Kaerm IM, founded in 2023 and headquartered in the United States, is a trading platform that offers a diverse range of tradable assets, including forex, cryptocurrencies, commodities, indices, and precious metals. Regulated by the Financial Crimes Enforcement Network (FinCEN) with license number 31000255528484, Kaerm IM provides multiple account types such as Comprehensive, Finance, and Financial STP, accommodating various trading preferences. The platform boasts flexible leverage ranging from 1:100 to 1:500 and competitive floating spreads as low as one point. Utilizing the Tradingweb trading platform, Kaerm IM collaborates with Goldman Sachs to provide advanced chart analysis tools and automated investment analysis. While the platform emphasizes a streamlined withdrawal process and multiple customer support channels, concerns arise due to an abnormal regulatory status with the National Futures Association and limited transparency on spreads and commissions.

| Kaerm IM | Basic Information |

| Company Name | Kaerm IM |

| Founded | 2023 |

| Headquarters | United States |

| Regulations | Unregulated |

| Tradable Assets | Forex, Precious Metals, Commodities, Cryptos, Indices |

| Account Types | Comprehensive, Finance, Financial STP |

| Minimum Deposit | Not specified |

| Maximum Leverage | 1:100 to 1:500 |

| Spreads | Floating, as low as one point |

| Commission | Not specified |

| Deposit Methods | Bank Wire Transfers, Credit Cards, Cryptocurrencies |

| Trading Platforms | Tradingweb |

| Customer Support | Email (support@kaermiuser.com), Live Chat |

| Trading Tools | Analyst View (AOI), Adaptive Candle Diagram (AC), Adaptive Trend Indicator (ADC) |

| Bonus Offerings | Not mentioned |

Overview of Kaerm IM

Kaerm IM, established in 2023 and headquartered in the United States, is a trading platform that positions itself as a versatile financial hub.

Kaerm IM provide multiple account types, such as Comprehensive, Finance, and Financial STP, granting traders the flexibility to align their accounts with their specific trading goals.

With leverage options ranging from 1:100 to 1:500, the platform empowers users to tailor their market exposure according to their risk tolerance. Utilizing the Tradingweb trading platform, renowned for its robust chart analysis tools, Kaerm IM collaborates with Goldman Sachs to deliver advanced investment analysis and research tools.

Is Kaerm IM Legit?

Kaerm IM is not regulated by any regulatory authorities.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

Trading Instruments

Kaerm IM offers a comprehensive array of trading instruments, spanning various financial markets to accommodate a broad spectrum of investor preferences. The product range includes:

1. Foreign Exchange (Forex):

Kaerm IM provides access to a diverse selection of mainstream currency pairs, offering trading opportunities in major forex pairs such as EUR/USD, USD/CAD, and GBP/USD. Traders can engage in the dynamic and liquid forex market, capitalizing on the fluctuations of global currencies.

2. Precious Metals:

The platform facilitates spot trading in precious metals, featuring gold (XAUUSD) and silver (XAGUSD). This enables investors to participate in the precious metals market, taking advantage of market movements in these valuable commodities.

3. Crude Oil:

Kaerm IM caters to energy commodity traders by offering trading in US crude oil (UsOIL). Traders can navigate the volatility of the crude oil market, taking positions based on their market outlook and strategies.

4. Indices:

Indices trading is available on Kaerm IM, featuring key benchmarks like the Hong Kong Hang Seng Index (HK50), the German Index (GER30), and the S&P 500 Index (US500). This allows traders to gain exposure to the overall performance of specific stock markets and broader market trends.

5. Cryptocurrency:

Kaerm IM stands out in the cryptocurrency market by offering a diverse range of mainstream digital currency pairs. Traders can explore opportunities in popular cryptocurrencies such as Bitcoin (BTC/USD), Ether (ETH/USD), and Ripple (XRP/USD), navigating the dynamic and rapidly evolving cryptocurrency landscape.

Account Types

Kaerm IM caters to diverse trading preferences by offering a flexible range of account types tailored to varying investor needs.

1. Comprehensive Account:

The Comprehensive Account is designed to provide traders with the flexibility to engage in Contracts for Difference (CFD) contracts continuously. This account type utilizes a unique and proprietary composite index that accurately simulates real market movements. Traders can benefit from around-the-clock trading opportunities.

2. Finance Account:

The Finance Account is structured for traders seeking a broad spectrum of trading instruments. With this account, users can trade forex, commodities, and cryptocurrencies, both in standard and microtransactions. The inclusion of high leverage options enhances the potential for capital efficiency.

3. Financial STP Account:

The Financial STP (Straight Through Processing) Account is tailored to accommodate traders with varying preferences in terms of trade volume and spreads. This account type offers the flexibility to major or minor in trade, allowing traders to navigate markets with larger or smaller trade volumes.

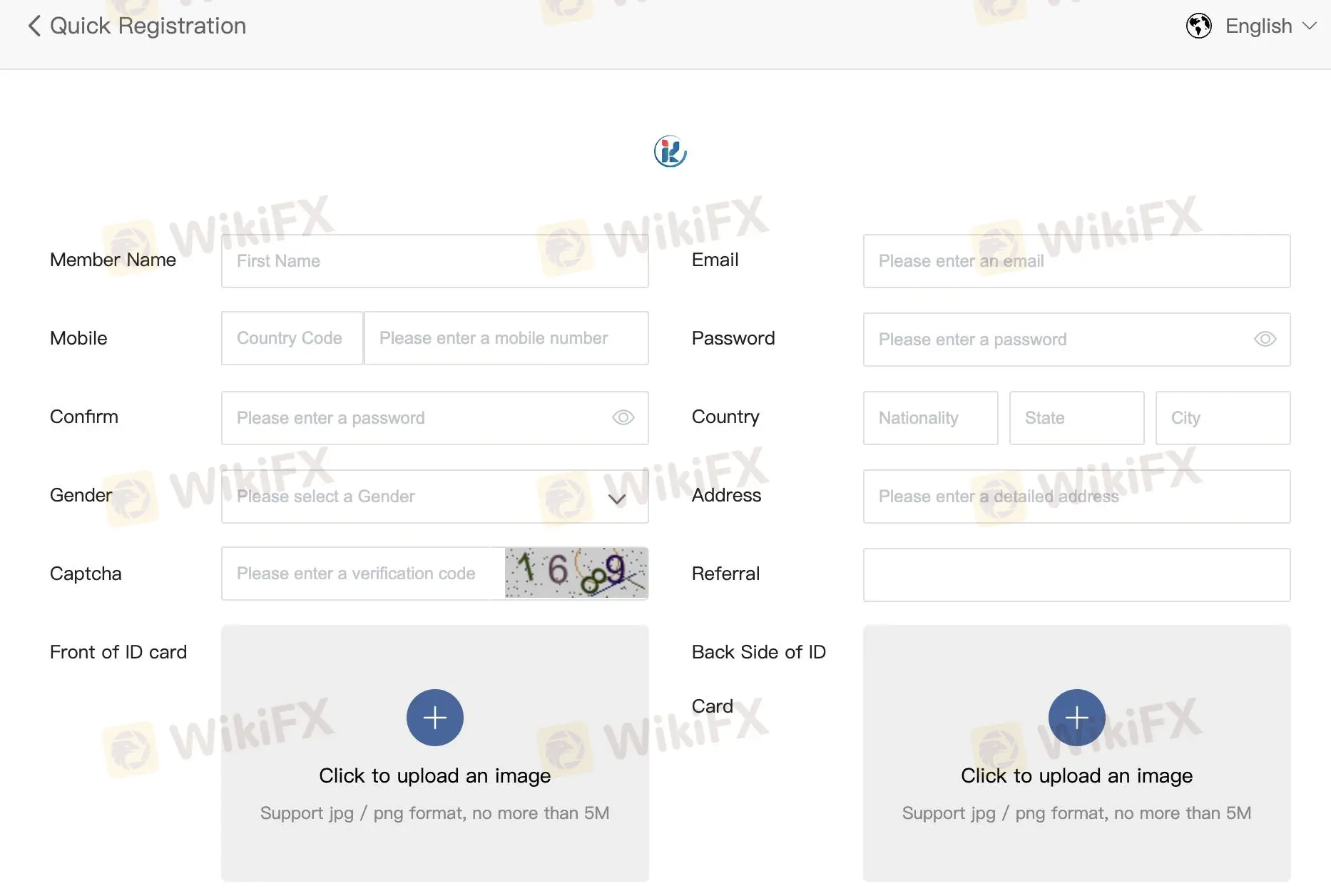

How to Open an Account?

To open an account with Kaerm IM, follow these steps.

- Visit the Kaerm IM website. Look for the “Register” button on the homepage and click on it.

- Sign up on websites registration page, providing details such as member name, first name, email, mobile number, and password.

- Receive your personal account login from an automated email

- Log in

- Proceed to deposit funds to your account

- Download the platform and start trading

Leverage

Kaerm IM provides traders with a flexible leverage offering, ranging from 1:100 to 1:500.

Spreads and Commissions

Kaerm IM offers traders competitive and dynamic spreads, with floating spreads that can go as low as one point.

Deposit & Withdraw Methods

Kaerm IM facilitates user transactions with a user-friendly and flexible approach to deposit and withdrawal methods. Deposit methods include traditional options such as bank wire transfers and credit cards. Bank wire transfers, a conventional and secure means of funding accounts, typically take 2-5 business days to process.

Trading Platforms

Kaerm IM offers the Tradingweb trading platform, renowned as one of the most widely used online trading platforms globally. This platform is equipped with robust chart analysis tools, including over 50 technical indicators and intraday analysis tools.

Customer Support

Kaerm IM provides customer support through various channels to assist users with their inquiries and concerns. Users can reach out to the customer support team via email at support@kaermiuser.com.

For those who prefer traditional means of communication, the company's physical address is provided as 96 WADSWORTH BLVD NUM 127-3255, LAKEWOOD, CO 80226, U.S.A.

Trading Tools

Kaerm IM collaborates with the prestigious Goldman Sachs, a globally recognized analysis agency, to offer users award-winning automated investment analysis and research tools.

FAQs

What tradable assets does Kaerm IM offer?

Kaerm IM provides a diverse range of tradable assets, including forex, cryptocurrencies, commodities, indices, and precious metals.

What account types are available on Kaerm IM?

Kaerm IM offers multiple account types, including Comprehensive, Finance, and Financial STP.

What is the maximum leverage offered by Kaerm IM?

Kaerm IM provides flexible leverage options ranging from 1:100 to 1:500.

Which trading platform does Kaerm IM use?

Kaerm IM utilizes the Tradingweb trading platform.

Broker WikiFX

FXTM

Exness

DBG Markets

CXM Trading

TMGM

AvaTrade

FXTM

Exness

DBG Markets

CXM Trading

TMGM

AvaTrade

Broker WikiFX

FXTM

Exness

DBG Markets

CXM Trading

TMGM

AvaTrade

FXTM

Exness

DBG Markets

CXM Trading

TMGM

AvaTrade

Tin hot

Tin tức tổng hợp - Một quỹ đầu tư bị chỉ trích vì giam tiền trader hơn 1 năm

Đà Nẵng phát lệnh truy nã đặc biệt một nghi phạm trong vụ Mr. Pips Phó Đức Nam

Binance tung cơ chế niêm yết mới nhắm vào Pi Network?

Những gì bạn cần biết về cơ chế niêm yết mới của Binance

Tính tỷ giá hối đoái