Bigul

Lời nói đầu:Bigul, established in India in 2023, is a trading platform offering a wide range of assets, including equities, commodities, and currencies. With a flat-rate fee of Rs.18 per trade, it provides cost transparency. The platform's user-friendly mobile interface and educational resources, such as webinars, enhance the trading experience. However, its unregulated status raises considerations about user protection, and the absence of 24/7 customer support poses challenges for global users.

| Aspect | Information |

| Company Name | Bigul |

| Registered Country/Area | India |

| Founded year | 2023 |

| Regulation | Unregulated |

| Market Instruments | Equities, Commodities, Currencies |

| Maximum Leverage | Up to 1:5 |

| Trading Platforms | BigU Trading App |

| Customer Support | Email support@bigul.co, Phone numbers 6273 5500 / 6836 3700 |

| Deposit & Withdrawal | Payment options include HDFC UPI, Razorpay, Atom |

| Educational Resources | Webinars, educational materials |

Overview of Bigul

Bigul, established in India in 2023, is a trading platform offering a wide range of assets, including equities, commodities, and currencies.

With a flat-rate fee of Rs.18 per trade, it provides cost transparency. The platform's user-friendly mobile interface and educational resources, such as webinars, enhance the trading experience.

However, its unregulated status raises considerations about user protection, and the absence of 24/7 customer support poses challenges for global users.

Is Bigul legit or a scam?

Bigul operates without regulatory oversight, indicating a lack of adherence to specific compliance standards and external audits.

The absence of regulatory scrutiny poses potential challenges related to transparency, accountability, and adherence to industry best practices. In an unregulated environment, uncertainties will potentially impact trust and confidence among stakeholders.

Operating without regulatory guidance exposes the platform to risks that could have implications for user protection and overall industry standards.

Pros and Cons

| Pros | Cons |

| Flat-rate charged-Rs.18 per trade. | Unregulated |

| Multiple payment options including HDFC UPI, Razorpay and Atom | No 24/7 customer support |

| Various trading segments including equities, commodities, and currencies | Complex fee structure |

| Webinar and educational resources | |

| User-friendly mobile platform | |

| Algo trading feature provided |

Pros:

Flat-rate charged - Rs.18 per trade:

Simple and transparent fee structure with a fixed charge per trade, providing clarity and predictability for traders.

2. Multiple payment options:

Offers flexibility for users to choose from various payment methods , including HDFC UPI, Razorpay and Atom, enhancing convenience and accessibility.

3. Wide range of trading segments:

Provides access to a variety of trading segments, including equities, commodities, and currencies, allowing users to diversify their investment portfolio according to their preferences and risk tolerance.

4. Webinar and educational resources:

The platform offers educational resources and webinars, fostering financial literacy and helping traders make more informed decisions.

5. User-friendly mobile platform:

The mobile platform is easy to use, ensuring a friendly trading experience for users on the go.

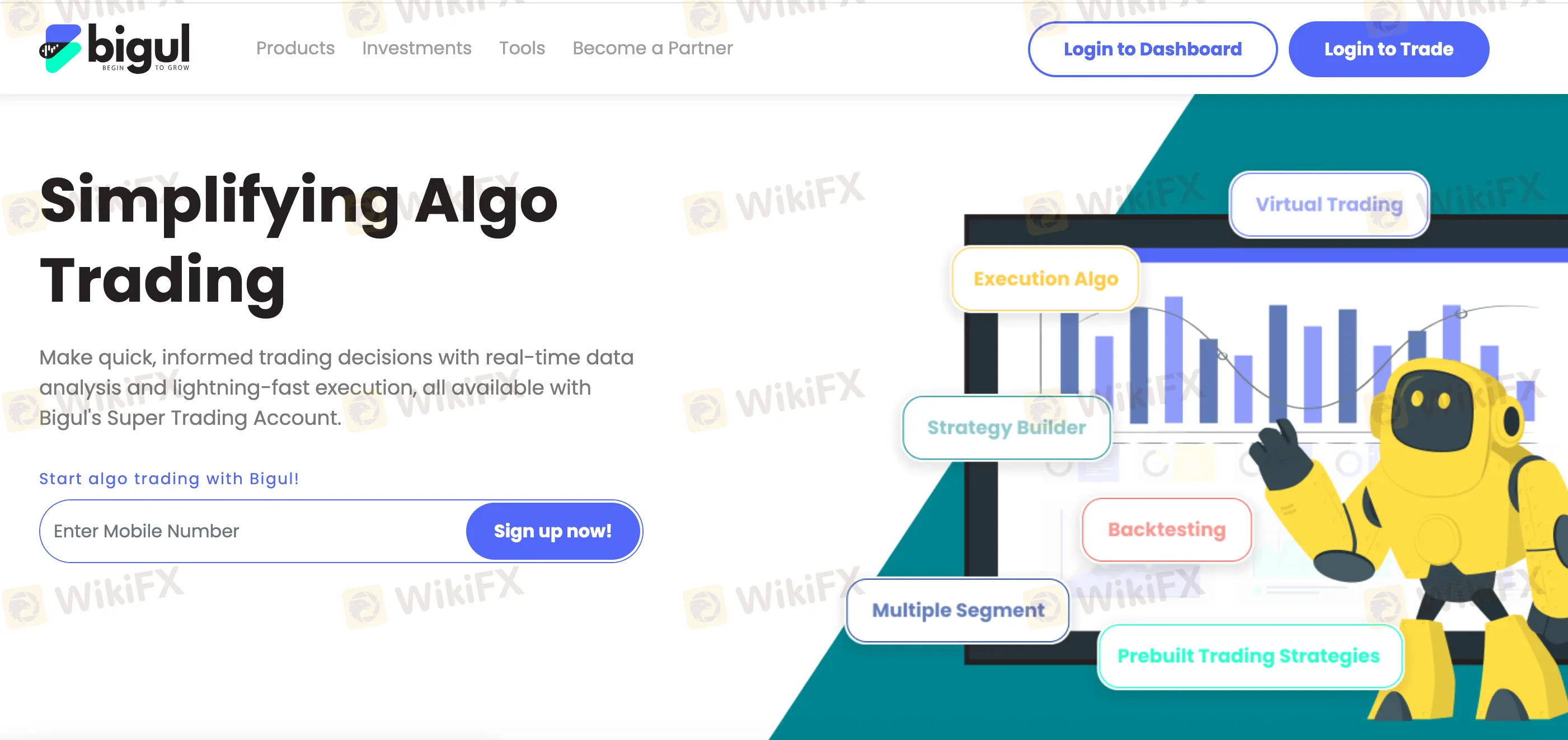

6. Algo trading feature provided:

Incorporates algorithmic trading capabilities, enabling users to automate trading strategies for efficiency and precision.

Cons:

Unregulated:

The platform lacks regulatory oversight, potentially raising consideration about the safety and security of user funds and transactions.

2. No 24/7 customer support:

The absence of round-the-clock customer support poses challenges for users in different time zones or those requiring immediate assistance during non-business hours.

3. Complex fee structure:

Despite the flat-rate per trade, the overall fee structure might become intricate when considering other charges, potentially leading to confusion for some traders.

Market Instruments

Bigul offers a wide range of trading assets to accommodate different investment preferences.

Stocks form a significant part of their asset offerings, allowing users to trade shares of listed companies from various sectors and regions. Additionally, users can explore Mutual Funds for diversified investment portfolios managed by professional fund managers.

For those interested in fixed-income securities, Bigul provides access to Bonds and Non-Convertible Debentures (NCDs), offering avenues for stable returns. Exchange-Traded Funds (ETFs) further contribute to the platform's asset variety, providing a cost-effective way to invest in diversified baskets of assets.

Investors seeking regular investment in equities can explore the Stock SIP (Systematic Investment Plan) feature. The platform also facilitates trading in the dynamic markets of Commodities and Currencies. Additionally, users can engage in sophisticated trading strategies through Futures & Options.

Bigul offers participation in Initial Public Offerings (IPOs), providing opportunities to invest in newly listed companies. Lastly, the availability of a Demat Account streamlines the process of holding and managing various securities in electronic form.

How to Open an Account?

Visit Bigul Brokerage Website:

Navigate to the official Bigul Brokerage website.

2. Click on “Open an Account”:

Look for the “Open an Account” option prominently displayed on the homepage.

3. Provide Mobile Number:

Enter your valid mobile number in the designated field.

4. Click “Continue”:

Once the mobile number is entered, click on the “Continue” button to proceed with the account opening process.

5. Complete Account Application:

Fill in the necessary details in the account application form. This includes personal information, financial details, and other relevant data.

6. Verification and Approval:

After submitting the application, undergo the verification process as per regulatory requirements. Upon successful verification, your account will be approved, and you can start trading with your new Bigul trading and demat account.

Leverage

Bigul Brokerage offers varying levels of leverage or margin facilities across different trading segments.

For equity delivery, the leverage is set at 1x, meaning the trader can only trade with the available funds in their account.

In equity intraday trading, the leverage extends up to 5x, subject to the specific stocks being traded. Equity futures and options carry forward trades maintain a leverage of 1x, while intraday trading in these segments allows for a margin of 1.3x.

Similarly, both commodity futures and options carry forward trades, as well as intraday trading, have a leverage of 1x and 1.3x, respectively.

Currency futures and options maintain a fixed leverage of 1x. It's important for traders to be mindful of these leverage levels, as they directly impact their exposure and risk in the respective trading segments.

| Trading Segment | Leverage |

| Equity Delivery | 1x |

| Equity Intraday | Up to 5x (Stock-dependent) |

| Equity F&O Carry Forward | 1x |

| Equity F&O Intraday | 1.3x |

| Commodity F&O Carry Forward | 1x |

| Commodity F&O Intraday | 1.3x |

| Currency F&O | 1x |

Fees

Bigul applies various charges for its services. The account opening is free, providing accessibility to users without any initial costs. For maintenance, there is an annual charge of Rs.300, but the first year is free.

At Bigul Brokerage, regardless of whether you engage in equity delivery, equity intraday, equity future, equity option, commodity future, commodity option, currency future, or currency option trading, the applicable charge is a flat rate of Rs.18 per trade.

In terms of Securities Transaction Tax (STT) and Commodity Transaction Tax (CTT), charges vary across segments. For equity delivery, there is a 0.1% charge on both buy and sell transactions. Equity intraday incurs a 0.025% charge on sell transactions, while equity futures face a 0.0125% charge on sell transactions. Equity options attract a 0.125% charge on buy and 0.0625% on sell transactions. Commodity futures and options have charges of 0.01% and 0.05% on sell transactions, respectively.

Additionally, Bigul has some hidden charges. It applies SEBI turnover charges of Rs.10 per crore across all segments. There is also a Rs.25 per scrip fee on sell transactions and an 18% GST on total brokerage, SEBI, and transaction charges incurred during trading activities. Furthermore, availing the call and trade facility is subject to a Rs.50 per trade fee. It's essential for users to be aware of these charges to make informed decisions regarding their trading activities on the Bigul platform.

| Fee Type | Charges |

| Account Opening | Free |

| Annual Maintenance Charges | Rs.300 per year (1st year free) |

| Transaction Fees | Rs.18 per trade |

| STT & CTT Charges | |

| - Equity Delivery | 0.1% on buy and sell |

| - Equity Intraday | 0.025% on sell |

| - Equity Future | 0.0125% on sell |

| - Equity Option | 0.125% on buy, 0.0625% on sell |

| - Commodity Future | 0.01% on sell |

| - Commodity Option | 0.05% on sell |

| Hidden Charges | |

| - SEBI Turnover Charges | Rs.10 per crore (across all segments) |

| - Sell Transaction Fee | Rs.25 per scrip |

| - GST on Brokerage and Charges | 18% on total brokerage, SEBI, and charges |

| - Call and Trade Facility Fee | Rs.50 per trade |

Trading Platform

BigU Trading App:

BigU Trading App is a user-friendly platform that suitable for both novice and experienced traders. With a straightforward interface, users can easily navigate the app for their trading activities. The app supports a variety of features including real-time market data, order placement, portfolio tracking, and advanced charting tools. Traders can conveniently manage their investments, execute trades, and stay updated on market trends through the mobile application.

Bigul's Algo Strategy Builder:

Bigul's Algo Strategy Builder is a powerful tool for traders seeking to implement algorithmic trading strategies. It provides an intuitive drag-and-drop interface for creating custom strategies without extensive coding knowledge. The tool offers pre-built blocks for technical analysis indicators, enabling users to construct complex strategies effortlessly. Additionally, traders can leverage the platform's backtesting capabilities to evaluate strategy performance using historical market data.

The Algo Strategy Builder facilitates parameter optimization, ensuring optimal real-time trading performance. It supports a range of technical analysis indicators for crafting personalized strategies. This tool is versatile, benefiting both novice and experienced traders by streamlining trading activities, automating strategies, and allowing for well-informed decisions based on backtesting and optimization. Users can download the Bigul Trading App to access these features and enhance their trading experience.

Deposit & Withdrawal

Bigul Brokerage provides users with various payment options, offering flexibility and convenience.

Traders can choose to pay through HDFC UPI, streamlining transactions with the popular HDFC UPI platform.

Additionally, the platform supports payments through Razorpay, a secure and efficient payment gateway that facilitates friendly financial transactions.

Atom is another available payment method, providing users with an alternative means to fund their accounts.

Customer Support

Bigul Brokerage offers robust customer support through various channels.

For assistance, customers can contact the Corporate Office at Plot No. M-2, Cama Industrial Estate, Walbhat Road, Goregaon (E), Mumbai - 400063, with phone numbers 6273 5500 / 6836 3700 and fax at 022 26865772.

The Head Office, located at 2 / 2A, First Floor, Lakshmi Insurance Building, Asaf Ali Road, New Delhi - 110002, can be reached at 011-40348700/61271900.

Additionally, the Registered Office at 4353/4C, Madan Mohan Street, Ansari Road, Daryaganj, New Delhi - 110002, can be contacted at 011-23242022 to 23, with fax at 011-23241993.

Educational Resources

Bigul Brokerage offers a comprehensive suite of educational resources to empower traders.

Through webinars, users gain insights into market dynamics, strategies, and trends.

Calculators aid in financial planning, ensuring informed decisions. Downloads include essential documents and tools for efficient trading.

The Knowledge Centre serves as a hub for in-depth articles and guides. The Support Center addresses queries promptly, fostering a supportive learning environment.

Video-based learning enhances understanding with visual content, serving different learning preferences. Collectively, these resources reflect Bigul's commitment to educating its users across various aspects of trading, fostering financial literacy and enhancing their overall trading experience.

Conclusion

In conclusion, Bigul presents a mixed landscape for traders. On the positive side, the platform offers a user-friendly mobile interface and a transparent fee structure with a flat rate of Rs.18 per trade, providing simplicity and cost predictability. Additionally, the inclusion of educational resources such as webinars enhances the overall trading experience, fostering financial literacy among users.

However, the absence of regulatory oversight raises considerations about user protection, potentially impacting the platform's reliability and security.

FAQs

Q: What trading segments does Bigul offer?

A: Bigul provides access to equities, commodities, and currencies.

Q: Is Bigul regulated?

A: No, Bigul is currently unregulated.

Q: How much is the minimum deposit to open an account?

A: The minimum deposit requirement is not specified.

Q: What is the maximum leverage offered by Bigul?

A: Leverage varies by trading segment; for example, equity intraday allows up to 5x.

Q: Are there 24/7 customer support services?

A: No, customer support is not available round-the-clock.

Q: What payment options can I use for deposits and withdrawals?

A: Bigul supports payments through HDFC UPI, Razorpay, and Atom.

Broker WikiFX

FXTM

Exness

DBG Markets

FOREX.com

EC Markets

MultiBank Group

FXTM

Exness

DBG Markets

FOREX.com

EC Markets

MultiBank Group

Broker WikiFX

FXTM

Exness

DBG Markets

FOREX.com

EC Markets

MultiBank Group

FXTM

Exness

DBG Markets

FOREX.com

EC Markets

MultiBank Group

Tính tỷ giá hối đoái