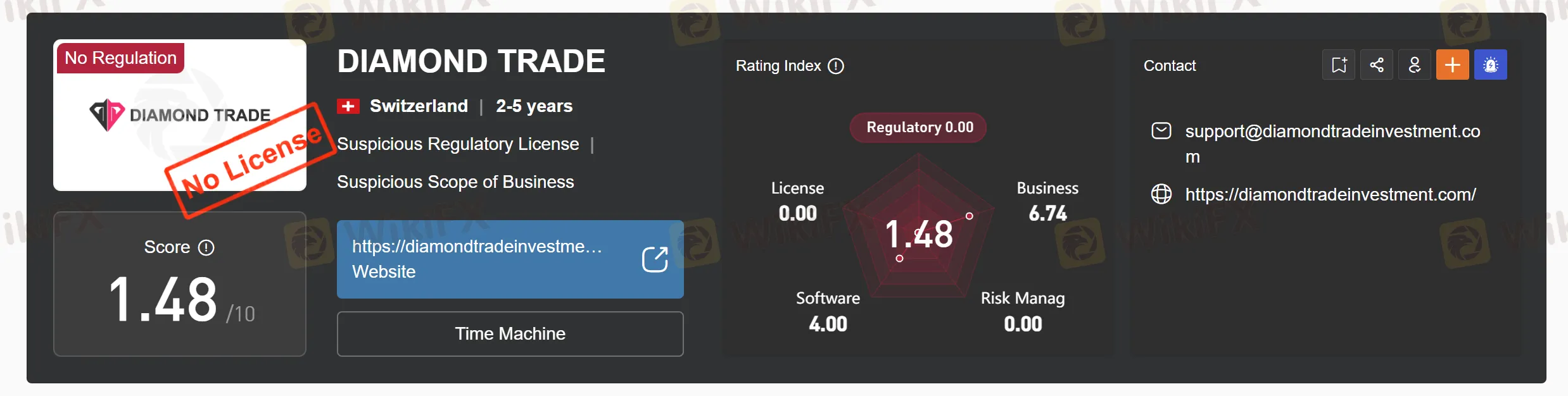

DIAMOND TRADE

Lời nói đầu:DIAMOND TRADE, based in Switzerland, positions itself as a versatile trading platform offering a range of account types to cater to diverse trading preferences. Despite its prominence, it's essential to note that the platform currently operates without valid regulatory oversight, necessitating caution among potential traders. The company provides a flexible minimum deposit requirement, accommodating a broad spectrum of investors with varying financial capabilities. Traders can choose from four distinct account types – PRO, PLATINUM, GOLD, and SILVER – each offering different features such as leverage, minimum deposit, and spreads, providing a customizable trading experience.

| Aspect | Information |

| Registered Country/Area | Switzerland |

| Company Name | DIAMOND TRADE |

| Regulation | Currently operates without valid regulatory oversight |

| Minimum Deposit | Varies by account type, ranging from 100 to more than 10,000 |

| Maximum Leverage | 1:500 |

| Spreads | Vary by account type, ranging from 0 to 3 pips |

| Tradable Assets | Forex, Commodities, Equities, Indices |

| Account Types | PRO, PLATINUM, GOLD, SILVER |

| Customer Support | Multichannel support (email, live chat, phone) |

| Educational Tools | Tutorials, webinars, articles, live training sessions, e-books, written guides |

Overview of DIAMOND TRADE

DIAMOND TRADE, based in Switzerland, positions itself as a versatile trading platform offering a range of account types to cater to diverse trading preferences. Despite its prominence, it's essential to note that the platform currently operates without valid regulatory oversight, necessitating caution among potential traders. The company provides a flexible minimum deposit requirement, accommodating a broad spectrum of investors with varying financial capabilities. Traders can choose from four distinct account types – PRO, PLATINUM, GOLD, and SILVER – each offering different features such as leverage, minimum deposit, and spreads, providing a customizable trading experience.

With a maximum leverage of 1:500, DIAMOND TRADE empowers traders to engage in various markets, including forex, commodities, equities, and indices. The platform's customer support reflects a commitment to client satisfaction through multichannel assistance, including email, live chat, and phone support. DIAMOND TRADE recognizes the importance of education in trading and offers an array of educational tools, including tutorials, webinars, articles, live training sessions, e-books, and written guides. While the platform's diverse account types, maximum leverage, and customer support are notable strengths, potential users should weigh these against the absence of regulatory oversight and consider the platform's limitations, such as limited cryptocurrency options and minimum deposit requirements. As traders explore the platform's offerings, it is recommended to conduct thorough research and stay informed about market conditions for a well-informed trading experience.

Is DIAMOND TRADE legit or a scam?

It is crucial to highlight that DIAMOND TRADE currently operates without valid regulatory oversight. Regulation plays a pivotal role in ensuring the integrity and security of financial services, offering clients a level of assurance regarding the broker's adherence to industry standards. The absence of regulation raises concerns about the lack of oversight and accountability in DIAMOND TRADE's operations.

Regulation is a key factor that traders often consider when choosing a broker, as it signifies a commitment to transparency, fair practices, and client protection. Without regulatory oversight, there may be increased uncertainties regarding fund protection, dispute resolution, and the overall trustworthiness of the broker. It is recommended that potential clients carefully evaluate the implications of trading with an unregulated broker and weigh the associated risks before proceeding with any transactions on the DIAMOND TRADE platform.

Pros and Cons

DIAMOND TRADE offers a range of benefits, including diverse account types, high maximum leverage, responsive customer support, and a comprehensive set of trading tools. Traders can choose from various account options tailored to their preferences. The platform's high maximum leverage provides flexibility for more advanced trading strategies, and a responsive support team ensures prompt assistance.

However, there are certain drawbacks to consider. DIAMOND TRADE has limited cryptocurrency options and imposes minimum deposit requirements, potentially restricting entry for some traders. While offering comprehensive tools, the platform could enhance its educational resources, and beginners might find the platform's complexity challenging.

| Pros | Cons |

|

|

|

|

|

|

|

|

Market Intruments

DIAMOND TRADE offers a diverse range of market instruments to cater to the trading preferences of its clients. Traders on the platform have access to various financial instruments across different asset classes, allowing them to build diversified portfolios and implement a wide array of trading strategies.

One of the primary categories of market instruments available on DIAMOND TRADE is forex (foreign exchange). Traders can engage in currency trading, taking advantage of fluctuations in exchange rates between major and minor currency pairs. This provides opportunities for both short-term and long-term trading strategies based on global economic conditions.

In addition to forex, DIAMOND TRADE facilitates trading in commodities. This includes popular commodities such as gold, silver, oil, and other raw materials. Commodity trading allows investors to diversify their portfolios and respond to market trends influenced by geopolitical events, supply and demand dynamics, and macroeconomic factors.

Equity trading is another significant market instrument available on the platform. Traders can access a variety of stocks representing companies from different sectors and regions. This enables investors to participate in the performance of individual companies and benefit from their growth or respond to market developments affecting specific industries.

Furthermore, DIAMOND TRADE provides opportunities for trading indices, allowing investors to speculate on the overall performance of a basket of stocks from a particular market. This diversification can be attractive for those seeking exposure to broader market movements rather than individual assets.

Account Types

The account types offered by DIAMOND TRADE include PRO, PLATINUM, GOLD, and SILVER. Each account type comes with specific features related to maximum leverage, minimum deposit, and minimum spread. Here's a breakdown of each account type:

PRO Account:

- Maximum Leverage: 1:500

- Minimum Deposit: More than 10,000

- Minimum Spread: 0 pip

PLATINUM Account:

- Maximum Leverage: 1:500

- Minimum Deposit: 5,001-10,000

- Minimum Spread: 1.5 pips

GOLD Account:

- Maximum Leverage: 1:500

- Minimum Deposit: 501-5,000

- Minimum Spread: 2.5 pips

SILVER Account:

- Maximum Leverage: 1:500

- Minimum Deposit: 100-500

- Minimum Spread: 3 pips

| Feature | PRO Account | PLATINUM Account | GOLD Account | SILVER Account |

| Maximum Leverage | 1:500 | 1:500 | 1:500 | 1:500 |

| Minimum Deposit | > 10,000 | 5,001 - 10,000 | 501 - 5,000 | 100 - 500 |

| Minimum Spread | 0 pip | 1.5 pips | 2.5 pips | 3 pips |

How to open an account?

Visit the Platform's Website: Locate the “Open an Account” or “Sign Up” section.

Choose Account Type: Select the account type that suits your needs.

Provide Information: Fill out an application form with personal details, contact information, and financial information (if required).

Verify Identity: Upload or submit documents to verify your identity and address, such as a government-issued ID and proof of residence.

Review Terms and Conditions: Carefully read and agree to the platform's terms of service and privacy policy.

Submit Application: Complete and submit the application for review.

Await Approval: The platform will review your application and notify you of approval or any additional requirements.

Fund Account (if applicable): If approved, deposit funds into your account to start trading.

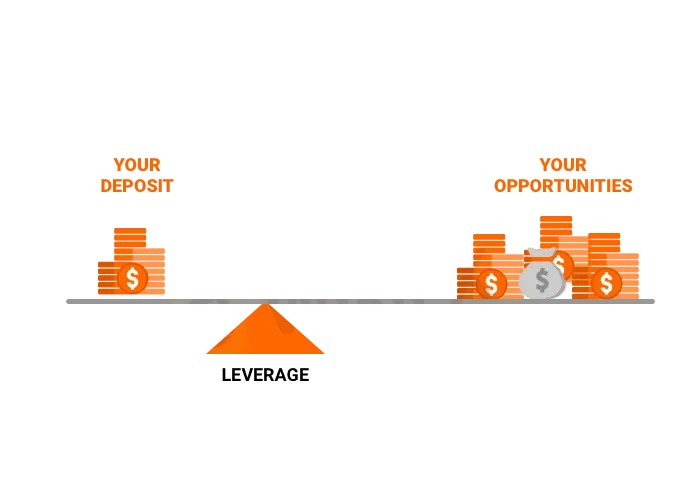

Leverage

The maximum trading leverage for all account types provided by DIAMOND TRADE is 1:500. Each account category, including PRO, PLATINUM, GOLD, and SILVER, offers traders the flexibility to use a maximum leverage of 1:500. This allows users to amplify their trading positions relative to their invested capital, potentially increasing both profits and risks. It's important for traders to carefully consider and manage leverage, as higher leverage also entails higher potential losses.

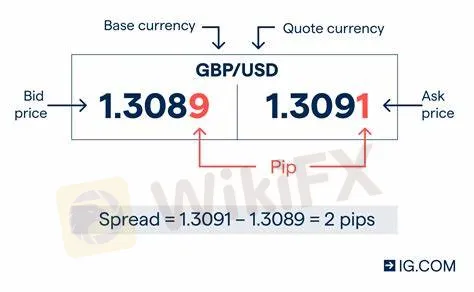

Spreads & Commissions (Trading Fees)

Spreads:

When it comes to spreads, this broker offers a tiered system that favors higher initial deposits. The PRO account boasts the most attractive option with a minimum spread of 0 pips. This essentially means you pay no transaction fees on top of the market price when entering or exiting trades.

Moving down the ladder, the PLATINUM account introduces a slightly wider spread of 1.5 pips, while the GOLD and SILVER accounts have even less appealing spreads of 2.5 pips and 3 pips, respectively.

For traders who prioritize tight spreads and frequent trading, the PRO account presents a clear advantage. However, this comes at the cost of a higher minimum deposit. Those with smaller initial investments might find the PLATINUM or GOLD accounts more accessible, although they should be aware of the slightly higher transaction costs. Ultimately, the best choice depends on your individual trading style and budget.

Commissions:

Transaction Fees: These are flat fees charged per diamond purchase or sale, regardless of the transaction value.

Percentage Fees: These fees are a percentage of the transaction value, typically charged to both buyers and sellers.

Minimum Fees: Some platforms may have minimum fees that apply regardless of the transaction amount.

Non-Trading Fees

Overnight Interest Fees:

Charged on leveraged positions held overnight, essentially the cost of borrowing capital from the platform for diamond purchases.

Typically expressed as an annual percentage rate (APR), often varying based on the loan amount, leverage ratio, and platform policy.

Deposit and Withdrawal Fees:

Fees incurred when adding or removing funds from your account.

May vary depending on the deposit/withdrawal method (bank transfer, credit card, etc.) and transaction amount. Some platforms offer fixed fees, while others charge a percentage of the transferred amount.

Inactivity Fees:

Charged if you haven't used your account for a specific period (e.g., 6 months).

Aim to discourage dormant accounts and maintain platform activity.

Usually flat fees charged monthly or annually until the account becomes active again.

Additional Fees:

Some platforms may have additional fees like:

Storage fees for holding diamonds purchased through the platform.

Insurance fees for protecting your diamonds against loss or damage.

Currency conversion fees if you trade in a different currency than your account base currency.

Trading Platform

Platform Features:

Inventory Access: Explain how you can browse and search for diamonds, including search filters and sorting options.

Trading Tools: Highlight any available analytical tools, price charts, or market data resources.

Order Management: Explain the process of placing buy and sell orders, including order types and execution methods.

Communication Tools: Describe available communication channels for interacting with sellers, buyers, or platform support.

Security Features: Mention any security measures implemented to protect user data and transactions.

Additional Information:

Supported Currencies: Specify the currencies accepted for trading and any potential conversion fees.

Fees and Commissions: Explain the platform's fee structure for buying, selling, and other transactions.

Customer Support: Describe the available customer support options and their responsiveness.

Deposit & Withdrawal

Deposit Methods:

Available deposit methods may include bank transfers, credit cards, wire transfers, or cryptocurrency wallets.

Each method might have different minimum and maximum deposit limits, processing times, and associated fees.

Withdrawal Methods:

Withdrawal methods might mirror deposit options, but platforms may have limitations depending on the chosen deposit method.

Similar to deposits, there may be minimum and maximum withdrawal limits, processing times, and potential fees.

Important Considerations:

Currency: Confirm if the platform operates in your preferred currency or if currency conversion is involved, which might incur additional fees.

Verification: Some platforms require account verification before allowing withdrawals, so ensure you have completed any necessary verification steps.

Security: Always prioritize using secure platforms and methods for deposits and withdrawals to protect your financial information and assets.

Customer Support

DIAMOND TRADE prides itself on providing robust and customer-centric support services to ensure a positive and seamless trading experience for its clients. The customer support(support@diamondtradeinvestment.com) at DIAMOND TRADE is characterized by its responsiveness, expertise, and dedication to addressing client queries and concerns.

Educational Resources

DIAMOND TRADE prioritizes client empowerment through comprehensive educational resources. Designed for both novice and seasoned traders, the platform offers tutorials, articles, and market analyses in a user-friendly format. Interactive webinars, led by industry experts, provide real-time discussions and practical insights. The platform also features a library of e-books and guides, catering to various learning styles. Overall, DIAMOND TRADE's commitment to accessible and relevant educational content reflects its dedication to supporting clients in making informed and strategic trading decisions.

Conclusion

DIAMOND TRADE offers a diverse range of account types, high leverage, and responsive customer support, making it attractive for flexible trading. The platform provides tools for market analysis, suitable for both novice and experienced traders.

However, limitations include a restricted cryptocurrency selection and minimum deposit requirements that may challenge users with smaller budgets. While offering various tools, DIAMOND TRADE's educational resources could improve, and beginners might find its complexity challenging.

Ultimately, choosing DIAMOND TRADE depends on individual preferences, experience levels, and specific needs. For those prioritizing varied accounts, high leverage, and responsive support, DIAMOND TRADE is a suitable choice. Weighing pros and cons is crucial for an informed decision aligned with trading goals.

FAQs

Q: What account types does DIAMOND TRADE offer?

A: DIAMOND TRADE offers a range of account types, including PRO, PLATINUM, GOLD, and SILVER, each with varying features such as leverage, minimum deposit, and minimum spread.

Q: Is DIAMOND TRADE regulated?

A: As of the latest available information, DIAMOND TRADE is currently operating without valid regulatory oversight.

Q: What financial instruments can I trade on DIAMOND TRADE?

A: DIAMOND TRADE provides access to a diverse range of financial instruments, including forex, commodities, equities, and indices.

Q: How can I contact DIAMOND TRADE's customer support?

A: DIAMOND TRADE offers multichannel support, including email, live chat, and phone support, to assist clients with inquiries and concerns.

Q: What is the maximum leverage offered by DIAMOND TRADE?

A: The maximum leverage varies across account types, with a common maximum leverage of 1:500.

Q: Are there educational resources available on DIAMOND TRADE?

A: Yes, DIAMOND TRADE provides educational resources such as tutorials, webinars, articles, and live training sessions to support traders at different skill levels.

Q: What are the minimum deposit requirements for DIAMOND TRADE accounts?

A: Minimum deposit requirements depend on the account type, ranging from more than 10,000 for PRO to 100-500 for SILVER.

Q: Does DIAMOND TRADE offer cryptocurrency trading?

A: DIAMOND TRADE has a limited selection of cryptocurrency options available for trading.

Q: Can I trade on DIAMOND TRADE's platform using a mobile device?

A: Yes, DIAMOND TRADE offers a mobile-friendly platform, allowing traders to execute trades and manage accounts on the go.

Q: Is there a demo account available on DIAMOND TRADE?

A: DIAMOND TRADE provides a demo account, allowing traders to practice and familiarize themselves with the platform without risking real funds.

Broker WikiFX

FXTM

Exness

DBG Markets

FOREX.com

GMI

XM

FXTM

Exness

DBG Markets

FOREX.com

GMI

XM

Broker WikiFX

FXTM

Exness

DBG Markets

FOREX.com

GMI

XM

FXTM

Exness

DBG Markets

FOREX.com

GMI

XM

Tin hot

Powell và Trump: Lời đáp trả chính thức hay "Dĩ hòa vi quý"?

Phong thủy Forex 2025: Mệnh nào dẫn lối thành công trên thị trường ngoại hối?

Pi Network lên OKX và mở mạng: Cú hích lịch sử hay chiêu trò truyền thông?

WikiFX Review FXCM 2025: Ông lớn giao dịch thuật toán nhưng có đáng để quan tâm?

Tin tức tổng hợp - TRUMP Coin và DeepSeek làm rung chuyển thị trường toàn cầu

WikiEXPO chính thức hợp tác với Chính phủ Liberland: Thúc đẩy giao dịch tài chính toàn cầu

Những “ảo tưởng” khi bước vào Forex mà ai cũng từng tin

Chỉ số Tham lam và Sợ hãi trong giao dịch: Con số phản ánh tâm lý thị trường

Tính tỷ giá hối đoái