BRIDGEROCK

Lời nói đầu:BRIDGEROCK is a newly established brokerage firm targeting traders in the United Kingdom, Australia, and Spain. It provides online trading services across diverse asset classes such as Forex, Indices, Commodities, Stocks, and Cryptocurrencies. Despite its extensive offerings, concerns arise due to the platform's lack of regulatory oversight, an inaccessible website, and lack of customer service channels.

Note: BRIDGEROCK's official site - https://bridgerock.ai/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| BRIDGEROCK Review Summary | |

| Region/Country | Not mentioned |

| Founded | 2024 |

| Regulation | No regulation |

| Market Instruments | Forex, Indices, Commodities, Stocks, Cryptocurrencies |

| Demo Account | Not available |

| Spread | From 0.05 pips |

| Leverage | Up to 1:200 |

| Trading Platform | Web-based platform |

| Minimum Deposit | 250 USD |

| Customer Support | Feedback form |

BRIDGEROCK Information

BRIDGEROCK is a newly established brokerage firm targeting traders in the United Kingdom, Australia, and Spain. It provides online trading services across diverse asset classes such as Forex, Indices, Commodities, Stocks, and Cryptocurrencies. Despite its extensive offerings, concerns arise due to the platform's lack of regulatory oversight, an inaccessible website, and lack of customer service channels.

In the following article, we will analyse the characteristics of this company in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Pros & Cons

| Pros | Cons |

| Diverse Asset Selection | Lack of regulatory oversight |

| Competitive Spreads | Website Accessibility Issues |

| No MT4/5 Platforms | |

| Absence of Customer Support Channels | |

| No Info About Commissions | |

| Extreme High Minimum Deposit to Open an Account |

Pros:

Diverse Asset Classes: BRIDGEROCK offers trading across Forex, Indices, Commodities, Stocks, and Cryptocurrencies, providing a broad range of investment opportunities.

Competitive Spreads: The broker offers competitive spreads, starting from as low as 0.05 pips for certain account types, which can benefit traders looking to minimize trading costs.

Cons:

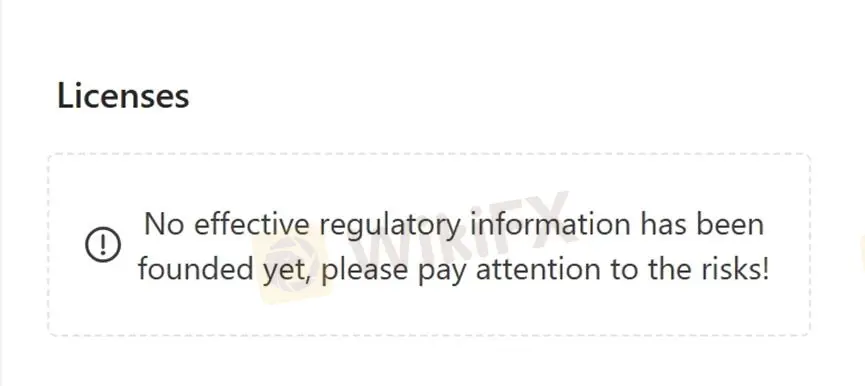

Lack of Regulatory Oversight: BRIDGEROCK operates without clear regulatory oversight, raising concerns about investor protection and operational transparency.

Website Accessibility Issues: Ongoing problems with website accessibility hinder traders' ability to access trading services and customer support effectively.

No MT4/5 Platforms: BRIDGEROCK's absence of MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms deprives traders of popular, robust tools and functionalities essential for advanced trading strategies and analysis.

Absence of Customer Support Channels: The sole reliance on a feedback form, which is currently inaccessible, leaves traders without adequate support options in case of issues or inquiries.

No Info About Commissions: BRIDGEROCK's lack of transparency regarding commission details raises concerns about hidden costs and potential financial implications for traders.

Extreme High Minimum Deposit to Open an Account: BRIDGEROCK's exceptionally high minimum deposit requirement from USD 5,000 poses a significant barrier for entry, limiting access to traders who prefer to start with smaller initial investments.

Is BRIDGEROCK Legit?

When considering the safety of a brokerage like BRIDGEROCK or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

- Regulatory sight: The broker's current operation without legitimate regulatory oversight only fuels concerns about its legitimacy and trustworthiness. These worries are compounded by the broker's inaccessible website.

- User feedback: For a deeper insight into the brokerage, traders should read reviews and feedback from existing clients. These valuable inputs from users, available on trustworthy websites and discussion forums, can provide firsthand information about the broker's operations.

- Security measures: BRIDGEROCK provides negative balance protection to safeguard traders from losing more than their initial investment. This security measure ensures that clients' account balances cannot fall below zero, mitigating the risk of owing additional funds beyond what they have deposited, even during volatile market conditions.

In the end, choosing whether or not to engage in trading with BRIDGEROCK is an individual decision. We advise you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

BRIDGEROCK provides a comprehensive selection of market instruments mainly for traders in the United Kingdom, Australia, and Spain.

- Forex: Traders can access a wide range of currency pairs, allowing for speculation on global exchange rate movements.

- Indices: BRIDGEROCK offers trading opportunities in major stock indices, enabling investors to capitalize on broader market trends.

- Commodities: The platform supports trading in commodities such as gold, oil, and agricultural products, providing exposure to physical goods' price movements.

- Stocks: Investors can trade shares of publicly listed companies, gaining exposure to individual equity markets worldwide.

- Cryptocurrencies: BRIDGEROCK includes cryptocurrencies like Bitcoin and Ethereum, facilitating speculative trading in digital assets.

Account Types

BRIDGEROCK offers a range of account types designed to accommodate traders at different experience levels and financial capacities. The account tiers are structured as follows:

- Beginner Account: Requires a minimum deposit of 5,000 USD, which is for new traders looking to start with a modest investment.

- Standard Account: Requires a minimum deposit of 25,000 USD, providing enhanced features and capabilities compared to the Beginner tier.

- Trader Account: Requires a minimum deposit of 75,000 USD, catering to more experienced traders seeking additional trading tools and benefits.

- Advanced Account: Requires a minimum deposit of 200,000 USD, offering advanced trading features and priority support for high-volume traders.

- Professional Account: Requires a minimum deposit of 500,000 USD, tailored for professional traders who require customizable trading conditions and personalized services.

- VIP Account: Requires a minimum deposit of 1,000,000 USD, offering the highest level of service, including exclusive benefits and the most favorable trading conditions.

These minimum deposit requirements are quite high compared to other brokers in the market, factor of which should be carefully weighed when considering whether to trade with this broker.

| Account Type | Minimum Deposit (USD) |

| Beginner | 5,000 |

| Standard | 25,000 |

| Trader | 75,000 |

| Advanced | 200,000 |

| Professional | 500,000 |

| VIP | 1,000,000 |

Leverage

Regarding leverage, BRIDGEROCK maintains a consistent maximum leverage ratio of 1:200 across all account types. This leverage allows traders to amplify their positions relative to their initial margin, increasing both profits and losses depending on market movements.

Traders should carefully manage their leverage to mitigate risk and adhere to their trading strategies effectively.

Spread & Commission

BRIDGEROCK does not disclose specific information regarding commissions. However, the platform offers competitive spreads across its various account types:

- Beginner to Standard Accounts: Spreads start from 0.18 pips and 0.13 pips respectively, providing cost-effective trading options for entry-level and intermediate traders.

- Trader Account: Offers tighter spreads starting from 0.1 pips, enhancing trading efficiency and reducing transaction costs.

- Advanced Accounts: Feature even tighter spreads starting from 0.05 pips, suitable for high-volume trading strategies that require minimal cost impact.

- Professional Accounts and VIP Account: Provides negotiable spreads and commissions, offering the most favorable pricing terms tailored to the specific needs of elite traders.

These spread offerings alongside other factors should be carefully considered when evaluating BRIDGEROCK's suitability for their trading needs.

| Account Type | Spreads (Starting from) | Commission |

| Beginner | 0.18 pips | Information not disclosed |

| Standard | 0.13 pips | |

| Trader | 0.1 pip | |

| Advanced | 0.05 pips | |

| Professional | Negotiable | |

| VIP | Negotiable |

Trading Platform

BRIDGEROCK's trading platform is solely web-based, lacking support for widely-used platforms like MetaTrader (MT4/MT5). This omission deters experienced traders who rely on MT4/MT5 for their advanced charting tools, automated trading capabilities, and extensive plugin ecosystem.

The web-based interface, while functional, provides basic trading features and real-time market data but falls short in offering the robustness and customization options expected by seasoned investors. This limitation restricts traders' ability to execute complex strategies efficiently and impact overall trading experience and performance.

Deposit & Withdrawal

BRIDGEROCK supports three payment methods for funding live trading accounts and withdrawing profits: credit/debit cards, wire transfers, and e-wallets. The minimum deposit requirement is $250. This variety of payment options provide convenience and flexibility for traders.

Customer Service

BRIDGEROCK's customer service is alarmingly restricted to a single feedback form, which is currently inaccessible due to issues with the website. This severe limitation leaves traders without viable channels to seek assistance or resolve issues promptly.

Such a lack of alternative communication methods leaves traders unsupported and raises concerns about the broker's commitment to providing adequate support and responsiveness to client needs.

Conclusion

In conclusion, BRIDGEROCK provides online trading services spanning Forex, Indices, Commodities, Stocks, and Cryptocurrencies to its clients. However, serious concerns persist regarding the broker's lack of regulatory oversight, ongoing issues with website accessibility, and the absence of alternative customer service channels. These factors greatly diminish confidence in BRIDGEROCK's reliability and operational stability.

Therefore, we strongly advise against using BRIDGEROCK. We recommend you seeking alternative platforms that prioritize transparency, regulatory compliance, and reliable customer service to ensure a secure and trustworthy trading experience.

Frequently Asked Questions (FAQs)

Is BRIDGEROCK regulated?

No. The broker is currently under no valid regulation.

Is BRIDGEROCK a good broker for beginners?

No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its unavailable website and absence of available customer support channels.

Does BRIDGEROCK offer industry leading MT4 & MT5?

No, it only offers a proprietary web-based platform.

What is the minimum deposit does BRIDGEROCK request?

$250.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Broker WikiFX

FXTM

Exness

DBG Markets

IC Markets Global

CXM Trading

STARTRADER

FXTM

Exness

DBG Markets

IC Markets Global

CXM Trading

STARTRADER

Broker WikiFX

FXTM

Exness

DBG Markets

IC Markets Global

CXM Trading

STARTRADER

FXTM

Exness

DBG Markets

IC Markets Global

CXM Trading

STARTRADER

Tính tỷ giá hối đoái