2020-10-09 15:08

Phân tích thị trườngINDIAN RUPEE, USD/INR UPDATE

Các sản phẩm liên quan:

Forex,Khác,Khác,Khác,Khác,Khác

Phân tích thị trường:

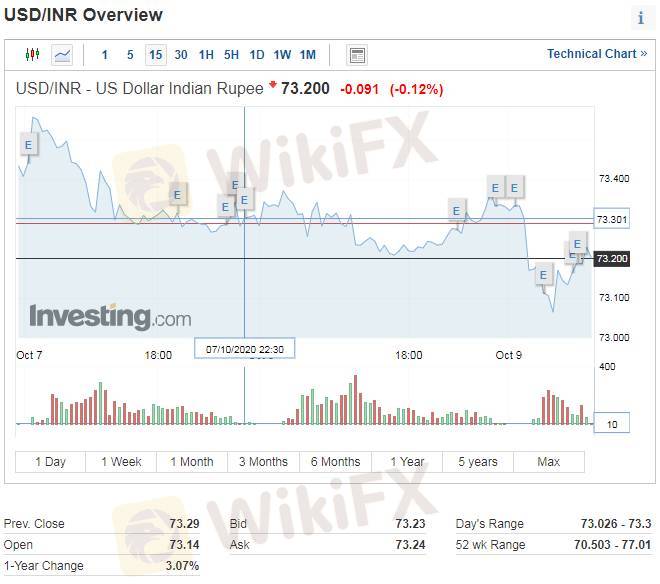

After being postponed to this week, the Indian Rupee and Nifty 50 are awaiting today’s Reserve Bank of India (RBI) monetary policy announcement at 6:15 GMT. The central bank is anticipated to maintain benchmark lending rates unchanged following recent upward pressures on inflation.

The RBI will also offer updated estimates for growth in the new fiscal year. For a further analysis of the interest rate decision, check out my outline here. What are the technical circumstances USD/INR and the Nifty are facing?

The Indian Rupee has been struggling to find further progress against the US Dollar after USD/INR fell under short-term rising support from late August. This has shifted the setting into a consolidative state where the pair is ranging between 72.76 and 74.04. A breakout to the downside would open the door to downtrend resumption towards the 72.14 – 72.40 inflection zone.

For upside scenarios, keep a close eye on the medium-term 50-day Simple Moving Average.

callmemaybe

Händler

Bình luận phổ biến

Ngành

Có cao quá k?

Ngành

Xin ý kiến liberforex

Ngành

Đầu tư CDG

Ngành

Cắt lỗ

Ngành

Có nên chốt lỗ?

Ngành

Hỏi về dòng tiền

Phân loại diễn đàn

Nền tảng

Triển lãm

IB

Tuyển dụng

EA

Ngành

Chỉ số thị trường

Chỉ số

INDIAN RUPEE, USD/INR UPDATE

Ấn Độ | 2020-10-09 15:08

Ấn Độ | 2020-10-09 15:08After being postponed to this week, the Indian Rupee and Nifty 50 are awaiting today’s Reserve Bank of India (RBI) monetary policy announcement at 6:15 GMT. The central bank is anticipated to maintain benchmark lending rates unchanged following recent upward pressures on inflation.

The RBI will also offer updated estimates for growth in the new fiscal year. For a further analysis of the interest rate decision, check out my outline here. What are the technical circumstances USD/INR and the Nifty are facing?

The Indian Rupee has been struggling to find further progress against the US Dollar after USD/INR fell under short-term rising support from late August. This has shifted the setting into a consolidative state where the pair is ranging between 72.76 and 74.04. A breakout to the downside would open the door to downtrend resumption towards the 72.14 – 72.40 inflection zone.

For upside scenarios, keep a close eye on the medium-term 50-day Simple Moving Average.

Forex

Khác

Khác

Khác

Khác

Khác

Thích 1

Tôi cũng muốn bình luận.

Đặt câu hỏi

0bình luận

Chưa có người bình luận, hãy là người bình luận đầu tiên

Đặt câu hỏi

Chưa có người bình luận, hãy là người bình luận đầu tiên