2025-01-29 00:45

NgànhPartial profit-taking in forex trading.

#firstdealofthenewyearAKEEL

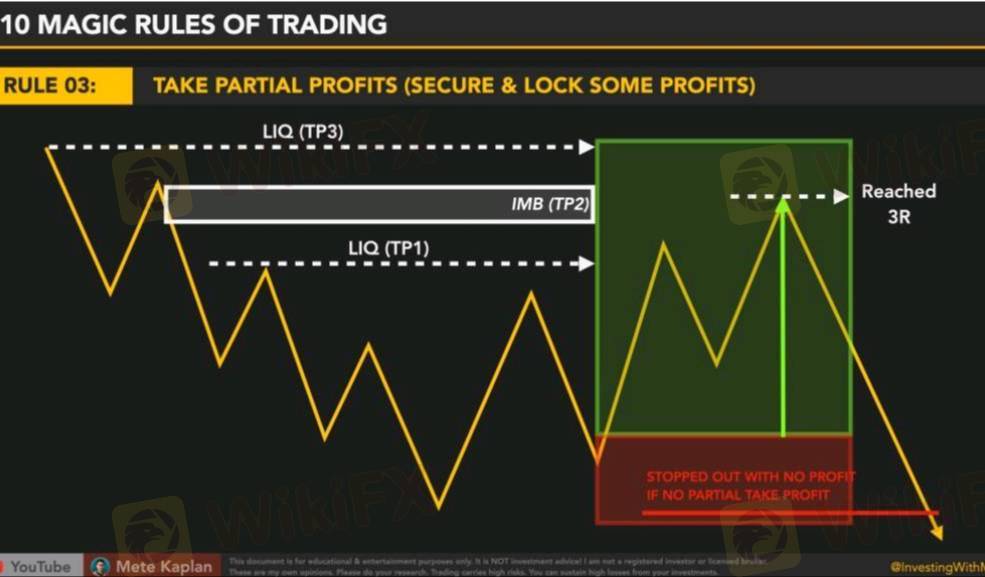

Partial profit-taking is a trading strategy where a trader closes a portion of their position to lock in some profits while keeping the rest of the trade open to capitalize on further potential gains.

How It Works

Open a Trade: Enter a position with a specific lot size (e.g., 1.0 lot).

Set a Target Zone: Identify a price level where partial profits will be taken, often based on technical analysis (e.g., support/resistance, Fibonacci levels).

Close Part of the Position: When the price reaches the target, close a portion of the trade (e.g., 0.5 lots) to secure profits.

Adjust Stop-Loss:

Move the stop-loss to breakeven (entry price) or a more favorable level to minimize risk on the remaining position.

This ensures the trade is risk-free or profitable overall.

Let the Rest Run: Allow the remaining position to run toward a higher target or until the market signals an exit.

Advantages of Partial Profit-Taking

Locks in Profits:

Reduces the emotional pressure of holding the entire position.

Secures gains even if the market reverses.

Balances Risk and Reward:

Ensures a reward while still participating in potential future market moves.

Creates a "win-win" scenario: some profit is guaranteed, and more can be earned.

Increases Flexibility:

Allows traders to adapt to changing market conditions without fully exiting the trade.

Improves Trade Psychology:

Reduces fear and greed, helping traders stick to their plan more effectively.

Disadvantages of Partial Profit-Taking

Reduces Overall Profit Potential:

By closing part of the position, the trader limits potential gains if the price continues moving in their favor.

Additional Execution Costs:

Closing trades in parts may result in higher transaction fees or spreads.

Requires Precise Planning:

Poor timing or incorrect partial exits can lead to suboptimal results.

When to Use Partial Profit-Taking

Volatile Markets:

When price movements are unpredictable, securing partial profits can be a safer strategy.

Uncertainty Near Key Levels:

When the price approaches major resistance or support zones where reversals are likely.

Scaling Out of Trades:

When the trade is highly profitable but hasn’t yet reached the final target, taking partial profits helps to lock in gains.

Long-Term Trades:

For swing or position traders, it’s a way to balance short-term gains while letting the remaining trade ride long-term trends.

Example of Partial Profit-Taking

Entry: Buy EUR/USD at 1.1000 with 1.0 lot size.

Partial Target: Close 0.5 lots at 1.1050 to secure 50 pips of profit.

Stop-Loss Adjustment: Move stop-loss to 1.1020 for the remaining 0.5 lots, ensuring a risk-free trade.

Final Target: Let the remaining 0.5 lots run toward 1.1100 or until a reversal signal.

Tips for Effective Partial Profit-Taking

Plan in Advance:

Set predefined levels for partial exits based on analysis, not emotions.

Use Risk-Reward Ratios:

Ensure the reward for both partial and full exits aligns with your risk tolerance.

Combine with Trailing Stops:

Use trailing stops to protect profits on the remaining position.

Monitor News Events:

Be cautious around high-impact news, which can cause unexpected reversals.

Partial profit-taking is a versatile strategy that allows traders to balance risk and reward effectively while maintaining psychological comfort.

#firstdealofthenewyearAKEEL

Thích 0

Mky9196

Trader

Bình luận phổ biến

Ngành

Có cao quá k?

Ngành

Xin ý kiến liberforex

Ngành

Đầu tư CDG

Ngành

Cắt lỗ

Ngành

Có nên chốt lỗ?

Ngành

Hỏi về dòng tiền

Phân loại diễn đàn

Nền tảng

Triển lãm

IB

Tuyển dụng

EA

Ngành

Chỉ số thị trường

Chỉ số

Partial profit-taking in forex trading.

Nigeria | 2025-01-29 00:45

Nigeria | 2025-01-29 00:45#firstdealofthenewyearAKEEL

Partial profit-taking is a trading strategy where a trader closes a portion of their position to lock in some profits while keeping the rest of the trade open to capitalize on further potential gains.

How It Works

Open a Trade: Enter a position with a specific lot size (e.g., 1.0 lot).

Set a Target Zone: Identify a price level where partial profits will be taken, often based on technical analysis (e.g., support/resistance, Fibonacci levels).

Close Part of the Position: When the price reaches the target, close a portion of the trade (e.g., 0.5 lots) to secure profits.

Adjust Stop-Loss:

Move the stop-loss to breakeven (entry price) or a more favorable level to minimize risk on the remaining position.

This ensures the trade is risk-free or profitable overall.

Let the Rest Run: Allow the remaining position to run toward a higher target or until the market signals an exit.

Advantages of Partial Profit-Taking

Locks in Profits:

Reduces the emotional pressure of holding the entire position.

Secures gains even if the market reverses.

Balances Risk and Reward:

Ensures a reward while still participating in potential future market moves.

Creates a "win-win" scenario: some profit is guaranteed, and more can be earned.

Increases Flexibility:

Allows traders to adapt to changing market conditions without fully exiting the trade.

Improves Trade Psychology:

Reduces fear and greed, helping traders stick to their plan more effectively.

Disadvantages of Partial Profit-Taking

Reduces Overall Profit Potential:

By closing part of the position, the trader limits potential gains if the price continues moving in their favor.

Additional Execution Costs:

Closing trades in parts may result in higher transaction fees or spreads.

Requires Precise Planning:

Poor timing or incorrect partial exits can lead to suboptimal results.

When to Use Partial Profit-Taking

Volatile Markets:

When price movements are unpredictable, securing partial profits can be a safer strategy.

Uncertainty Near Key Levels:

When the price approaches major resistance or support zones where reversals are likely.

Scaling Out of Trades:

When the trade is highly profitable but hasn’t yet reached the final target, taking partial profits helps to lock in gains.

Long-Term Trades:

For swing or position traders, it’s a way to balance short-term gains while letting the remaining trade ride long-term trends.

Example of Partial Profit-Taking

Entry: Buy EUR/USD at 1.1000 with 1.0 lot size.

Partial Target: Close 0.5 lots at 1.1050 to secure 50 pips of profit.

Stop-Loss Adjustment: Move stop-loss to 1.1020 for the remaining 0.5 lots, ensuring a risk-free trade.

Final Target: Let the remaining 0.5 lots run toward 1.1100 or until a reversal signal.

Tips for Effective Partial Profit-Taking

Plan in Advance:

Set predefined levels for partial exits based on analysis, not emotions.

Use Risk-Reward Ratios:

Ensure the reward for both partial and full exits aligns with your risk tolerance.

Combine with Trailing Stops:

Use trailing stops to protect profits on the remaining position.

Monitor News Events:

Be cautious around high-impact news, which can cause unexpected reversals.

Partial profit-taking is a versatile strategy that allows traders to balance risk and reward effectively while maintaining psychological comfort.

#firstdealofthenewyearAKEEL

Thích 0

Tôi cũng muốn bình luận.

Đặt câu hỏi

0bình luận

Chưa có người bình luận, hãy là người bình luận đầu tiên

Đặt câu hỏi

Chưa có người bình luận, hãy là người bình luận đầu tiên