2025-02-06 15:17

NgànhSmart contract trading strategies

#firstdealofthenewyearFateema

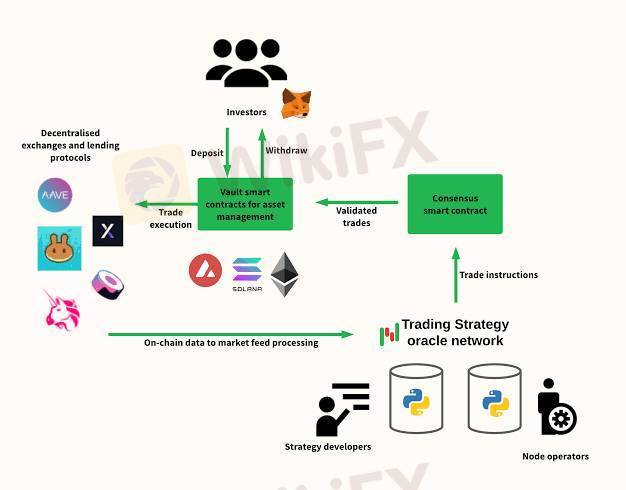

Smart contract trading strategies involve using automated, self-executing contracts to execute trades based on predefined conditions. These strategies are widely used in decentralized finance (DeFi) for market-making, arbitrage, liquidation, and automated portfolio management. Here are some key strategies:

1. Arbitrage Trading

Cross-DEX Arbitrage: Identifying price discrepancies between decentralized exchanges (DEXs) like Uniswap, Sushiswap, or STON.fi to buy low and sell high.

Triangular Arbitrage: Exploiting price differences within a single DEX by trading through three different assets in a loop.

Flash Loan Arbitrage: Borrowing funds without collateral using flash loans to perform arbitrage trades and repaying in the same transaction.

2. Market-Making & Liquidity Provision

Automated Market Maker (AMM) Strategies: Providing liquidity on platforms like Uniswap v3, Balancer, or Curve while using concentrated liquidity strategies for optimal returns.

Rebalancing Liquidity Positions: Adjusting liquidity positions dynamically based on market conditions to minimize impermanent loss.

3. Trend-Following Strategies

Moving Average Crossovers: Using smart contracts to track exponential moving averages (EMA) and execute buy/sell orders when trends shift.

Momentum Trading: Executing trades when an asset’s price or volume exceeds predefined thresholds.

4. Mean Reversion Trading

Bollinger Bands Strategy: Buying when an asset’s price is below the lower band and selling when it is above the upper band.

RSI-Based Trading: Buying when the RSI is oversold (<30) and selling when it is overbought (>70).

5. Automated Yield Farming & Staking

Yield Optimization: Using smart contracts to move assets between DeFi protocols like Aave, Compound, or Yearn to maximize APY.

Auto-Compounding: Automating reinvestment of rewards to maximize returns over time.

6. Liquidation Bots

Lending Protocol Liquidation: Monitoring platforms like Aave or MakerDAO to liquidate undercollateralized positions and earn a liquidation bonus.

7. Sandwich Attacks & MEV Strategies

Front-Running Arbitrage: Placing a buy order before a large trade and selling immediately after to profit from slippage.

Back-Running: Detecting profitable transactions in the mempool and submitting orders right after to benefit.

Would you like to explore a specific strategy or discuss implementing a trading bot using smart contracts?

Thích 0

mmaette100

Nhà đầu tư

Bình luận phổ biến

Ngành

Có cao quá k?

Ngành

Xin ý kiến liberforex

Ngành

Đầu tư CDG

Ngành

Cắt lỗ

Ngành

Có nên chốt lỗ?

Ngành

Hỏi về dòng tiền

Phân loại diễn đàn

Nền tảng

Triển lãm

IB

Tuyển dụng

EA

Ngành

Chỉ số thị trường

Chỉ số

Smart contract trading strategies

Nigeria | 2025-02-06 15:17

Nigeria | 2025-02-06 15:17#firstdealofthenewyearFateema

Smart contract trading strategies involve using automated, self-executing contracts to execute trades based on predefined conditions. These strategies are widely used in decentralized finance (DeFi) for market-making, arbitrage, liquidation, and automated portfolio management. Here are some key strategies:

1. Arbitrage Trading

Cross-DEX Arbitrage: Identifying price discrepancies between decentralized exchanges (DEXs) like Uniswap, Sushiswap, or STON.fi to buy low and sell high.

Triangular Arbitrage: Exploiting price differences within a single DEX by trading through three different assets in a loop.

Flash Loan Arbitrage: Borrowing funds without collateral using flash loans to perform arbitrage trades and repaying in the same transaction.

2. Market-Making & Liquidity Provision

Automated Market Maker (AMM) Strategies: Providing liquidity on platforms like Uniswap v3, Balancer, or Curve while using concentrated liquidity strategies for optimal returns.

Rebalancing Liquidity Positions: Adjusting liquidity positions dynamically based on market conditions to minimize impermanent loss.

3. Trend-Following Strategies

Moving Average Crossovers: Using smart contracts to track exponential moving averages (EMA) and execute buy/sell orders when trends shift.

Momentum Trading: Executing trades when an asset’s price or volume exceeds predefined thresholds.

4. Mean Reversion Trading

Bollinger Bands Strategy: Buying when an asset’s price is below the lower band and selling when it is above the upper band.

RSI-Based Trading: Buying when the RSI is oversold (<30) and selling when it is overbought (>70).

5. Automated Yield Farming & Staking

Yield Optimization: Using smart contracts to move assets between DeFi protocols like Aave, Compound, or Yearn to maximize APY.

Auto-Compounding: Automating reinvestment of rewards to maximize returns over time.

6. Liquidation Bots

Lending Protocol Liquidation: Monitoring platforms like Aave or MakerDAO to liquidate undercollateralized positions and earn a liquidation bonus.

7. Sandwich Attacks & MEV Strategies

Front-Running Arbitrage: Placing a buy order before a large trade and selling immediately after to profit from slippage.

Back-Running: Detecting profitable transactions in the mempool and submitting orders right after to benefit.

Would you like to explore a specific strategy or discuss implementing a trading bot using smart contracts?

Thích 0

Tôi cũng muốn bình luận.

Đặt câu hỏi

0bình luận

Chưa có người bình luận, hãy là người bình luận đầu tiên

Đặt câu hỏi

Chưa có người bình luận, hãy là người bình luận đầu tiên