2025-02-13 04:26

NgànhCurrency wars and competitive devaluations

#firstdealofthenewyearastytz

Competitive devaluation is a complex issue with significant implications for global trade and the Forex market. Here's a breakdown of the key aspects:

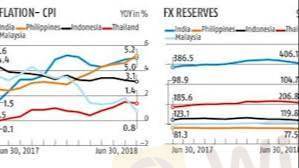

* The Mechanism: When a country devalues its currency, its exports become cheaper in foreign markets, making them more competitive. Conversely, imports become more expensive, discouraging consumption of foreign goods. This can boost a country's trade balance and stimulate economic growth.

* The Drawbacks: However, competitive devaluation can trigger a downward spiral. If other countries retaliate by devaluing their currencies, it can lead to a "currency war" where everyone is trying to gain an advantage by weakening their currency. This can create instability in the Forex market and hurt global trade.

* Impact on Forex Market: Devaluation can cause volatility in the Forex market as investors react to the changing value of currencies. This volatility can make it difficult for businesses to plan and invest, and can also impact the value of assets denominated in foreign currencies.

* Economic Crises: Global economic crises can exacerbate trade imbalances and lead to competitive devaluation. During recessions, countries may be tempted to devalue their currencies to stimulate exports and boost their economies. However, this can backfire if it triggers a currency war or leads to inflation.

In conclusion, competitive devaluation is a double-edged sword. While it can offer short-term benefits for a country's trade balance, it can also lead to instability in the Forex market and harm the global economy. It's crucial for countries to consider the potential consequences of such policies before resorting to them.

Thích 0

Monix

Corretoras

Bình luận phổ biến

Ngành

Có cao quá k?

Ngành

Xin ý kiến liberforex

Ngành

Đầu tư CDG

Ngành

Cắt lỗ

Ngành

Có nên chốt lỗ?

Ngành

Hỏi về dòng tiền

Phân loại diễn đàn

Nền tảng

Triển lãm

IB

Tuyển dụng

EA

Ngành

Chỉ số thị trường

Chỉ số

Currency wars and competitive devaluations

Hong Kong | 2025-02-13 04:26

Hong Kong | 2025-02-13 04:26#firstdealofthenewyearastytz

Competitive devaluation is a complex issue with significant implications for global trade and the Forex market. Here's a breakdown of the key aspects:

* The Mechanism: When a country devalues its currency, its exports become cheaper in foreign markets, making them more competitive. Conversely, imports become more expensive, discouraging consumption of foreign goods. This can boost a country's trade balance and stimulate economic growth.

* The Drawbacks: However, competitive devaluation can trigger a downward spiral. If other countries retaliate by devaluing their currencies, it can lead to a "currency war" where everyone is trying to gain an advantage by weakening their currency. This can create instability in the Forex market and hurt global trade.

* Impact on Forex Market: Devaluation can cause volatility in the Forex market as investors react to the changing value of currencies. This volatility can make it difficult for businesses to plan and invest, and can also impact the value of assets denominated in foreign currencies.

* Economic Crises: Global economic crises can exacerbate trade imbalances and lead to competitive devaluation. During recessions, countries may be tempted to devalue their currencies to stimulate exports and boost their economies. However, this can backfire if it triggers a currency war or leads to inflation.

In conclusion, competitive devaluation is a double-edged sword. While it can offer short-term benefits for a country's trade balance, it can also lead to instability in the Forex market and harm the global economy. It's crucial for countries to consider the potential consequences of such policies before resorting to them.

Thích 0

Tôi cũng muốn bình luận.

Đặt câu hỏi

0bình luận

Chưa có người bình luận, hãy là người bình luận đầu tiên

Đặt câu hỏi

Chưa có người bình luận, hãy là người bình luận đầu tiên