2025-02-18 01:13

NgànhHow to calculate position sizing.

#forexrisktip

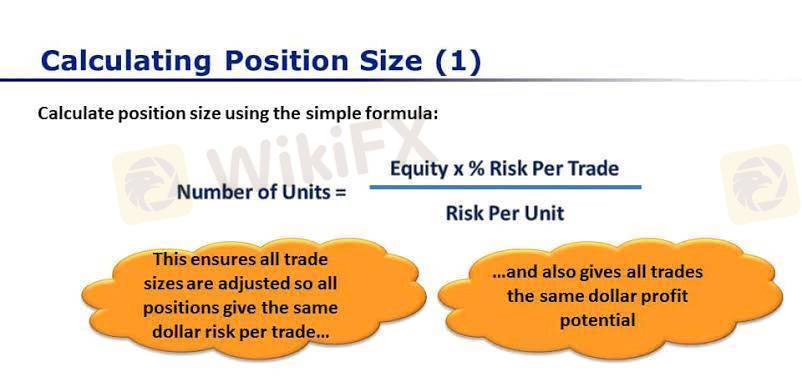

Position sizing is a risk management technique used by traders and investors to determine the appropriate number of units of an asset to buy or sell in order to control the potential loss from a trade. It involves calculating the position size based on the trader's account balance, risk tolerance, and the stop-loss level for the trade.

The basic formula for calculating position size is:

Position size = (Account balance * Risk percentage) / (Entry price - Stop-loss price)

For example, if a trader has an account balance of $10,000, a risk tolerance of 2%, an entry price of $100, and a stop-loss price of $95, the position size would be:

Position size = ($10,000 * 2%) / ($100 - $95) = 200 shares

This means that the trader should buy 200 shares of the asset. If the trade goes wrong and the price falls to the stop-loss level of $95, the trader will lose $1,000, which is 2% of their account balance.

Position sizing is an important risk management tool that can help traders to limit their losses and protect their capital. By carefully calculating the position size for each trade, traders can ensure that they are not risking more than they can afford to lose.

Thích 0

Forextrederr73

Nhà đầu tư

Bình luận phổ biến

Ngành

Có cao quá k?

Ngành

Xin ý kiến liberforex

Ngành

Đầu tư CDG

Ngành

Cắt lỗ

Ngành

Có nên chốt lỗ?

Ngành

Hỏi về dòng tiền

Phân loại diễn đàn

Nền tảng

Triển lãm

IB

Tuyển dụng

EA

Ngành

Chỉ số thị trường

Chỉ số

How to calculate position sizing.

Ấn Độ | 2025-02-18 01:13

Ấn Độ | 2025-02-18 01:13#forexrisktip

Position sizing is a risk management technique used by traders and investors to determine the appropriate number of units of an asset to buy or sell in order to control the potential loss from a trade. It involves calculating the position size based on the trader's account balance, risk tolerance, and the stop-loss level for the trade.

The basic formula for calculating position size is:

Position size = (Account balance * Risk percentage) / (Entry price - Stop-loss price)

For example, if a trader has an account balance of $10,000, a risk tolerance of 2%, an entry price of $100, and a stop-loss price of $95, the position size would be:

Position size = ($10,000 * 2%) / ($100 - $95) = 200 shares

This means that the trader should buy 200 shares of the asset. If the trade goes wrong and the price falls to the stop-loss level of $95, the trader will lose $1,000, which is 2% of their account balance.

Position sizing is an important risk management tool that can help traders to limit their losses and protect their capital. By carefully calculating the position size for each trade, traders can ensure that they are not risking more than they can afford to lose.

Thích 0

Tôi cũng muốn bình luận.

Đặt câu hỏi

0bình luận

Chưa có người bình luận, hãy là người bình luận đầu tiên

Đặt câu hỏi

Chưa có người bình luận, hãy là người bình luận đầu tiên