2025-02-18 02:02

NgànhAvoiding emotional trading.

#forexrisktip#

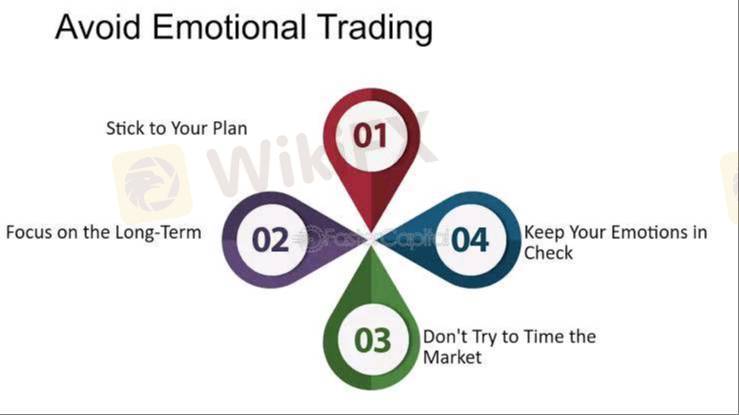

Emotional trading is when you make investment decisions based on fear, greed, or other feelings, rather than on a sound, logical strategy. This often leads to poor choices and significant losses. Here are some strategies to avoid emotional trading:

* Have a solid trading plan:

* Define your goals, risk tolerance, and investment strategy.

* Set clear entry and exit points for your trades.

* Stick to your plan and avoid impulsive decisions.

* Manage your risk:

* Only invest money you can afford to lose.

* Use stop-loss orders to limit potential losses.

* Diversify your portfolio to spread risk.

* Control your emotions:

* Recognize your emotional triggers and learn to manage them.

* Avoid making trades when you're feeling stressed, angry, or overly excited.

* Take breaks when needed to clear your head.

* Be patient:

* Don't chase quick profits or try to time the market.

* Wait for the right opportunities and don't rush into trades.

* Remember that investing is a long-term game.

* Keep a trading journal:

* Track your trades and analyze your decisions.

* Identify patterns of emotional trading and learn from your mistakes.

* Seek support:

* Talk to other traders or financial advisors.

* Join online communities to share experiences and learn from others.

Remember, successful trading requires discipline, patience, and a rational approach. By following these strategies, you can minimize the impact of emotions on your trading and increase your chances of success.

Thích 0

Jekam

Trader

Bình luận phổ biến

Ngành

Có cao quá k?

Ngành

Xin ý kiến liberforex

Ngành

Đầu tư CDG

Ngành

Cắt lỗ

Ngành

Có nên chốt lỗ?

Ngành

Hỏi về dòng tiền

Phân loại diễn đàn

Nền tảng

Triển lãm

IB

Tuyển dụng

EA

Ngành

Chỉ số thị trường

Chỉ số

Avoiding emotional trading.

Ấn Độ | 2025-02-18 02:02

Ấn Độ | 2025-02-18 02:02#forexrisktip#

Emotional trading is when you make investment decisions based on fear, greed, or other feelings, rather than on a sound, logical strategy. This often leads to poor choices and significant losses. Here are some strategies to avoid emotional trading:

* Have a solid trading plan:

* Define your goals, risk tolerance, and investment strategy.

* Set clear entry and exit points for your trades.

* Stick to your plan and avoid impulsive decisions.

* Manage your risk:

* Only invest money you can afford to lose.

* Use stop-loss orders to limit potential losses.

* Diversify your portfolio to spread risk.

* Control your emotions:

* Recognize your emotional triggers and learn to manage them.

* Avoid making trades when you're feeling stressed, angry, or overly excited.

* Take breaks when needed to clear your head.

* Be patient:

* Don't chase quick profits or try to time the market.

* Wait for the right opportunities and don't rush into trades.

* Remember that investing is a long-term game.

* Keep a trading journal:

* Track your trades and analyze your decisions.

* Identify patterns of emotional trading and learn from your mistakes.

* Seek support:

* Talk to other traders or financial advisors.

* Join online communities to share experiences and learn from others.

Remember, successful trading requires discipline, patience, and a rational approach. By following these strategies, you can minimize the impact of emotions on your trading and increase your chances of success.

Thích 0

Tôi cũng muốn bình luận.

Đặt câu hỏi

0bình luận

Chưa có người bình luận, hãy là người bình luận đầu tiên

Đặt câu hỏi

Chưa có người bình luận, hãy là người bình luận đầu tiên