2025-02-21 18:14

NgànhComparing USD trends during different rate cuts be

#FedRateCutAffectsDollarTrend

Comparing U.S. Dollar Trends During Different Fed Rate Cut Cycles

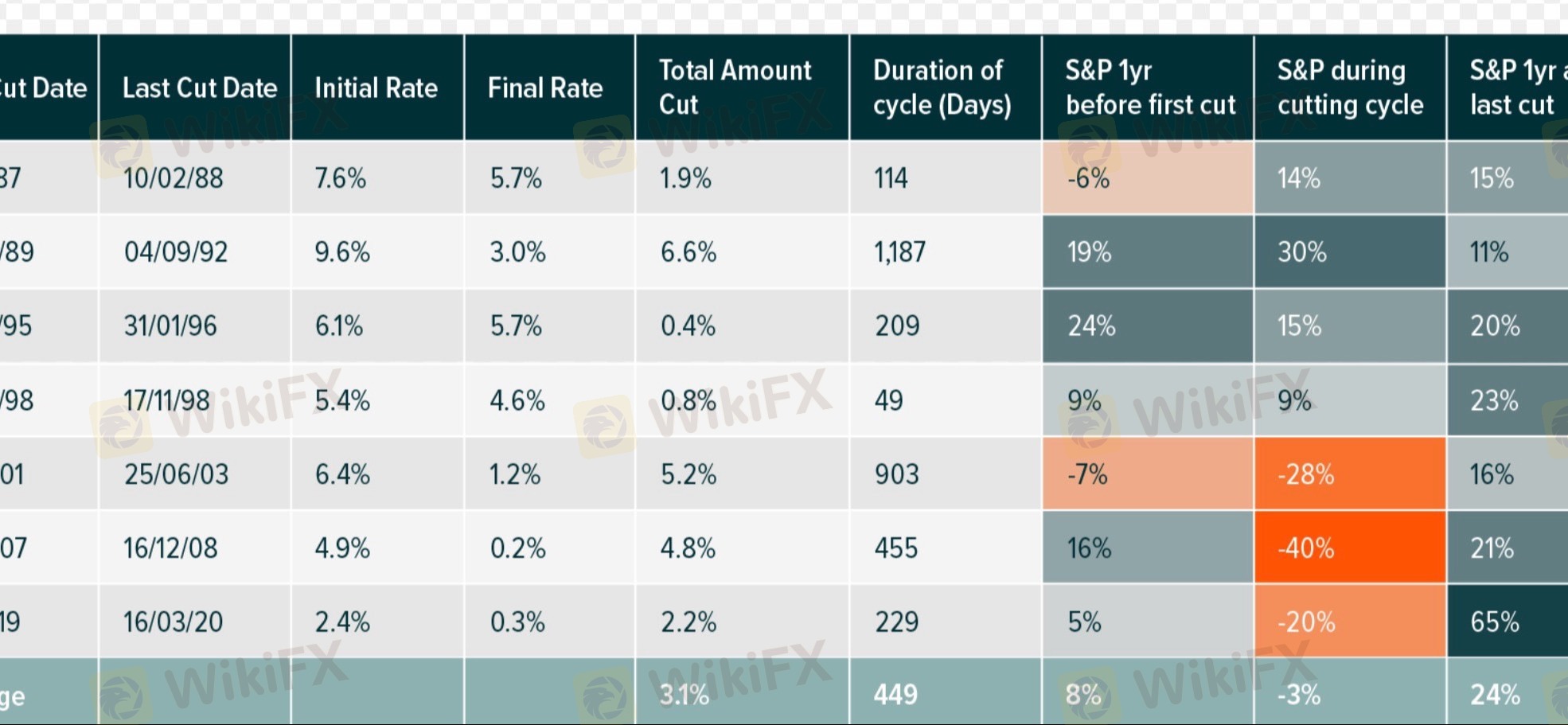

The impact of Fed rate cuts on the U.S. dollar varies depending on the economic conditions surrounding each easing cycle. Some cycles saw an immediate dollar decline, while others resulted in temporary strength before longer-term weakness. Below is a comparison of major rate cut cycles and how the dollar responded.

1. 2001-2003: Dot-Com Bubble & Post-9/11 Recession

Rate Cuts: The Fed cut rates aggressively from 6.5% in 2000 to 1.0% by 2003.

USD Trend: Significant weakening (-33% vs. the euro from 2002-2004)

• The Fed eased policy aggressively to prevent recession, leading to capital outflows.

• The stock market crash and economic uncertainty weakened the dollar.

• The euro surged as investors shifted to foreign markets.

2. 2007-2009: Global Financial Crisis

Rate Cuts: The Fed slashed rates from 5.25% in 2007 to 0-0.25% by 2008.

USD Trend: Initial strength, then weakness

• The dollar initially strengthened (2008) due to a flight to safety as investors fled to U.S. Treasuries.

• After the crisis stabilized (2009-2011), the dollar weakened as QE flooded markets with liquidity.

• Emerging markets and risk assets outperformed the dollar post-crisis.

3. 2019-2020: Pre-COVID Precautionary Cuts & Pandemic Response

Rate Cuts:

• 2019: The Fed cut rates three times (from 2.5% to 1.75%) as a precautionary measure.

• 2020: The Fed cut rates from 1.75% to near zero in March 2020 due to COVID-19.

USD Trend: Mixed—initial strength, then sharp decline

• The dollar stayed strong in 2019 because global economic uncertainty drove investors into U.S. assets.

• In early 2020, the dollar spiked during the COVID crash, then weakened as the Fed flooded the market with liquidity and QE.

• The DXY fell ~10% in late 2020 as risk appetite returned.

Key Takeaways: How the Dollar Reacts to Rate Cuts

Rate Cut Cycle Initial USD Reaction Long-Term USD Trend Key Factors

2001-2003 Weakened Continued weakening U.S. recession, capital outflows

2007-2009 Strengthened Weakened after crisis stabilized Safe-haven demand → liquidity expansion

**

Thích 0

FX6276045692

Nhà đầu tư

Bình luận phổ biến

Ngành

Có cao quá k?

Ngành

Xin ý kiến liberforex

Ngành

Đầu tư CDG

Ngành

Cắt lỗ

Ngành

Có nên chốt lỗ?

Ngành

Hỏi về dòng tiền

Phân loại diễn đàn

Nền tảng

Triển lãm

IB

Tuyển dụng

EA

Ngành

Chỉ số thị trường

Chỉ số

Comparing USD trends during different rate cuts be

Ấn Độ | 2025-02-21 18:14

Ấn Độ | 2025-02-21 18:14#FedRateCutAffectsDollarTrend

Comparing U.S. Dollar Trends During Different Fed Rate Cut Cycles

The impact of Fed rate cuts on the U.S. dollar varies depending on the economic conditions surrounding each easing cycle. Some cycles saw an immediate dollar decline, while others resulted in temporary strength before longer-term weakness. Below is a comparison of major rate cut cycles and how the dollar responded.

1. 2001-2003: Dot-Com Bubble & Post-9/11 Recession

Rate Cuts: The Fed cut rates aggressively from 6.5% in 2000 to 1.0% by 2003.

USD Trend: Significant weakening (-33% vs. the euro from 2002-2004)

• The Fed eased policy aggressively to prevent recession, leading to capital outflows.

• The stock market crash and economic uncertainty weakened the dollar.

• The euro surged as investors shifted to foreign markets.

2. 2007-2009: Global Financial Crisis

Rate Cuts: The Fed slashed rates from 5.25% in 2007 to 0-0.25% by 2008.

USD Trend: Initial strength, then weakness

• The dollar initially strengthened (2008) due to a flight to safety as investors fled to U.S. Treasuries.

• After the crisis stabilized (2009-2011), the dollar weakened as QE flooded markets with liquidity.

• Emerging markets and risk assets outperformed the dollar post-crisis.

3. 2019-2020: Pre-COVID Precautionary Cuts & Pandemic Response

Rate Cuts:

• 2019: The Fed cut rates three times (from 2.5% to 1.75%) as a precautionary measure.

• 2020: The Fed cut rates from 1.75% to near zero in March 2020 due to COVID-19.

USD Trend: Mixed—initial strength, then sharp decline

• The dollar stayed strong in 2019 because global economic uncertainty drove investors into U.S. assets.

• In early 2020, the dollar spiked during the COVID crash, then weakened as the Fed flooded the market with liquidity and QE.

• The DXY fell ~10% in late 2020 as risk appetite returned.

Key Takeaways: How the Dollar Reacts to Rate Cuts

Rate Cut Cycle Initial USD Reaction Long-Term USD Trend Key Factors

2001-2003 Weakened Continued weakening U.S. recession, capital outflows

2007-2009 Strengthened Weakened after crisis stabilized Safe-haven demand → liquidity expansion

**

Thích 0

Tôi cũng muốn bình luận.

Đặt câu hỏi

0bình luận

Chưa có người bình luận, hãy là người bình luận đầu tiên

Đặt câu hỏi

Chưa có người bình luận, hãy là người bình luận đầu tiên