Trade Swing

Lời nói đầu: Trade Swing is an unregulated brokerage that offers a range of market instruments including forex, indices, stocks, metals, cryptocurrencies, and energies. They provide two account types: Lite and Premium (VIP), with a demo account available for users to practice trading. The maximum leverage offered is Lite: 1:100 and Premium (VIP): 1:300. Premium (VIP) account holders benefit from raw spreads, while Lite account holders enjoy no commission fees. The trading platform offered by Trade Swing is MT4/MT5, although broken links have been reported. Unfortunately, specific details about the minimum deposit requirement are not available. For deposit and withdrawal methods, Trade Swing supports wire transfers and crypto wallets. It is worth noting that Trade Swing operates without regulation, which raises concerns about the company's reliability and customer protection. Before considering any financial engagement with Trade Swing, it is advisable to conduct thorough due diligence and consider

| Information | Details |

| Name | Trade Swing |

| Regulation | Unregulated |

| Market Instruments | Forex / Indices / Stocks / Metals / Cryptocurrencies / Energies |

| Account Types | Lite / Premium (VIP) |

| Demo Account Availability | Yes |

| Maximum Leverage | Lite: 1:100 / Premium (VIP): 1:300 |

| Spread | Premium (VIP): Raw Spreads |

| Commission | Lite: No Commission / Premium (VIP): Commission included |

| Trading Platform | MT4/MT5 (broken links) |

| Minimum Deposit | N/A |

| Deposit & Withdrawal Method | Wire Transfers / Crypto Wallet |

Overview of Trade Swing

Trade Swing is an unregulated brokerage that offers a range of market instruments including forex, indices, stocks, metals, cryptocurrencies, and energies. They provide two account types: Lite and Premium (VIP), with a demo account available for users to practice trading. The maximum leverage offered is Lite: 1:100 and Premium (VIP): 1:300. Premium (VIP) account holders benefit from raw spreads, while Lite account holders enjoy no commission fees. The trading platform offered by Trade Swing is MT4/MT5, although broken links have been reported. Unfortunately, specific details about the minimum deposit requirement are not available. For deposit and withdrawal methods, Trade Swing supports wire transfers and crypto wallets. It is worth noting that Trade Swing operates without regulation, which raises concerns about the company's reliability and customer protection. Before considering any financial engagement with Trade Swing, it is advisable to conduct thorough due diligence and consider the potential risks associated with an unregulated brokerage.

Pros and Cons

Pros: Trade Swing offers a variety of market instruments, including forex, indices, stocks, metals, cryptocurrencies, and energies. This allows traders to diversify their portfolios and take advantage of different market opportunities. Trade Swing provides leverage options, such as up to 1:100 for Lite accounts and potentially up to 1:300 for Premium (VIP) accounts. Higher leverage ratios can amplify potential profits for traders who employ appropriate risk management strategies. Trade Swing supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms offer a range of advanced features, charting tools, and customization options, allowing traders to implement their trading strategies effectively.

Cons: Trade Swing is reported to be unregulated, which raises concerns about customer protection, transparency, and adherence to industry standards. The absence of regulatory oversight increases the risk for traders in terms of fund safety and dispute resolution. There are gaps in the available information regarding specific details, such as minimum deposit requirements, spreads, commissions, and withdrawal methods. This lack of transparency can make it challenging for traders to assess the full cost structure and terms of trading with Trade Swing. Reports of Trade Swing's website displaying a “Service Temporarily Unavailable” message indicate potential reliability and technical issues. This can disrupt the trading experience and cast doubts on the company's stability and operational efficiency.

| Pros | Cons |

| - Access to multiple market instruments | - Lack of regulation |

| - Leverage options (up to 1:100 or 1:300) | - Limited information and transparency regarding key details |

| - Availability of MT4 and MT5 trading platforms | - Unreliable website and potential technical issues |

Market Instruments

Trade Swing offers a diverse range of market instruments for trading. Their selection includes popular options such as forex, indices, stocks, metals, cryptocurrencies, and energies.

This variety allows traders to engage in different markets and capitalize on various investment opportunities. Forex trading provides access to the foreign exchange market, enabling users to trade currency pairs. Indices represent a basket of stocks from a specific market, allowing traders to speculate on the overall performance of an index. Stocks allow investors to trade shares of publicly listed companies. Metals, such as gold and silver, offer opportunities to trade in precious metals markets. Cryptocurrencies provide access to the growing digital currency market. Lastly, energies cover commodities like oil and natural gas, allowing traders to participate in energy-related markets. With this diverse range of market instruments, Trade Swing aims to cater to the varied trading preferences and strategies of its customers.

Account Types

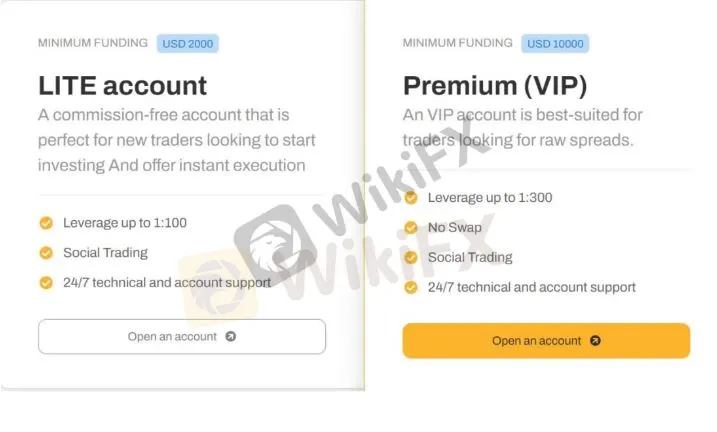

Apart from demo accounts, Trade Swing offers two distinct account types to accommodate the varying needs and preferences of traders. These account types are the Lite account, Extra Account and the Premium (VIP) account. Unfortunately, due to the limited information on the Extra Account type, it cannot be analysized.

The Lite account is designed for traders seeking a more accessible entry point into the financial markets. This account type typically offers competitive trading conditions with a lower minimum deposit requirement, although specific details about the minimum deposit for Trade Swing are unavailable. Lite account holders can trade a range of market instruments, including forex, indices, stocks, metals, cryptocurrencies, and energies. They may benefit from leverage of up to 1:100, allowing them to amplify their trading positions. Additionally, the Lite account typically features no commission charges, allowing traders to focus on their trading strategies without incurring extra costs.

On the other hand, the Premium (VIP) account caters to traders with more advanced trading requirements and a larger trading capital. This account type usually offers enhanced features and benefits compared to the Lite account. Premium (VIP) account holders may enjoy higher leverage and the Premium (VIP) account may offer access to raw spreads, which can be advantageous for traders seeking tighter spreads and competitive pricing. However, specific details about the commission structure and other features of the Premium (VIP) account at Trade Swing are not available.

However, the broker mentions no information about the minimum initial deposit requirement to open an account for either account type.

The Lite account is designed for traders seeking a more accessible entry point into the financial markets. This account type typically offers competitive trading conditions with a lower minimum deposit requirement, although specific details about the minimum deposit for Trade Swing are unavailable. Lite account holders can trade a range of market instruments, including forex, indices, stocks, metals, cryptocurrencies, and energies. They may benefit from leverage of up to 1:100, allowing them to amplify their trading positions. Additionally, the Lite account typically features no commission charges, allowing traders to focus on their trading strategies without incurring extra costs.

On the other hand, the Premium (VIP) account caters to traders with more advanced trading requirements and a larger trading capital. This account type usually offers enhanced features and benefits compared to the Lite account. Premium (VIP) account holders may enjoy higher leverage and the Premium (VIP) account may offer access to raw spreads, which can be advantageous for traders seeking tighter spreads and competitive pricing. However, specific details about the commission structure and other features of the Premium (VIP) account at Trade Swing are not available.

However, the broker mentions no information about the minimum initial deposit requirement to open an account for either account type.

Leverage

Trade Swing offers different leverage rates depending on the account type chosen by traders. The leverage rate determines the amount of capital that traders can control relative to their initial investment. It can amplify both potential profits and losses in trading positions.

For the Lite account, Trade Swing typically provides leverage of up to 1:100. This means that for every dollar of the trader's own funds, they can control up to $100 in trading volume.

In comparison, the Premium (VIP) account at Trade Swing generally offers a higher leverage rate, often up to 1:300.

Spreads & Commissions

Trade Swing offers different spreads and commission structures depending on the type of account chosen and the specific trading conditions. However, based on the available information, here's a general overview:

Spreads: The spread refers to the difference between the bid price (selling price) and the ask price (buying price) of a financial instrument. While specific details about spreads at Trade Swing are not provided, it is mentioned that Premium (VIP) account holders may have access to raw spreads. Raw spreads typically refer to spreads that are derived directly from the underlying market liquidity, often resulting in tighter spreads and potentially more competitive pricing. On the other hand, the spread for Lite account holders is not specified.

Commissions: The commission structure at Trade Swing appears to vary based on the account type. For Lite account holders, it is stated that there are typically no commission charges. This means that Lite account traders can execute trades without incurring additional costs beyond the spread. Conversely, the commission structure for Premium (VIP) account holders is not explicitly mentioned.

It's important to note that specific details about the spreads and commission rates for Trade Swing are limited, and traders should refer to the official documentation or directly consult with Trade Swing representatives to obtain accurate and up-to-date information on the spreads and commissions applicable to their chosen account type.

Trading Platform Available

Trade Swing provides access to the popular and widely-used trading platforms, namely MT4 (MetaTrader 4) and MT5 (MetaTrader 5), for its clients. These platforms are known for their robust features, user-friendly interfaces, and comprehensive charting capabilities, making them a preferred choice for many traders.

It's important to note that in the previous information shared, broken links to the trading platforms were mentioned. This could imply that there may be issues with accessing or utilizing the MT4 and MT5 platforms provided by Trade Swing. Traders should exercise caution and verify the availability and functionality of the trading platforms directly with Trade Swing or explore alternative platforms if necessary.

Deposit & Withdrawal

Based on the available information, Trade Swing supports deposit methods such as wire transfers. The site encourages the adding of a crypto wallet address, which suggests that the broker offers cryptocurrency deposit options. The brokers website states that there is no deposit fee charged.

Customer Support

Trade Swing's customer support can be contacted through multiple channels. Traders can reach their support team by telephone at +19718000856 during business hours (Monday to Friday, 9 AM to 5 PM). Alternatively, they can send an email to support@trade-swing.com or utilize the online messaging system available on the company's website to get in touch. For any correspondence or physical mail, the company's address is C/o Suite 305, Griffith Corporate Centre Beachmont, Kingstown, St. Vincent & Grenadines. These contact options provide avenues for traders to seek assistance, address queries, or communicate with Trade Swing's customer support team.

Risk Warning

Online trading carries substantial risks, and there is a possibility of losing all your invested capital. It may not be suitable for all traders or investors. It is crucial to thoroughly comprehend the associated risks and acknowledge that the information provided in this article is solely for general informational purposes.

Customer Reviews/Experiences

Multiple negative customer experiences have been reported regarding Trade Swing, formerly known as Wizard Capitals. The company, registered in Saint Vincent and the Grenadines, has displayed unreliability and questionable practices. Users have encountered issues such as the company's website showing a “Service Temporarily Unavailable” message and the absence of a regulatory license. Furthermore, the minimum deposit requirement of $2,000 appears unusually high compared to many reputable brokerage firms. Customers have reported significant financial losses, with allegations of Trade Swing and Wizard Capitals abruptly closing servers without paying their clients, leaving them stranded. It has been suggested that the call centers associated with these firms may be located in India, with a minimal presence in the UAE. Such negative experiences highlight the need for caution and thorough research when dealing with Trade Swing or any financial institution.

Conclusion

In conclusion, the information available about Trade Swing suggests a number of potential concerns and risks. The company operates without regulation, which raises questions about customer protection and transparency. Additionally, there are gaps in specific details, such as minimum deposit requirements and commission structures, which can impact traders' ability to fully understand the costs involved as well as reported issues with the website's reliability. On the positive side, Trade Swing offers access to a range of market instruments and supports popular trading platforms like MT4 and MT5.

FAQs

Q: What market instruments can I trade with Trade Swing?

A: Trade Swing offers a range of market instruments, including forex, indices, stocks, metals, cryptocurrencies, and energies.

Q: What leverage options are available with Trade Swing?

A: Trade Swing provides leverage options, such as up to 1:100 for Lite accounts and potentially up to 1:300 for Premium (VIP) accounts.

Q: Is Trade Swing a regulated brokerage?

A: No, Trade Swing is reported to be unregulated, which raises concerns about customer protection and transparency.

Q: What are the available trading platforms on Trade Swing?

A: Trade Swing supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

Q: Are there any specific details about the spreads and commissions on Trade Swing?

A: Specific details about the spreads and commissions are not provided.

Q: How can I contact Trade Swing's customer support?

A: Trade Swing's customer support can be reached by telephone at +19718000856 during business hours, via email at support@trade-swing.com, or through the online messaging system on their website.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Xem thêm

Mô hình Hybrid là gì? Mối quan hệ giữa A-Book và B-Book trong Forex

Trong thế giới giao dịch ngoại hối đầy phức tạp và biến động, các nhà môi giới (broker) vận hành theo nhiều mô hình khác nhau để quản lý giao dịch và rủi ro của khách hàng.

Top 5 sàn lừa đảo chiếm đoạt hơn 100 tỷ đồng trong năm 2024

Top 5 sàn forex lừa đảo chiếm đoạt hơn 100 tỷ đồng trong năm 2024, cảnh báo nhà đầu tư về các chiêu trò tinh vi và rủi ro mất tiền.

Khám phá 4 sàn môi giới có lượt sử dụng VPS nhiều nhất trên WikiFX năm 2024

Trong thế giới giao dịch ngoại hối đầy biến động, công nghệ VPS (Virtual Private Server) đã trở thành trợ thủ đắc lực của các nhà giao dịch chuyên nghiệp.

Margin là gì? Làm thế nào để tránh Margin Call?

Trong thế giới giao dịch, đặc biệt là trong thị trường Forex (Ngoại hối) và các thị trường sử dụng đòn bẩy khác, một thuật ngữ thường xuyên xuất hiện là "margin" (biên độ).

Broker WikiFX

Pepperstone

FP Markets

VT Markets

EC Markets

STARTRADER

FXTM

Pepperstone

FP Markets

VT Markets

EC Markets

STARTRADER

FXTM

Broker WikiFX

Pepperstone

FP Markets

VT Markets

EC Markets

STARTRADER

FXTM

Pepperstone

FP Markets

VT Markets

EC Markets

STARTRADER

FXTM

Tính tỷ giá hối đoái