Salma Markets

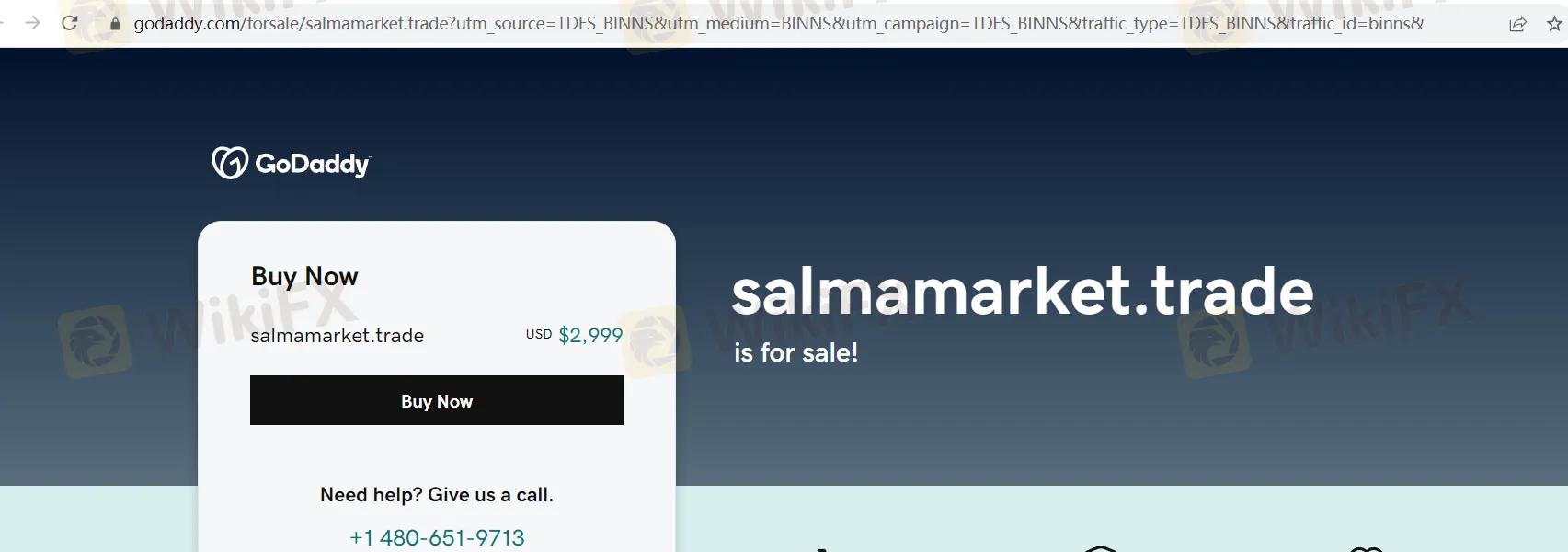

Lời nói đầu:Salma Markets, a company established in China in 2020, operates as an unregulated entity, which immediately raises concerns about the safety of your investments. With just a minimum deposit requirement of $1 and leverage of up to 1:1000, it may appear accessible, but the lack of regulation, variable spreads, and subpar customer support make it a risky choice. The trading platform, MetaTrader 4 (MT4), is a solid choice, but the absence of educational resources and the fact that the company's domain name is being sold suggest a lack of commitment to trader success. Proceed with caution when considering Salma Markets as your trading partner.

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2020 |

| Company Name | Salma Markets |

| Regulation | Unregulated |

| Minimum Deposit | $1 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Variable spreads |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, CFDs on Indices, Cryptocurrencies |

| Account Types | STP Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Subpar customer support |

| Payment Methods | Bank Transfer, Fasapay, NETELLER |

| Educational Tools | Limited educational resources |

Overview

Salma Markets, a company established in China in 2020, operates as an unregulated entity, which immediately raises concerns about the safety of your investments. With just a minimum deposit requirement of $1 and leverage of up to 1:1000, it may appear accessible, but the lack of regulation, variable spreads, and subpar customer support make it a risky choice. The trading platform, MetaTrader 4 (MT4), is a solid choice, but the absence of educational resources and the fact that the company's domain name is being sold suggest a lack of commitment to trader success. Proceed with caution when considering Salma Markets as your trading partner.

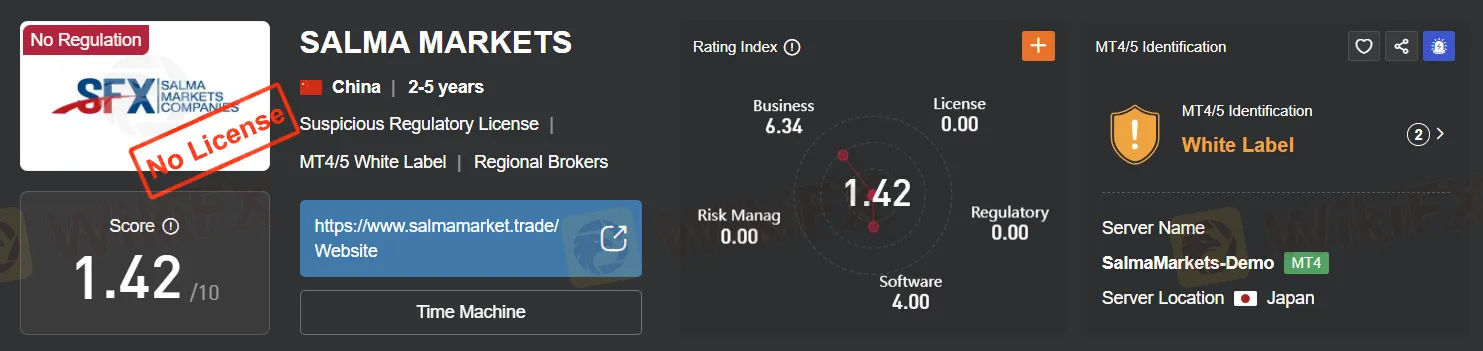

Regulation

SALMA MARKETS operates as an unregulated brokerage firm, which means that it lacks oversight and regulation from financial authorities or regulatory bodies, potentially exposing investors to a higher level of risk. Unregulated brokers typically operate without the stringent compliance standards and safeguards that regulated counterparts adhere to, leaving investors vulnerable to potential fraudulent activities, mismanagement of funds, and inadequate customer protection measures. It is essential for individuals considering engaging with SALMA MARKETS or any unregulated broker to exercise caution, conduct thorough due diligence, and carefully assess the risks associated with entrusting their capital to an entity operating in a regulatory vacuum. Engaging with regulated and licensed brokerage firms is generally considered a safer choice, as they are subject to established rules and regulations designed to protect investors and maintain market integrity.

Pros and Cons

Salma Markets, as an unregulated brokerage firm, presents both advantages and disadvantages for traders. It offers a range of market instruments and the widely recognized MetaTrader 4 (MT4) trading platform. The STP Account with a low minimum deposit and high leverage can be appealing to traders. However, the absence of regulatory oversight raises concerns about the broker's trustworthiness. Educational resources are notably lacking, and customer support is subpar. Variable spreads and a lack of transparency in fee structures further contribute to uncertainty. Traders must weigh these factors carefully before considering Salma Markets as their trading partner.

| Pros | Cons |

|

|

|

|

|

|

|

Market Instruments

Salma Markets appears to offer a range of market instruments for trading. Here's a brief description of the mentioned instruments:

Forex (Foreign Exchange):

EUR/USD (Euro/US Dollar): This currency pair represents the exchange rate between the Euro (EUR) and the US Dollar (USD). Traders speculate on the price movements of these two major currencies.

EUR/GBP (Euro/British Pound): EUR/GBP is the exchange rate between the Euro (EUR) and the British Pound (GBP). Traders use this pair to take positions on the relative strength of the Euro and the Pound.

USD/CHF (US Dollar/Swiss Franc): This currency pair represents the exchange rate between the US Dollar (USD) and the Swiss Franc (CHF). It's often used by traders looking for a safe-haven asset.

CAD/NZD (Canadian Dollar/New Zealand Dollar): CAD/NZD represents the exchange rate between the Canadian Dollar (CAD) and the New Zealand Dollar (NZD). Traders use this pair to speculate on the currency movements of Canada and New Zealand.

CFDs on Indices:

JPN225 (Japan 225): This represents the Nikkei 225 index, which is a stock market index for the Tokyo Stock Exchange. It includes 225 of the largest publicly-traded companies in Japan.

AUS200 (Australia 200): AUS200 typically represents the S&P/ASX 200 index, which includes the top 200 companies on the Australian Securities Exchange (ASX).

GER40 (Germany 40): GER40 is associated with the DAX 30 index, which comprises 30 major German companies listed on the Frankfurt Stock Exchange.

UK100 (UK 100): UK100 typically refers to the FTSE 100 index, which includes the 100 largest companies listed on the London Stock Exchange (LSE) by market capitalization.

ESTX50 (Euro Stoxx 50): ESTX50 represents the Euro Stoxx 50 index, which consists of 50 of the largest and most liquid stocks from Eurozone countries.

Crypto (Cryptocurrencies):

BTC (Bitcoin): Bitcoin is the first and most well-known cryptocurrency. It's often used as a digital store of value and a medium of exchange.

ETH (Ethereum): Ethereum is a blockchain platform known for its smart contract functionality. Ether (ETH) is its native cryptocurrency.

XRP (Ripple): XRP is the native cryptocurrency of the Ripple network, which is designed for cross-border payments and remittances.

Minimum Deposit: $1

Maximum Leverage: 1:1000

Demo Account: Available

Demo Margin: $10,000

Customization: Limited

Suitable For: Traders of Various Experience Levels

Notes: Exercise caution when transitioning from demo to live trading, as conditions may differ.

Account Types

SalmaMarket offers a single trading account type known as the STP Account. This account is designed to cater to traders of various experience levels. However, it's worth noting that SalmaMarket does not offer multiple account tiers, which may limit customization options for traders seeking specific features or benefits.

STP Account:

The STP Account has a low minimum deposit requirement, making it accessible to traders with varying budgetary constraints. This affordability can be particularly attractive to novice traders. The account also offers a high maximum leverage of 1:1000, potentially allowing for amplified positions in the market, although this also entails higher risk.

SalmaMarket also provides traders with the option to open a Demo Account. This demo account is suitable for beginners and offers a risk-free environment for practice. However, traders should be aware that the demo trading experience may not perfectly replicate real market conditions and is often designed to encourage traders to transition to live trading.

In summary, SalmaMarket primarily offers the STP Account for live trading, while the Demo Account is available for practice purposes. Traders should carefully consider their trading needs, risk tolerance, and understanding of leverage before engaging in live trading.

Leverage

SalmaMarket offers a maximum trading leverage of up to 1:1000 for its STP Account, allowing traders to control positions up to 1000 times their initial deposit. While high leverage can amplify potential profits, it also significantly increases the risk of losses. Traders should exercise caution and implement effective risk management strategies when using such high leverage to protect their capital and trade responsibly. Understanding the mechanics and risks of leverage is essential before incorporating it into their trading strategies.

Spreads & Commissions

Spreads: SalmaMarket offers variable spreads, which means that the spread can fluctuate depending on market conditions. Variable spreads are often influenced by factors such as market volatility and liquidity. Traders should be aware that while variable spreads can provide potentially tighter spreads during favorable market conditions, they may widen during times of increased volatility.

Commissions: SalmaMarket specifies that the commission for trading is set at 0 USD. This indicates that there is no explicit commission fee charged on trades. Instead, the broker likely generates revenue through the spread, meaning that traders may indirectly pay a cost through the difference between the buy and sell prices (bid-ask spread).

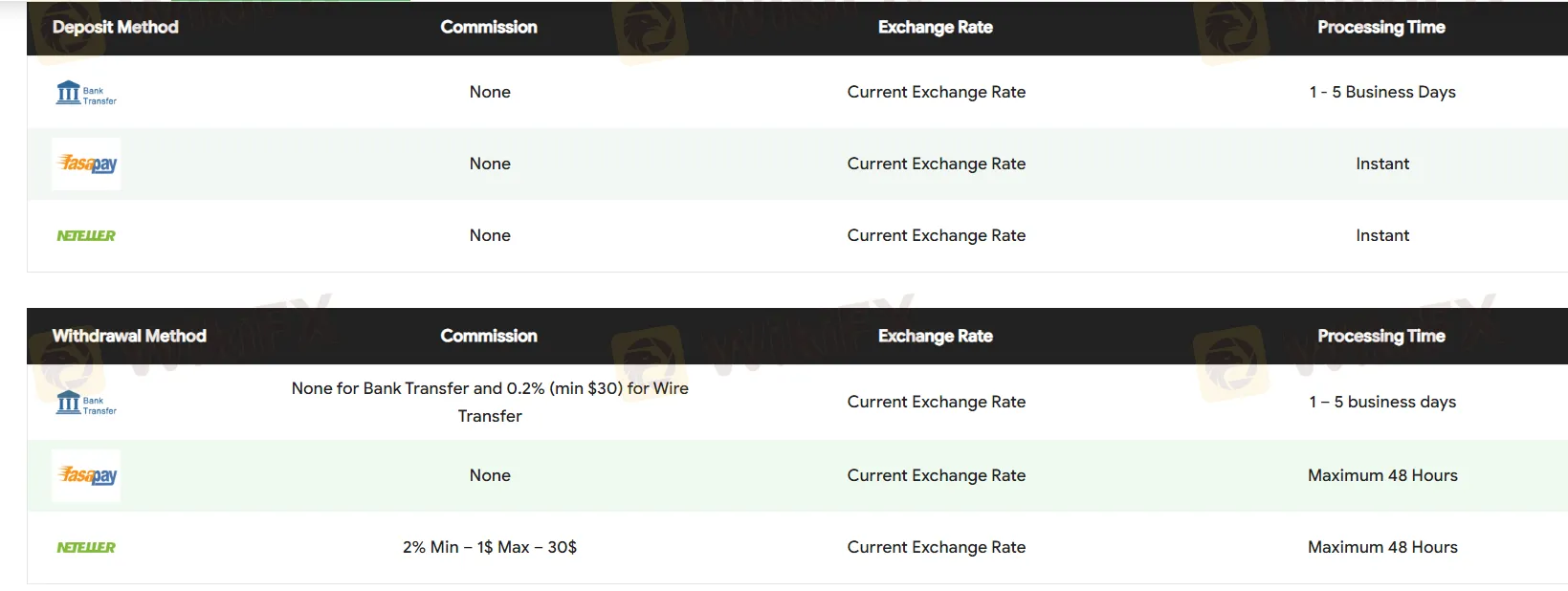

Deposit & Withdrawal

Salma Markets offers three main deposit methods: bank transfer, Fasapay, and NETELLER. Bank transfers are secure but take 1 - 5 business days to process, with no commissions. Fasapay and NETELLER provide instant deposits with no fees. For withdrawals, you have the same options. Bank transfers and Fasapay withdrawals take a bit longer but come with no withdrawal fees. NETELLER offers regular withdrawals with no fees and a Wire Transfer option with a 0.2% commission (min $30). All methods use the “Current Exchange Rate.” Stay updated on their official website for the latest details.

Trading Platforms

SalmaMarket utilizes the MetaTrader 4 (MT4) trading platform, a well-established industry standard known for its robust tools suitable for traders of all levels. However, it's important to note that SalmaMarket's use of MT4 may be considered somewhat outdated compared to newer trading software.

Moreover, SalmaMarket operates as an unregulated entity, raising concerns about the reliability of their services, particularly regarding best execution practices.

For mobile trading, SalmaMarket offers the SalmaFX Trader mobile app, resembling MT4. However, doubts exist about its competitiveness due to SalmaMarket's loss of licensing status.

In summary, SalmaMarket's primary trading platform is MT4, but traders should exercise caution given regulatory concerns and explore alternative platforms for a more secure and up-to-date trading experience.

Customer Support

SalmaMarkets' customer support, as experienced through support@salmamarkets.com, leaves much to be desired. Response times are frustratingly slow, often taking days to address even basic inquiries. When they do respond, the answers provided are frequently vague and lack the depth of information needed for confident decision-making. It's apparent that the level of commitment to customer satisfaction falls short of industry standards, leaving traders feeling unsupported and frustrated in their interactions with the company.

Educational Resources

SalmaMarkets' educational resources are severely lacking, offering traders minimal opportunities for learning and skill development. With no substantial educational content or resources available, traders are left without the tools and guidance needed to improve their trading strategies or make informed decisions. This lack of educational support not only hinders traders' growth but also raises concerns about the broker's commitment to helping their clients succeed in the financial markets.

Summary

Salma Markets presents significant concerns for traders. The broker operates without regulation, exposing investors to heightened risks and potential malpractices. While they offer a variety of market instruments and a user-friendly MT4 trading platform, the absence of educational resources and subpar customer support greatly diminish the overall trading experience. Additionally, the unclear fee structure with variable spreads and the lack of transparency regarding commissions raise doubts about the broker's integrity. Given these issues, traders are advised to exercise extreme caution when considering Salma Markets as their brokerage choice and explore more reliable and regulated alternatives in the market.

FAQs

Q1: Is Salma Markets a regulated brokerage firm?

A1: No, Salma Markets operates as an unregulated broker, which means it lacks oversight and regulation from financial authorities, potentially posing higher risks to investors.

Q2: What trading platform does Salma Markets offer?

A2: Salma Markets primarily offers the MetaTrader 4 (MT4) trading platform, a well-known industry standard. However, this platform may be considered somewhat outdated compared to newer options.

Q3: Are there educational resources available at Salma Markets?

A3: Unfortunately, Salma Markets offers minimal educational resources, which limits opportunities for learning and skill development.

Q4: What are the deposit and withdrawal options at Salma Markets?

A4: Salma Markets provides deposit methods including bank transfer, Fasapay, and NETELLER. Withdrawal options are the same, with varying processing times and fees for some methods.

Q5: What is the maximum leverage offered by Salma Markets?

A5: Salma Markets offers a maximum trading leverage of up to 1:1000 for its STP Account. However, traders should exercise caution when using such high leverage due to the associated risk.

Broker WikiFX

IC Markets Global

GO MARKETS

FOREX.com

EC Markets

ATFX

HFM

IC Markets Global

GO MARKETS

FOREX.com

EC Markets

ATFX

HFM

Broker WikiFX

IC Markets Global

GO MARKETS

FOREX.com

EC Markets

ATFX

HFM

IC Markets Global

GO MARKETS

FOREX.com

EC Markets

ATFX

HFM

Tin hot

Tin tức tổng hợp - Một quỹ đầu tư bị chỉ trích vì giam tiền trader hơn 1 năm

Đà Nẵng phát lệnh truy nã đặc biệt một nghi phạm trong vụ Mr. Pips Phó Đức Nam

Pi Network: Dự báo về giá đồng Pi trong tháng 03/2025

Cộng đồng sáng tạo WikiFX: Cùng Pi Network chinh phục thị trường

Robot Forex: Bí quyết tự động hóa giao dịch Forex hiệu quả với WikiFX

Entry là gì? Vì sao Entry trong Forex thuận xu hướng vẫn thua?

Cập nhật Pi Network mới nhất: Những lo ngại tăng cao về đội ngũ cốt lõi của Pi

WikiFX Review sàn Forex MHMarkets 2025: Chương trình đối tác hấp dẫn từ sàn quốc tế

Thông báo Cập nhật ứng dụng WikiFX phiên bản 3.6.4

Pi Network: Hàng loạt Pioneers rơi vào thế bí

Tính tỷ giá hối đoái