PhilipCapital

Lời nói đầu:PhilipCapital is an unregulated financial company registered in China. The broker's official website has been closed, so traders cannot obtain more security information.

Note: PhilipCapital's official website: https://www.phillip.com.cn/index.html is currently inaccessible normally.

PhilipCapital Information

PhilipCapital is an unregulated financial company registered in China. The broker's official website has been closed, so traders cannot obtain more security information.

Is PhilipCapital Legit?

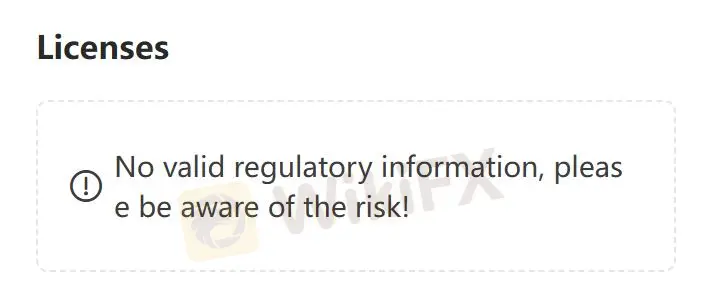

PhilipCapital is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with the company.

Downsides of PhilipCapital

- Unavailable Website

PhilipCapital's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since PhilipCapital does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

PhilipCapital is not regulated, which is less safe than a regulated one.

Conclusion

PhilipCapital Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that this brokers trading risks are high. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Broker WikiFX

OANDA

Exness

AvaTrade

FP Markets

EC Markets

IB

OANDA

Exness

AvaTrade

FP Markets

EC Markets

IB

Broker WikiFX

OANDA

Exness

AvaTrade

FP Markets

EC Markets

IB

OANDA

Exness

AvaTrade

FP Markets

EC Markets

IB

Tin hot

Nỗi sợ thua lỗ: Rào cản lớn nhất trong trading

Lý do tại sao Forex là thị trường tài chính lớn nhất thế giới

Tính tỷ giá hối đoái