Intercity Broker

Lời nói đầu:Founded in Serbia in 2018, Intercity Broker offers a diverse range of trading assets, including shares, bonds, and indices such as Belex15 and BelexLine. With a user-friendly interface on MetaTrader 4 and MetaTrader 5, the broker provides competitive leverage levels and responsive 24/5 customer support. However, it operates without international regulatory oversight, posing potential risks for investors. While the company's location in Serbia may offer regional advantages, the absence of regulatory backing raises concerns about transparency and investor protection. Traders should carefully weigh the accessible assets and user-friendly platforms against the lack of regulatory supervision before engaging with Intercity Broker.

| Aspect | Information |

| Company Name | Intercity Broker |

| Registered Country/Area | Serbia |

| Founded Year | 2018 |

| Regulation | Not Regulated |

| Market Instruments | Shares, Bonds, Belex15, BelexLine |

| Account Types | Standard, ECN |

| Minimum Deposit | $200 |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Customer Support | Phone at +381 11 3083-100 and 3087-862, email at office@icbbg.rs |

| Deposit & Withdrawal | Bank Wire Transfer, Credit/Debit Cards, E-Wallets |

| Educational Resources | Q&A, News Section |

Overview of Intercity Broker

Founded in Serbia in 2018, Intercity Broker offers a diverse range of trading assets, including shares, bonds, and indices such as Belex15 and BelexLine. With a user-friendly interface on MetaTrader 4 and MetaTrader 5, the broker provides competitive leverage levels and responsive 24/5 customer support. However, it operates without international regulatory oversight, posing potential risks for investors. While the company's location in Serbia may offer regional advantages, the absence of regulatory backing raises concerns about transparency and investor protection. Traders should carefully weigh the accessible assets and user-friendly platforms against the lack of regulatory supervision before engaging with Intercity Broker.

Is Intercity broker legit or a scam?

Intercity Broker operates without regulatory oversight, lacking supervision from any governing authority.

The absence of regulatory scrutiny raises concerns about transparency, investor protection, and adherence to industry standards. Without regulatory backing, traders may face increased risks, as the platform's practices are not subject to the established frameworks that ensure fair conduct and financial integrity. Investors should exercise caution and consider the potential impacts of choosing an unregulated broker, as the absence of oversight can leave them vulnerable to uncertainties and potential challenges in the trading environment.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Lack of Regulatory Oversight |

| Competitive Leverage Levels | Higher Minimum Deposit for ECN Account |

| User-Friendly Trading Platforms | Commission Fees for Both Account Types |

| Responsive 24/5 Customer Support | Credit/Debit Card Transaction Fees |

Pros:

Diverse Market Instruments:

Intercity Broker offers a wide range of trading assets, including shares, bonds, Belex15, BelexLine, prospectuses, and important information. This diversity allows traders to explore various investment opportunities within the Serbian market.

2. Competitive Leverage Levels:

The broker provides competitive leverage levels, with up to 1:200 for the Standard Account and up to 1:500 for the ECN Account. This allows traders to amplify their positions, potentially increasing profits, although it comes with higher risk.

3. User-Friendly Trading Platforms:

Intercity Broker's MetaTrader 4 and MetaTrader 5 platforms offer a user-friendly interface and advanced features, facilitating efficient trading. These platforms are accessible on desktop, web, and mobile devices, enhancing flexibility for traders.

4. Responsive 24/5 Customer Support:

The company provides responsive customer support through various channels, including live chat, email, and phone. This 24/5 support ensures that clients can seek assistance and resolve issues promptly.

Cons:

Lack of Regulatory Oversight:

Intercity Broker operates in Serbia but lacks international regulatory oversight. This absence raises concerns about the level of supervision and investor protection, as regulatory bodies play a crucial role in ensuring fair and transparent financial practices.

2. Higher Minimum Deposit for ECN Account:

Opening an ECN Account requires a higher minimum deposit of $1,000 compared to the $200 minimum deposit for the Standard Account. This might limit accessibility for some traders, particularly those with smaller capital.

3. Commission Fees for Both Account Types:

Both Standard and ECN Accounts incur commission fees. While this fee structure is transparent, it adds to the overall trading costs and may impact the profitability of trades.

4. Credit/Debit Card Transaction Fees:

Intercity Broker charges a fee for credit/debit card transactions, typically around 2.5% of the transaction amount. This cost may be a consideration for traders who prefer using this payment method, impacting the overall cost-effectiveness of transactions.

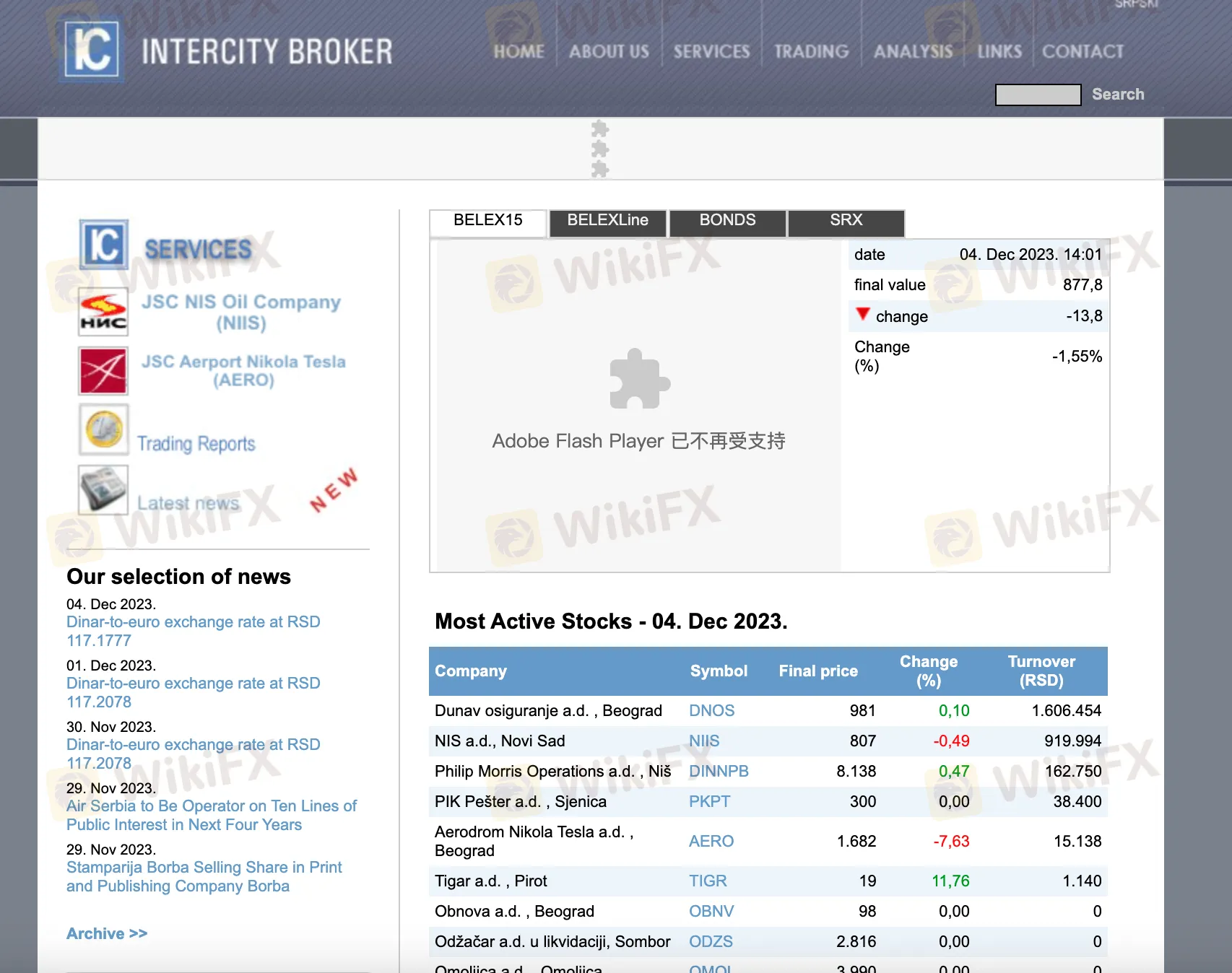

Market Instruments

Intercity Broker is a securities broker-dealer in Serbia, offering a wide range of trading assets to its clients. These assets include:

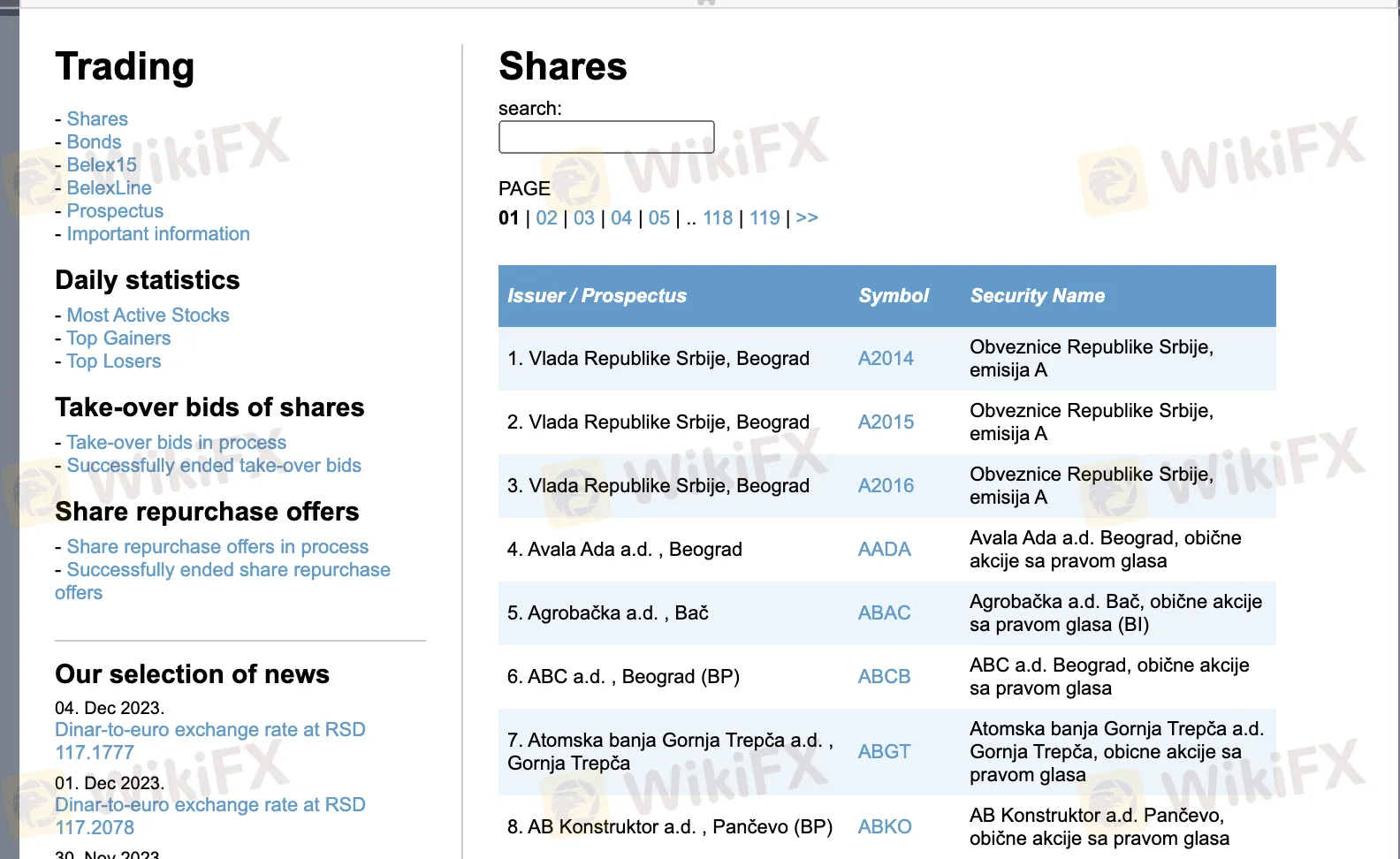

Shares: Intercity Broker offers access to a wide range of shares listed on the Belgrade Stock Exchange (BELEX), including blue-chip stocks, small-cap stocks, and exchange-traded funds (ETFs).

Bonds: Intercity Broker offers a variety of bonds, including government bonds, corporate bonds, and municipal bonds.

Belex15: Belex15 is a capital-weighted index of the 15 most liquid stocks on the BELEX. Intercity Broker offers clients the opportunity to trade Belex15 futures and options.

BelexLine: BelexLine is a real-time index of the BELEX. Intercity Broker offers clients the opportunity to trade BelexLine futures and options.

Prospectus: A prospectus is a document that provides detailed information about a security, such as its issuer, its financial condition, and its risks. Intercity Broker can provide clients with prospectuses for all of the securities that it trades.

Important information: Intercity Broker provides clients with important information about the securities that it trades, such as their latest price, their trading volume, and their market capitalization.

Account Types

Intercity Broker offers two distinct account types, each tailored to meet the diverse needs of traders.

The Standard Account provides traders with leverage of up to 1:200, offering flexibility in managing their positions. Spreads start from 1.5 pips, ensuring competitive pricing for various trading instruments. Traders utilizing the Standard Account are subject to a commission of $10 per standard lot round turn. The minimum deposit required to open a Standard Account is $200, making it accessible to a wide range of investors. Additionally, users can familiarize themselves with the platform using a Demo Account, and they have access to popular trading tools such as MetaTrader 4 and MetaTrader 5. Customer support is available 24/5 through live chat, email, and phone.

On the other hand, the ECN Account caters to traders seeking enhanced trading conditions. With leverage of up to 1:500, this account type offers greater flexibility in managing risk and positions. The standout feature is the ultra-low spreads starting from 0 pips, providing traders with a cost-efficient trading environment. The commission for ECN Account users is $7 per standard lot round turn. A higher minimum deposit of $1,000 is required to open an ECN Account, reflecting the advanced features and benefits associated with this account type. Similar to the Standard Account, traders using the ECN Account can access a Demo Account and utilize MetaTrader 4 and MetaTrader 5. Customer support is available 24/5 through live chat, email, and phone, ensuring a responsive service for ECN Account users.

| Feature | Standard Account | ECN Account |

| Leverage | Up to 1:200 | Up to 1:500 |

| Spreads | From 1.5 pips | From 0 pips |

| Commission | $10 per standard lot round turn | $7 per standard lot round turn |

| Minimum Deposit | $200 | $1,000 |

| Demo Account | Yes | Yes |

| Trading Tool | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 |

| Customer Support | 24/5 live chat, email, phone | 24/5 live chat, email, phone |

How to Open an Account?

To open an account with Intercity Broker, follow these concrete steps:

Visit the Website:

Navigate to the official Intercity Broker website using your web browser.

2. Account Registration:

Locate the “Sign Up” button on the website and click on it.

Fill in the required information in the registration form, including personal details, contact information, and choose the type of account you wish to open (e.g., Standard Account or ECN Account).

3. Document Verification:

After submitting the registration form, you may be required to upload necessary identification documents. This typically includes a government-issued ID, proof of address, and possibly a financial statement.

4. Deposit Funds:

Once your registration and documents are verified, you'll need to fund your account. Log in to your newly created account and navigate to the deposit section.

Choose your preferred payment method (bank transfer, credit card, etc.) and follow the instructions to deposit the minimum required amount based on the selected account type (e.g., $200 for a Standard Account or $1,000 for an ECN Account).

After completing these steps, your Intercity Broker account should be active and ready for trading. Make sure to familiarize yourself with the trading platform, terms and conditions, and risk management strategies before engaging in any trading activities.

Leverage

Intercity Broker provides varying maximum leverage depending on the chosen account type. For the Standard Account, traders can enjoy a maximum leverage of up to 1:200. This level of leverage allows traders to control larger positions with a relatively smaller amount of capital, amplifying both potential profits and risks.

On the other hand, the ECN Account offers a higher maximum leverage of up to 1:500. This elevated leverage level is designed to cater to traders who seek greater flexibility and risk management capabilities in their trading strategies. While higher leverage can enhance potential returns, it's crucial for traders to exercise caution and employ risk management practices to mitigate potential losses.

Spreads & Commissions

Intercity Broker offers competitive spreads and commissions, providing transparency in its fee structure.

In the Standard Account, traders encounter spreads that begin at 1.5 pips, reflecting the difference between the bid and ask prices. Additionally, a commission of $10 per standard lot round turn is applied, covering the costs associated with facilitating trades.

For the ECN Account, traders benefit from ultra-low spreads starting from 0 pips. However, there is a commission of $7 per standard lot round turn, ensuring a fair and transparent pricing model. The commission-based structure is common in ECN accounts, where traders gain access to direct market liquidity.

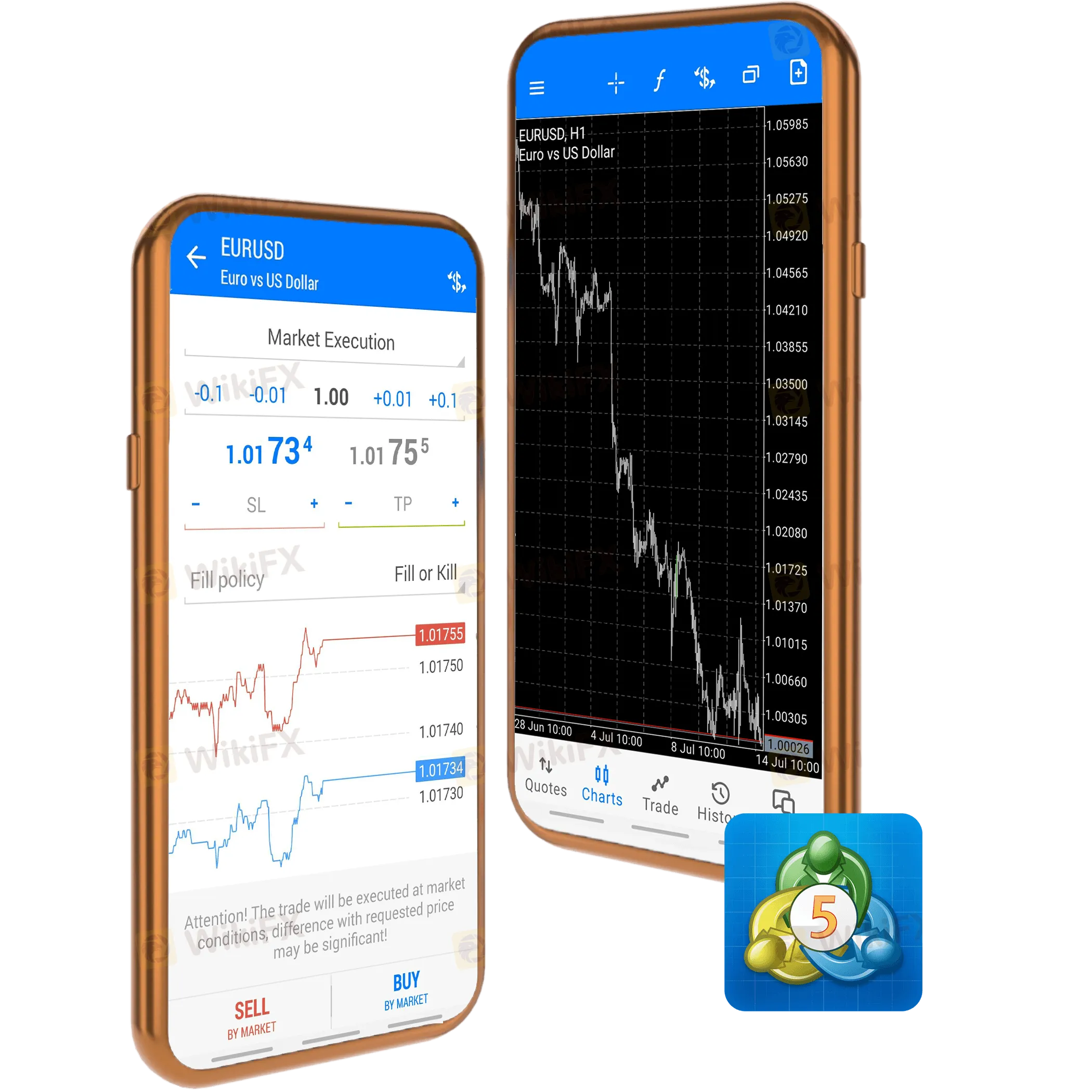

Trading Platform

Intercity Broker offers a suite of trading platforms that cater to the needs of both novice and experienced traders. The platforms are available on desktop, web, and mobile devices, providing flexibility and accessibility for traders on the go.

MetaTrader 4 and MetaTrader 5

Intercity Broker's primary trading platforms are MetaTrader 4 and MetaTrader 5, both of which are widely recognized and respected in the forex trading industry. These platforms offer a comprehensive suite of features, including:

Advanced charting tools for technical analysis

A variety of order types to execute trading strategies effectively

Automated trading capabilities using Expert Advisors (EAs)

Market Depth for real-time order book visibility

Intercity Broker provides a demo account for traders to familiarize themselves with the trading platform and practice trading strategies without risking real capital. The demo account simulates live market conditions and allows traders to test their strategies before committing real funds.

Deposit & Withdrawal

Intercity Broker offers a variety of payment methods for deposits and withdrawals, including:

Bank Wire Transfer: This is a traditional and secure method for transferring funds between bank accounts. Processing times for bank wires typically range from 2 to 5 business days.

Credit/Debit Cards: Intercity Broker accepts Visa, MasterCard, and Maestro credit and debit cards for deposits and withdrawals. Processing times for credit/debit card transactions are typically instant.

E-Wallets: Intercity Broker supports several popular e-wallets, including Skrill, Neteller, and Perfect Money. Processing times for e-wallet transactions are typically instant.

The minimum deposit requirement for Intercity Broker accounts varies depending on the account type and the chosen payment method. In general, the minimum deposit for Standard is $200, while the minimum deposit for ECN accounts is $1000.

Intercity Broker does not charge any fees for deposits or withdrawals made via bank wire transfer or e-wallets. However, there is a small fee for credit/debit card transactions, typically around 2.5% of the transaction amount.

Processing times for deposits and withdrawals vary depending on the chosen payment method. Bank wires typically take 2 to 5 business days to process, while credit/debit card transactions and e-wallet transactions are typically processed instantly.

Customer Support

Intercity Broker JSC Belgrade provides accessible customer support through various channels.

Clients can reach them at Maksima Gorkog 52, 11118 Belgrade, Republic of Serbia.

The company offers telephone assistance at +381 11 3083-100 and 3087-862, with fax services available at +381 11 3083-150.

For inquiries or assistance, individuals can also contact the company via email at office@icbbg.rs.

This multi-channel approach enhances communication accessibility, allowing clients to engage with Intercity Broker efficiently, fostering a responsive and customer-centric support system.

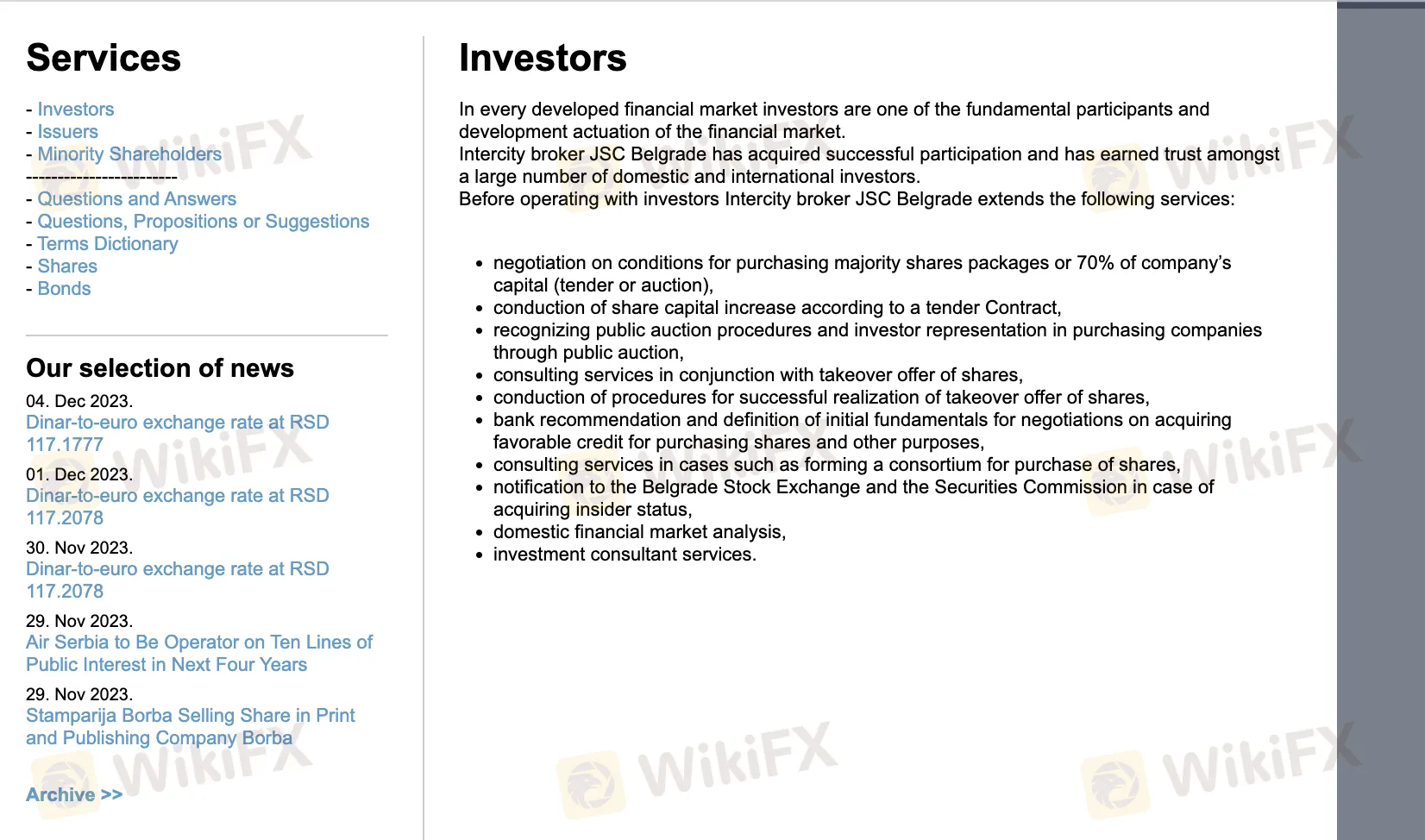

Educational Resources

Intercity Broker offers comprehensive educational resources catering to investors, issuers, and minority shareholders.

The platform provides a repository of valuable information, including a Questions and Answers section, a dedicated space for inquiries, propositions, or suggestions, and a user-friendly Terms Dictionary. Additionally, users can access detailed insights on shares and bonds.

Stay informed with the latest financial developments through the curated news section, covering significant events such as exchange rates and business transactions.

This diverse range of educational tools empowers users with the knowledge needed to make informed investment decisions and navigate the financial landscape effectively.

Conclusion

In conclusion, Intercity Broker provides a diverse array of trading instruments through user-friendly platforms like MetaTrader 4 and 5. The company's competitive leverage levels and responsive 24/5 customer support contribute to its appeal. However, the absence of international regulatory oversight raises concerns about transparency and investor protection. Traders must carefully consider the higher minimum deposit for ECN accounts and commission fees for both account types. While Intercity Broker offers valuable educational resources, its advantages in asset variety and platform usability are counterbalanced by regulatory uncertainties and potential trading costs, demanding careful consideration from prospective investors.

FAQs

Q: Is Intercity Broker regulated internationally?

A: No, Intercity Broker operates without international regulatory oversight.

Q: What are the minimum deposit requirements for account types?

A: The Standard Account requires a minimum deposit of $200, while the ECN Account has a higher minimum deposit of $1,000.

Q: What is the maximum leverage offered by Intercity Broker?

A: The Standard Account provides leverage up to 1:200, and the ECN Account offers leverage up to 1:500.

Q: Are there commission fees for trading on Intercity Broker?

A: Yes, both Standard and ECN Accounts incur commission fees, with $10 and $7 per standard lot round turn, respectively.

Q: What trading platforms are available?

A: Intercity Broker offers MetaTrader 4 and MetaTrader 5 as its primary trading platforms.

Q: How can I contact customer support?

A: Customer support is available 24/5 through live chat, email (office@icbbg.rs), and phone (+381 11 3083-100, 3087-862).

Broker WikiFX

TMGM

ATFX

STARTRADER

FXCM

OANDA

XM

TMGM

ATFX

STARTRADER

FXCM

OANDA

XM

Broker WikiFX

TMGM

ATFX

STARTRADER

FXCM

OANDA

XM

TMGM

ATFX

STARTRADER

FXCM

OANDA

XM

Tin hot

Bitcoin vs Pi Network: Nếu được chọn, bạn sẽ chọn ai?

Chuyên gia Bitcoin yêu cầu điều tra vụ việc Crypto đang bị thao túng

WikiFX Review sàn FPG 2025: Không phí nạp rút, ưu đãi hoa hồng 60%

Vì sao các quỹ cấp vốn đầu tư Forex đổ bộ vào Thị trường Việt Nam?

SkyLine Guide Malaysia: Hướng tới 'Michelin Guide' cho ngành forex!

Đã đến lúc Binance nhận ra giá trị thật của Pi Network?

Top 4 sàn môi giới bị tố cáo nhiều nhất tháng 02/2025 trên WikiFX

Những yếu tố cần cân nhắc để giao dịch Forex hiệu quả tại Việt Nam

Pi Network: Giá tăng vọt khi khai thác lao dốc

Pi Network: Liệu có thể phục hồi sau cú rơi chấn động?

Tính tỷ giá hối đoái