Avalon Capital Markets

Lời nói đầu:Avalon Capital Markets, established in 2014, is a UK-based broker specializing in equity derivatives, ETFs, fixed income, and FX. Although in operation for almost a decade, the broker remains unregulated. The firm offers tailored trading strategies, has multiple global offices, and offers various customer support channels. However, the absence of transparency around account types, fees, leverage, and the trading platform makes it challenging for potential clients to get on board.

| Feature | Details |

| Company Name | Avalon Capital Markets |

| Registered Country | United Kingdom |

| Founded Year | 2014 |

| Regulation | No Regulation |

| Tradable Assets | Equity Derivatives, Cash Equity, Exchange-Traded Funds, Fixed Income, FX |

| Customer Support | Phone, Email, Contact Form, Office Addresses (London, Paris, Dubai) |

| Educational Resources | Research, Event Driven |

Overview of Avalon Capital Markets

Founded in 2014, Avalon Capital Markets is a UK-based broker offering specialized trading services in equity derivatives, cash equities, exchange-traded funds (ETFs), fixed income, and foreign exchange (FX). Although Avalon has been around for nearly a decade, it is not regulated by any recognized financial regulatory body. With offices in London, Paris, and Dubai, Avalon Capital Markets seeks to provide several customer supports. However, a lack of transparency around account types, spreads, leverage, and trading platforms is notable.

Pros and Cons

Avalon Capital Markets provides several equity derivative products and maintains a market-leading position in the secondary ETF market. It also offers tailored trading strategies and services, supports in-person interaction through multiple global offices, and provides customer support through a contact form on the website.

However, this broker is not regulated, which poses potential challenges. There's also a lack of transparency in essential areas like account types, fees, leverage, and the trading platform. The absence of a straightforward registration process on their website further complicates the onboarding process for potential clients.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Is Avalon Capital Markets legit or a scam?

Avalon Capital Markets lacks regulatory oversight from any established financial authority. The unregulated status means there's no oversight to ensure the security of clients' funds or the integrity of trading practices.

Products

Equity Derivatives: Offers a broad range of specialized equity derivative products, including European indices (EuroStoxx, DAX, FTSE), sector indices (SX7E, SX7P), single stock options, and Delta One products like synthetics and dividend swaps.

Cash Equity: Focuses on efficient trading in the cash equity spectrum, providing execution services that include best market execution, minimised opportunity cost, and direct market connectivity.

Exchange-Traded Funds (ETFs): Avalon is a market leader in the secondary ETF market, offering liquidity and pricing inside issuer creation and redemption costs.

Fixed Income: Provides a wide range of products including interest rate derivatives, futures and options execution, government bonds, high yield bonds, and emerging markets.

FX: Specializes in managing foreign exchange exposures for international investments, providing strategies for hedging or leveraging volatility as a source of alpha.

How to Open an Account with Avalon Capital Markets

Avalon Capital Markets does not offer a direct registration process on its website, only providing a 'Client Login' button. To open an account:

Contact the Company: Reach out to Avalon Capital Markets via their email (info@www.avaloncapitalmarkets.com) or the contact form on their website to express interest in opening an account.

Discuss Account Details: Request details about account types, minimum deposits, and any specific requirements.

Complete KYC Requirements: Provide identification and necessary documents to satisfy Know Your Customer (KYC) verification.

Finalize Registration and Fund Your Account: Once verified, follow instructions to complete the registration and make the initial deposit to start trading.

Customer Support

Phone Support: +44 (0)-20-3060-8895

Email Support: info@www.avaloncapitalmarkets.com

Offices:

London Office: 5th Floor Moray House, 23-35 Great Titchfield Street, London W1W 7PA

Paris Office: 105 rue du Faubourg Saint-Honoré, 75008 Paris

Dubai Office: Unit 108 of Tower 2, Al Fattan Currency House, DIFC Dubai

Contact Form: Available on their website to connect clients with the support team for inquiries or assistance.

Educational Resources

Research: This service offers unbiased analysis on 1,500 stocks worldwide, emphasizing value and momentum research to provide unique perspectives on global stock trends.

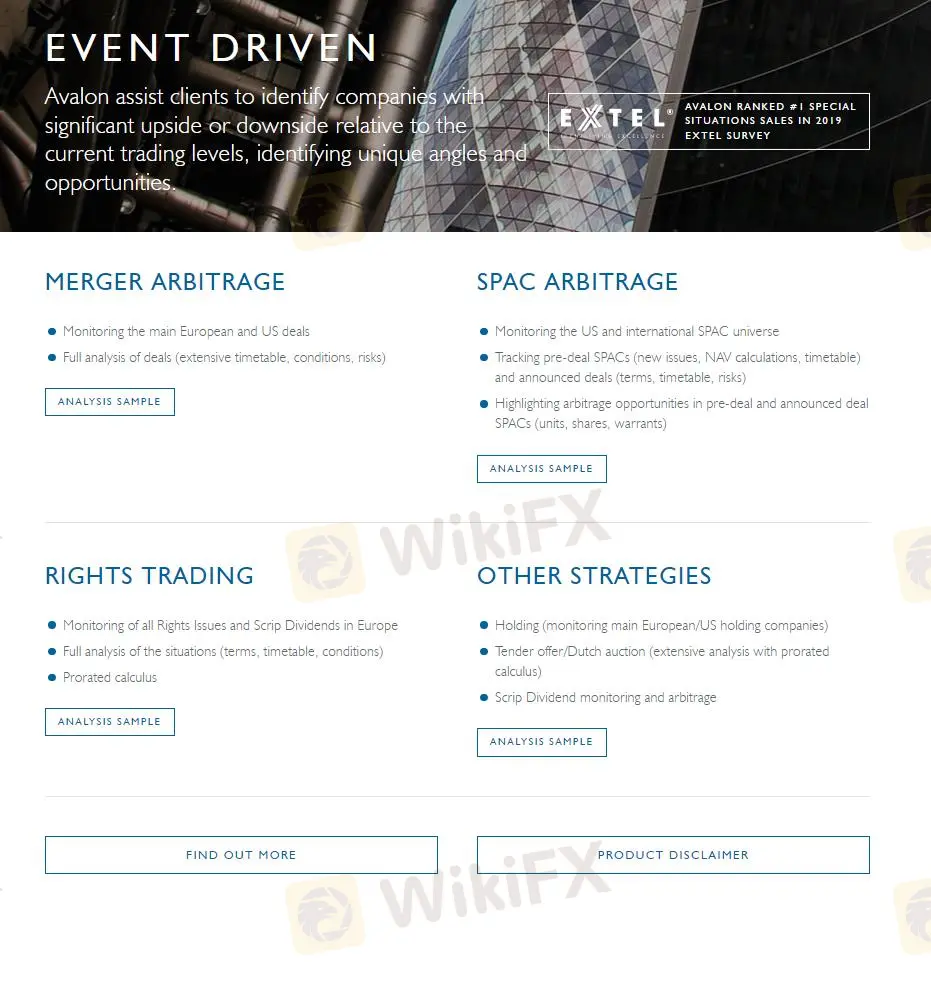

Event Driven: The Event Driven service helps clients pinpoint companies with significant movement potential, providing distinct market insights. The firm also monitors SPACs, offering detailed information on pre-deal and announced deal SPACs to uncover arbitrage opportunities.

Conclusion

Avalon Capital Markets, a UK-based broker established in 2014, provides trading services in various financial products. However, the lack of regulation is a substantial disadvantage that overshadows the firm's strengths in equity derivatives and ETFs. The broker offers tailored trading strategies and maintains multiple global offices, but the absence of clarity around essential information like account types, fees, and leverage indicates challenges. Moreover, the missing online registration procedure complicates the onboarding process.

FAQs

Q: Is Avalon Capital Markets regulated?

A: No, Avalon Capital Markets is not regulated by any recognized financial regulatory authority.

Q: What trading instruments does Avalon Capital Markets offer?

A: Avalon Capital Markets offers a range of trading instruments including equity derivatives, cash equities, ETFs, fixed income, and foreign exchange (FX).

Q: What customer support options does Avalon Capital Markets provide?

A: Avalon Capital Markets provides customer support through phone, email, and contact forms on their website. They also have offices in London, Paris, and Dubai.

Q: How can I open an account with Avalon Capital Markets?

A: You need to contact the company through their email or contact form, discuss the account details, and complete the KYC verification before finalizing the registration.

Q: Does Avalon Capital Markets provide educational resources for traders?

A: Yes, Avalon Capital Markets offers research and event-driven services that provide analysis on global stocks and insights into companies with significant movement potential.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. We strongly advise readers to verify updated details directly with the company before making any decisions, as the readers must be aware of and willing to accept the inherent risks involved in utilizing this information.

Broker WikiFX

STARTRADER

FBS

FXTM

FP Markets

GO MARKETS

OANDA

STARTRADER

FBS

FXTM

FP Markets

GO MARKETS

OANDA

Broker WikiFX

STARTRADER

FBS

FXTM

FP Markets

GO MARKETS

OANDA

STARTRADER

FBS

FXTM

FP Markets

GO MARKETS

OANDA

Tin hot

Tin tức tổng hợp - Một quỹ đầu tư bị chỉ trích vì giam tiền trader hơn 1 năm

Đà Nẵng phát lệnh truy nã đặc biệt một nghi phạm trong vụ Mr. Pips Phó Đức Nam

Pi Network: Dự báo về giá đồng Pi trong tháng 03/2025

Binance tung cơ chế niêm yết mới nhắm vào Pi Network?

Những gì bạn cần biết về cơ chế niêm yết mới của Binance

Tính tỷ giá hối đoái